eToro and AvaTrade are famous no-dealing desk Forex brokers and operate with hundreds of thousands of international clients. They were established nearly at the same time, AvaTrade appearing on the market in 2006 and eToro following it in 2007. The eToro brokerage is based in Cyprus, while AvaTrade has a home in Ireland. The headquarters of eToro are located in the United Kingdom, China, and Russia and the headquarters of AvaTrade can be found in Australia, Germany, Italy, France, South Africa, and Japan. The clients from the United States are welcome on the eToro platform, however, cannot access AvaTrade services at the moment.

Both brokers are authorized to operate on almost every continent worldwide and are regulated by multiple authorities. They mostly offer similar financial instruments’ portfolios with the major product being Forex. The users can trade 47 currency pairs with eToro and over 55 pairs with AvaTrade. Furthermore, both brokers offer hundreds of CFD assets, crypto CFDs, and social/copy trading. eToro additionally offers trading with cryptocurrencies on its platform. Also, AvaTrade allows more freedom in terms of choosing the trading strategies with both scalping and hedging allowed on the trading platforms of the broker. For the clients of eToro, scalping is not an option, though.

Our broker comparison review of AvaTrade vs eToro will cover the major features of these two brokers and compare the trading conditions and benefits available to each of the broker’s clients.

|

|

AvaTrade |

eToro |

|

Rating |

|

|

|

Min. Deposit |

100 USD |

50 USD - 10,000 USD |

|

Max. Leverage |

1:400 |

1:30 |

|

Regulations |

ASIC, CySEC, FSA, FFAJ, FSCA, ISA, FRSA, CBI, B.V.I FSA |

FCA, ASIC, CySEC |

|

Trading Platforms |

MT4, MT5, ZuluTrade, DupliTrade, AvaTrade GO, AvaSocial |

Social Trading App |

|

Bonuses |

Referral Program |

Crypto Bonus |

Which broker offers better fees, eToro or AvaTrade?

Forex trading costs include spreads, commissions, minimum deposits, and withdrawal or deposit fees. We can say that both eToro and AvaTrade are rather budget-friendly options for Forex traders than expensive ones. However, it may also depend on your country of residence. For example, eToro’s minimum deposit requirements will vary according to the regions where the traders come from. The United States residents have an opportunity to start trading with just 50 US dollars, whereas citizens of other countries might be required to invest 250 USD or even 1000 USD. That is not the case for AvaTrade broker since it has a universal minimum deposit requirement of 100 USD across all nationalities.

Forex trading costs include spreads, commissions, minimum deposits, and withdrawal or deposit fees. We can say that both eToro and AvaTrade are rather budget-friendly options for Forex traders than expensive ones. However, it may also depend on your country of residence. For example, eToro’s minimum deposit requirements will vary according to the regions where the traders come from. The United States residents have an opportunity to start trading with just 50 US dollars, whereas citizens of other countries might be required to invest 250 USD or even 1000 USD. That is not the case for AvaTrade broker since it has a universal minimum deposit requirement of 100 USD across all nationalities.

Most of the trading account types with eToro and AvaTrade operate commission-free. The brokers charge commission rates for the special and premium account types only. However, these special accounts usually offer tighter spreads and more flexible leverage options. eToro does not display its spreads on the assets as they vary from one product to another. As for the AvaTrade broker, the spread on the most popular Forex currency pair traded – EUR/USD starts from 0.91 pips on the Standard account, which is often considered as a Cent account as well.

EToro offers more diversity in the payment solutions supported on the broker’s platform when it comes to payment methods. It includes more than 10 different payment systems including the most popular ones, such as Skrill, Neteller, WebMoney, etc. However, AvaTrade provides more convenient solutions with no fees on deposits and withdrawal fees depending on the payment solution that the trader chooses. Usually, the cheapest withdrawal and deposit options are through Visa/Mastercard payments, Skrill, Neteller, PayPal, or M-Pesa depending on your country of residence.

Trade Forex with tightest spreads with AvaTrade

|

|

AvaTrade |

eToro |

|

EUR/USD |

0.9 pips |

1 pip |

|

USD/JPY |

1.1 pips |

1 pip |

|

GBP/USD |

1.6 pips |

2 pips |

|

USD/CAD |

2 pips |

3 pips |

|

AUD/USD |

1.1 pips |

2 pips |

Which one has provided better software, AvaTrade or eToro?

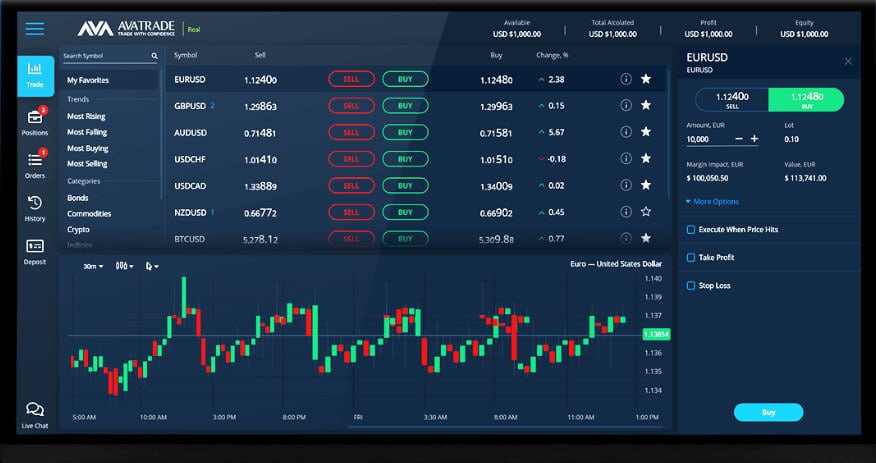

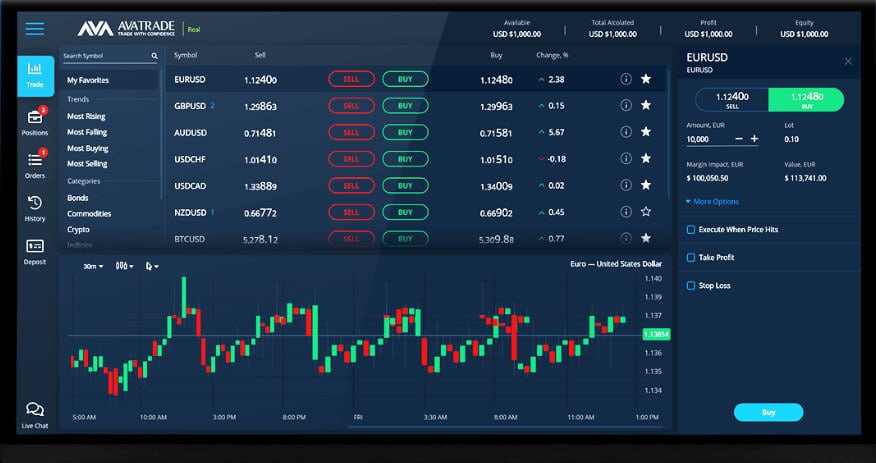

Both AvaTrade and eToro are industry-leading brokerage companies and one of the reasons for their popularity is their sophisticated trading platforms. These two brokers put an extra effort to develop the user-friendly interface and compatibility of the trading software. However, since eToro is a social trading broker by nature, it has its own trading platform in contrast to AvaTrade, which also supports the most popular trading software of MetaTrader 4 and MetaTrader 5.

Both AvaTrade and eToro are industry-leading brokerage companies and one of the reasons for their popularity is their sophisticated trading platforms. These two brokers put an extra effort to develop the user-friendly interface and compatibility of the trading software. However, since eToro is a social trading broker by nature, it has its own trading platform in contrast to AvaTrade, which also supports the most popular trading software of MetaTrader 4 and MetaTrader 5.

MetaTraders need no introduction or presentation from our side as they are quite famous and recognized platforms worldwide. However, apart from these two systems, AvaTrade broker also offers AvaTrade GO and AvaSocial trading platforms which are ground-breaking innovations to the financial industry introduced by the broker. AvaTrade GO is the mobile application supporting all the accounts with MetaTrader 4. It is a single interactive and user-centric platform uniting all the features essential to trading multiple financial instruments. AvaSocial on the other hand is a social trading platform enabling users to connect in numerous ways. It is one of the most advanced platforms to use for automated trades.

Start trading on AvaSocial and AvaTrade GO platforms

Which broker provides better safety for traders, AvaTrade or eToro?

In Forex, the security of the broker does not come from the safe platform with data protection systems only. In fact, the primary guarantee of security comes from the licenses and regulations that a broker holds. The general rule is that the more regulations a company has the safer it is for the traders. However, one should always be careful with the listed regulations on the brokerages’ websites as they might display non-legit bodies or incompetent organizations that granted licenses to the broker. But, it is easy to double-check whether the regulatory body can be trusted or not on the internet.

In Forex, the security of the broker does not come from the safe platform with data protection systems only. In fact, the primary guarantee of security comes from the licenses and regulations that a broker holds. The general rule is that the more regulations a company has the safer it is for the traders. However, one should always be careful with the listed regulations on the brokerages’ websites as they might display non-legit bodies or incompetent organizations that granted licenses to the broker. But, it is easy to double-check whether the regulatory body can be trusted or not on the internet.

Both AvaTrade and eToro are licensed by multiple regulatory authorities, which is a huge incentive for the traders to choose these two brokers. eToro is in fact regulated by two of the most dominant regulatory bodies worldwide – the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority of the United Kingdom (FCA). These two organizations authorize eToro to provide its services both to the clients within the European Union and outside the region, as well.

AvaTrade is one of the most regulated and reliable Forex brokers holding licenses from ten different regulatory organs listed below:

- Central Bank of Ireland (CBI)

- British Virgin Islands Financial Services Commission (BVI FSC)

- Australian Securities and Investments Commission (ASIC)

- Financial Sector Conduct Authority (FSCA)

- Financial Services Agency (FCA)

- The Financial Futures Association of Japan (FFAJ)

- Financial Services Regulatory Authority (FSRA)

- Cyprus Securities and Exchange Commission (CySEC)

- Israel Securities Authority (ISA)

Register with AvaTrade for maximum security

Which one has better bonus offers, eToro or AvaTrade?

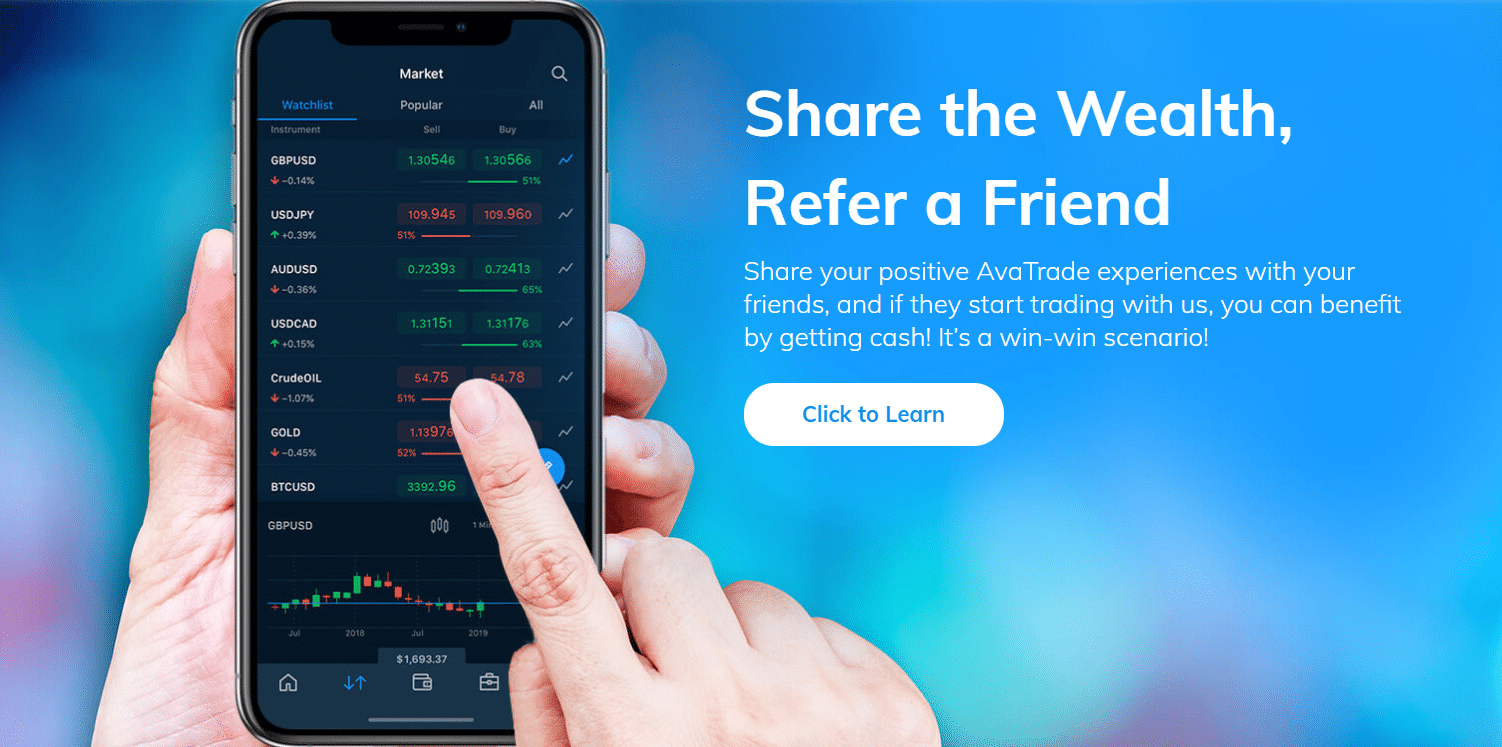

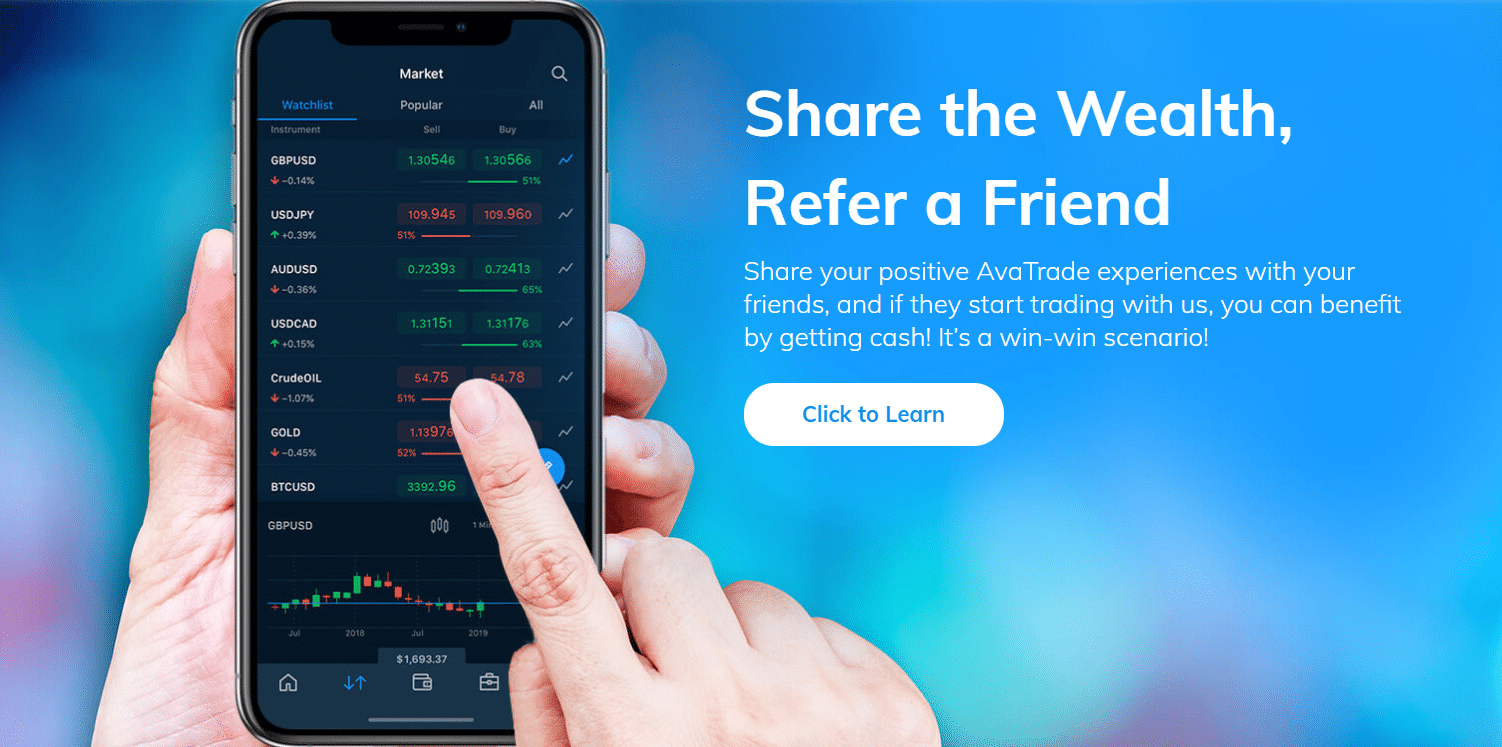

Usually, promotional campaigns with bonus programs are quite rare with regulated Forex brokers. The reason behind it is the fact that the regulations prohibit the bonus offerings in many jurisdictions. For example, the European Union regulations completely ban the bonus programs of their regulated brokers. That is why neither eToro nor AvaTrade provides deposit or no deposit bonuses to their clients. However, instead of the bonus schemes, they have convenient referral programs that reward the clients with cash prizes.

Usually, promotional campaigns with bonus programs are quite rare with regulated Forex brokers. The reason behind it is the fact that the regulations prohibit the bonus offerings in many jurisdictions. For example, the European Union regulations completely ban the bonus programs of their regulated brokers. That is why neither eToro nor AvaTrade provides deposit or no deposit bonuses to their clients. However, instead of the bonus schemes, they have convenient referral programs that reward the clients with cash prizes.

eToro awards 50 USD to their clients who refer a new registering user on the broker’s website. The new user will also get a 50 USD referral bonus. You will be receiving the referral bonus every time you bring your friend or acquaintance to eToro’s trading platform and they make a trade of at least 100 USD value. AvaTrade’s referral program also follows the same logic. However, with AvaTrade clients get more generous rewards. For instance, if your referral deposits 250-500 USD, then you will receive a 75 USD referral bonus. For deposits up to 10,000 USD, AvaTrade is giving out 400 USD bonuses.

|

|

AvaTrade |

eToro |

|

Pros |

Low trading cost |

Social trading broker |

|

Flexible leverage |

Accepts US clients |

|

Mutiple regulations |

Crypto bonus |

|

Cons |

No bonuses |

Restricted leverage |

|

One account type |

Limited portfolio |

|

Geographic restrictions |

High trading costs |

eToro vs AvaTrade: which one is a better broker overall?

We were glad to observe that both brokers comply with the market standards and modern trends of the Forex industry. They are both reliable brokerage companies with multiple licenses and authorizations from notable institutions. They both provide flexible terms and convenient trading conditions to their clients with cheaper services relative to the market average. Traders of both AvaTrade and eToro can enjoy promotional campaigns like referral programs and earn extra revenue through participating in them. Therefore, we can say that these two brokers represent a safe and even a clever option. However, AvaTrade has a slight advantage over eToro, as the broker has much more licenses, more generous bonus offerings, and diverse options of trading platforms. But, in the end, it is still up to you which broker do you prefer.

FAQs on AvaTrade vs eToro

What is better than eToro?

For Forex traders, the better broker is AvaTrade, XM, or HotForex due to several reasons. First of all, since eToro is a social trading broker its prices are higher than average. For instance, eToro’s spreads on currency pairs start from 2 pips on some of the most popular Forex assets, whereas AvaTrade has spreads starting from 0.9 pips. Furthermore, eToro has no traditional and advanced platforms, which might be a huge drawback for Forex traders.

Is AvaTrade a good broker?

AvaTrade is one of the most reliable Forex brokers. The company is regulated and authorized by nine different regulatory bodies across numerous jurisdictions. Furthermore, AvaTrade offers commission-free trading to its clients with ultra-tight spreads starting from 0.9 pips. Additionally, AvaTrade has one of the most advanced trading platforms that include both traditional MT4 and MT5, as well as the innovative platforms of AvaTrade GO and AvaSocial.

Is eToro good for beginners?

We would not recommend eToro for beginners. Firstly, the broker has a complicated cost structure meaning that it would be difficult for beginner traders to understand where they are charged with commissions. Secondly, eToro has no popular trading platforms that are easy to learn such as MT4 or MT4. Instead, the broker offers proprietary trading terminals which could be a bit hard for beginners to learn.

English

English  Forex trading costs include spreads, commissions, minimum deposits, and withdrawal or deposit fees. We can say that both eToro and AvaTrade are rather budget-friendly options for Forex traders than expensive ones. However, it may also depend on your country of residence. For example, eToro’s minimum deposit requirements will vary according to the regions where the traders come from. The United States residents have an opportunity to start trading with just 50 US dollars, whereas citizens of other countries might be required to invest 250 USD or even 1000 USD. That is not the case for AvaTrade broker since it has a universal minimum deposit requirement of 100 USD across all nationalities.

Forex trading costs include spreads, commissions, minimum deposits, and withdrawal or deposit fees. We can say that both eToro and AvaTrade are rather budget-friendly options for Forex traders than expensive ones. However, it may also depend on your country of residence. For example, eToro’s minimum deposit requirements will vary according to the regions where the traders come from. The United States residents have an opportunity to start trading with just 50 US dollars, whereas citizens of other countries might be required to invest 250 USD or even 1000 USD. That is not the case for AvaTrade broker since it has a universal minimum deposit requirement of 100 USD across all nationalities. Both AvaTrade and eToro are industry-leading brokerage companies and one of the reasons for their popularity is their sophisticated trading platforms. These two brokers put an extra effort to develop the user-friendly interface and compatibility of the trading software. However, since eToro is a social trading broker by nature, it has its own trading platform in contrast to AvaTrade, which also supports the most popular trading software of MetaTrader 4 and MetaTrader 5.

Both AvaTrade and eToro are industry-leading brokerage companies and one of the reasons for their popularity is their sophisticated trading platforms. These two brokers put an extra effort to develop the user-friendly interface and compatibility of the trading software. However, since eToro is a social trading broker by nature, it has its own trading platform in contrast to AvaTrade, which also supports the most popular trading software of MetaTrader 4 and MetaTrader 5.

In Forex, the security of the broker does not come from the safe platform with data protection systems only. In fact, the primary guarantee of security comes from the licenses and regulations that a broker holds. The general rule is that the more regulations a company has the safer it is for the traders. However, one should always be careful with the listed regulations on the brokerages’ websites as they might display non-legit bodies or incompetent organizations that granted licenses to the broker. But, it is easy to double-check whether the regulatory body can be trusted or not on the internet.

In Forex, the security of the broker does not come from the safe platform with data protection systems only. In fact, the primary guarantee of security comes from the licenses and regulations that a broker holds. The general rule is that the more regulations a company has the safer it is for the traders. However, one should always be careful with the listed regulations on the brokerages’ websites as they might display non-legit bodies or incompetent organizations that granted licenses to the broker. But, it is easy to double-check whether the regulatory body can be trusted or not on the internet. Usually, promotional campaigns with bonus programs are quite rare with regulated Forex brokers. The reason behind it is the fact that the regulations prohibit the bonus offerings in many jurisdictions. For example, the European Union regulations completely ban the bonus programs of their regulated brokers. That is why neither eToro nor AvaTrade provides deposit or no deposit bonuses to their clients. However, instead of the bonus schemes, they have convenient referral programs that reward the clients with cash prizes.

Usually, promotional campaigns with bonus programs are quite rare with regulated Forex brokers. The reason behind it is the fact that the regulations prohibit the bonus offerings in many jurisdictions. For example, the European Union regulations completely ban the bonus programs of their regulated brokers. That is why neither eToro nor AvaTrade provides deposit or no deposit bonuses to their clients. However, instead of the bonus schemes, they have convenient referral programs that reward the clients with cash prizes.