SAXO Bank Forex Review

In this SAXO Bank review we will give an overview of what the broker has to offer for Forex traders, its trading platforms, instruments, features, fees, and more.

SAXO is a popular broker among European traders and is known for its security and diverse selection of instruments.

Is SAXO Bank a good choice to open an FX trading account with? – Let’s find out.

SAXO Bank Broker History

Founded in 1992 in Denmark, SAXO Bank has become one of the most recognizable and respected names in the global brokerage industry.

The firm is generally well-regarded among clients and offers an extensive lineup of tradable instruments, as well as some of the highest levels of security among its peers.

The firm is licensed and regulated by FINMA in Switzerland, while also holding licenses from some of the world’s top-tier regulatory agencies, such as the FCA in the UK, ASIC in Australia, and the FSA in Japan, among others.

With over 60,000 different financial instruments, SAXO is among the most diverse brokers in the world, offering its services to millions of clients in Europe and beyond.

SAXO Bank Accounts and Features

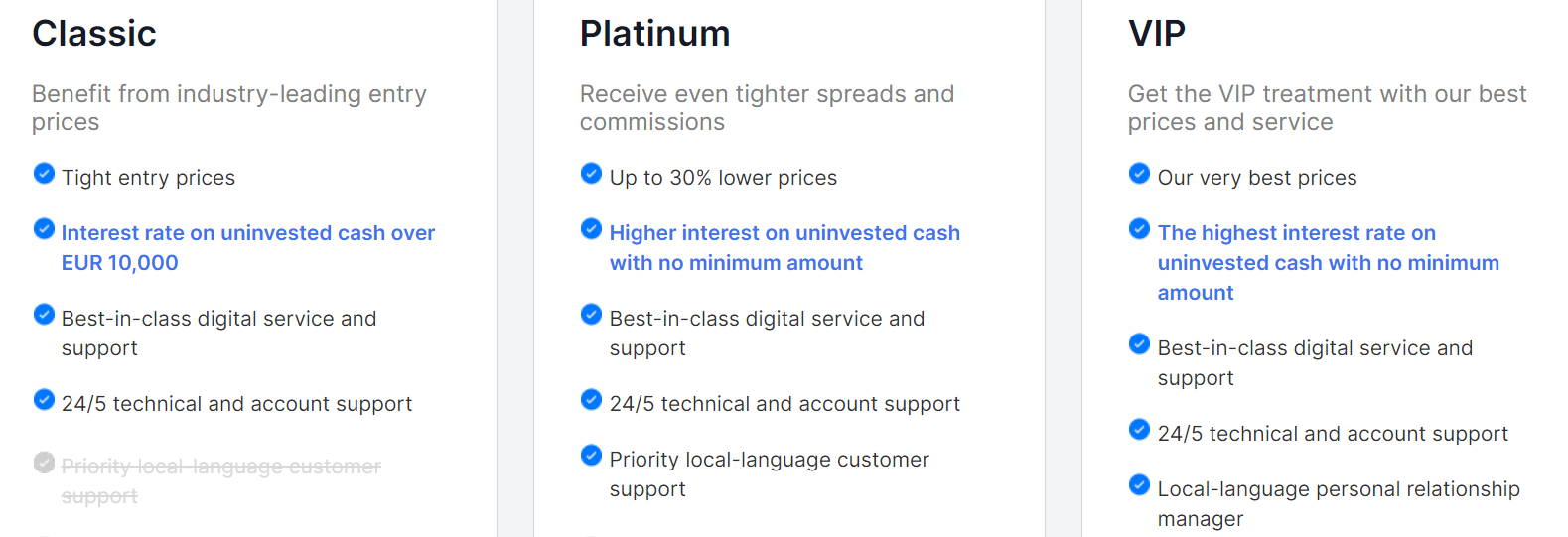

There are three different types of accounts available at SAXO Bank and each are designed for different customer segments. These accounts are – Classic, Platinum, and VIP.

The Classic account is the most accessible and therefore the most popular account, with the minimum deposit requirement starting at USD 5,000.

The account comes with all the necessary tools and instruments available at SAXO and gives traders access to 60,000+ assets.

The Platinum account is for users with a higher net worth and the minimum deposit is as high as USD 250.000. This account includes all the features of the Classic account with 30% lower trading fees, as well as the option of a designated account manager to administer your portfolio on your behalf.

The VIP accounts are reserved for clients who can deposit north of USD 1,250,000 to their accounts and come with a personal assistant, as well as exclusive access to SaxoStrats and invitations to events organized by SAXO.

Clients can hold balances in a wide range of different currencies, which include: AED, AUD, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, ILS, JPY, MXN, NOK, NZ, PLN, RON, RUB, SEK, SGD, ZAR, TRY, and USD.

SAXO Bank Fees and Commissions

Unlike other brokerage firms, SAXO Bank offers direct STP execution, and charges a small commission over the market spread.

SAXO does not charge any fees on deposits or withdrawals. And there isn’t any inactivity fee on your accounts.

As for trading spreads, they vary between instruments, as well as the three account types offered by the brokerage. Below we can see a table containing the spreads of some of the most popular FX instruments offered by SAXO, as well as the spread differences between the Classic, Platinum, and VIP accounts:

| Instrument | Classic | Platinum | VIP |

|---|---|---|---|

| EURUSD | 0.7 pips | 0.6 pips | 0.5 pips |

| GBPUSD | 0.8 pips | 0.6 pips | 0.5 pips |

| EURJPY | 1 pip | 0.8 pips | 0.7 pips |

| USDJPY | 0.8 pips | 0.7 pips | 0.5 pips |

| AUDUSD | 0.6 pips | 0.5 pips | 0.4 pips |

| XAUUSD | 0.10 USD | 0.08 USD | 0.06 USD |

Clients can make deposits and withdrawals at SAXO Bank using bank transfers. E-wallets and credit cards are not supported and there is a minimum deposit requirement of USD 5,000.

Transfers are typically processed within 2-3 business days upon request.

SAXO Bank Trading Platforms Review

SAXO Bank offers three distinct trading platforms to its clients – SaxoTraderGO, SaxoInvestor and SaxoTraderPRO, with the first being geared towards trader retail clients, the second towards investors, and the latter for professional and corporate clients.

Free demo versions are offered for clients to test them out before committing.

SaxoTraderGo

SaxoTraderGO is an online trading platform that allows clients to trade from anywhere and comes with plenty of useful functionalities to make for a rewarding trading experience.

Some notable features of the SaxoTraderGO platform include:

- Fundamental analysis tools and analyst sentiment indicators on all major stocks

- Access to news and analytical pieces from the in-house analytics team at SAXO

- Technical tools like live charts, indicators, as well as annotation tools on charts

- Customizable charts with over 40 indicators and drawing tools

- FX vanilla and touch options chains that can be directly linked with watchlists

SaxoTraderGO was designed to give retail traders plenty of value for their money, while also being accessible to complete beginners. Thanks to the intuitive design of the platform, traders can easily find what they are looking for and place trades with ease.

The platform also comes with performance analysis capabilities, as well as historical portfolio returns and composition, and an in-depth research tab with live updates from markets all around the world.

Saxoinvestor

A user-friendly, mobile investment platform. SaxoInvestor provides everything you need to invest quickly and securely in one place.

- Make, manage and research your investments from your desktop, phone and laptop

- Get access to Stocks, Mutual Funds, ETFs, Bonds and Managed Portfolios.

- Explore current market trends to discover where new opportunities may exist

- View curated stock lists to easily identify potential investments within your preferred sector

- Use professional analyst ratings from Morningstar to identify your next investment

SaxoTraderPro

SaxoTraderPRO was created with professional traders in mind and comes equipped with all the basic features of the Go platform, as well as new additions for highly skilled, technical traders, such as:

- Depth Trader that allows users to place and manage orders in relation to the Level 2 order book in real time

- Access to real-time order flow on any exchange

- Modifiable algorithmic orders on European, U.S, and Asian markets

- Customizable charts with over 50 technical indicators and advanced drawing options

Additionally, SaxoTraderPRO also comes with reactive risk management features, such as quick-close, which closes all open FX and CFD positions in just two clicks.

Overall, SaxoTraderPRO provides added value to the SaxoTraderGO platform by introducing new features for professional traders that need to react very quickly to changing market dynamics.

SAXO Bank Additional Features

In addition to the web and desktop platforms, SAXO Bank also offers a mobile app for iOS and Android devices, which comes with all the necessary features of SaxoTraderGO and SaxoInvestor platforms built-in.

SAXO also offers a way to upgrade existing accounts from Classic to Platinum and VIP, which is part of a points-based loyalty program. For example, upgrading from Classic to Platinum requires 160,000 points, while 500,000 points are required to upgrade to a VIP account.

The maximum leverage available at Saxo Bank is 1:30 for retail traders and 1:66 for Professional clients.

Among the 60,000 plus tradable instruments offered by SAXO Bank are:

- 185+ spot pairs and 140+ forwards

- 6 cryptocurrencies

- 29 indices

- 19 commodities

- 8,800+ CFDs

- 23,500+ stocks

- 250+ futures

- 45+ FX vanilla options

- 3,200+ listed options

- 250+ mutual funds

- 5,900+ Bonds

- 7,000+ ETFs

Such a wide selection of instruments makes SAXO one of the richest brokerages in the world, offering something to every type of trader.

Educational Resources at SAXO Bank

SAXO Bank is also known for its extensive educational content. The official website includes articles explaining the basic concepts and core mechanics behind various instruments, such as bonds, options, futures, etc.

The firm also offers trading courses where clients can watch webinars and read articles to accumulate knowledge about the markets, which is very convenient for absolute beginners who are taking their first steps in the world of trading.

Risk management rules are also part of the package, explaining some core risk management and hedging strategies, how they work, and why they are important.

SAXO Bank Customer Support

SAXO Bank clients benefit from 24/5 customer support, with live chat option driven by AI available on the platform. Email support and hotline are both available and response times are typically low.

VIP clients can have a designated relationship manager that provides support in their local language, which is an added advantage for high-net-worth clients.

Conclusion

Overall, SAXO Bank shines in a few different key areas and offers plenty of value for money to their diverse client base. Some of the strongest advantages of using SAXO Bank as your primary FX broker include:

- An extensive selection of tradable instruments, such as: Currency pairs, stocks, bonds, commodities, cryptocurrencies, ETFs, mutual funds, futures and options

- Ultra-competitive prices, with no inactivity fees or platform fees and no minimum custody fees

- Educational materials that also come with a trading course

- Separate trading platforms for retail and professional traders and for investors

- Responsive customer support that is active 24/5

A well-rounded package makes SAXO one of the best choices for first-time traders of any asset class and competitive spreads and a long list of tradable instruments gives it a competitive edge over many competitors.

Comments (0 comment(s))