Many traders choose to enter the market using funded trading accounts, as opposed to using their own capital. This gives traders more structure in their strategies, as trading account providers present them with guidelines, clear trading objectives and considerably more funds than otherwise available to them.

A funded forex account is especially popular among traders due to the large degree of leverage they can tap into to increase their purchasing power.

There are dozens of funded trading accounts forex traders can use and each come with their own perks and limitations.

For this reason, tip funded trading accounts compete with each other to offer the best terms and trading platforms to their prospective traders.

When a trader applies for a funded account, they have to go through an audition process, which ensures that the trader can comply with the guidelines of the account provider and can also demonstrate their proficiency and knowledge of the market.

If you are looking for a list of the top funded trading accounts, you’ve come to the right place.

What Are Funded Trading Accounts?

Before diving into the top funded trading accounts list, it is important to briefly overview what funded trading accounts are and how they function.

Funded trading accounts are offered by firms that give their own capital to traders on contract who then use the money to execute trades and generate profits. These accounts come with a set of terms, such as a profit sharing agreement, as well as other limitations or specifications set by the firm.

After the trader has applied, they will go through the auditioning process where they must demonstrate their knowledge of the market and the ability to trade within the bounds set by the firm.

Once the trader has successfully finalized their audition, they are awarded a capital tier and can start using the money to make trades on the market.

Surgetrader

Surgetrader offers one of the highest-rated funded trading accounts for forex and precious metals traders. The firm comes with a sophisticated trading platform and has a broadly long-term focus with its investments.

The terms offered by Surgetrader include:

- A profit share of up to 90%

- A profit target of 10%

- 5% daily loss limit

- 8% maximum trailing drawdown

- 10:1 leverage for forex, oil, metals, and indices, and 5:1 for stocks, with an option to increase the leverage up to 20:1 for forex and metals trades

- No time limits on traders

- Funding tiers that range from Starter ($25,000) to Master ($1,000,000)

- Audition fees ranging from $250 (Starter) to $6,500 (Master)

Features

Surgetrader aids their traders by providing 3-5 trade ideas every day, which traders can use or disregard at their own discretion.

The firm also does not limit traders on their methodology, as long as the daily loss and trailing drawdown boundaries are met. However, in the case of a hard breach, traders risk losing access to their accounts.

All trading accounts provided by Surgetrader are managed by EightCap, which is a broker regulated by the Australian Securities and Investments Commission (ASIC).

The audition process at Surgetrader is a relatively fast process that is typically concluded in 24-48 hours, after which traders have direct access to their funded trading accounts.

Treaders enjoy an uninterrupted access to real-time data and analytics to structure their trades in accordance with market conditions.

Traders who use Surgetrader are required to place a stop-loss on all of their trades to mitigate risk.

Payout Methods

Traders on Surgetrader can withdraw their funds using a wide variety of methods, such as PayPal, Revolut, Payoneer, and Transferwise.

ACH withdrawals are also available and Surgetrader also allows for withdrawals in cryptocurrency.

Fidelcrest

Fidelcrest is one of the best funded trading accounts forex traders can use and offers a host of features to help traders make the most of their accounts.

Fidelcrest offers two distinct trader programs – Pro and Micro. Each of these programs have different risk profiles, performance targets, and capital allocation.

Fidelcrest Pro Trader

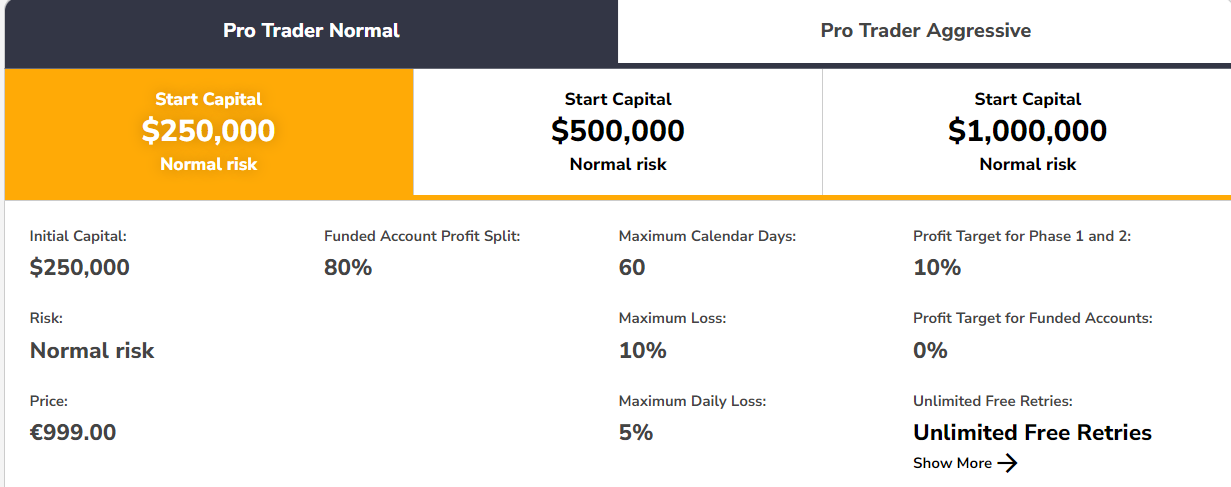

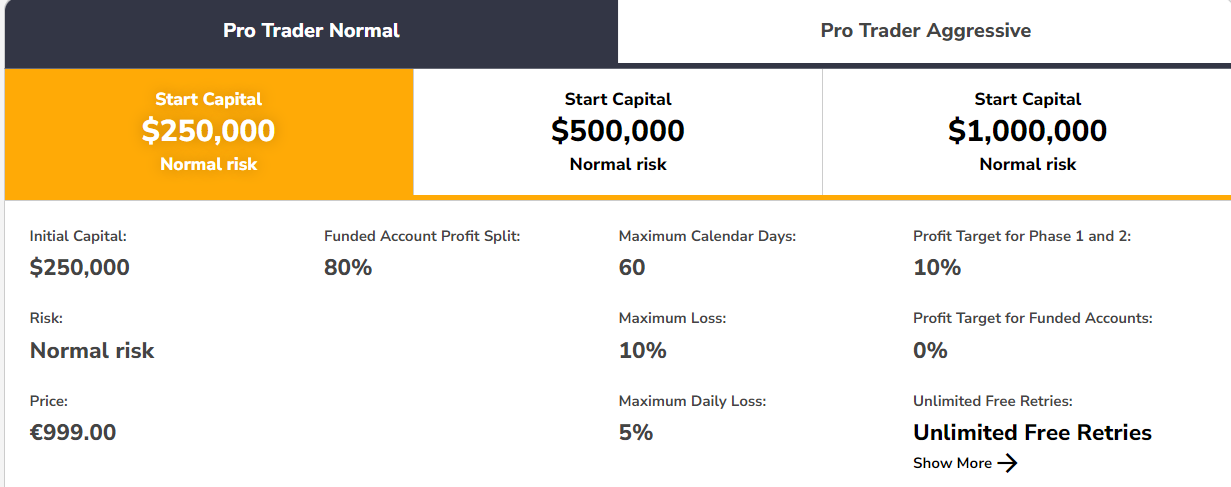

The Fidelcrest Pro Trader program is divided into two risk profiles – Normal and Aggressive.

The Normal risk profile offers traders the ability to get $250,000, $500,000, or $1,000,000 in funding.

The terms of the Normal Pro Trader package include:

- Program price of EUR 999, EUR 1,899, and EUR 2,999, respectively

- Each of these accounts split profits 80/20 in favor of the trader

- The profit target for Phase 1 and Phase 2 is 10%

- Maximum daily loss of 5%

- Maximum loss limit of 10%

- Maximum 60 calendar days

- 0% profit target for funded accounts

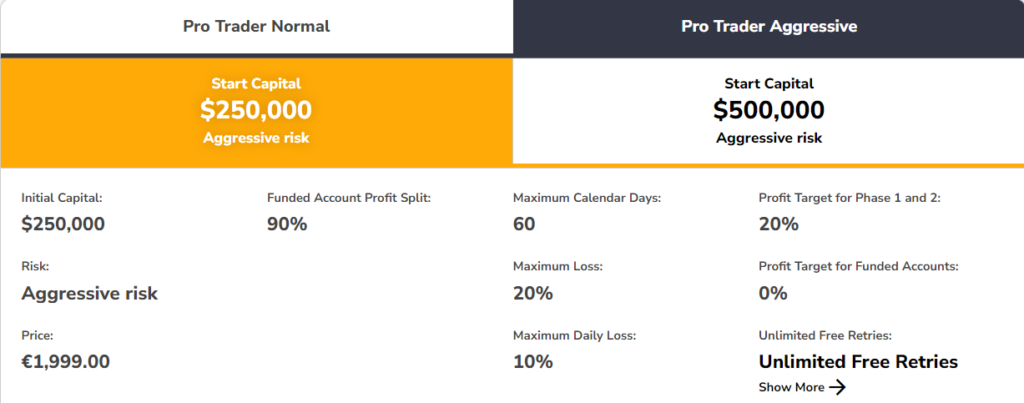

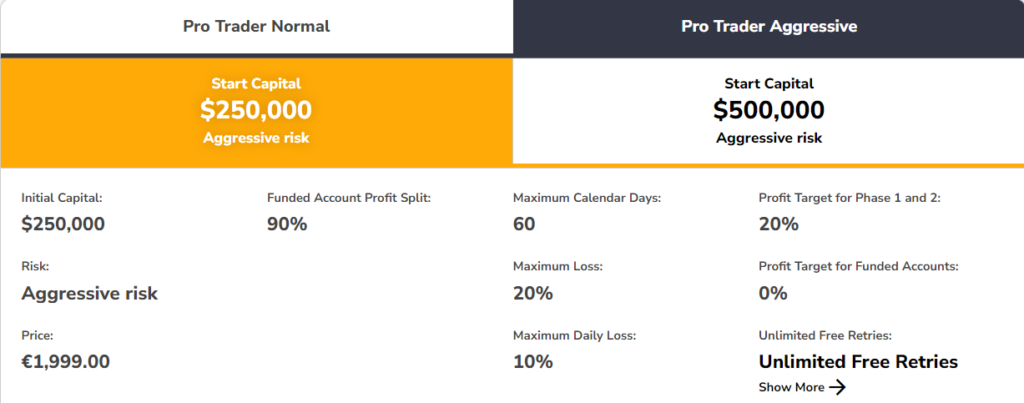

On the other hand, the Aggressive risk profile allocated $250,000 or $500,000 to traders. The terms for the Aggressive risk profile are as follows:

- Program price of EUR 1,999 and EUR 3,499, respectively

- A profit split of 90/10 in favor of the trader

- The profit target for Phase 1 and Phase 2 is 20%

- 0% profit target for funded accounts

- Maximum daily loss of 10%

- Maximum loss limit of 20%

- Maximum 60 calendar days

Fidelcrest Micro Trader

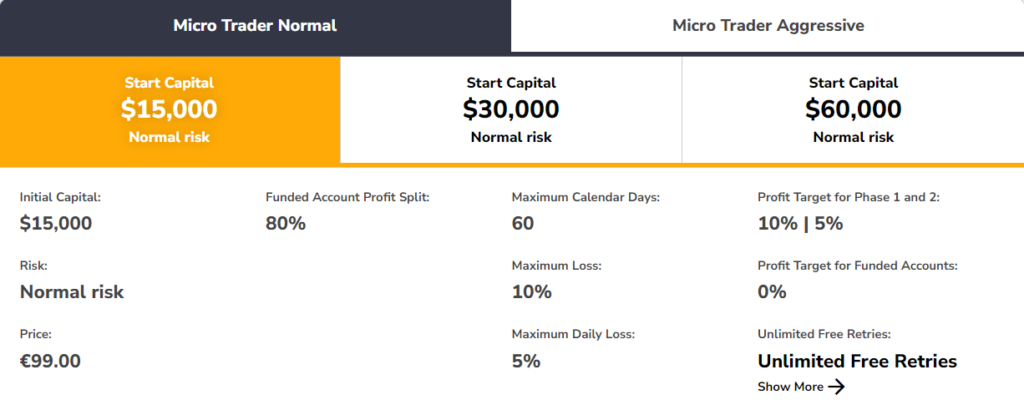

The Fidelcrest Micros Trader accounts are designed for traders with a more modest budget and are also divided into Normal and Aggressive risk profiles.

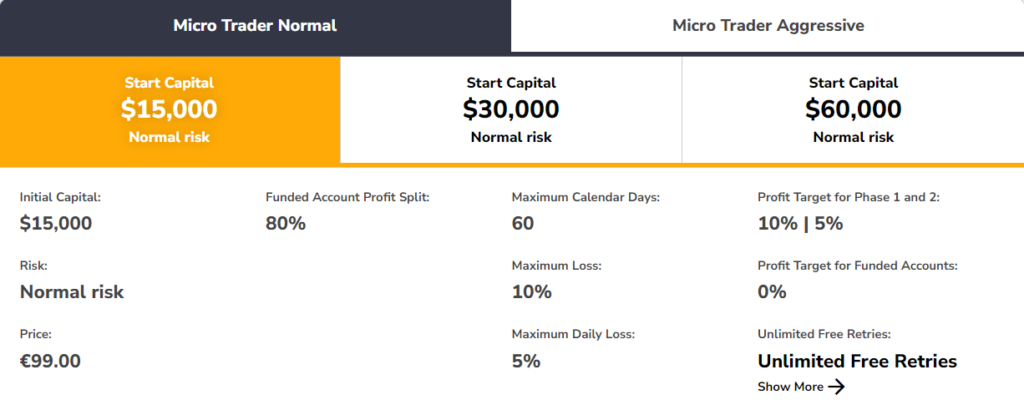

The Micro Trader Normal account offers the following terms:

- Starting capital of $15,000, $30,000, or $60,000

- The prices of these accounts are EUR 99, EUR 199 and EUR 299, respectively

- Funded account profit split 80/20 in favor of the trader

- Maximum daily loss of 5%

- Maximum loss limit of 10%

- Profit target for funded traders is 0%

- 10% profit target for Phase 1, 5% for Phase 2

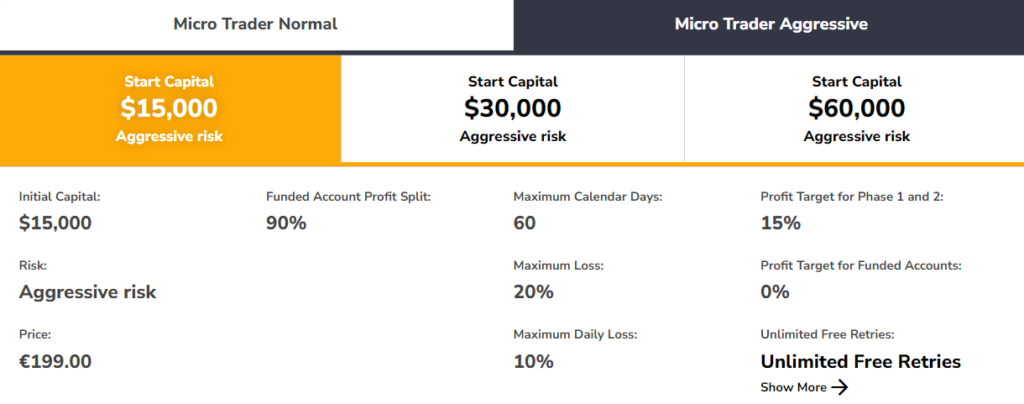

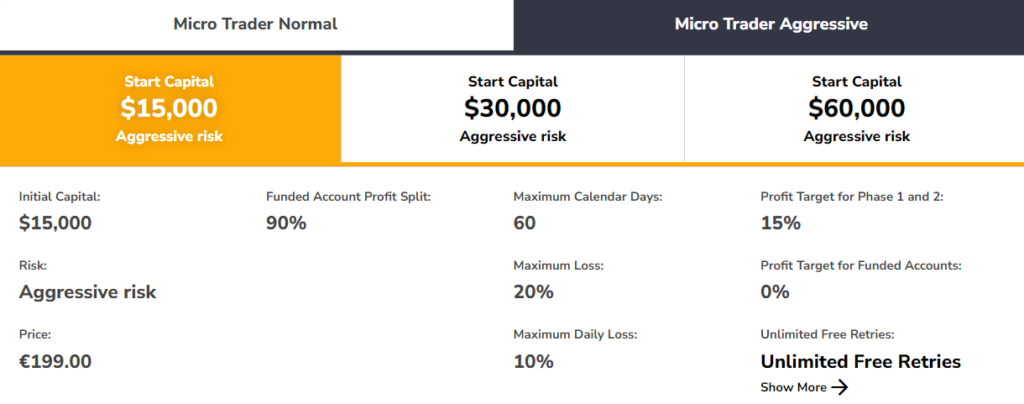

The Micro Trader Aggressive account, on the other hand, offers the following terms:

- Starting capital of $15,000, $30,000, or $60,000

- The prices of these accounts are EUR 199, EUR 299, and EUR 399, respectively

- Funded account profit split 90/10 in favor of the trader

- Maximum daily loss of 10%

- Maximum loss limit of 20%

- Profit target for funded traders is 0%

- 15% profit target for Phase 1 and Phase 2

Features

Other key features of a Fidelcrest funded account include:

- 5% profit target on MicroFX accounts

- 1:100 maximum leverage

- A minimum requirement of 10 active days per period

- Aggressive accounts can hold trades overnight and through the weekend

- Swap-free accounts available

Payout Methods

The payout methods offered by Fidelcrest include: PayPal, Skrill, Neteller. Traders can also use wire transfers and credit cards.

FTMO

One of the top funded trading accounts, FTMO offers traders a robust selection of account features, as well as risk profiles and funding tiers.

Traders using FTMO can choose between Normal and Aggressive risk profiles and get funding between $10,000 – $200,000 for Normal profiles, and $10,000 – $100,000 for Aggressive profiles.

Traders can choose between 7 different currencies, such as: USD, EUR, CAD, CHF, GBP, AUD, and CZK.

Traders must complete the FTMO Challenge to become full-fledged members, at which point their initial deposit is refunded.

Normal Risk

Using the Normal Risk account, traders can get funding from $10,000 up to $200,000. Here is the breakdown of the fees and performance metrics associated with a Normal Risk account:

- 5 different funding options ($10,000, $25,000, $50,000, $100,000, $200,000)

- No applicable trading period limits

- Minimum of 4 trading days

- Maximum daily loss of 5%

- Maximum loss limit of 10%

- 10% profit target

- Refundable fees of EUR 155, EUR 250, EUR 345, EUR 540, and EUR 1080, respectively

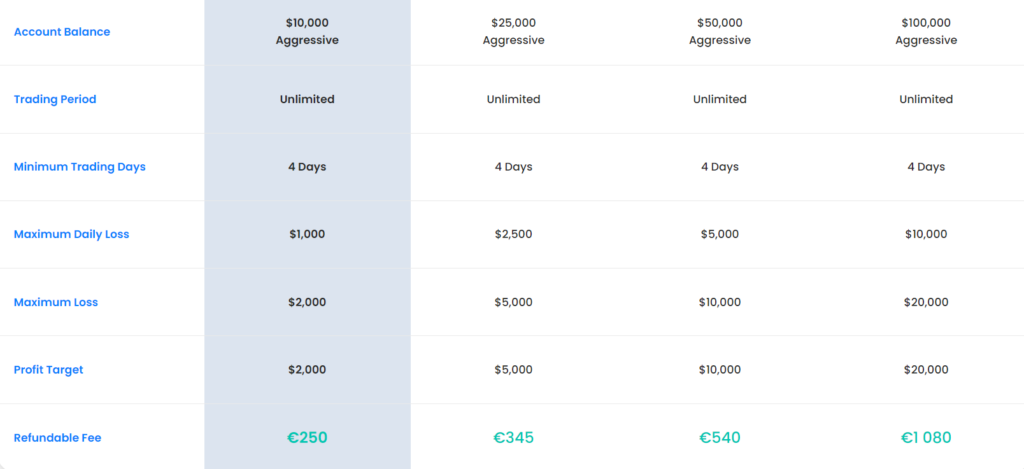

Aggressive Risk

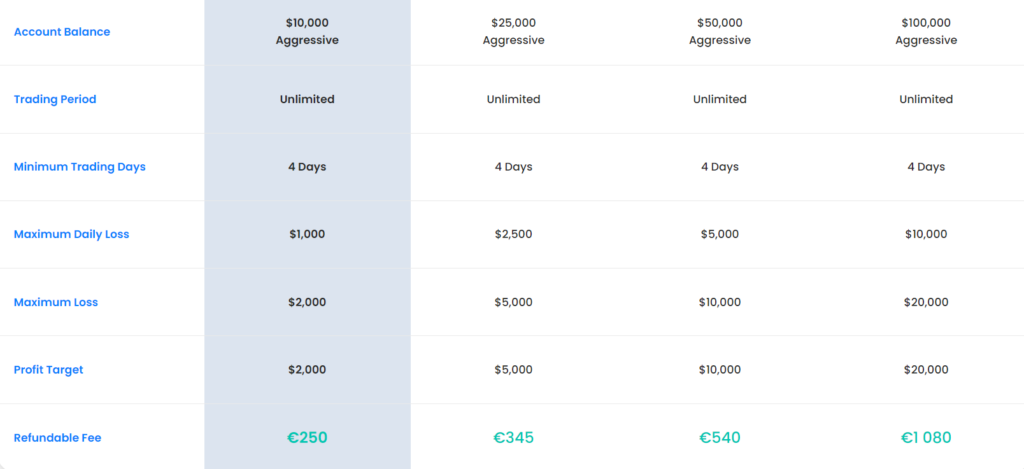

The FTMO Aggressive Risk account allows traders to obtain funding between $10,000 and $100,000. Here is the breakdown of the performance requirements associated with an Aggressive Risk account:

- 5 different account balance options ($10,000, $25,000, $50,000, $100,000)

- No applicable trading period limits

- Minimum of 4 trading days

- Maximum daily loss of 10%

- Maximum loss limit of 20%

- 20% profit target

- Refundable fees of EUR 250, EUR 345, EUR 540, and EUR 1080, respectively

Features

- MetaTrader 4, MetaTrader 5, and cTrader available

- Available assets include: stocks, bonds, cryptocurrencies, forex, commodities, indices

- Free trial option available

- Complete autonomy in terms of trading style

- Performance coaches to evaluate and provide feedback on areas that might need improvement

- Customer support via email, phone, and live chat

- Trading basics for beginner users

- Different apps available for traders

Payout Methods

FTMO has a relatively limited number of payout methods available, such as Google Pay, bank wire transfer, and debit/credit cards.

TopStepTrader

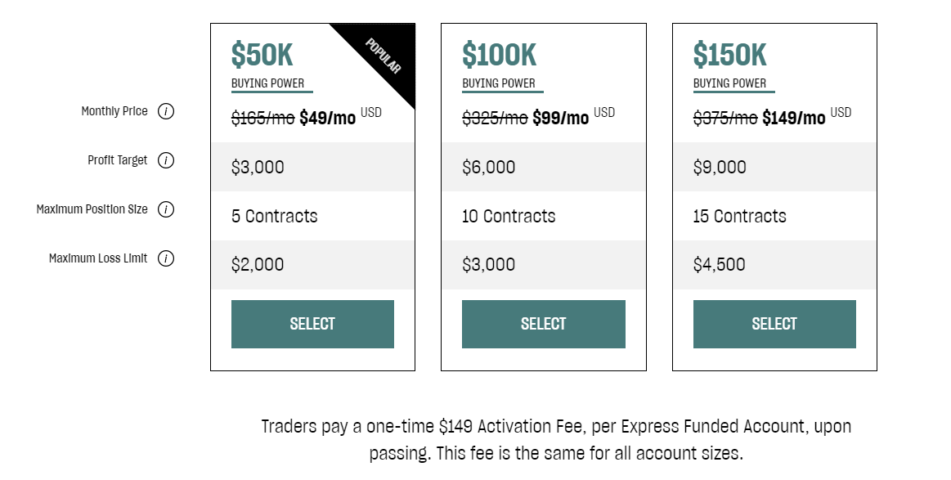

Next up on our top funded trading accounts list is TopStepTrader. TopStep focuses mostly on futures trading and offers the likes of crude oil, gold, interest rates, and micro indices to traders, among other instruments.

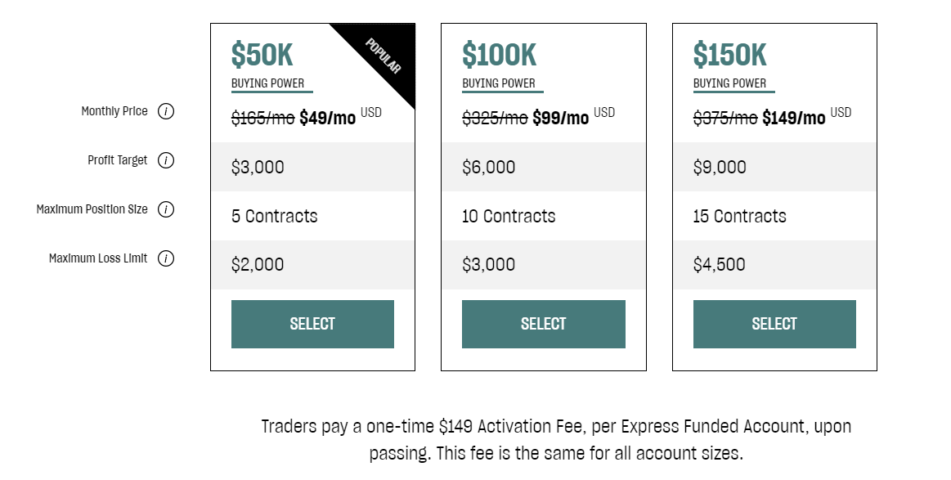

TopStep has a three-tier account system, with $50,000, $100,000, and $150,000 available in funding.

Features

- Trader pay a one-time activation fee of $149 for the Express Funded Account

- The monthly prices of the $50,000, $100,000 and $150,000 accounts are $165, $325, and $375, respectively

- Each account has a 6% profit target

- Maximum position sizes are 5, 10, and 15 contracts, respectively

- Maximum loss limits are $2,000, $3,000, and $4,500, respectively

- Traders get to keep 100% of their profits for the first $5,000 and 90% of all the profits generated after that

- Maximum buying power of $500,000, with requests for additional increases possible

- No bonuses and automated trading options

- Traders can choose between 1:1 coaching, or a group setting

- Customer support available only on weekdays, on select hours

Payout Methods

The payout methods offered by TopStep include: U.S bank transfers and e-wallets. Bank transfers via SWIFT are also available.

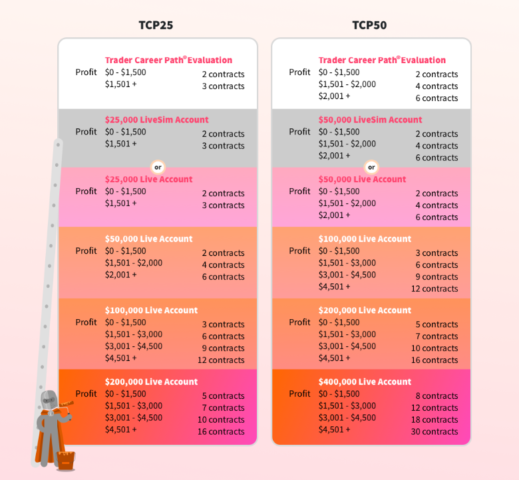

Earn2Trade

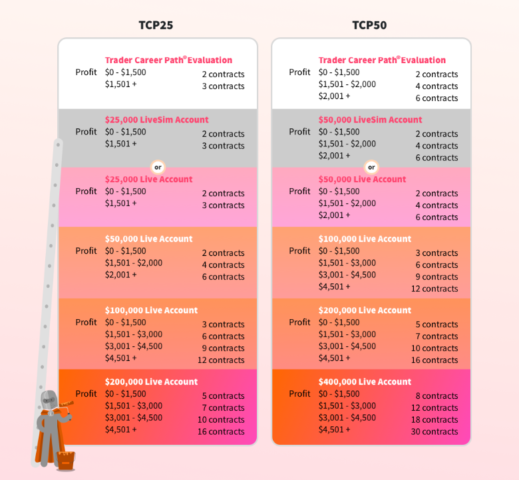

Earn2Trade is a prop trading firm that offers funded futures trading accounts to prospective traders. Accounts on Earn2Trade are divided into two tiers – TCP25 and TCP50, with TCP50 offering funding up to $400,000.

Traders on Earn2Trade go through an evaluation process, where they trade with a simulated account worth $25,000 to demonstrate their abilities and knowledge of the market.

Features

Earn2Trade offers one simulated and four funded live accounts, with funding amounting to $25,000, $50,000, $100,000, or $200,000 for live accounts.

The features and limitations of the live accounts include:

- Trailing drawdowns of $1,500, $2,000 and $3,500 for accounts up to $100,000, and a fixed drawdown of $194,000 for the $200,000 live account

- Daily loss limits of $550, $1,100, $2,200, $4,400, respectively

- Traders keep 80% of the generated profits

- Traders must trade at least 15 days and must close all of their positions by 3:50pm CT until 5pm CT

- Trades can be conducted during the day, with public holidays being an exception

- Traders can use from 2 to a maximum of 30 contracts

Payout Methods

Payout methods available on Earn2Trade include: bank wire transfers, PayPal, Payoneer, Wise, and Revolut. Traders can also use cryptocurrency withdrawals if they have a valid Coinbase account. All withdrawals are processed through Deel.

Key Takeaways From The Best Funded Trading Accounts To Try Out

- Funded trading accounts allow traders to use the prop firm’s funds to make trades and keep up to 90% of the generated profits

- Prop firms offer a wide range of asset classes, such as stocks, bonds, crypto, forex, indices, futures, etc

- Prop trading accounts come with a set of limitations and requirements that traders must meet in order to maintain their account privileges

- Traders must demonstrate their proficiency and the ability to trade within the prop firm’s limits during the auditioning process, which is often conducted using simulated accounts

- The best funded trading accounts forex traders can join include the likes of FTMO, TopStepTrader, Earn2Trade, Fidelcrest, and Surgetrader

- Some of these prop traders, such as SurgeTrader and Fidelcrest, offer up to $1,000,000 in funding to experienced traders

FAQs On The Best Funded Trading Accounts

What are the best funded trading accounts?

Some of the best funded trading accounts include the likes of FTMO, TopStepTrader, Earn2Trade, Surgetrader and Fidelcrest. These proprietary trading firms allow traders to exchange a wide variety of assets and also offer flexible payout terms.

Can I open a funded forex account?

Yes. You can open a funded forex account after you have successfully passed the auditioning stage and proven your knowledge of the markets. After which, you can choose the account size that best suits you. Most prop trading firms give traders full autonomy on how they approach their trades, as long as the performance fits within the agreed limits.

Do funded forex accounts have limits?

Yes. funded forex accounts come with a few limits, such as the maximum drawdown and loss a trader can incur on the principal amount. There are also other restrictions in place for prop traders to limit reckless trading using their funds, in which case the trader may lose their account privileges.

English

English