Finding the best financial trading software

Table of contents

In Forex, currency exchange is executed using financial trading software. The trading software that you end up using will have a significant impact on your future success in trading. It will define how many trading instruments you can use within a single platform, as well as how fast and smooth your order executions are.

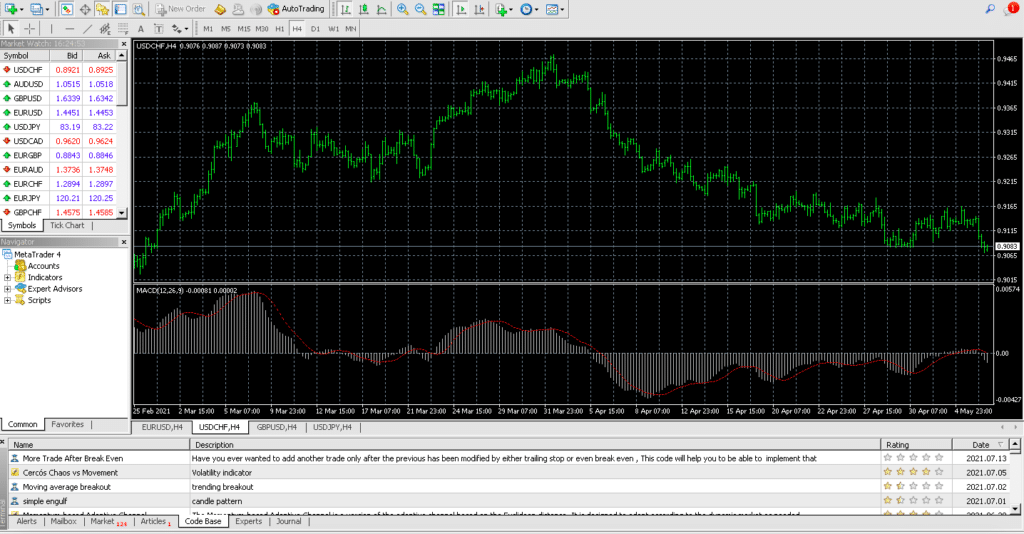

Besides driving the trading process itself, a financial trading platform offers you many other features as well. The main ones include technical indicators, live price quotes, and various chart types, all of which you can incorporate into your individual trading strategy.

There are a number of trading platforms that are widely used in trading, including MetaTrader 4, MetaTrader 5, and cTrader. Moreover, many Forex brokers offer proprietary software that was developed specifically for them and their clients.

In this financial trading software guide, we will have a closer look at the main functions of the trading platforms and how best to incorporate them in your trading plan. Finally, we will explore some of the most popular trading platforms available today.

Register with best MT4 Broker – XM

What are the main types of financial trading software?

Before diving deep into discussing the main features of the trading software, let’s have a look at the different types of trading platforms available in the market today. With the recent technological advancements, you will have a choice of accessing the Forex market on your mobile, or on your PC – with downloadable and non-downloadable software.

With a variety of forms in which the trading software comes, you might find it difficult to choose the one that suits you and your needs best. Below, we have provided a brief overview of the types of software to trade finance:

Desktop trading software

In order to start using this kind of software, you will need to download the program to your program and then access the Forex market. This form of the trading platform will best be suitable for those who wish to trade from one place and one computer, e.g. your home PC.

You will find that a large number of financial trading software companies offer this form of software as an option for their clients, and there is good reasoning behind it. By using desktop trading software, you will be able to log in to your account within just a few seconds, as opposed to a few minutes that the web-based trading software takes.

On top of the speed advantage, many experts note that desktop programs can often offer more trading features, as well as more information to refer to, prior to reacting to the market movements. Finally, for those of you who take privacy seriously, using downloadable software might feel safer than trading with a web-based one.

However, it is worth noting once again that with a downloadable program, you will only be able to use your software for financial trading to access the market from the one PC that it is downloaded to – which means that your ability to react swiftly to the market developments will be very much limited.

Web-based trading software

Finally, with this type of trading software, you will be able to access the Forex market whenever you want and wherever you are – so long as you have a stable Internet connection. You will also see that almost every broker around the world offers this trading option.

Thus, the most obvious benefit of web-based trading software is the flexibility that it provides for the traders who use it. Moreover, it is usually very user-friendly, and you should have no problem getting the gist of it in no time. For that reason, web-based trading can easily be listed as very advisable finance trading software for beginners.

On top of that, the backup feature of the web-based trading software, is, without a doubt, more reliable than that of the downloadable program, as with cloud storage your data is less likely to be lost for good. Finally, unlike the downloadable program, web-based software will not require as many PC resources, and will still allow you to trade in an advanced environment.

Having said that, we should note that depending on your server provider, your web-based software can be vulnerable to a number of threats. If the cloud storage collapses, there is no guarantee as to what is going to happen to your personal data.

Moreover, if either your service provider or Internet connection fails to perform, your order execution may be compromised. Thus, before deciding to use finance trading software online, you should make sure that both the service provider is sufficiently reliable and the Internet connection is strong.

Mobile App

A mobile trading application is a type of trading software designed specifically for one’s mobile phone or tablet. All you will need is a stable connection to the Internet and the app that needs to be downloaded to the device of your choice.

There are multiple benefits of using the mobile app to trade on the go. First of all, you will no longer be bound to your computer screen and will be able to react to the relevant market developments swiftly and from any location.

Moreover, with the mobile trading software, you will still be able to access most of the key features of the trading software – such as the educational material, withdrawal, and depositing of trading funds, as well as various technical indicators. Finally, with a mobile version of the Forex trading software demo account, you will be able to test-drive the app and see if it is suitable for your personal trading style and needs.

However, there is a downside to using a mobile version of financial trading software. Many professional traders claim that the small size of the mobile phone’s screen prevents you from seeing some of the key details that are otherwise well visible on the PC.

Furthermore, some mobile devices process transactions much slower than PCs, and, coupled with an often unstable Internet connection, can really delay, or even interrupt the placing of your orders.

Trade using the mobile app – XM

What are the main features of financial trading software?

On top of allowing you to buy and sell currencies, financial trading software has a lot of other tools and indicators integrated into it. Below, we will provide a brief overview of some of the main features, and how they can be used to your benefit.

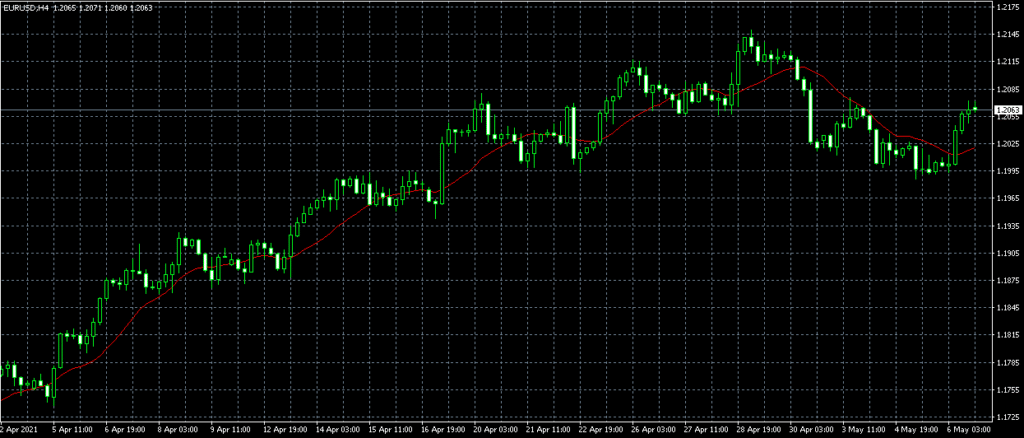

Charts

In Forex trading, charts are used as a visual representation of the price movements over a certain period of time. They usually come in a form of candlesticks, dots, bars, or lines, and the time intervals can vary from a minute to a month, and the time frame you will need to use will depend entirely on whether your trading strategy is short- or long term.

With financial trading analysis software, you will also get a number of charting tools that you can use to make the chart analysis more comprehensive, enjoyable, and easier. With those in hand, you will be able to draw chart patterns, trend corridors, as well as support and resistance lines, or even make notes on the chart itself. For additional information, you can easily check out our Forex chart guide here.

Scanning and notifying

With the scanning and notifying feature, you can have the software scan the market for the relevant developments and notify you once the trading opportunity is found. Therefore, all you’re left to do is make a decision according to the market analysis the finance AI trading software has done for you

Backtesting and optimisation

This feature may not be as popular as other trading software solutions, yet if you’re using analysis in your trades, backtesting can come in handy for you.

Essentially, blacklisting refers to the software automatically testing your trading strategy against the historical price action. This is very useful if you are unsure whether your chosen methodology will end up being profitable.

With automated backtesting, all that will be required from you is to fill in a number of parameters and receive the result of the testing. You can also conduct manual backtesting on any platform that has price action records.

However, this process is more complex and time-consuming. Moreover, backtesting is available as a separate tool online, although it usually charges a fee and is only available for a set number of trading strategies.

Similarly, optimization is a feature of the financial market trading software, that adjusts technical indicator parameters according to the historical price action per each individual instrument.

Trading

As we have already mentioned, the primary function of financial trading software is allowing its users to trade currencies. However, there are a number of interesting features that you can use in order to make your overall experience more efficient and successful.

Among the most popular ones is the automated mode of trading, which can easily be found in various types of trading software. This function uses complex computer algorithms to scan the market, find the best fitting opportunity, and execute the trade. All that is required from you is to adjust your trading parameters, such as the exit and entry points for the potential positions, and let the software do the rest.

The obvious advantage of using financial auto trading software is that it reduces human involvement to almost no involvement at all. Moreover, it executes the trades fast and does not deviate from the pre-chosen trading strategy. However, you should bear in mind that the strategies that showed good results during the backtesting might not be as successful in the real life, and the overall success rate might not live up to your expectations.

There are many other features that the financial trading software has to offer, including coding, which allows traders to write their own codes for various tools, be it technical indicators or expert advisors. but it doesn’t need a specific section. Professional traders often advise you to research each individual software, to work out the specific features that it has to offer and whether or not they will suit your trading needs.

How to find the best financial trading software for beginners?

As mentioned earlier, amateur traders might find themselves overwhelmed with the variety of options that are available in the financial trading software market today. Your best shot would be choosing the software that will be able to accommodate your individual style of trading, however, there are also a number of factors that you may want to keep in mind while conducting your research:

- Compatibility: this component will be of little relevance if you choose web-based trading software, however, if you want to go for a desktop or mobile app, it is of crucial importance. It is always useful to double-check whether your software of choice is compatible with Windows or iOS ( or both), or your mobile device.

- How much does it cost? The costs of the financial trading software vary, however, in most cases it is offered free of charge by the broker himself. Nevertheless, since it is not always the case, we would advise researching the possible fees and additional costs for the platform’s features. If you do not wish to spend a lot of money on your trading software, it is worth searching for the “financial trading software free download”.

- The platform features: as we have mentioned above, some of the features and tools of your trading software might require additional fees. Some features, such as take-profit, stop-loss, and research software should be free by default. Others, such as trailing stops or backtesting, might cost you extra, which is why you should determine which one of the paid functions will actually be useful for your individual trading strategy. Finally, a trader should also pay attention to the types of orders available with specific trading software.

- General impression: trading software that you will end up choosing will be a crucial component of your trading sessions. Thus, before making your mind up, you should be confident that you actually enjoy using it – from the interface and functions to the way it looks, all of those factors are equally important in choosing the best financial trading software.

What is the most popular financial trading software for beginners?

When it comes to the most popular financial trading software, most professional traders single out three: MetaTrader4 (MT4), MetaTrader5 (MT5), and cTrader. All three of them have gained popularity and recognition due to their reliability and efficiency, however, there are some key differences between them.

Both MT4 and MT5 were developed by a Russia-based company called MetaQuotes. The original version of the software – MT4, was released back in 2005 to replace all the previous versions of this trading software. The MT4 made the overall trading experience safer and more efficient, due to the reliable server and trading platform that was better overall.

In 2010, the company released a new version of the software, the MT5. Although the interface did differ much from the original, the software bugs were fixed and more features were added, including more assets to trade with (e.g. stocks and commodities). As of today, the financial trading software reviews usually speak very highly of both the MT4 and the MT5.

cTrader, on the other hand, was released in 2011 by a company called Spotware, and, similarly to the MT5, offered its users access to a variety of trading instruments and tools. However, unlike MT5, cTrader’s interface was much more simplistic and modern.

Here are some other differences between the platforms:

- Chart types and timeframes: With MT4 and MT5 you will find 4 charts for each asset, which either be lines, candlesticks, or bars. As for the timeframes, with MT4 you will have 9 different ones ( 4-minute, 2-hour, weekly, and monthly frames), while MT5 offers a total of 21 (11 minutes -, 7hour-, daily, weekly, and monthly frames).

As for the cTrader, it features one chart that can either be dots, candlesticks, lines, or bar. It also offers 26 timeframes: 14 minutes,7 hours -, 3 days -, weekly and monthly frames. - Automated trading mode: this important feature, which is often cited in financial software reviews, can also be found with MT4, MT5, and cTrader. The only difference is the tools that each of the software provides: MT4 and MT5 have Expert Advisors ( EA), while the cTrader uses cBots.

- Trading instruments: finally, when it comes to the trading instruments, all three of the trading software discussed here offer an impressive variety of more than 200 Forex currency pairs, as well instruments, such as stocks and commodities. However, it is slightly easier to incorporate new trading instruments with cTrader, as there is a separate sub-category for this function on its menu.

As you can probably tell, there is not much of a difference in terms of the quality of the software discussed above, and the question is rather about what you, as a trader, will find most suitable and necessary. Otherwise, if you search t for the “financial trading best software”, MT4, MT5, and cTrader will be among the first ones to come up. If you want to know more about which software suits your interests the best, you can check out our articles on MT4 vs cTrader, and MT4 vs MT5.

Final thoughts on financial trading software

Financial trading software allows traders to access the market and execute trades. There are a variety of options available in the market today, ranging from the most popular pieces of software like MetaTrader or cTrader to the software that is custom-made for a specific broker.

Most of the alternatives on the financial trading software list will offer you to choose from web-based, desktop, or mobile app trading. The features of each of those choices differ, thus, it is advisable to conduct prior research to determine what software functions and tools are available to you, and whether or not they are free.

Comments (0 comment(s))