AvaTrade and XM are the two industry-leading Forex brokes with more than a decade of experience on the market. They are recognized in almost every corner of the world and dominate the list of the top Forex brokers globally. The reasons for their popularity are numerous and vary from service excellence and safety to flexible trading conditions and exclusive offers. Millions of Forex traders are registered on these brokers’ trading platforms, and their customer base keeps growing every day. However, people will often compare AvaTrade and XM brokers to choose the best of the two for trading Forex.

Even though both of the brokers are essentially high-quality service providers, they have different approaches, products, and conditions for their clients. That is why the choice between the AvaTrade and XM broker depends on your trading goals, style, and strategy. In our XM vs AvaTrade broker comparison review, we will cover all the similarities and differences that these two brokers have. We will also suggest when is it best to go for XM broker and in which case you should prefer AvaTrade over XM.

|

|

AvaTrade |

XM |

|

Rating |

|

|

|

Min. Deposit |

100 USD |

5 USD |

|

Max. Leverage |

1:400 |

1:888 |

|

Regulations |

ASIC, CySEC, FSA, FFAJ, FSCA, ISA, FRSA, CBI, B.V.I FSA |

IFSC, ASIC, CySEC |

|

Trading Platforms |

MT4, MT5, ZuluTrade, DupliTrade, AvaTrade GO, AvaSocial |

MT4, MT5 |

|

Bonuses |

Referral Program |

30 USD no deposit |

Which broker offers better spreads and fees, XM or AvaTrade?

The costs of trading Forex differ for AvaTrade and XM customers. To start with, both brokers have more or less similar financial instrument portfolios. Their major product is the Forex currency pairs where traders can access more than 55 pairs on the trading platform including both popular and exotic currencies. The brokers also offer commodities, metals, shares, and stock indices within their portfolios. Therefore, the major factor that determines the difference between the XM and AvaTrade costs is their respective trading conditions and account types. AvaTrade is considered a bit more expensive than XM, but it has to be noted that AvaTrade has more experience in the Forex industry.

The costs of trading Forex differ for AvaTrade and XM customers. To start with, both brokers have more or less similar financial instrument portfolios. Their major product is the Forex currency pairs where traders can access more than 55 pairs on the trading platform including both popular and exotic currencies. The brokers also offer commodities, metals, shares, and stock indices within their portfolios. Therefore, the major factor that determines the difference between the XM and AvaTrade costs is their respective trading conditions and account types. AvaTrade is considered a bit more expensive than XM, but it has to be noted that AvaTrade has more experience in the Forex industry.

Account types and minimum deposits

Both AvaTrade and XM have four different live trading account types. The AvaTrade broker ranks the account types according to their premium features: Silver account, Gold account, Platinum account, and Ava Select. All account types at AvaTrade include the benefits of accessing educational resources, such as webinars, courses, video tutorials, various e-books, financial news, mobile trading, exclusive debit card of AvaTrade, and a margin protection plan. More premium account types get better trading conditions, such as tighter spreads and more flexible leverage options. The minimum deposit starts at 100 USD. To achieve the professional trading account level the user has to fulfill the account balance requirements.

XM broker, on the other hand, provides Micro account, Standard Account, XM Ultra-Low account, and the Shares account. The minimum deposit requirement for Micro, Standard, and XM Ultra-Low accounts starts at 5 US dollars. The users can apply Islamic account options to all of these three account types. Hedging is also allowed on these three types of accounts. However, the Shares account comes with the deposit requirement of 10,000 US dollars.

Spreads and Commissions

AvaTrade allows its customers to trade on the broker’s platform without any commissions for any account type. However, respectively the spreads are not as tight as for few account types of XM. Usually, the spreads start from 1 pip on the popular currency pair of EUR/USD at AvaTrade, whereas the XM Ultra-Low account type at XM provides a spread of 0.6 pips on the same currency pair. On the other hand, the Shares account at XM comes with the commission fees, while the rest of the account types can be used without any commission payable. Usually, there is a trade-off between the commissions and spreads when it comes to decent brokerage companies. You cannot expect a broker to let you trade commission-free and give you ultra-tight spreads starting at 0.4 pips. That is why the conditions presented by these two brokers are indeed reasonable.

Trade Forex with tightest spreads with XM

|

|

AvaTrade |

XM |

|

EUR/USD |

0.9 pips |

1.7 pips |

|

USD/JPY |

1.1 pips |

1.6 pips |

|

GBP/USD |

1.6 pips |

2.2 pips |

|

USD/CAD |

2 pips |

2.2 pips |

|

AUD/USD |

1.1 pips |

1.8 pips |

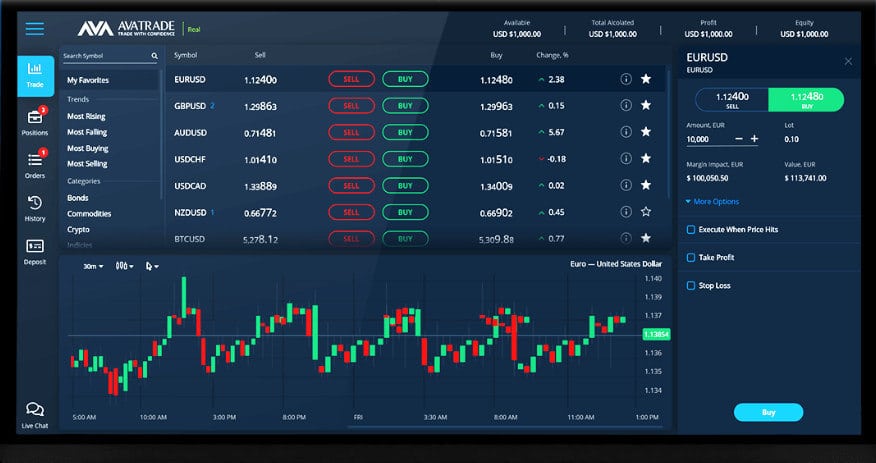

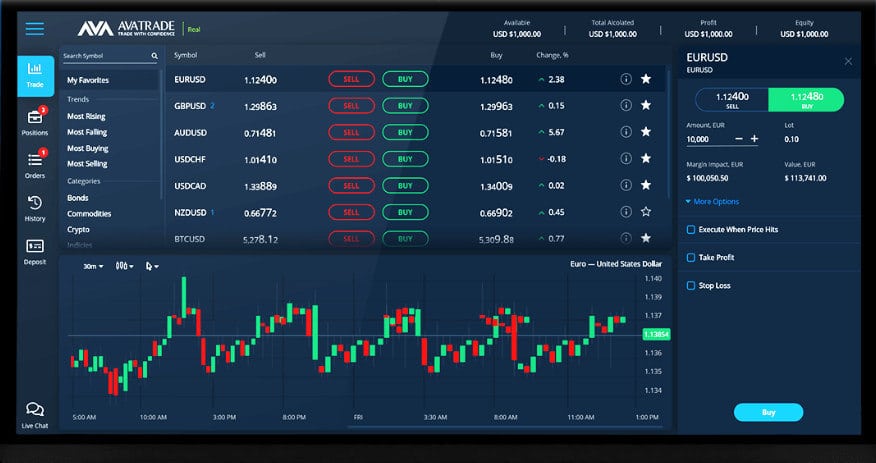

Which one has provided better software, AvaTrade or XM?

XM and AvaTrade support similar trading platforms mostly. They both offer MetaTrader software to their clients. Most of the Forex brokers will limit their customers to using only MetaTrader 4 platform as it is one of the most essential trading software in the Forex industry. However, these two brokers decided to support both MetaTrader 4 and MetaTrader 5, whereas the latter one is the newer modification of the original MetaTrader platform. They both allow the traders to use complex tools for analyzing the market trends and conducting technical analysis. They come with charting features and numerous indicators for both professional and beginner traders.

XM and AvaTrade support similar trading platforms mostly. They both offer MetaTrader software to their clients. Most of the Forex brokers will limit their customers to using only MetaTrader 4 platform as it is one of the most essential trading software in the Forex industry. However, these two brokers decided to support both MetaTrader 4 and MetaTrader 5, whereas the latter one is the newer modification of the original MetaTrader platform. They both allow the traders to use complex tools for analyzing the market trends and conducting technical analysis. They come with charting features and numerous indicators for both professional and beginner traders.

In addition to MT4 and MT5, AvaTrade also features two additional trading platform options – AvaTrade Go and AvaSocial. AvaTrade Go was awarded the title for the best Forex trading App a few years ago. The platform allows its users to access live feeds and social trends across the global trading markets. It is compatible with mobile devices, as well, and is designed to provide reduced trading risk. AvaSocial, on the other hand, is a unique concept developed by the broker for automated trading. The beginner and intermediate traders have an opportunity to copy or observe the trades of the expert Forex traders.

Start trading on AvaSocial and AvaTrade GO platforms

Which broker provides better safety for traders, XM or AvaTrade?

It is complicated to say that any of these two brokers is safer than the other. Both XM and AvaTrade brokers are multi-regulated companies that hold numerous licenses from the very authorities around the globe. They are authorized to conduct the business within multiple jurisdictions, which is why XM and AvaTrade are often considered as the leading international Forex brokers globally. XM holds licenses from the notorious regulatory authorities – the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investment Commission (ASIC), and the Financial Conduct Authority (FCA).

It is complicated to say that any of these two brokers is safer than the other. Both XM and AvaTrade brokers are multi-regulated companies that hold numerous licenses from the very authorities around the globe. They are authorized to conduct the business within multiple jurisdictions, which is why XM and AvaTrade are often considered as the leading international Forex brokers globally. XM holds licenses from the notorious regulatory authorities – the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investment Commission (ASIC), and the Financial Conduct Authority (FCA).

Whereas, AvaTrade holds numerous authorizations from below market regulators:

- the Cyprus Securities and Exchange Commission

- the Australian Securities and Investment Commission

- the Financial Sector Conduct Authority in South Africa

- the Financial Services Agency in Japan

- the Financial Regulatory Services Authority in UAE

- the Israel Securities Authority

- the British Virgin Islands Financial Services Commission

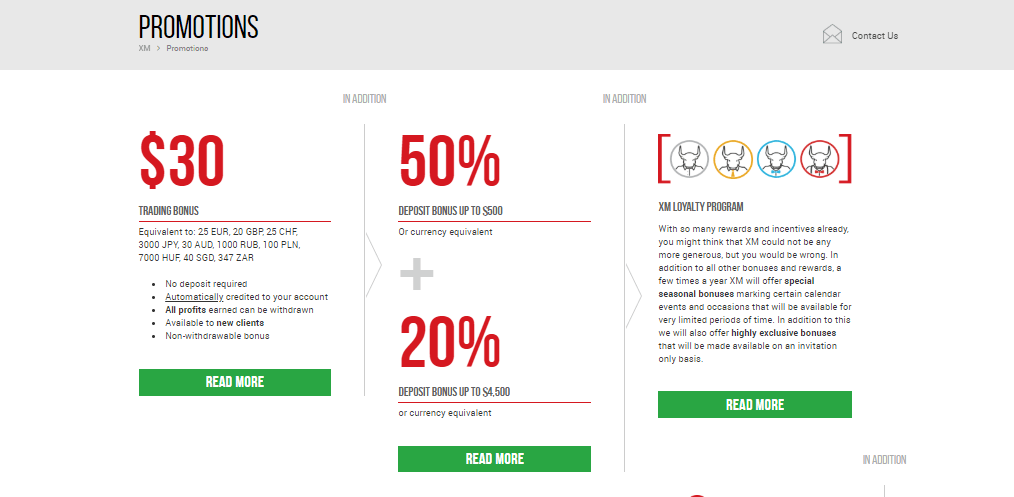

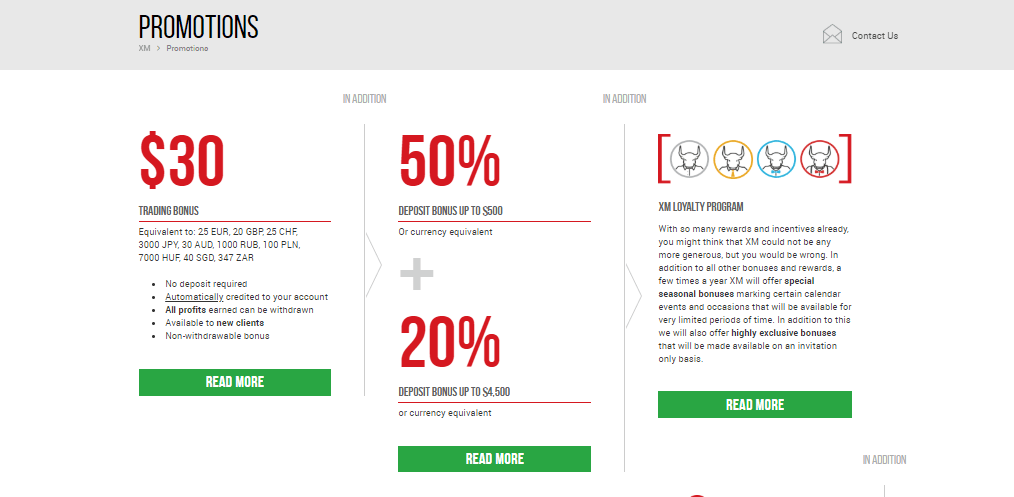

Which one has better bonus offers, XM or AvaTrade?

Both brokers run promotional programs but they incorporate different types of bonuses and schemes. XM broker offers both deposit and no deposit bonuses, whereas AvaTrade provides only referral bonuses. While most beginner Forex traders will undoubtedly prefer deposit/no deposit bonus programs, it has to be noted that some of the regulatory bodies prohibit Forex brokers from providing the bonus campaigns. That is why AvaTrade is not able to design bonus schemes for its clients.

Both brokers run promotional programs but they incorporate different types of bonuses and schemes. XM broker offers both deposit and no deposit bonuses, whereas AvaTrade provides only referral bonuses. While most beginner Forex traders will undoubtedly prefer deposit/no deposit bonus programs, it has to be noted that some of the regulatory bodies prohibit Forex brokers from providing the bonus campaigns. That is why AvaTrade is not able to design bonus schemes for its clients.

XM’s bonus program includes a 30 USD welcome bonus which can be claimed at the time of registering with the broker. Once you complete your verification process you are eligible to trade with the no deposit amount that the broker credits to your trading account. However, you cannot withdraw the bonus without trading with it first. The XM deposit bonus will double up your investment upon your initial deposit for up to 500 USD, afterward, your deposit will generate an additional 20% deposit bonus with a maximum bonus amount reaching a 4,500 USD limit.

The referral bonuses for AvaTrade have a simple structure and do not come with a set of conditions for the withdrawal in contrast to deposit and no deposit bonuses. The traders can refer their friends or relatives and for each referral, they generate a certain amount of bonus. Referred clients need to deposit on the platform. The minimum deposit that is eligible for the referral bonus starts at 250 USD and can generate a 75 USD bonus. For the deposits over 10,000 USD made by the referrals, AvaTrade clients will receive a 400 USD bonus.

Claim 30 USD bonus with XM

|

|

AvaTrade |

XM |

|

Pros |

Diverse platforms |

Lower min. deposit |

|

Low trading costs |

Bonus programs |

|

Mutiple regulations |

Flexible leverage |

|

Cons |

No bonuses |

Limited portfolio |

|

One account type |

Geographic restrictions |

|

Geographic restrictions |

Only MT platforms |

XM vs AvaTrade: Which one is a better broker overall?

Both XM and AvaTrade are experienced, reliable, and popular Forex brokers with already a large customer base. These brokers pay more attention to retaining their existing clients through offering numerous loyalty programs. Therefore, you don’t only benefit from starting trading with these brokers but also have a chance to receive various rewards if you stay with them. The number of loyal customers always reveals the quality of the brokerage company, since no trader would ever stay with an inconvenient broker. Nevertheless, we have discussed many features of the brokers that emphasize their dedication towards the excellence of the traders’ experience. Since it is not possible to clearly determine the better broker of these two, we suggest that you trade with the one that is regulated in your region.

FAQs on AvaTrade vs XM

Can XM be trusted?

Yes. XM is one of the most trustworthy and reliable Forex brokers. It is regulated by the leading regulatory bodies such as the Cyprus Securities and Exchange Commission (CySEC), as well as the Australian Securities and Investments Commission (ASIC). Furthermore, the broker has been on market for more than a decade now with hundreds of thousands of loyal customers trading on XM platforms.

What is the minimum deposit for AvaTrade?

AvaTrade minimum deposit is 100 US dollars. It is not the lowest minimum deposit available on market, however, it is a great price value since the broker offers numerous trader benefits, including free educational resources, competitive trading costs, flexible leverage, and an extremely secure trading environment.

Is AvaTrade good for beginners?

AvaTrade is good for beginners for several reasons. Firstly, the broker has an extensive library of free educational packs and resources for its new registering clients. Secondly, the broker provides numerous trading platforms that range according to the difficulty. The AvaTrade GO platform is a super user-friendly and simplistic platform developed to suit the needs of beginner traders.

English

English  The costs of trading Forex differ for AvaTrade and XM customers. To start with, both brokers have more or less similar financial instrument portfolios. Their major product is the Forex currency pairs where traders can access more than 55 pairs on the trading platform including both popular and exotic currencies. The brokers also offer commodities, metals, shares, and stock indices within their portfolios. Therefore, the major factor that determines the difference between the XM and AvaTrade costs is their respective trading conditions and account types. AvaTrade is considered a bit more expensive than XM, but it has to be noted that AvaTrade has more experience in the Forex industry.

The costs of trading Forex differ for AvaTrade and XM customers. To start with, both brokers have more or less similar financial instrument portfolios. Their major product is the Forex currency pairs where traders can access more than 55 pairs on the trading platform including both popular and exotic currencies. The brokers also offer commodities, metals, shares, and stock indices within their portfolios. Therefore, the major factor that determines the difference between the XM and AvaTrade costs is their respective trading conditions and account types. AvaTrade is considered a bit more expensive than XM, but it has to be noted that AvaTrade has more experience in the Forex industry. XM and AvaTrade support similar trading platforms mostly. They both offer MetaTrader software to their clients. Most of the Forex brokers will limit their customers to using only MetaTrader 4 platform as it is one of the most essential trading software in the Forex industry. However, these two brokers decided to support both MetaTrader 4 and MetaTrader 5, whereas the latter one is the newer modification of the original MetaTrader platform. They both allow the traders to use complex tools for analyzing the market trends and conducting technical analysis. They come with charting features and numerous indicators for both professional and beginner traders.

XM and AvaTrade support similar trading platforms mostly. They both offer MetaTrader software to their clients. Most of the Forex brokers will limit their customers to using only MetaTrader 4 platform as it is one of the most essential trading software in the Forex industry. However, these two brokers decided to support both MetaTrader 4 and MetaTrader 5, whereas the latter one is the newer modification of the original MetaTrader platform. They both allow the traders to use complex tools for analyzing the market trends and conducting technical analysis. They come with charting features and numerous indicators for both professional and beginner traders.

It is complicated to say that any of these two brokers is safer than the other. Both XM and AvaTrade brokers are multi-regulated companies that hold numerous licenses from the very authorities around the globe. They are authorized to conduct the business within multiple jurisdictions, which is why XM and AvaTrade are often considered as the leading international Forex brokers globally. XM holds licenses from the notorious regulatory authorities – the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investment Commission (ASIC), and the Financial Conduct Authority (FCA).

It is complicated to say that any of these two brokers is safer than the other. Both XM and AvaTrade brokers are multi-regulated companies that hold numerous licenses from the very authorities around the globe. They are authorized to conduct the business within multiple jurisdictions, which is why XM and AvaTrade are often considered as the leading international Forex brokers globally. XM holds licenses from the notorious regulatory authorities – the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investment Commission (ASIC), and the Financial Conduct Authority (FCA). Both brokers run promotional programs but they incorporate different types of bonuses and schemes. XM broker offers both deposit and

Both brokers run promotional programs but they incorporate different types of bonuses and schemes. XM broker offers both deposit and