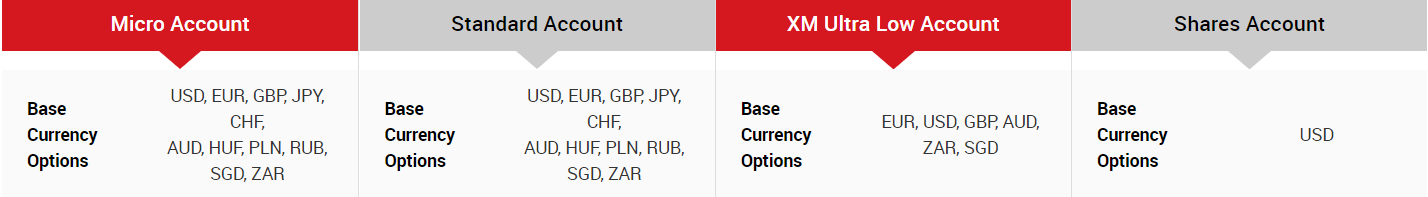

XM broker minimum deposit is one of the lowest deposit requirements existing on the market. The minimum trading capital needed to start trading with the broker is just 5 US dollars. However, the broker has four different live trading accounts that come with different requirements. Also, the minimum deposit threshold may vary according to the nationalities and the base currencies of the accounts. XM offers numerous base currency options including USD, EUR, GBP, JPY, AUD, RUB, HUF, and PLN. Furthermore, in 2015, the broker has introduced a new opportunity for the traders residing in South Africa and Singapore – they can now choose ZAR and SGD as their base currencies. Therefore, you will not need to worry about currency conversions all the time.

The article below will cover XM trading minimum deposit requirements across all four trading accounts at XM with the different base currencies. We will also discuss the reasons why a broker chooses certain requirements for a specific account type and will advise if it is worth it to go for accounts with higher deposit requirements.

Start trading with 5 USD at XM

XM deposit requirements in ZAR

As we have already mentioned, the broker allows its clients to deposit and withdraw their funds in more than 10 different currencies. One of the most popular currencies within the XM customer base is South African Rand (ZAR). Several years ago, South African traders were not able to use their national currency for trading with XM. Instead, they would have to pay for the conversion fees to deposit in USD. Since South African traders make up one of the largest nationalities of XM traders, the broker decided to introduce ZAR as a new base currency.

XM minimum deposit in ZAR is around 72 rands, or equivalent to 5 US dollars. It is the same for the three most popular account types of the broker – Micro, Standard, and Ultra-low trading account types. The XM Micro ZAR account is the most budget-friendly account since it calculates trades in micro-lots instead of the standard ones. While XM Ultra-low ZAR account is the most convenient account for South African Forex traders who are seeking ultra-tight spreads on Forex currency pairs. On the XM Ultra-low account, which has the same XM global minimum deposit requirement, average spreads on Forex assets start at 0.6 pips.

Below is the list of the XM requirements for minimum deposit in supported base currencies:

Account Types of XM and their deposit requirements

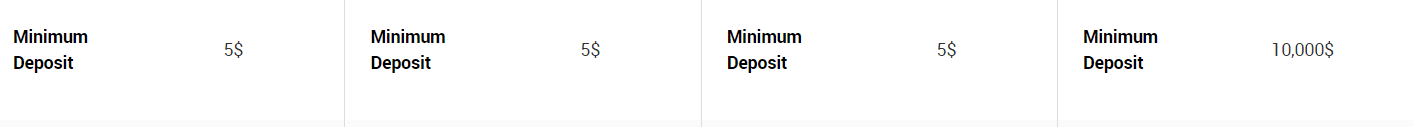

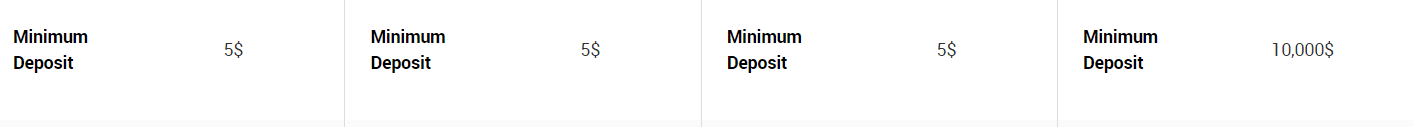

XM broker has four trading accounts – Micro, Standard, XM Ultra-low, and the Shares trading account. All four accounts can be tested on a demo account. There are quite a few differences among these account types including the minimum deposit requirement, as well. However, the three account types (Micro, Standard, and XM Ultra-Low) have a 5 USD deposit requirement. The Shares trading account, on the other hand, comes with a requirement of 10,000 US dollars or 145,310 ZAR.

Micro account or Cents account is the best option for low-cost Forex trading with XM. Apart from the XM Forex broker minimum deposit low requirement, the account type also offers trading in micro-lots instead of the standard lots. The next cheap option is a Standard account which closely resembles the Micro account but operates in standard lots. The Ultra-low account type is the low-spread account where the spreads on most popular currency pairs, such as EUR/USD start at 0.6 pips, which is at least 0.4 pips lower than the market average.

Get your ZAR Micro account with XM

How to deposit with XM broker?

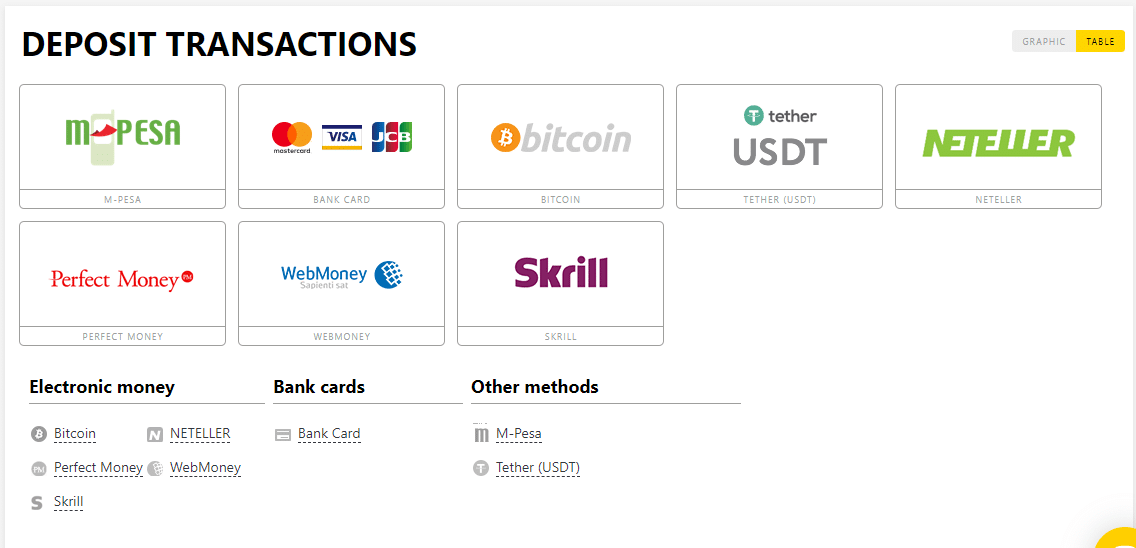

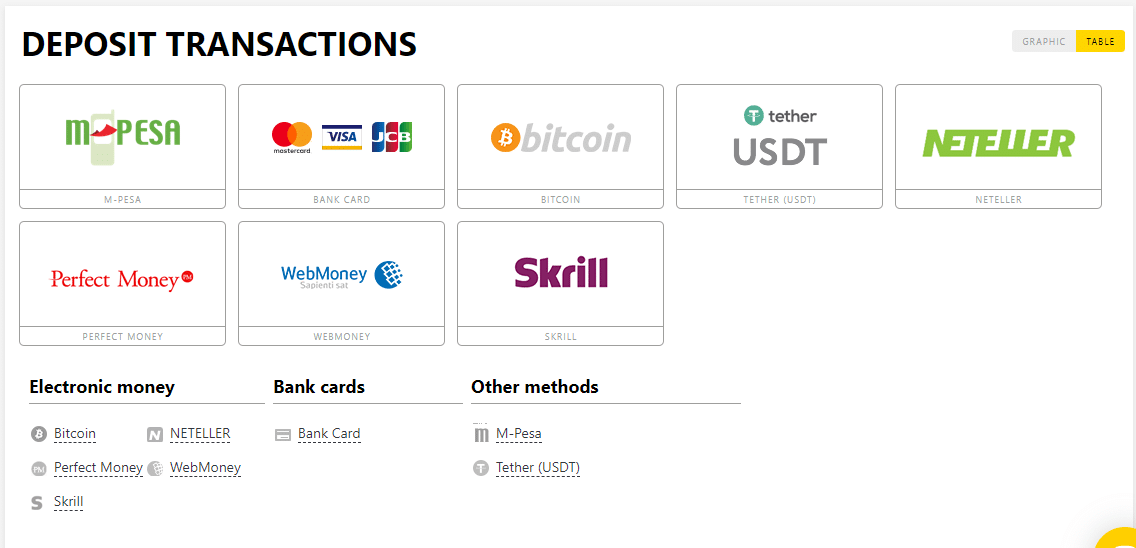

XM has one of the most diverse payment method portfolios among all Forex brokers. The broker allows its users to deposit and withdraw using dozens of payment solutions ranging from the most standard methods like bank wire transfers and credit card payments to innovative online e-payment platforms. You can make a minimum deposit XM Forex either through bank wire, Visa/Mastercard credit, and debit cards, UnionPay, Skrill, Neteller, Bitcoin, USDT, WebMoney, and Perfect Money. One of the most common and favorite payment options for South African traders that XM supports is M-Pesa, which is a mobile payment app exclusively partnering with XM.

XM does not charge any fees for the deposits or withdrawals. However, the payment solutions providers themselves might demand a service fee, which will range from 1% to 3% of the transaction amount. In some cases, XM will also refund for the deposit cost that your payment service provider might charge you.

FAQs on minimum deposit for XM broker

How much do I need to start trading with XM?

XM requires a minimum deposit of just 5 US dollars on three of its real trading account types – Micro, Standard, and XM Ultra-low accounts. The fourth account of the broker – the Shares account type comes with a minimum deposit requirement of 10,000 US dollars. Furthermore, there are no fees applicable on deposits made with the broker.

How long does it take to withdraw from XM?

XM withdrawals should not take longer than 24 hours. However, it does not depend only on the broker. XM will release the amount almost immediately after you request the withdrawal. It solely depends on the payment method that you choose. The bank wire transfers will take longer – around several working days, while online payment methods like Skrill and Neteller might offer instant transactions for an additional fee.

Does XM have ZAR account?

Yes, XM has a ZAR account with the account base currency in South African rand. The broker decided to launch ZAR accounts in 2015 along with the SGD accounts. The minimum deposit in ZAR with XM is around 72 rands which is not a fixed amount. The deposit will vary according to the exchange rate of ZAR/USD. It will be equivalent to 5 US dollars at any time.

How do I deposit my XM account?

You can choose your payment method with the broker from the following options: bank wire transfer, Visa/Mastercard credit, and debit cards, UnionPay, Skrill, Neteller, Bitcoin, M-Pesa, USDT, WebMoney, and Perfect Money. Check on the broker’s deposit page to see the available payment methods.

English

English