Alvexo Review

After its launch in 2014, Alvexo broker concentrated in offering FX, CFD, commodities and stocks trading services. After the popularity of cryptocurrency, Alvexo became one of the many firms that started offering crypto trading. The firm is registered and licensed by CySEC and FCA and this qualifies it as a reliable brokerage firm. The firm has its head offices in Limassol, Cyprus and offices in the UK and Switzerland. In this Alvexo review, we look into some of the features that make the broker stand out and also the ones that make it not so appealing.

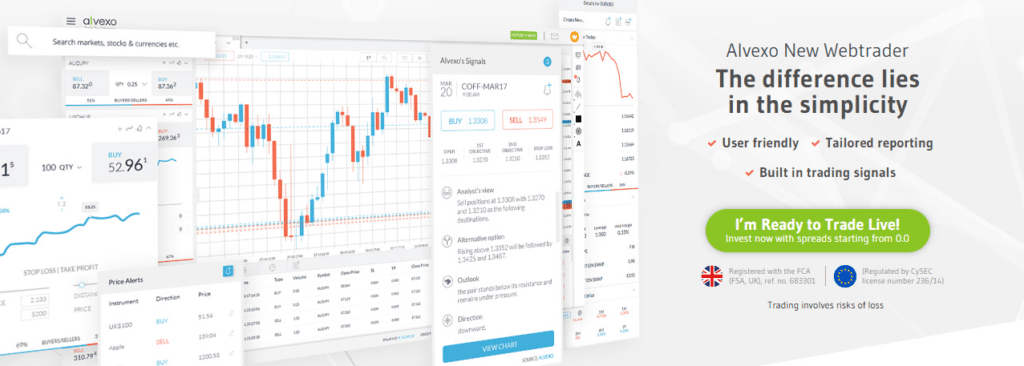

The trading platform

Given that Alvexo is registered and licensed by leading regulatory bodies, it becomes easy for traders from all over the world to trust the brand. The trading platform of the broker is designed to use WebTrader which is web-based, MT4 and a Mobile App. These trading platforms enable every type of a trader to trade from wherever and whenever. On the official website, the broker promises traders 100% real-time quotes which come from different reliable sources. For speed, safety and reliability, the broker offers the trader a one-click trading platform, high-speed execution and reinforced security. According to some Alvexo reviews, some traders especially the ones who want to start a career in FX trading usually have a hard time. This is because of the high initial deposit of $500. There are many brokers out there that ask for as little as $50 for the initial deposit and also offer traders exceptional service. Moreover, newbie traders needn’t risk $500 the first time as FX is one of the riskiest ventures.

It is, however, good to note that new traders are afforded an advantage by the broker with the demo account. New traders are given a chance to practice and hone their forex trading skills using $50,000 virtual money. In an effort to avoid an Alvexo scam, the firm allows traders to open demo accounts without demanding any deposit first. This means that you can open a demo account, practice and even close it without having to deposit any real money.

Alvexo accounts review

Alvexo is licensed and regulated by CySEC and FCA of the UK. This makes the firm one of the well-regulated FX brokers which can also be trusted. There are four different types of accounts that you can open at Alvexo. There is the Classic account which comes with a 15% educational bonus and which demands an initial minimum deposit of $500. There is the Gold, the ECN and the Prime accounts. They require $2,500, $5,000 and $10,000 as initial deposit respectively. All the accounts other than Classic come with ‘dealing room’s daily dose’, ‘dealing room direct line’, and economic calendar (SMS) service. Alvexo trading signals are available for all type of accounts.

Should you invest in Alvexo?

There are numerous reasons why you should consider investing in Alvexo. However, there are Alvexo reviews by real-life clients and also from expert reviewers which you should consider. Once you deposit money into your account, you are supposed to receive a lot of good things/ features. However, there are complaints from several traders online that the firm does not always deliver on its end of the bargain. There are also complaints that the support team is rather aggressive especially when it comes to persuading traders to invest more money even when a trader is making losses. Even though the firm is regulated by CySEC, as a trader you should evaluate the cons and the pros that come with the firm before making that first deposit.

Comments (0 comment(s))