Mitrade rating, features, and regulatory background in the detailed review

In this Mitrade broker review we will look at some key terms and features offered by the firm, which includes fees and spreads, maximum available leverage, regulations and onboarding bonuses, and more.

This review aims to answer two key questions regarding the firm – Is Mitrade a scam and can you trust Mitrade? – Let’s find out.

Mitrade Broker History

Mitrade is a largely unregulated brokerage firm based in Australia that offers users the opportunity to trade a wide range of instruments, including shares, commodities, forex, and indices.

The firm does not state its date of incorporation on the official website, but the earliest available licensing information dates back to 2019, which makes Mitrade a fairly new player on the global brokerage market.

The only notable regulatory license held by the firm is from the Mauritius Financial Services Commission (FSC), which is not a top-tier regulatory agency.

Traders have access to some 60 currency pairs, 12 indices, 13 commodities, and shares primarily from the S&P 500 index.

As for other types of derivatives, such as options, Mitrade does not yet support them on its trading platforms.

Mitrade Accounts Review

Mitrade does not offer a step-by-step onboarding guide for new clients on the website. However, the firm does state that no hidden account fees are applicable when trading with Mitrade.

Mitrade charges a spread for the instruments available on its platform. Not stating the exact fees on the official website might be a red flag for many traders, as transparency issues do not inspire confidence in the user.

Overnight holdings are also charged by Mitrade, but the rate is also missing from the website.

In general, Mitrade is a commission-free broker that only charges spread on its instruments.

The firm offers two different account types – Live and Demo.

The demo account is a free-to-use practice account that allows users to trade using simulated funds and test their abilities. Real-life market data is provided by the firm free of charge.

The live account is the primary trading account that users can fund and buy and sell instruments with.

Traders signing up for the live account can qualify for a $2,000 welcome bonus after they deposit $10,000, $400 for a $2,000 deposit, or $100 for an initial deposit of $500.

Traders looking to add leverage to their strategies, Mitrade offers a maximum leverage of 1:200 for currency pairs.

Mitrade Review of Trading Platforms

Mitrade has its own trading platform that is available as a web platform and an iOS/Android app.

A desktop application is also readily available and can be downloaded from the official Mitrade website.

Some of the core features of the Mitrade desktop trading platform include:

- Customizable watchlists to track asset performance

- Price and market update alerts

- Split charts on different timeframes

- Trading sentiment analysis on the platform

It must be noted that Mitrade does not offer MetaTrader or cTrader to its clients, which can be a major downside for some traders.

While the drawing tools and technical indicators on Mitrade’s platform are plentiful, they do lack certain features that are readily available for MetaTrader 4 users, such as backtesting. The lack of these major trading platforms may raise questions whether is Mitrade legit or not.

Traders looking for reliable platforms and software may be content with Mitrade, barring a few tradeoffs that come with the platform.

Mitrade lists FXStreet, Trading Central, and Investing.com as its corporate partners that provide the firm with necessary software and charting tools to grant traders access to the markets.

Mitrade Extra Features Review

Aside from the standard trading experience, Mitrade does offer certain additional features to its clients. Some notable features and perks include:

- Monthly, weekly, and quarterly price forecasts for some of the most actively traded instruments on the market

- Economic calendars with major events and news releases

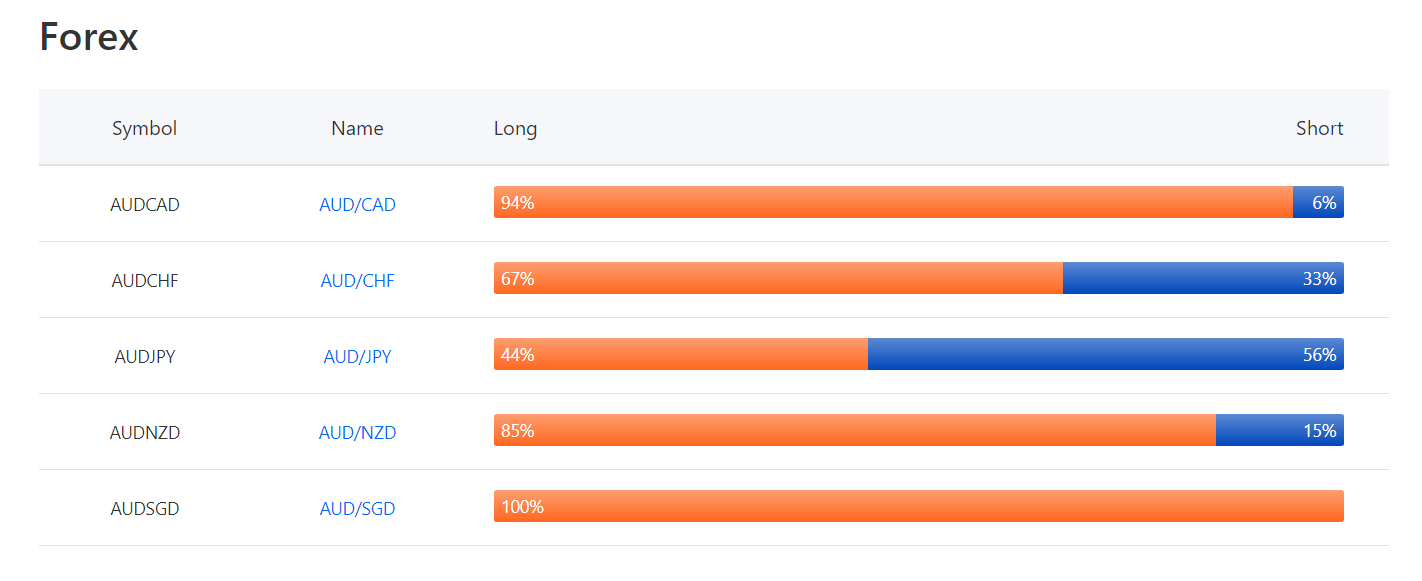

- Market sentiment analysis, including long and short position volume

- Tutorials on how to use free risk management tools, such as stop-loss and take-profit

- The Mitrade Learn blog, which includes articles and guides on various asset classes and trading strategies for beginners

Overall, the extra features offered by Mitrade are standard across the board and many other brokerages also offer such additional features free of charge. Typically, such features are built into the trading platform of the brokerage firm.

Mitrade Customer Support Review

When it comes to customer support and client questions, Mitrade offers an FAQ section that includes information about the instruments available on its platforms, account types, order execution, as well as technical details.

Users can contact Mitrade via the customer support email address, or by sending an enquiry via the website.

The Mitrade customer service team is available 24 hours a day, 5 days a week.

The firm also lists the addresses to its Mauritius and Australia headquarters.

The hotline is the only customer support channel missing from the official Mitrade website, which is not confidence-inspiring for beginners that may have many questions regarding the firm.

Mitrade Deposit and Withdrawal

Traders at Mitrade can fund their accounts using a wide variety of payment methods, such as:

- Visa

- Mastercard

- Neteller

- PayID

- Skrill

- Worldpay

- Bank transfer

Deposits and withdrawals at Mitrade are not subject to additional fees, aside from the relevant fees charged by the payment system providers.

The Mitrade website does not state whether the firm upholds maximum deposit and withdrawal limits for each transaction

Conclusion

Is Mitrade a scam and are traders’ funds safe with this brokerage? – Mitrade’s official website is missing some important information, such as the company hotline, a breakdown of spreads, and an overall description of the specifications of trading with the firm.

Furthermore, the firm only offers its own trading platform and does not have access to MetaTrader or cTrader, which is a disadvantage of Mitrade.

The lack of verifiable information on the official Mitrade website can be seen as a dealbreaker by many traders, especially considering the number of competing firms that are more transparent with their fees and other data.

So, is Mitrade a scam? While the firm may not overtly be a fraudulent practice, it certainly lacks some core features that are readily available to clients of other full-service brokerage firms.

Traders looking for a fulfilling trading experience are better off with other brokers that offer MetaTrader and more additional features and instruments.

Comments (1 comment(s))