Fintana Review

Fintana Platform History

Fintana is a multi-asset brokerage firm that was registered with the FSC of Mauritius in 2023 and offers currency pairs, commodities, indices, stocks and crypto to a global audience of traders.

The official Fintana website features an “About Us” section, which provides basic information about the regulation of the firm. However, it is worth noting that the website does not provide comprehensive information regarding the executives and founders of the company.

This can be a noticeable issue for prospective clients, as the firm is not transparent regarding its background. In fact, the official website also does not provide the date of incorporation for the company, which is another issue worth considering when choosing whether to pick Fintana as your long-term brokerage partner.

Fintana Safety Features

When it comes to brokerage firms, traders tend to be concerned with the issue of security, as they are putting their capital at risk.

The firm is only regulated by the Mauritius FSC, which means that jurisdictions with a high level of scrutiny are unlikely to allow Fintana on their markets in the short term.

Fintana provides segregated accounts for each of its clients, which is an industry standard and to be expected from a reputable FX broker.

Furthermore, clients can enable 2FA to add a layer of protection by using an email or SMS code upon each sign-in.

However, more robust security features are either lacking, or simply omitted from the official Fintana website, which can be a concern for some clients.

It is worth noting that Fintana is not available in the United States and a number of other jurisdictions, primarily due to lack of meaningful licenses.

Available Markets at Fintana

Fintana is a multi-asset brokerage firm, which means that clients can trade different asset classes, which include CFDs on stocks and commodities, as well as currency pairs, indices and cryptocurrencies.

The allowable leverage also differs considerably based on the instrument of your choice. For example, leverage on currencies is 1:400, while stocks and crypto are limited to 1:5.

Forex

The forex market is the most liquid market in the world and attracts billions of dollars in transaction volume every single day.

Traders who sign up at Fintana have access to major pairs, such as EUR/USD, CHF/USD, GBP/USD, etc., as well as minors and exotics.

As we have already mentioned above, the maximum allowable leverage for forex trading is capped at 1:400, which is a competitive limit.

The spreads charged on major currency pairs differ considerably at Fintana, with the Classic and Silver accounts charging 2.5 pips, while the VIP account only charges 0.9 pips per transaction.

A major advantage of trading forex at Fintana is that the market is open 24/7, allowing traders to access the market at any part of the day.

Indices

Major equity indices, such as the US500, US100, GER40 and others, are commonly traded by market participants that would like to gain exposure to the equity market without holding individual instruments or CFDs on stocks.

Indices are relatively less volatile than some currency pairs, which gives traders the necessary vehicle to diversify their positions.

The maximum possible leverage accessible on indices at Fintana is capped at 1:200.

Crypto

Crypto trading has been growing in popularity among traditional brokerage firms and Fintana is no exception. Clients who sign up at the firm can trade Bitcoin, Ethereum, Ripple, Bitcoin Cash and other cryptocurrencies, with the spreads on crypto starting at 5.7 for the Classic and Silver accounts, up to 5 on the VIP account.

The maximum leverage allowed for crypto trades is limited to 1:5, which is a common cap among brokers.

The stop-out levels for margin trades are the same for all instruments available at Fintana.

Commodities

Commodity trading is popular among Fintana clients, which trade gold, Crude oil, natural gas and other commonly traded commodities.

Energies are particularly popular, as they are characterized by high price volatility. For traders using leverage, positions with leverage up to 1:200 are permitted by Fintana.

The spreads on commodity trades start at 2.8 on Classic and Silver accounts, while the VIP account charges 1.4.

Stocks

Stock CFDs are some of the most popular instruments at Fintana and traders buy and sell the likes of TSLA, AAPL, MSFT and others, with a maximum allowed leverage of up to 1:5.

The spread on stocks is $2 on the Classic and Silver accounts, while the VIP account charges $1.4 per trade.

The platform features CFDs on large cap stocks which provide traders with plenty of options to diversify from forex and commodities.

While the overall selection of stock CFDs at Fintana may be limited, traders can expect more options to be added in the future.

Metals

Precious metals, such as gold and silver, are some of the most popular commodities on the market and Fintana offers commodity CFDs to their clients, with the maximum leverage being limited to 1:200, while spreads on metals start from 2.8 pips on the Classic and Silver accounts and 1.4 pips on the VIP account.

It is worth noting that metals CFDs are limited to gold and silver, as palladium and other metals are unavailable as of this writing.

Education and Additional Resources

For complete beginners or those with limited trading experience, Fintana offers free education resources on its official website.

The Education Center includes a blog that explains basic trading concepts, terms, economic indicators, as well as in-depth trading courses.

Furthermore, Fintana also offers several key additional resources on its website:

- Financial e-books to learn new terms and strategies

- A glossary of trading and financial terminology

- Economic calendars with notable financial data releases

- Risk management tools, such as stop-loss and take-profit orders

- Signals to help traders stay ahead of market developments

Therefore, we can see that Fintana’s educational resources are quite comprehensive and able to provide valuable information to traders of any experience level.

Fintana Trading Accounts

For prospective clients looking to sign up at Fintana, the firm offers several account tiers, based on the budget and trading needs of the client in question. The Classic account is the most popular entry-level account, while the VIP account tier comes with greater personalization and additional features.

Classic

The Classic account is a simple and straightforward introduction to the Fintana platform and offers a STP order execution model to Fintana clients.

The account requires a minimum deposit of $250 and offers leverage up to 1:400 on major currency pairs, such as: EUR/USD, GBP/USD, USD/JPY, etc.

The leverage on stocks and cryptocurrencies is capped at 1:5, while commodities receive a cap of 1:200. The spread on EUR/USD starts at 2.5 pips, which is higher than many competitors. Gold and Crude Oil spreads start at 2.8 pips.

A total of over 160 instruments are available for trading on the Fintana Classic account.

The customer support is available on a 24/7 basis and ready to answer client inquiries.

Clients can choose between four account currencies – USD, GBP, EUR and CHF.

The stop-out level for the Classic account is set at 20%.

Silver

On the other hand, the Fintana Silver account is designed for traders with some experience on the forex and commodities markets.

While the core requirements and features are similar to the Classic account, the minimum deposit requirement is considerably higher at $2,000.

The spread on each instrument is the same on the Silver and Classic accounts. The leverage on commodities is capped at 1:200, while forex leverage is limited to 1:400.

Gold

An upgrade from the Silver account, the Fintana Gold trading account requires a minimum deposit of $50,000 and is geared towards experienced traders with substantial capital savings.

While the available markets are unchanged, the spreads on the Gold account are much tighter when compared to the Classic and Silver accounts.

For example:

- Spread on EUR/USD is 1.8 pips, compared to 2.5 pips on Classic and Silver

- Spread on Gold and Crude Oil is 2.3 pips, compared to 2.8 pips on Classic and Silver

- Stock spreads are also lower at $1.8, compared to $2 on Classic and Silver

As we can see, the main appeal of the Gold account lies in tighter spreads and lower commissions, while the lineup of tradable instruments remains unchanged from the Classic and Silver accounts.

Platinum

The Platinum account is designed for high net worth individuals that require tighter spreads and trade using larger positions.

The minimum deposit requirement for Platinum accounts is $100,000, while spreads on major currency pairs start at 1.4 pips, which is considerably lower than the Classic and Silver accounts.

Furthermore, the spread on commodities like Gold and Crude Oil, starts at 2 pips, as opposed to 2.8 pips on the Classic and Silver accounts.

The commissions on stocks start at $1.6, as opposed to $2 on Classic and Silver accounts.

VIP

The VIP account is exclusively reserved for Fintana clients that are interested in a personalized brokerage service and the best possible trading terms available at the brokerage.

The VIP account requires a minimum deposit of $250,000 and spreads on major currency pairs start at 0.9 pips, which is considerably lower than other Fintana accounts.

The commissions per stock trade are also noticeably lower at $1.2, as opposed to $2 on the Classic and Silver account levels.

All other terms and account features are unchanged across Fintana accounts, while the VIP account offers the best possible trading fees available on the platform.

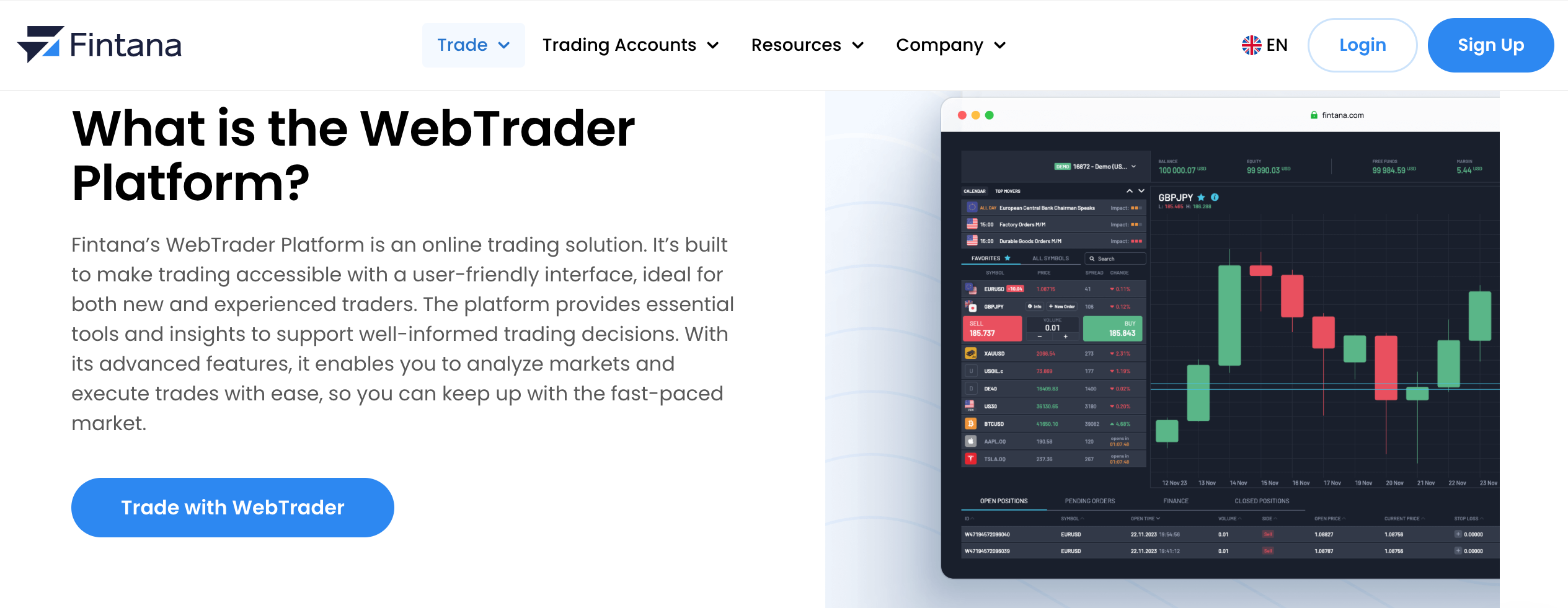

Fintana Trading Platforms

While MT4 and MT5 are generally viewed as the gold standard for forex trading platforms, Fintana offers its in-house web trader, which comes equipped with all the basic features required for FX trading, such as economic calendars, market news, multiple technical indicators and customizable price charts.

The web platform allows traders to access every instrument available for trading at Fintana in mere seconds and comes with some additional features as well, such as;

- Customizable trading setups with multiple interface options for a more personalized experience

- Advanced visual analysis tools, such as dynamic charts, data sets and customizable indicators

- Onboarding customer support in document gathering and client portal navigation

- Access to live market data, stop-loss and take-profit features and strategy optimization functions

Furthermore, Fintana also offers a mobile trading app for both iOS and Android devices. The Firebase Test App allows users to download the Fintana app using an invite link sent to their email address.

The mobile app comes equipped with all the basic features that are standard with the web trading platform.

Customer Support at Fintana

Customer support is essential for any functioning brokerage service and Fintana offers a customer support suite including a 24/7 live chat and a support email address.

The live chat is quite responsive and able to answer basic inquiries and directs users to the technical support team if necessary. Users can also find the FAQ section that answers commonly asked questions from existing and prospective customers alike.

The official Fintana website also lists two support hotline numbers for English and Portuguese speakers, while local support is available in English, Spanish, Portuguese, Thai, French, German, Italian and Malay.

There are three support email addresses for General, Support and Compliance purposes.

Deposits and Withdrawals

While Fintana does offer several methods for deposits and withdrawals, the official website does not indicate which specific e-wallet providers are supported.

Credit and debit card payments and withdrawals are processed instantly and are not subject to deposit fees.

Wire transfers to and from Fintana take 3-5 business days to process and are subject to a $30 withdrawal fee, which is high when compared to other firms on the market.

As for e-wallet transactions, they are instant and a $10 minimum deposit requirement applies.

FAQ on Fintana

Is Fintana a legit forex broker?

While Fintana is a legitimate forex broker, the firm lacks meaningful licenses and is regulated by the Financial Services Commission of Mauritius, which is not considered to be a high-authority regulatory body, which can raise security concerns for some prospective clients.

What is the minimum deposit at Fintana?

The minimum deposit requirement at Fintana is $250, which is higher than most competing forex and CFDs brokers. This can be a downside for traders that are just starting out and do not have much capital to spare – Making Fintana relatively inaccessible to complete beginners.

What can I trade at Fintana?

Fintana offers a relatively diverse selection of tradable instruments, such as: Forex pairs, CFDs on stocks, commodities and metals, indices, as well as cryptocurrencies.

The maximum leverage on forex trading offered by Fintana is 1:400, with a 1:200 cap on commodities.

Comments (0 comment(s))