Dowmarkets Forex Review

Read our full Dowmarkets review to get exact details about their safety, accounts, spreads, platforms, assets, support, and many more. Our unbiased Dowmarkets opinion allows our readers to decide whether Dowmarkets is a reliable broker.

Dowmarkets Forex Broker History

Dowmarkets is a Forex broker that has allowed CFDs trading since 2018. The broker offers multiple trading accounts and offers access to diverse assets on the Xcritical trading platform. The broker is based in the Marshall Islands but is not regulated there. There is a live chat built inside the website. Despite being experienced, it lacks some of the most crucial safety features, which can not be overlooked by traders.

Dowmarkets broker safety

The safety of Dowmarkets is very questionable as the broker is not regulated. It has more than enough experience to already have a license but it is not overseen by any authority. As a result, the broker is an offshore-based FX and CFDs broker that is very risky for traders.

We can not confirm the broker truly employs segregated bank accounts to ensure trader funds are on separate accounts from its own operational funds.

Dowmarkets lack negative balance protection, a crucial policy that ensures traders can never go into minuses in case they abuse the leverage trading.

Dowmarkets Broker Review of Accounts

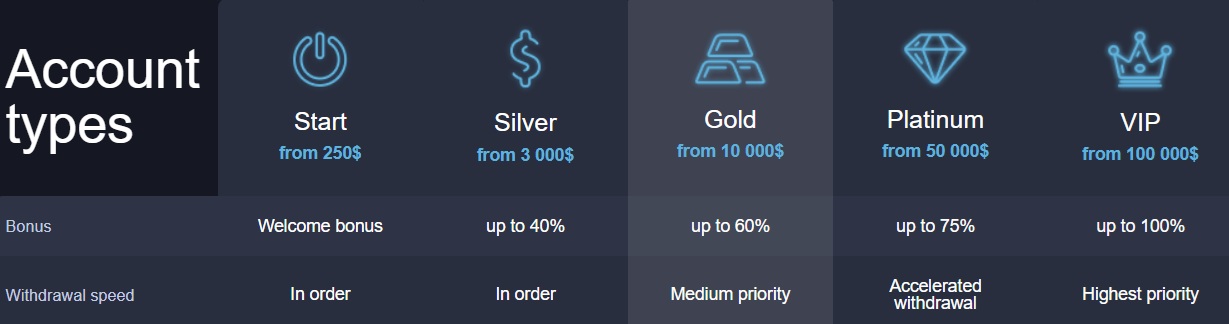

Dowmarkets offers a multitude of different accounts. These accounts are tiered depending on the minimum deposit and higher tier accounts offer more features and higher bonuses on deposits. These tiers include start, silver, gold, platinum, and VIP.

Dowmarkets Start Account

The start account is the basic account that has the lowest minimum deposit among trading accounts. It starts from 250 dollars, which is still very high as many reliable brokers offer better trading conditions for lower deposits. The broker does not disclose exact spreads on these accounts and we assume they should be well beyond 1 pip or there would not be a reason why the broker would hide its spreads. The information about commissions is not disclosed either but it should be a commission-less standard account. The maximum leverage is capped at 1:200 and the minimum lot size is 0.01 lots.

Dowmarkets Silver Account

The silver account is the next tier after the starter account and the broker requires traders to deposit at least 3,000 dollars. However, spreads and commissions are not disclosed, which is a red flag. The maximum leverage is also 200:1 on the silver account and the minimum lot size also starts from 0.01 lots.

Dowmarkets Gold Account

The gold account claims golden spreads but details are not disclosed here. The minimum deposit is really high at 10,000 dollars and the broker does not transparently offer details regarding commissions. The bonus is up to 40% on this account and traders can access personal education. The maximum leverage is up to 200:1 and the minimum lot size starts from 0.01 lots.

Dowmarkets Platinum Account

The Premium trading account by Dowmarkets requires an even higher minimum deposit than the last account. The deposit here starts from 50,000 USD which is well beyond a beginner’s capacity. The account is not clear about its spreads and commissions, which is a serious drawback. It offers many advanced features and a deposit bonus of up to 75%. The minimum lot size is 0.01 lots but we could not find info about the maximum leverage.

Dowmarkets VIP Account

The VIP offering by Dowmarkets has even higher minimum deposit requirements of 100,000 dollars, which makes it very expensive to start trading on this account. The details about trading conditions such as spreads, commissions, and leverage are not disclosed but the broker offers up to a 100% deposit bonus and various other additional features like personal trading trainer and account managers.

Dowmarkets instruments

Dowmarkets range of trading assets is diverse and includes popular markets like Forex, commodities, indices, cryptos, and stock CFDs. From currency pairs, traders can access all popular pairs like majors, and minors, and there are also exotic pairs accessible. Popular cryptos include BTC and ETH, and the leverage is up to 1:200, which gives the trader serious trading power, amplifying their position size 200 times. Unfortunately, the broker is not specific about exact spreads and commissions, which makes it difficult to conclude whether it is feasible to trade any of those assets.

Dowmarkets Reviews of Trading Platforms

Dowmarkets allows access only to a custom trading platform. This trading platform is called “Xcritical” and is not as advanced as other popular platforms like MT4 and 5. This platform is only available on web browsers and mobile devices including iOS and Android tablets and smartphones. The lack of standalone desktop trading software is a serious downside especially when the broker has such high minimum deposit requirements.

Dowmarkets Forex Review of Extra Features

Dowmarkets offers several bonus features depending on the trading account type. While starter account users do not receive any bonuses, starting from silver, traders can get from 20% to a maximum of 100% deposit bonuses. The silver account offers up to 40%, Gold up to 60%, platinum up to 75%, and VIP up to 100%. There are conditions applied to these bonuses which make them not very attractive and minimum deposit requirements are also very high and unattractive.

Dowmarkets Reviews of Customer Support

The customer support of Dowmarkets consists of live chat, email, and phone numbers. Traders can find the phone support at the bottom part of the website or use the live chat which is built inside the website. When it comes to multilingual support, the broker only offers 2 to 3 different languages, which does not make it a multilingual FX broker.

Dowmarkets Deposit and Withdrawal

Deposits and withdrawals are a crucial part of financial trading. When dealing with unregulated brokers, profit withdrawal procedures are important to check before account registration. The broker accepts several types of payments such as bank cards (Visa, MasterCard), QIWI, Bitcoin, and WebMoney. Deposits are fee-free but we could not find details regarding the withdrawal fees and processing times, which is a serious red flag. As a result, we can not confirm the broker allows profit withdrawals, and traders should be extremely careful here.

Dowmarkets Review Conclusion – can you trust Dowmarkets?

Dowmarkets remains unregulated and is based offshore with unclear trading conditions and very high entry barriers. The broker does not offer advanced trading platforms either. Despite offering bonuses and a variety of accounts, the lack of transparency on spreads, commissions, and withdrawals makes it too risky to consider as your main trading partner.

FAQs on Dowmarkets

Is Dowmarkets a scam?

Dowmarkets scam is a real possibility as the broker is unregulated, lacks transparency, and does not disclose details regarding withdrawals.

What is the Dowmarkets minimum deposit?

The minimum deposit is $250 for the basic account, with VIP accounts starting at $100,000.

Is Dowmarkets a cheap broker?

No, the broker does not disclose spreads and commissions, while account costs are high, making it an expensive and risky choice.

Comments (0 comment(s))