Errante Forex Review

Read our full Errante review to get exact details about their safety, accounts, spreads, platforms, assets, support, and many more. Our unbiased Errante opinion allows our readers to decide whether Errante is a reliable broker.

Errante Forex Broker History

Errante is a regulated broker offering Forex and CFD assets to its traders. The broker targets both international traders and European Union member country residents. The broker was established in 2018, and it should be experienced enough in the brokerage industry to offer refined services. However, we have found several drawbacks and red flags with this regulated broker which we will explain in more detail below.

The broker allows access to the advanced MetaTrader 5 trading platform on both desktop and mobile devices. Errante has expensive spreads from 1.8 pips on its standard accounts, making it less competitive. Expert Advisors (EAs) are allowed as well as news trading and scalping. However, because of high spreads, it is only possible to scalp on a Tailor Made account which has a minimum deposit of 15,000 euros. The minimum deposit on a standard account starts from 50 euros which is competitive.

Errante broker safety

The safety of any financial broker starts from regulations. The more licenses the broker has, the safer it is considered. In the case of Errante, the broker holds two licenses. The broker is overseen by the CySEC or Cyprus Securities and Exchange Commission and the Seychelles Financial Services Authority (FSA). The CySEC regulations allow it to offer trading services to European Union citizens, while Seychelles FSA allows it to attract traders from across the globe.

Despite these regulations, the broker still falls short when it comes to negative balance protection. This is a crucial policy for traders as it prevents traders from losing more than their initial investment. Since going into minuses is not prevented, traders have to be very careful not to become liable for losses beyond their account balance which might happen in highly volatile markets.

Errante is a member of the Investor Compensation Fund, which is an important policy allowing traders and investors to get their investments back in case something goes wrong with the broker.

Errante Broker Review of Accounts

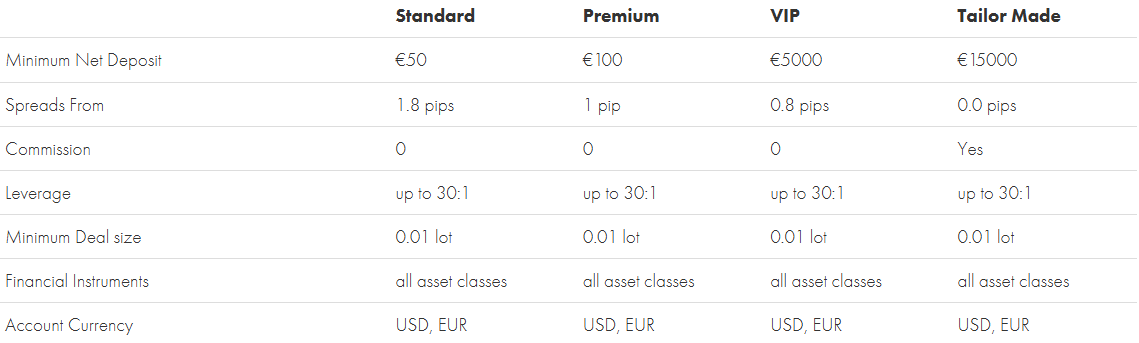

Errante offers traders four different account types: standard, premium, VIP, and Tailor Made. These trading accounts differ by their minimum deposit requirements and spreads, while other specs are almost the same.

Errante’s standard trading account has a minimum deposit requirement of 50 euros. Spreads are extremely high starting from 1.8 pips and there are no trading commissions. The minimum lot size is 0.01 lots (1,000 units), maximum leverage is up to 1:30, all assets are available, margin call is 100%, and stop-out happens at 50%. Traders can opt for swap-free standard accounts, but they need to request it from the broker.

Errante Premium trading account has the same specs, except for lower spreads from 1 pip and a higher minimum deposit requirement of 100 euros. There are no commissions charged.

The Errante VIP trading account has spreads of 0.8 pips and charges no commissions, but the minimum deposit requirement is 5,000 euros, which is high.

The Errante Tailor Made trading account has the lowest spreads from 0 pips on major pairs but charges commissions based on trading volume. The minimum deposit is also extremely high from 15,000 euros, making it incompatible with beginner traders.

Errante instruments

Errante offers a wide range of trading assets including shares, commodities, Forex pairs, and indices. The maximum leverage is up to 1:30 for all trading accounts. All the assets are available on all trading account types, which is flexible. The leverage for shares is 1:20, which is very high and competitive. Most FX pairs have 1:20 leverage and only CADCHF, CADJPY, and CHFJPY have 1:30, which is not competitive. Commodities have 1:10 and 1:20 depending on the specific instrument, and indices come with 1:20 leverage. The broker does not allow access to futures, bonds, or options, which is a minor drawback. The list of instruments in FX, commodities, and indexes is also limited.

Errante does not offer crypto pairs which is a big downside for the broker.

Errante Reviews of Trading Platforms

When it comes to trading platforms, the broker allows access to the advanced MetaTrader 5 (MT5) trading platform. MT5 is available for mobile devices Android and iOS in its mobile app form. The MT5 desktop platform allows custom indicators and Expert Advisors (EAs). The broker allows EAs or automated trading systems, which are very flexible.

Overall, the broker is really attractive when it comes to trading platforms.

Errante Deposit and Withdrawal

Errante allows several payment methods including wire transfers, bank cards, and e-wallets. Deposits are instant and commission-free, but withdrawals have mostly a commission of around 1% even on e-wallets. Withdrawals require 1-2 business days for processing, which is pretty standard time for FX brokers. Bank cards include Visa and MasterCard, and online wallets supported are Skrill and Neteller. The broker does not offer PayPal support, which is a serious downside as it is very popular among EU citizens.

Overall, the deposit and withdrawal experience is mediocre with Errante Broker, as it charges commissions on withdrawals.

Errante Forex Review of Extra Features

Errante offers several extra features. However, there is no deposit bonus available. There are no bonuses at all. This is a considerable downside as traders can not increase their trading power without depositing substantial capital.

The broker offers Errante Academy which includes webinars, video guides, and market analysis. The analysis offers articles for each trading day, which can be super useful for beginners who are starting to learn about analysis.

Errante Reviews of Customer Support

Errante provides several customer support options like email and phone support. There is no live chat, which is a serious red flag. Live chat is a cheap and fast way to get support in time, and the broker does not provide it. Traders will have to use phone support to resolve issues quickly, which is a costly option. Both the website and support channels of the broker are available in 5+ languages, which is very flexible.

Errante Review Conclusion

Errante is a regulated Forex and CFD broker offering access to the MetaTrader 5 platform and various account types including Standard, Premium, VIP, and Tailor Made. While it provides solid platform support and flexible trading options, the broker falls short in critical aspects such as high spreads, withdrawal fees, the absence of live chat, and negative balance protection. The broker does not allow crypto trading, and it has high spreads on standard accounts. To get 0 pips, traders have to deposit at least 15,000 euros, which is not convenient for beginners. Traders seeking a competitive fee structure and robust customer service might not find Errante attractive.

FAQs on Errante

Is Errante a scam?

Errante scam is not likely as the broker is regulated in two different jurisdictions. However, other specs are not attractive.

What is the Errante minimum deposit?

The minimum deposit on Errante starts at 50 euros for the standard account type.

Is Errante a cheap broker?

No, Errante has extremely high spreads from 1.8 pips, and for 0 pips traders have to pay commissions and deposit at least 15,000 euros.

Comments (0 comment(s))