FXOpen Review – The most experienced broker

Forex trading became popular only a few years ago. Until then, Forex traders were considered to be privileged people who had extensive knowledge and understanding of the market movements. Furthermore, the traders needed much more financial resources to get involved in the Forex industry than they need today. The increasing popularity of the Forex market came together with technological development. If in the past, traders were recording all the trades on paper, nowadays online platforms and various software types enable traders to process everything digitally.

This significant improvement in the trading experience produced millions of Forex traders worldwide. Accordingly, the brokerage firms began to appear on market to satisfy the increasing demand for Forex products. However, most of the brokerage firms are relatively new and therefore many of the customers have trust issues. One of the most reliable components of measuring the trustworthiness of the brokerage firm is to check how long the broker has been on the market.

FXOpen is a Forex broker with over 16 years of experience in the trading and Forex industry. The company was initially established in 2005 and since then has been a reliable broker of choice for thousands of traders. However, reliability only is not sufficient to be dominating the market. The trading conditions, trading platforms, promotions, and other features should be competitive enough to stand out among the hundreds of top Forex brokers worldwide. The review below will study the features of FXOpen in-depth and will reveal what are the benefits of trading with this broker and if there are any drawbacks to it.

FXOpen Quick Overview

As we have already stated, FXOpen is a retail Forex broker that provides online trading services on multiple trading platforms. The company is essentially operating in multiple countries worldwide with several main headquarters in Australia, Saint Kitts and Nevis, and the United Kingdom. Initially, the firm first opened in 2003 as an educational center of technical analysis. The company was based in Egypt back then. However, after two years FXOpen switched to providing brokerage services. After few years, the company was already successfully providing the services to numerous customers worldwide, with access to the ECN market via its MetaTrader platforms.

As we have already stated, FXOpen is a retail Forex broker that provides online trading services on multiple trading platforms. The company is essentially operating in multiple countries worldwide with several main headquarters in Australia, Saint Kitts and Nevis, and the United Kingdom. Initially, the firm first opened in 2003 as an educational center of technical analysis. The company was based in Egypt back then. However, after two years FXOpen switched to providing brokerage services. After few years, the company was already successfully providing the services to numerous customers worldwide, with access to the ECN market via its MetaTrader platforms.

FXOpen Forex broker is a brand name that unites several regional brokerage firms that are regulated by different regulatory authorities. The list of the branches of FXOpen and their corresponding regulatory bodies are listed below:

- FXOpen AU Pty Ltd – regulated by Australian Securities and Investments Commission (ASIC) with the license number AFSL 412871

- FXOpen Ltd – regulated by the Financial Conduct Authority (FCA) with the FCA register number 579202

- FXOpen Markets Limited – registered in Nevis with the registration number C42235

- FXOpen LP Limited – registered in Auckland, New Zealand with the registration number 5598865

FXOpen is a leading brokerage services provider for numerous reasons. The features that make the broker stand out are the first-time ever opportunity in the Forex industry to trade cryptocurrencies such as Bitcoin, Litecoin, Ethereum, Ripple, Monero, EOS, NEO, Bitcoin Cash, to choose from multiple account types that suit all sorts of trading styles with ECN, STP, Crypto, and Micro account types, to be able to open a real trading account with a minimum of 1 USD deposit, to access the maximum leverage of up to 1:500 and to have access to the wide range of the most popular payment options.

Trading at FXOpen

FXOpen is one of the world’s driving Forex dealers. They offer their clients alluring exchanging conditions, quick and error-free request execution, and the business’ generally exceptional and inventive innovative arrangements. FXOpen’s Forex trading accounts are intended for brokers with various degrees of involvement and abilities – from beginner dealers to shrewd experts. You can pick the account type that best suits your trading style, strategy, budget, and risk management. The Forex broker provides more than 50 currency pairs within its trading portfolio along with some of the most popular cryptocurrencies and gold and silver.

FXOpen Account Types

FXOpen offers some of the most diverse trading account options. There are in total four account types available on the trading platform of the broker. Each of the account types enables certain types of Forex traders to have a suitable trading environment for their trading style and strategies. The four account types are Micro, STP, ECN, and Crypto.

A Micro trading account allows traders to open an account with a minimum deposit requirement of 1 USD. The maximum balance can go up to 3 000 USD. The spreads are floating and there is no commission applicable to trades on this account type. The type of order execution is instant. The minimum transaction size is 0.1 micro-lots and the maximum transaction size is $1 000 000. The maximum amount of simultaneously open orders can go up to 100 open trades at the same time. The leverage can go up to 1:500. The margin call and stop out are 20% and 10% respectively. There is an option to apply an Islamic account to Micro Account. Available instruments for Micro account holders of FXOpen broker is 28 currency pairs plus gold and silver. Scalping is not allowed on Micro accounts, as well as News trading and phone dealing.

Crypto Account requires a minimum deposit of 10 USD in order to set up a real trading account. There are no limitations to the maximum balance on the account. The spreads are floating and the commission fee is applicable to trades on the Crypto account in the amount of 0.5% of trade volume round turn. The order execution type is market. The minimum transaction size is 0.01 lots. There are no limitations to maximum transaction size as well as to the maximum number of simultaneously open orders. The leverage for Crypto account holders can go up to 1:3. The margin call and stop out are 30% and 15% respectively. However, the Islamic account option is not available on the Crypto account. The trading instruments available on crypto account are 43 pairs with BTC, LTC, EOS, PPC, ETH, DASH, EMC. All trading styles are allowed on Crypto accounts including hedging, scalping, and EAs. Furthermore, News trading and phone dealing are also possible for Crypto account holders.

STP account also states the minimum deposit requirement is 10 USD. Similar to a Crypto account, there is no limit to the maximum balance on the account. The spreads are floating and there are no commission fees applicable to trades on STP account. The order execution type is the market. The minimum transaction size is 0.01 lots, whereas there are no limitations to the maximum transaction size. The traders can also enjoy unlimited simultaneously open orders. The leverage on the STP account can go up to 1:500. The margin call and stop out are 50% and 30% respectively. The Islamic account can be applied to the STP account, as well. Similar to the Crypto account, on an STP account traders can use any trading strategy that they like, including hedging, scalping, and EAs.

ECN is the most expensive account type with a minimum deposit requirement of 100 USD. The spreads are floating from 0.0 pips. The commissions are applicable to ECN accounts however in the amount of 15 USD per 1 mio. The order execution type is the market. The minimum transaction size is again 0.01 lots without any limitations to the maximum transaction size. Also, traders can have an unlimited amount of simultaneously open orders. The leverage for ECN account traders can go up to 1:500. The margin call and stop out are 100% and 50% respectively. The Islamic account can also be applied to the ECN account. The financial instruments available to trade on ECN account are 50+ FX Spot CFDs, 25+ Cryptocurrency CFDs, Shares CFDs, Index CFDs, Spot Metals CFDs and Commodity CFDs.

Trading Platforms

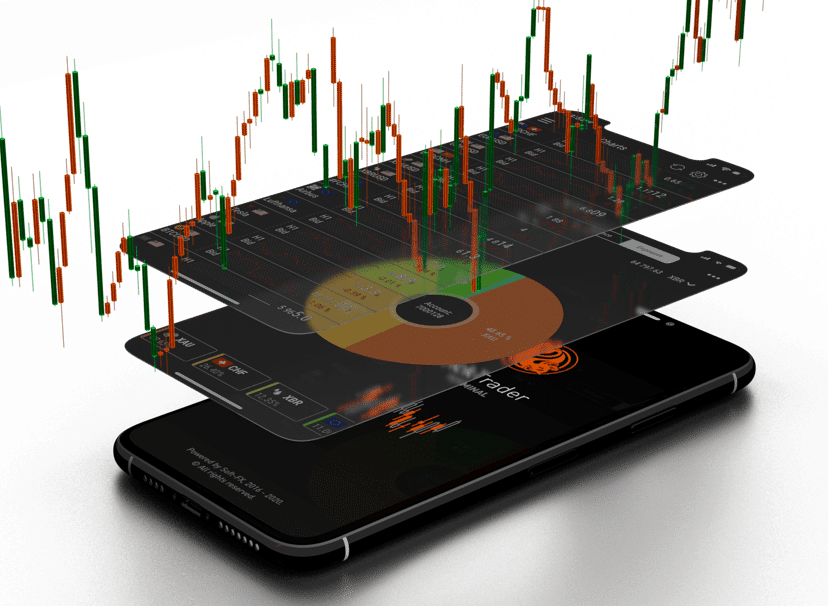

FXOpen opinion grants access to four different trading platforms to its clients. This is the most diverse portfolio of the platforms that the brokers in the region support. The traders can choose the unique TickTrader platform, well-known and popular MetaTrader4, and MetaTrader5 platforms, or the flexible and user-friendly WebTrader with the broker. Furthermore, mobile trading is also possible on the trading platform of FXOpen.

TickTrader

The best available option for retail FX brokerages and exchanges is the TickTrader Web Terminal. The platform is the innovative solution to providing for the physical delivery of the assets traded. The only requirement that the users need to satisfy while choosing TickTrader as their primary trading platform is to have a computer with a decent internet connection. The platform can be accessed from any location. TickTrader is a multi-asset trading platform and can be used directly through the platform or on FIX, REST, and WebSocket API.

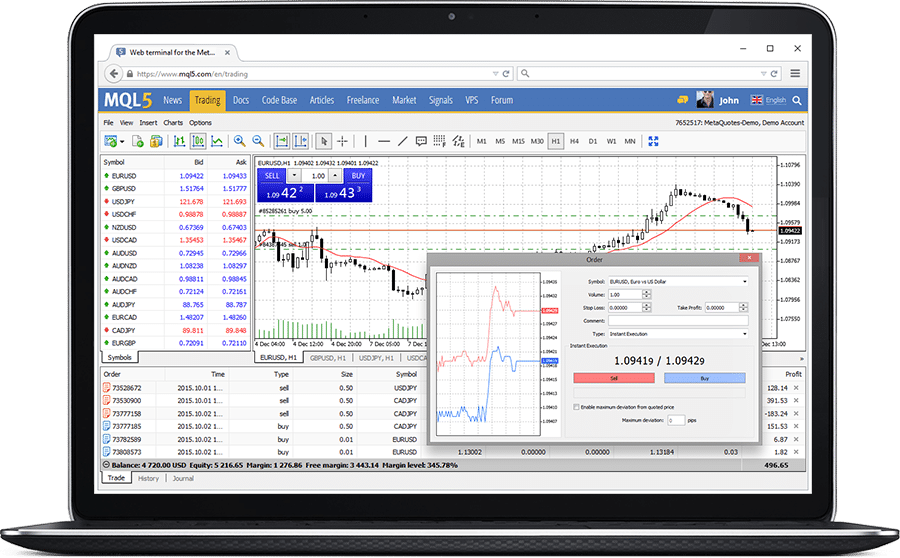

MT4 and MT5

MetaTrader 4 and MetaTrader 5 need no introduction from us as most of the traders, even the beginners have already heard more than enough about the platforms. FXOpen supports both software for its clients and successfully implements them into its trading platforms. It is not surprising that over 90% of all transactions on the retail Forex market are processed on MetaTrader 4. MetaTrader 4 is definitely the platform of choice for the Forex trader. MetaTrader 5 however is used for any other trading assets and could also successfully serve as an alternative for MT4 in Forex trading, too.

MetaTrader 4 and MetaTrader 5 need no introduction from us as most of the traders, even the beginners have already heard more than enough about the platforms. FXOpen supports both software for its clients and successfully implements them into its trading platforms. It is not surprising that over 90% of all transactions on the retail Forex market are processed on MetaTrader 4. MetaTrader 4 is definitely the platform of choice for the Forex trader. MetaTrader 5 however is used for any other trading assets and could also successfully serve as an alternative for MT4 in Forex trading, too.

WebTrader

The WebTrader is no a separate software on its own. It is rather a supporting interface for the MetaTrader 4 software. The platform implements all the features of the original software, however, operates without the need for downloading or installing it on the PC. The obvious advantage of the WebTrader is the easy accessibility of it through any device. The platform is compatible with all operating systems and is supported by all popular browsers. The interface is very familiar with MT4 Desktop. The client data is highly secured and protected on it and allows the users to experience one-click trading.

Promotional Campaigns of FXOpen

The traders have granted an FXOpen rating that is higher than for the average brokers. Partially, this is due to the fact that broker offers multiple promotional campaigns and programs. The various campaigns include the Forex no deposit bonuses as well, which are nowadays very popular bonus schemes offered globally to all sorts of traders. The list of the available bonuses includes:

- No Deposit Bonus for ECN TT GROSS accounts – 10 USD

- No Deposit Bonus for ECN TT NET accounts – 10 USD

- No Deposit Bonus for STP accounts – 10 USD

- No Deposit Bonus for Micro accounts – 1 USD

- ForexCup Trading Contest Bonus – % of the profit made in the contest demo account

In order to claim the above mentioned no deposit bonuses, clients need to register an FXOpen eWallet, get trade 1 verification and open a designated account applicable to the Forex bonus offers. The offers are valid for 90 days from the eWallet registration date. These bonuses are not withdrawable though, as they are for trading purposes only. However, the traders can withdraw any profit generated from trading with the bonus money at any point after they satisfy the trading volume requirements. The volume requirement is reached when the account volume exceeds 1 lot.

Comments (1 comment(s))