Exness and HotForex are two Forex brokers that have been in the business for more than 10 years. Their combined trading volume would actually exceed thousands of billions of US dollars in a single month only. They have hundreds of thousands of active users registered on their trading platforms and continue to supply them with high-quality trading services and facilities. These brokerage firms are equipped with like-minded professionals in the financial and informational technology areas and they know what traders are looking for. Both of the brokers have won multiple industry awards throughout the past few years and are now dominating the market of Forex trading. For instance, HotForex has more than 45 industry awards which include the title of Best Client Services 2020 and Best Forex Broker Asia. Additionally, both of these companies have favorable trading conditions offered to their clients including competitive leverage, spreads, and popular trading platforms.

Comparing these two Forex brokers is not simple. Both of them are highly reliable sources for Forex traders and both of them are legit, regulated companies holding multiple licenses within several different jurisdictions. They offer a competitive trading environment along with advanced trading tools, convenient pricing, promotional programs, high-quality and trustworthy trading platforms, and brilliant customer support services. However, each of them has its unique benefits that apply exclusively to their customers and therefore each has the potential to beat the other in certain features. The review below will deliver a comprehensive analysis of the similarities and differences between Exness and HotForex and will provide a solution for the traders who are still not sure which one to choose.

Which is the best?

When it comes to choosing your new favorite trading destination, there are some things that might influence your decision-making process. That’s why we decided to provide you with detailed information about trading features offered by these Forex brokers, so you don’t feel like you are missing out on something.

|

|

Rating |

Minimum Deposit |

Maximum Leverage |

Regulations List |

Trading Platforms |

Bonuses |

|

HotForex |

|

5 USD |

1:1000 |

FCA, DFSA, FSCA, FSA |

MT4, MT5, WebTrader |

100% supercharged, 100% credit bonus, 30% rescue bonus |

|

Exness |

|

1 USD |

1:unlimited |

FSA, FSCA, CySEC, FCA |

MT4, MT5, WebTrader |

10% no deposit |

Which broker offers better spreads and fees, Exness or HotForex?

The traders generally pay most attention to the commissions, spreads, and minimum deposits which are indeed one of the main features of the broker to take into account. Exness and HotForex have different business models and they charge for their services accordingly.

Commission Fees

The commission fees for both Exness and HotForex depend on the type of live trading account that the client registers on the trading platform of these brokers. For example, Exness charges commission fees only on two live trading accounts that are the Raw Spread account and the Zero account. For both of these accounts, the commission rate starts from 3.5 US dollars and can change according to the trading volume of the client. The rest of the accounts of the broker operate without commissions.

The commission fees for both Exness and HotForex depend on the type of live trading account that the client registers on the trading platform of these brokers. For example, Exness charges commission fees only on two live trading accounts that are the Raw Spread account and the Zero account. For both of these accounts, the commission rate starts from 3.5 US dollars and can change according to the trading volume of the client. The rest of the accounts of the broker operate without commissions.

HotForex has a little bit different structure. Even though this broker also charges commissions according to the trading account types, it can also vary according to the traded assets within the financial instruments portfolio. For example, the commission for cryptocurrency assets starts from 1 US dollar, whereas there is no commission on Forex currency pairs unless the trader signs up to get ultra-tight spreads with the broker. As for the account-specific commission structures, out of six different account types, only the Zero Spread account comes with the commission fees on Forex products.

Spreads and leverage

Spreads and leverage are two of the most popular indicators that the traders appreciate in the brokerage firm service quality. The leverage for Exness is actually determined by the equity in USD. For instance, 1:unlimited leverage is available for the accounts with the maximum equity of 999 US dollars, 1:2000 for the maximum equity of 4999 US dollars, 1:1000 for up to 5,000 US dollars, 1:600 for less than 15,000 US dollars, 1:400 for 30,000 US dollars, 1:200 for 60,000 US dollars and eventually 1:100 for any equity below 200 000 USD. The margin requirement at the last level of equity is 1%. For HotForex clients, the maximum available leverage can go up to 1:500.

Spreads and leverage are two of the most popular indicators that the traders appreciate in the brokerage firm service quality. The leverage for Exness is actually determined by the equity in USD. For instance, 1:unlimited leverage is available for the accounts with the maximum equity of 999 US dollars, 1:2000 for the maximum equity of 4999 US dollars, 1:1000 for up to 5,000 US dollars, 1:600 for less than 15,000 US dollars, 1:400 for 30,000 US dollars, 1:200 for 60,000 US dollars and eventually 1:100 for any equity below 200 000 USD. The margin requirement at the last level of equity is 1%. For HotForex clients, the maximum available leverage can go up to 1:500.

The spreads on the other hand are variable and depend on the type of trading asset. However, they are also determined according to the account types for both brokerage firms. At Exness, Standard account owners are offered spreads from 0.3, as well as Standard Cent account holders. For Raw Spread and Zero accounts, the spread can start from 0.0, and on Pro accounts, it starts from 0.1. For HotForex clients, the spreads are usually variable and start from 1 pip on most of the accounts. The exception on the other hand is a Zero Spread account and as the name suggests, Zero Spread account holders have spread from 0 pips on their trades in the Forex market.

Minimum deposits and Account Types

Both brokers provide at least five different trading account types and they might vary depending on the trading platform, as well. For example, Exness Forex broker has various account options for MetaTrader 4 and MetaTrader 5 trading platforms. On MetaTrader 4 platform the clients have much more options of which account to choose. Basically, the accounts come according to the traders’ experience and are classified either as Standard or Professional accounts. Within the Standard category of the MetaTrader 4 platform, there are two accounts available: Standard and Standard Cent. Whereas within the category of the Professional account there are three live trading account types: Raw Spread account, Zero accounts, and Pro account. Each of them provides its own benefits and trading conditions.

HotForex provides six different live trading accounts which range from Standard to Premium products. The clients can choose among Micro Account, Premium Account, Zero Spread Account, Auto Account, PAMM or Premium Account, and HFCopy Account. The micro account is very similar to the Cents account of Exness broker, as well as the Standard account. Zero Spread Account actually resembles the Zero account of the other broker. However, Auto, PAMM, and HFCopy accounts are unique account types of the broker and offer exclusive features to their traders such as automated trading tools, accounts for strategy providers and followers, and a Fund Manager program. The minimum deposit requirements vary from one account type to another.

Start trading Commission-Free with HotForex

|

|

EUR/USD |

USD/JPY |

GBP/USD |

USD/CAD |

AUD/USD |

|

HotForex |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Exness |

Yes |

Yes |

Yes |

Yes |

Yes |

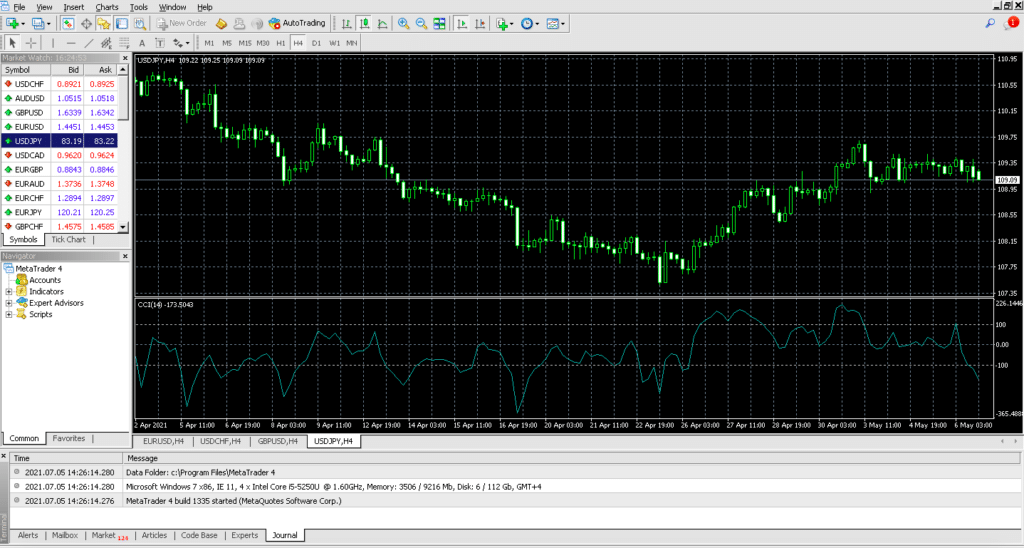

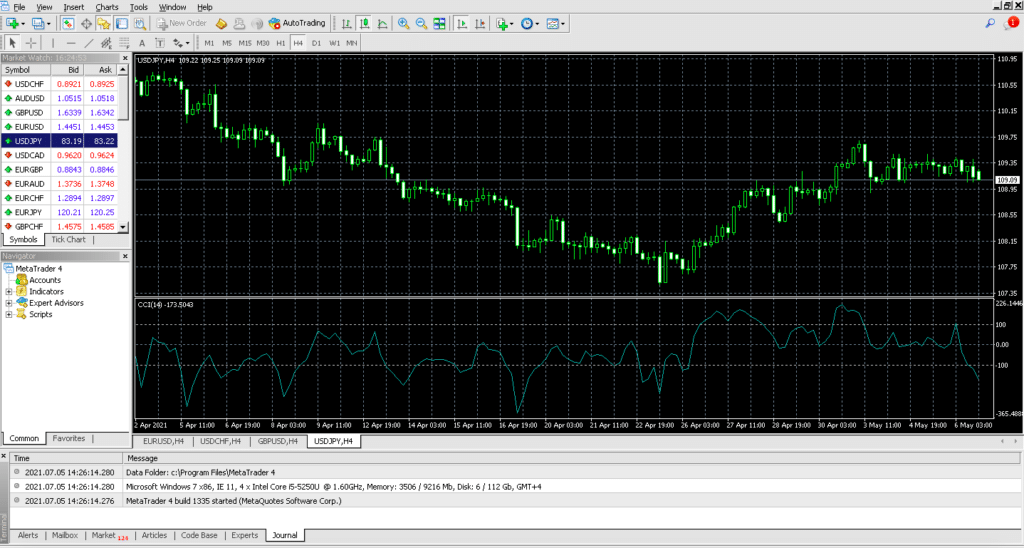

Which one has provided better software, HotForex or Exness?

Both HotForex and Exness support two of the most popular options for their traders – MetaTrader 4 and MetaTrader 5.

Both HotForex and Exness support two of the most popular options for their traders – MetaTrader 4 and MetaTrader 5.

Generally, MetaTrader is a Desktop terminal, meaning that it requires downloading and installation and can be run from the desktop. It might appear to be inconvenient for some of the traders who are looking for more user-friendly options and simple interface trading platforms. Therefore, these two brokers support various modifications and compatibility methods of these two platforms. HotForex and Exness provide the trading terminals that incorporate MT4 and MT5 but are accessible from various devices. For example, the WebTrader that these brokers offer borrows the same exact features that the original platforms offer, but is accessible from the browser of the trader. In contrast to the original software, WebTrader does not require any installation or downloading and can be accessed with ease.

Furthermore, Exness and HotForex provide mobile trading platforms which support the same trading software however are compatible with various types of mobile devices, including IOS and Android devices, as well. Both WebTrader and Mobile trading app-s are highly secure and guarantee the protection of the traders’ funds and private data. Additionally, these platforms are equipped with all the necessary features for trading including the market news, technical analysis, trader’s profile, placed trades, and so on.

What’s even better is that both of these Forex companies use a very famous program called Autochartist – this tool helps traders identify chart patterns and monitor the market for 24 hours a day, meaning that you can see real-time information which can help you make better trading decisions. Autochartist is compatible with programs such as MetaTrader 4 and MetaTrader 5, and the main benefit of using it is that it introduces you to potential trade possibilities exactly when they happen.

Get your MT4 account with HotForex

Which broker provides better safety for traders, X or Y?

Fortunately for the readers of this article, both Exness and HotForex accumulate the highest points of security including insurance, liquidity, regulations, negative balance protection, and the recognition of the broker.

Fortunately for the readers of this article, both Exness and HotForex accumulate the highest points of security including insurance, liquidity, regulations, negative balance protection, and the recognition of the broker.

HotForex is regulated by four different credible regulatory authorities that are the Financial Conduct Authority (FCA) in the United Kingdom, Dubai Financial Services Authority (DFSA), Financial Sector Conduct Authority (FSCA) in South Africa, and the Financial Services Authority (FSA) in Seychelles. In addition to multiple regulatory licenses, the company also employs a negative balance protection policy. Furthermore, the broker operates with top-tier banks only that provide liquidity and the company goes through regular audits to ensure that all the legal matters are in compliance with the market standards and regulatory requirements.

Exness, similar to HotForex, also holds licenses from four different regulatory authorities. The list of the regulatory bodies that authorized Exness Forex broker includes Financial Services Authority (FSA) in Seychelles, Financial Sector Conduct Authority (FSCA) in South Africa, Cyprus Securities and Exchange Commission (CySEC), and the Financial Conduct Authority (FCA) in the United Kingdom. Exness also supports negative balance protection and also operates with tier-1 banks globally. Exness is audited by Deloitte on a regular basis. The only difference between these two brokers and their corresponding security measures is that HotForex implemented a Civil Liability insurance program for a limit of 5,000,000 EUR. The insurance safeguards against errors, omissions, negligence, fraud, or other financial force majeure. Exness as no similar insurance.

|

|

ETF |

CFD |

Commodities |

Stocks |

Energies |

Metals |

Currencies |

Cryptos |

Indices |

|

HotForex |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Exness |

- |

Yes |

- |

Yes |

yes |

yes |

Yes |

Yes |

Yes |

Which one has better bonus offers, HotForex or Exness?

When it comes to promotions and bonuses, HotForex has a clear advantage over the Exness Forex broker. Of course, Exness provides the bonus programs, as well, but HotForex’s promo campaigns are massively diverse ranging from trading contests and loyalty programs to various types of Forex bonuses. Furthermore, these two brokers offer flexible terms and conditions on the bonus and promotional programs that they provide to their clients. Most of their campaigns are available both for new registering users and the already existing ones.

When it comes to promotions and bonuses, HotForex has a clear advantage over the Exness Forex broker. Of course, Exness provides the bonus programs, as well, but HotForex’s promo campaigns are massively diverse ranging from trading contests and loyalty programs to various types of Forex bonuses. Furthermore, these two brokers offer flexible terms and conditions on the bonus and promotional programs that they provide to their clients. Most of their campaigns are available both for new registering users and the already existing ones.

Exness only runs a single promotional program that offers a 10% deposit bonus. Within the program, new registering clients who verify their identity can receive an additional 10% of their initial deposit on their trading accounts. However, the program term is undefined, meaning that the broker can terminate the bonus scheme at any point without announcing it some time ahead. Furthermore, withdrawing the deposit bonus is not possible. Only the profits generated through trading with the bonus are withdrawable and under specific conditions. The traders have to satisfy the trading volume requirement before they cash out their profits on deposit bonuses.

HotForex on the other hand offers three types of bonus programs: 100% Supercharged bonus, 30% Rescue bonus, and 100% credit bonus. These bonuses apply on deposits in the amount of 50 USD for Rescue bonus, 100 USD for Credit bonus, and 250 USD for Supercharged bonus. While Credit and Supercharged bonuses serve as deposit bonuses, the Rescue bonus has another purpose. Rescue bonus protects the traders from loss-making and allows them to qualify for an additional stop-out bonus, as well. Apart from bonuses, the broker also runs several trading contests that come with generous prize pools, VIP incentive trips, expensive and luxury gadgets, and flexible trading conditions. The same applies to loyalty programs as the points collected through the different levels of the loyalty scheme can be exchanged for cash later.

|

|

Pros |

Cons |

|

HotForex |

4 Regulatory Licenses |

Less Tight Spreads |

|

Diverse Portfolio |

Geographic Restrictions |

|

Generous Promo Programs |

Only Derivatives On Some Products |

|

Exness |

4 Regulatory Licenses |

No Insurance |

|

Low Minimum Deposit |

Lack Of Promotional Programs |

|

Ultra-Tight Spreads |

Restrictions On Leverage |

Exness VS HotForex – which one is a better broker overall?

There is no clear answer to this question as it is up to the traders to decide which of them better suits their trading strategy or their trading goals. There are some areas where Exness dominates over HotForex, such as the tight spreads and convenient trading conditions which are of a much higher quality than the market average. However, HotForex promises the safety of the traders’ funds through various protection measures and provides an extensive portfolio of promotional campaigns, bonuses, trading contests, and loyalty programs. Also, traders can choose the broker based on their countries of residence. For instance, it would be recommended to go for the broker that actually has a license from your local regulatory authority. However, you must check whether the broker offers the services in your country of residence in advance.

FAQ on Exness VS HotForex

Is HotForex a good broker?

Yes, HotForex is considered a good broker due to several simple facts. First of all, this brokerage company is regulated by different financial regulatory bodies, which makes it a safe place for you to trade. If something inconvenient happens (e.g. the company goes bankrupt), you as a customer will definitely be protected. Other than that, with this broker, you have the possibility to access more than 1000 securities, including forex pairs and CFDs.

Which is better, HotForex or Exness?

It all depends on what kind of trader you are and what qualities you are looking for when dealing with a specific Forex broker. Each of these has its own benefits, for instance, HotForex offers good trading features for VIP customers, while Exness has a very nice ECN execution. You should definitely go for one that satisfies your needs the best.

What is the minimum deposit for HotForex?

The minimum deposit requirement at HotForex is set to 5$, which is quite a nice amount to start with. Moreover, it is also very competitive, as it correlates with the industry’s standards and makes it easier for customers to start their trading journey immediately, even when they have a low budget.

English

English  The commission fees for both Exness and HotForex depend on the type of live trading account that the client registers on the trading platform of these brokers. For example, Exness charges commission fees only on two live trading accounts that are the Raw Spread account and the Zero account. For both of these accounts, the commission rate starts from 3.5 US dollars and can change according to the trading volume of the client. The rest of the accounts of the broker operate without commissions.

The commission fees for both Exness and HotForex depend on the type of live trading account that the client registers on the trading platform of these brokers. For example, Exness charges commission fees only on two live trading accounts that are the Raw Spread account and the Zero account. For both of these accounts, the commission rate starts from 3.5 US dollars and can change according to the trading volume of the client. The rest of the accounts of the broker operate without commissions. Spreads and leverage are two of the most popular indicators that the traders appreciate in the brokerage firm service quality. The leverage for Exness is actually determined by the equity in USD. For instance, 1:unlimited leverage is available for the accounts with the maximum equity of 999 US dollars, 1:2000 for the maximum equity of 4999 US dollars, 1:1000 for up to 5,000 US dollars, 1:600 for less than 15,000 US dollars, 1:400 for 30,000 US dollars, 1:200 for 60,000 US dollars and eventually 1:100 for any equity below 200 000 USD. The margin requirement at the last level of equity is 1%. For HotForex clients, the maximum available leverage can go up to 1:500.

Spreads and leverage are two of the most popular indicators that the traders appreciate in the brokerage firm service quality. The leverage for Exness is actually determined by the equity in USD. For instance, 1:unlimited leverage is available for the accounts with the maximum equity of 999 US dollars, 1:2000 for the maximum equity of 4999 US dollars, 1:1000 for up to 5,000 US dollars, 1:600 for less than 15,000 US dollars, 1:400 for 30,000 US dollars, 1:200 for 60,000 US dollars and eventually 1:100 for any equity below 200 000 USD. The margin requirement at the last level of equity is 1%. For HotForex clients, the maximum available leverage can go up to 1:500. Both HotForex and Exness support two of the most popular options for their traders –

Both HotForex and Exness support two of the most popular options for their traders –

Fortunately for the readers of this article, both Exness and HotForex accumulate the highest points of security including insurance, liquidity, regulations,

Fortunately for the readers of this article, both Exness and HotForex accumulate the highest points of security including insurance, liquidity, regulations,  When it comes to promotions and bonuses, HotForex has a clear advantage over the Exness Forex broker. Of course, Exness provides the bonus programs, as well, but HotForex’s promo campaigns are massively diverse ranging from trading contests and loyalty programs to various types of Forex bonuses. Furthermore, these two brokers offer flexible terms and conditions on the bonus and promotional programs that they provide to their clients. Most of their campaigns are available both for new registering users and the already existing ones.

When it comes to promotions and bonuses, HotForex has a clear advantage over the Exness Forex broker. Of course, Exness provides the bonus programs, as well, but HotForex’s promo campaigns are massively diverse ranging from trading contests and loyalty programs to various types of Forex bonuses. Furthermore, these two brokers offer flexible terms and conditions on the bonus and promotional programs that they provide to their clients. Most of their campaigns are available both for new registering users and the already existing ones.