Exness Broker Review – Should You Trade With It?

How can one find a Forex broker that manages to incorporate both safety and profitability into a single trading platform? Is there a tried-and-tested way of making the right choice in this area?

These are the questions many Forex traders are struggling with. Unfortunately, the current trading market is full of fraudulent brokers with the only goal of stealing your money, and getting through them can often feel disheartening.

However, with the help of our unbiased counsel at Forex Trading Bonus, the challenge of finding the right brokerage becomes even easier. In today’s review of Exness Forex broker, we’ll provide you with yet another in-depth guide to tearing down this trading platform and finding out what’s hiding underneath it.

First impressions

Before we delve into an in-depth overview of the broker, let’s first take a step back and get a broader look at Exness. This can help us get a general impression of the broker, which then we can specify further down below.

As it turns out, Exness was founded in 2008 in Limassol, Cyprus. And as a Cyprus-based brokerage, it owns a license from the country’s main regulator CySEC. But it’s hardly the only agency monitoring Exness’ activities; the broker also holds licenses from the UK and Seychelles’ regulators, which, together with the CySEC, ensure the safest trading experience for you.

Trading terms and conditions are also pretty impressive at Exness. The broker offers you hundreds of financial assets to trade, and, as shown during our Exness review, commissions and leverage on these assets are way off the charts – especially leverage, which we’ll dive into a bit later.

All of these safety and trading features come together into three different platforms at Exness: MetaTrader 4, MetaTrader 5, and WebTerminal. With their top-notch features, these platforms promise to maximize your profitability in the market.

Now, let’s dive a little deeper and examine all of these features more closely.

Regulation and background

When looking for a brokerage, your main concern should always be safety. It doesn’t matter how lucrative trading features look, if your broker has a shady license and other safety measures, all those features can be considered as good as the paper/page they’re written on.

So, how does Exness fare in this sense? As it turns out, not too bad actually. In fact, as our in-depth Exness broker review shows, the company boasts some pretty impressive regulatory materials, as well as safety features.

First off, let’s start with licensing. Exness owns a financial license from three different Forex regulators, namely:

- Financial Conduct Authority (FCA) from the UK

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Authority (FSA) from Seychelles

Two out of three regulators in this list are considered some of the best financial agencies in Forex, and those are the FCA and CySEC. Brokers that boast these licenses are generally regarded as trustworthy, and no one even suspects any kind of fraudulent activity from such brokers.

And it’s pretty understandable: Both the United Kingdom and Cyprus are developed European countries with strict economic and financial regulations. This means that when it comes to ensuring the safest financial service for the people, they’re the ones you can trust.

As for the FSA from Seychelles, it doesn’t really reach that level of credibility, although it certainly elevates the overall trustworthiness of Exness’ trading platform.

But regulation is just half of the story. During our review of Exness Forex broker, we found that the platform comes with a number of top-tier fund protection mechanisms, namely:

- Negative balance protection

- Account segregation

- Customer compensation fund

With these mechanisms in place, you can rest assured that your deposits and profits are safely stored on separate bank accounts, and should anything happen to the broker, there’s going to be a compensation fund to return your losses.

To conclude, Exness features a top-notch safety framework that always puts your financial stability first.

Trading accounts at Exness, and how to get them

When you find your perfect Forex broker, the next logical step for you is to set up an account with it. And depending on how easy and fast the registration process is, it’s either going to be an overall great experience or an entirely dull one with this broker.

When doing this Exness review, we personally went through the registration process to see how easy it was to get a trading account with this broker. And as it turned out, it only took us a couple of minutes to finish everything.

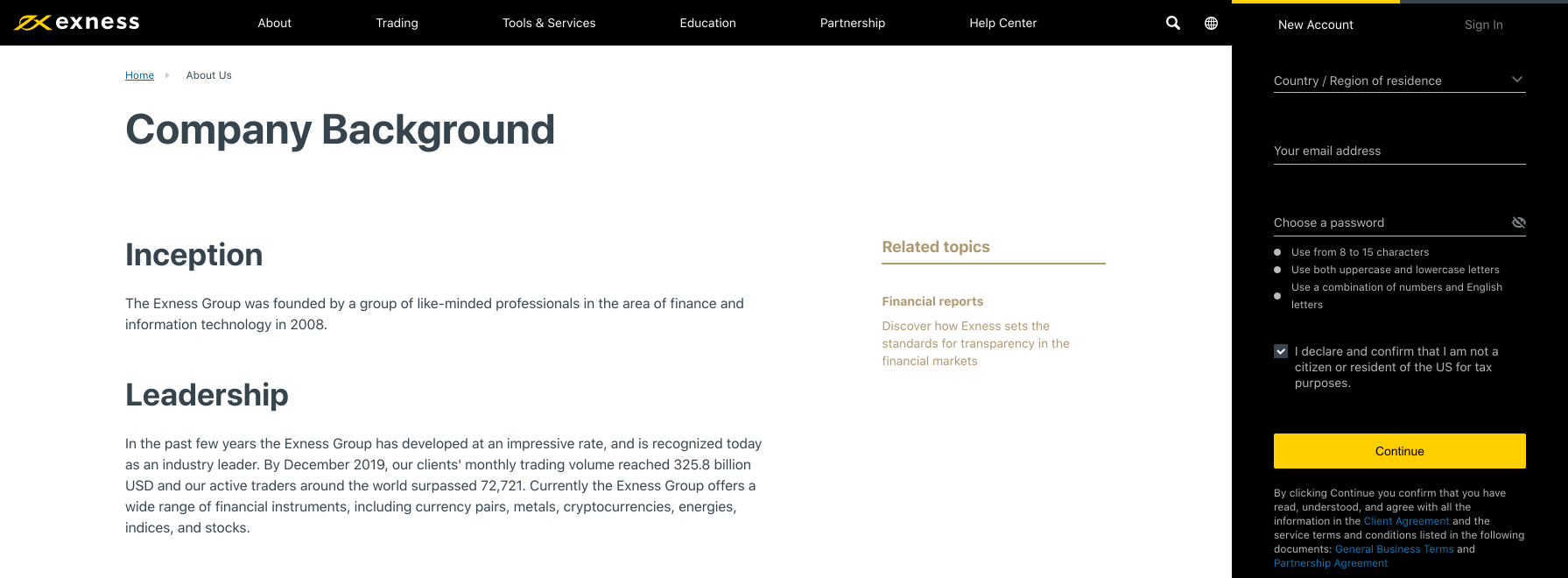

These are the steps you need to take to get a full-fledged live account with Exness:

- Fill in your personal information, such as your full name, country/region of residence, email address, and employment details;

- Upload your national ID/Passport/driver’s license to verify your identity, as well as the bank statement/utility bill to verify your address;

- Deposit funds using one of many available payment methods;

- Trade Forex, stocks/indices, cryptos, or commodities right away!

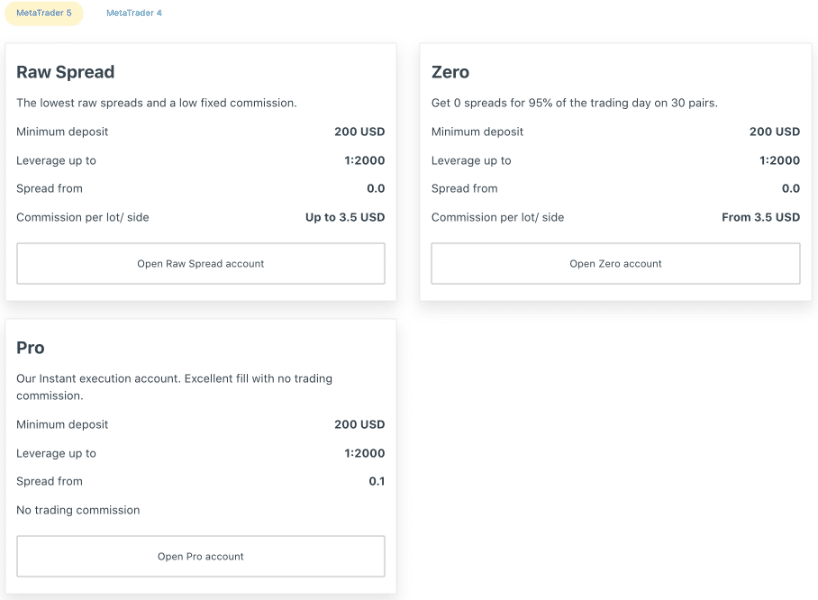

Now that you know what it takes to set up a live account with Exness, it’s time to talk about exactly which accounts are there available for a choice. And as it turns out from our in-depth Exness broker review, there are quite a few actually. In total, we counted 9 live accounts on the website, which is an impressive offering for any given brokerage.

These are the accounts with their specific terms and conditions:

- Standard account – 10 USD min. deposit; 1:2000 leverage; 0.3 pips for spreads.

- Standard MT4 account – 10 USD min. deposit; 1:unlimited leverage; 0.3 pips for spreads.

- Standard Cent MT4 account – 10 USD min. deposit; 1:unlimited leverage; 0.3 pips for spreads.

- Raw Spread account – 200 USD min. deposit; 1:2000 leverage; 0 pips for spreads.

- Raw Spread MT4 account – 200 USD min. deposit; 1:unlimited leverage; 0 pips for spreads.

- Zero account – 200 USD min. deposit; 1:2000 leverage; 0 pips for spreads.

- Zero MT4 account – 200 USD min. deposit; 1:unlimited leverage; 0 pips for spreads.

- Pro account – 200 USD min. deposit; 1:2000 leverage; from 0.1 pips for spreads.

- Pro MT4 account – 200 USD min. deposit; 1:unlimited leverage; from 0.1 pips for spreads.

An additional feature found during our review of Exness Forex broker is that some of these accounts can be converted into an Islamic account. More specifically, the Standard, Standard Cent, Pro, Zero, and Raw Spread accounts can be turned into swap-free accounts, which is a great condition for Muslim traders who want to trade Forex over extended amounts of time without getting interest rate charges.

On top of that, you can also set up a demo account, which comes in with very beneficial conditions, such as an unlimited virtual balance to trade all available instruments on Exness. Plus, you can incorporate all sorts of different tools and features you would get with a live account, which can further help you take your trading game to the next level.

Deposit and withdrawal methods at Exness

As we have noted earlier, one of the last steps of getting started with Exness is to make a deposit on your newly created account. And depending on which account you go for, the minimum deposit requirement will either be 10 USD or 200 USD. Also, it should be noted that the minimum deposit transaction for clients in Vietnam is $15.

As for the actual payment methods, our Exness review reveals tons of different financial platforms, which power both deposits and withdrawals. Here are those methods with their conditions as well:

- Qiwi – 1 USD min. deposit; Instant deposits; Instant withdrawals.

- Internet-bank “Promsvyazbank” – 1 USD min. deposit; Instant deposits; No withdrawals.

- Internet-bank “Alfa-Click” – 1 USD min. deposit; Instant deposits; No withdrawals.

- Bitcoin – 0 USD min. deposit; Deposits up to 4 hours; Withdrawals up to 72 hours.

- Tether (USDT) – 1 USD min. deposit; Deposits up to 72 hours; Withdrawals up to 72 hours.

- Bank Card (Visa, Mastercard) – 3 USD min. deposit; Instant deposits; Withdrawals up to 3-5 days.

- Neteller – 10 USD min. deposit; Instant deposits; Instant withdrawals.

- Yandex Money – 1 USD min. deposit; Instant deposits; Withdrawals within 24 hours.

- Perfect Money – 50 USD min. deposit; Instant deposits; Instant withdrawals.

- WebMoney – 1 USD min. deposit; Instant deposits; Instant withdrawals.

- Skrill – 10 USD min. deposit; Instant deposits; Instant withdrawals.

- Internal Transfer – 1 USD min. deposit; Instant deposits; Instant withdrawals.

As this Exness broker review shows, the transaction times are pretty advantageous for traders with any experience background. In addition to that, Exness has a very beneficial commission policy for them, which is no commissions at all. This way, you’re getting exactly the same amount of money you’ve deposited/withdrawn.

One thing to point out, however, is that some e-wallet providers may still charge certain commissions on their end, which Exness cannot do anything about and it’s also not blameworthy for it.

Overview of Exness’ trading assets

When searching for your brokerage, the first thing you’re probably looking at is its trading terms and conditions. And what better way to start a discussion about trading terms and conditions than to explore the instruments available on the trading platform.

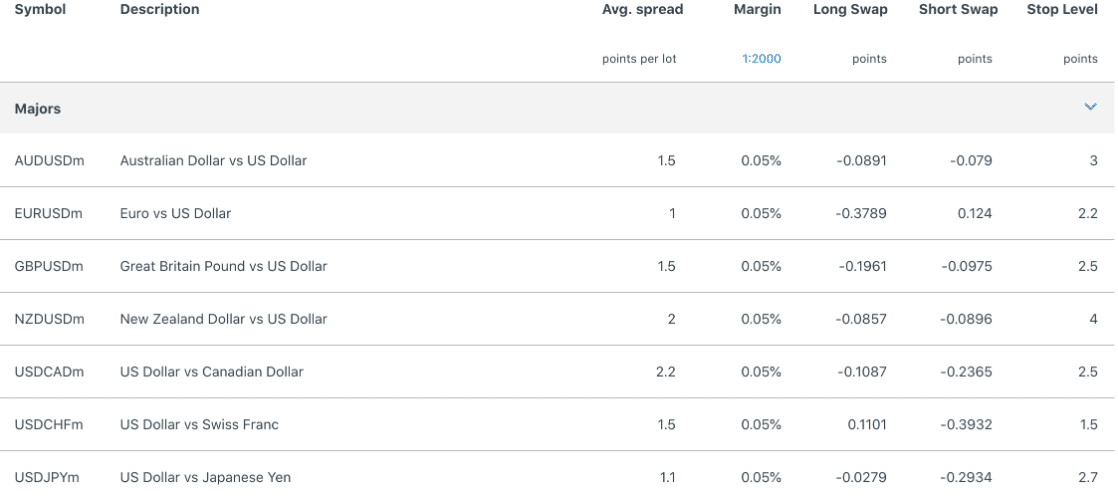

On Exness’ website, we found more than 150 financial assets you can choose from, which range in a number of different asset categories. Here are the instruments found during our review of Exness Forex broker:

- 107 currency pairs

- 40 stocks and indices

- 12 metals and energies

- 7 cryptocurrencies

What this level of diversity means is that you can choose a number of different instruments to trade simultaneously. This way, your portfolio will be more diversified against aggressive market fluctuations and maintain its stability.

Besides that, Exness also features very advantageous trading features alongside these instruments. First off, let’s take a look at leverage. As you may already know, many Forex brokers offer leverage to help their clients increase their trading capital quite substantially, and with Exness, you can take this practice to a whole new level.

The maximum leverage you can get at Exness actually has no limit whatsoever. If you decide to set up any of the Professional MT4 accounts, in theory, you’ll be able to apply for a 1:unlimited leverage rate.

More specifically, there are different deposit levels with varying maximum leverage levels. Here are these levels we found during our Exness review:

- From 0 to 999 position sizes – 1:Unlimited

- From 1,000 to 2,999 position sizes – 1:2000

- From 3,000 to 9,999 position sizes – 1:1000

- From 10,000 to 19,999 position sizes – 1:600

- From 20,000 to 49,999 position sizes – 1:400

- From 50,000 to 199,999 position sizes – 1:200

- From 200,000 to more – 1:100

What this categorization indicates is that Exness wants to offer the most convenient service to you, which means it targets your exact experience level to offer a specific leverage rate. If you’re less experienced, it’s logical to assume that you’d have fewer funds to invest in Forex, therefore, higher leverage would fix things.

Another important trading feature we looked into is Exness’ execution policy. Not only do you want a broker that expands your trading capital but also the one that helps you the best trader with that capital. And with Exness’ execution policy, you can be exactly that.

In the following Exness broker review, we found out that it features both instant and market execution modes, which are some of the fastest execution modes in the market. Besides, Exness also offers you stop-loss, take-profit, trailing loss, and many other modes that help you secure the profits, as well as limit the losses.

Which commissions are you paying at Exness?

Alongside the above-mentioned trading features, we also explored the commission levels at Exness. And what we saw is pretty impressive!

Trading commissions

First off, let’s take a look at which trading commissions you’re getting with Exness. The most important commission type here is a bid/ask spread, which goes all the way down to 0 pips, meaning the broker leaves your earnings alone sometimes. On average, however, spreads revolve around 1 pip on currency pairs, which is still a very acceptable condition.

As for account commissions, our review of Exness Forex broker shows that there are only two trading accounts that charge certain fees: Raw Spread account – less than 5 USD, and Zero account – more than 5 USD. Other than that, no other account type charges you a single penny.

Then there are swaps, which are charged to your overnight trading positions. But with Exness, you’re also getting pretty affordable deals on swaps, and some currencies even receive swap discounts.

Other than that, there are no commissions you need to pay at Exness, and considering how competitive the existing ones are, it’s not too bad of a deal at all.

Non-trading commissions

When it comes to non-trading fees, the conditions are even more beneficial than with trading fees. Exness completely removes deposit or withdrawal fees from its platform, therefore, you can make as many transactions as possible and rest assured that you’re getting the exact same amount you’ve transferred.

And even though we found an inactivity fee in our Exness review, it’s pretty easy to avoid it by deactivating an account when you stop trading for a while.

Exness’ trading platforms

When you choose Exness as your service provider in the trading market, you get a set of trading platforms that come with high-powered trading features. These platforms include:

- MetaTrader 4

- MetaTrader 5

- WebTerminal

MetaTrader 4 is the most actively-used trading platform in Forex, which isn’t just because it’s been around for 15 years now. MT4 comes with tons of technical indicators, as well as fundamental indicators and analytical objects, charts, and whatnot. And with Exness, it takes advantage of all the execution modes and available instruments to offer you the best possible experience.

As for MetaTrader 5, it’s pretty similar to MT4 in many ways, but the differences are more prominent: it features the economic calendar, market depth, and supports a far wider range of trading instruments.

The last platform found during our Exness broker review is WebTerminal, which is accessible from pretty much every popular browser, be it Safari, Chrome, Opera, or Firefox. And it comes with pretty much the same functionality as its desktop-based counterparts. All in all, trading platforms at Exness are taken to a whole another level, ensuring that you’re getting the best possible experience in the market.

Should you trade with Exness?

So, to put all this in a nutshell, is it worth choosing Exness as your main trading partner in Forex? Will you actually be safe by trading with this broker?

Well, everything we’ve discussed here indicates that Exness is a trustworthy broker. It comes with a set of licenses that is hard to neglect. Whether you take the FCA, CySEC, or FSA, you can be sure that they guarantee the safest trading terms and conditions for you.

Speaking of terms and conditions, Exness does actually come with very impressive features. There are hundreds of assets to choose from, and they get very low commission rates, not to mention unlimited leverage, which is something you cannot see every day in this market.

All in all, our review of Exness Forex broker proves that you cannot go wrong with choosing it as your service provider.

Comments (2 comment(s))