All you need to know about the broker in this HWFX review

Let’s kick this HWFX review similar to how we’re used to doing reviews on this website. We will look at the broker’s website and generate our first impressions through their design, transparency and the user-friendly nature of the platform.

Naturally, this may not represent any importance for actual customers of Forex brokerages, but when doing reviews, the design plays a massive role. It basically gives us an idea of how much the broker is willing to invest in making their platform comfortable in every aspect.

So, let’s do some criticizing.

HWFX review – first impressions and website design

One thing we can say right off the bat is that we’re very happy that the broker didn’t place all of the information on one single page. This is an indication that there is some kind of depth to the company, and their only virtues simply cannot fit on one long webpage.

Categorizing is extremely important because the customers don’t have to waste too much time digging through the page to find what they need, they can simply use the navigation bar.

The transparency is also commendable as almost all the information is neatly tucked away in the footer of the website. But we’re not here to observe the creativity of the designers. We’re here to determine if the HWFX scam is real or not, as there have been some rumors circling the web.

Can HWFX be trusted?

One thing we can say is that HWFX does indeed make a strong case for its trustworthiness just with the CySEC license. Now, this doesn’t directly belong to the company itself, but rather to its parent entity, called Haliway Investments Ltd. This is not the best-case scenario as it’s always better for the brokerage itself to be the license owner. Makes it easier to track changes in its regulation, but nevertheless, a hereditary license is better than no license at all.

Now that we’ve got the legal documentation topic off the table, let’s look at the trading conditions for the brokerage and see if there are any traces of the HWFX scam hidden away there.

HWFX review of trading conditions

Leverage & Spread

One thing we need to consider with HWFX is that it’s competing on the EU market, therefore it has to have industry-standard conditions. With leverage, it’s able to tick that checkbox as it’s offering a 1:30 maximum leverage cap. Since the company is located in the EU this is a standard leverage amount for CFDs due to ESMA regulations.

However, the issues with this HWFX review started when we first encountered the spread. With leverage that beneficial for the traders, we were expecting anything from 0.5 to 1.0 pips per standard lot. However, we were greeted with 1.5 pips per standard lot, which translates as 1.7 pips during actual trading.

Pairing that up with the 1:30 leverage maximum is definitely not advantageous for the traders considering the number of fees that CFDs come with.

Software

The trading software is also quite linear, traders can only use The HWFX MT4 platform, which although is the most popular option available in the market, a little bit more diversity would be hugely appreciated, at least as compensation for the unfavorable trading conditions.

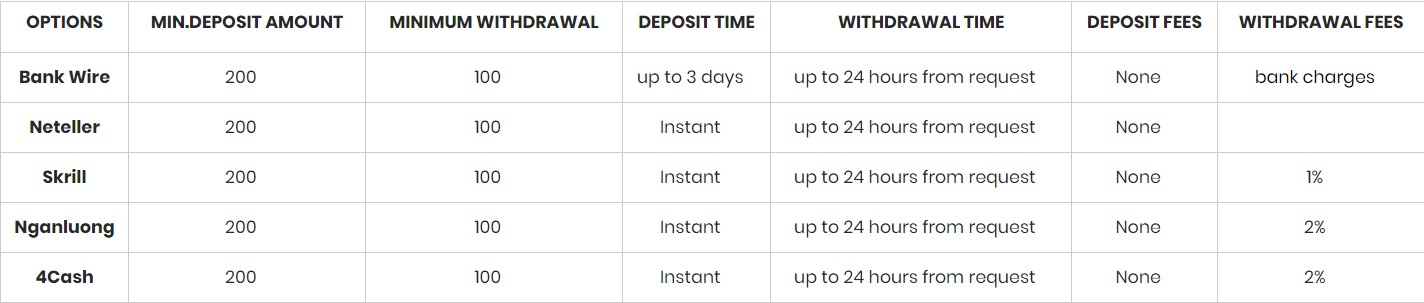

Withdrawals and deposit

The deposit minimum for the three available account types is $200, $1,000 and $5,000 respectively. When it comes to withdrawals though there is also a minimum cap of $100, which is unfortunately yet another disadvantage.

However, the HWFX scam argument started to make sense when we found out about the sheer number of fees associated with the brokerage. Everything including account maintenance, inactivity, and uncompleted registration come with fees ranging from $15 to $30 on all weekly, monthly and yearly basis.

Needless to say, the most crucial part of trading with a broker, that has to do with account funds turned out to be a huge letdown across the board. Once we were able to witness it ourselves, is when the HWFX scam rumors started to sound quite believable.

Is it worth it to trade with HWFX?

Considering the fact that the leverage is the only industry-standard trading condition that the broker is able to provide, it’s safe to say that HWFX is a below-average broker in the EU market.

Maybe if it was located somewhere else it could offer higher leverage compared to the spread it offers, but in this case, the profitability of traders is the first victim.

We’re not saying that HWFX is a scam directly, it’s just that the rumors and the allegations are slowly starting to make sense in the wake of the crippling fees and conditions.

Comments (0 comment(s))