OspreyFX is an ECN broker operating on the STP execution business model, whereas Oanda is a Forex broker with over 25 years of experience on the market. These two brokers do not share many similarities and rather are very different from each other. However, numerous traders still pose this question – is OspreyFX or Oanda better? In order to find out, we need to analyze in-depth the features and offerings of these two brokers and assess if they qualify as the top Forex broker.

One of the major differences between Oanda and OspreyFX is the regulation. OspreyFX is at the moment an unregulated Forex broker which still is deemed to be reliable by a number of traders. Oanda on the other hand is regulated within multiple jurisdictions. The brokers also differ according to their financial instruments portfolios. OspreyFX specializes in Forex currencies, Cryptos, Precious Metals, Indices, Energies, and US and EU shares. On the other hand, Oanda offers CFDs, Forex, Indices, Metals, and commodities. Furthermore, Oanda offers the maximum leverage of up to 200:1 on Forex products, whereas OspreyFX can boost it up to 1:500. Both brokers provide a great variety in the trading platforms and compatible terminals, as well as the trading and educational tools for their users.

Which is the best?

We understand that making a choice between different brokers might not be an easy task, especially when you are a newcomer to the industry. In order to make this decision-making process easier for you, we decided to provide our readers with all the important trading features that one should always keep in mind. Below you can see some additional information about OspreyFX vs Oanda, which will be further discussed later in the article.

|

|

Rating |

Minimum Deposit |

Maximum Leverage |

Regulations List |

Trading Platforms |

Bonuses |

|

Oanda |

|

1 USD |

200:1 |

NFA, IIROC, FCA, CMS, ASIC |

MT4 Web, MT4 Desktop, Oanda Mobile |

N/A |

|

OspreyFX |

|

25 USD |

1:500 |

N/A |

MT4 Web, MT4 Desktop, MT4 Mobile Devices |

Rebates, Withdrawal bonus, Trading Contests |

Which broker offers better spreads and fees, OspreyFX or Oanda?

There are various types of costs and fees associated with trading Forex. Usually, brokerage fees will significantly vary from one broker to another. Some of them will operate on commission fees, whereas others will implement the fees into spreads to offer a commission-free trading experience.

Commissions

Oanda provides three different live trading account types for its clients: Standard, Core, and Swap-free. The Standard and Swap-free account types give an opportunity to the traders to operate their trades without commission charges. However, the Core account type comes with a commission fee of 40 USD per million. Similarly, the OspreyFX commission also depends on the account type. At OspreyFX there are four account types available for trading: Standard, PRO, VAR, and Mini. The commission per lot is 7 USD for the Standard account, 8 USD for the PRO account, and 1 USD for the Mini account. VAR account operates without commission charges.

Oanda provides three different live trading account types for its clients: Standard, Core, and Swap-free. The Standard and Swap-free account types give an opportunity to the traders to operate their trades without commission charges. However, the Core account type comes with a commission fee of 40 USD per million. Similarly, the OspreyFX commission also depends on the account type. At OspreyFX there are four account types available for trading: Standard, PRO, VAR, and Mini. The commission per lot is 7 USD for the Standard account, 8 USD for the PRO account, and 1 USD for the Mini account. VAR account operates without commission charges.

Spreads

Oanda offers tight CFD spreads for its customers. Usually, Oanda spreads start from 1.1 points on indices such as Germany 30 or 1 point on the UK100, with the spreads as low as 1 pip for popular currency pairs such as EUR/USD or USD/JPY. The spread on Brent Crude Oil starts from 3.3 points, whereas the gold spread is around 30 cents. Typical spreads for OspreyFX on the other hand are relatively low. The spreads depend on the type of the account once again. The standard account holders get spreads from 0.8 pips on Forex pairs, Pro account holders can access the pairs with 0.4 pips, VAR account offers spreads from 1.2 pips and Mini account comes with the spreads starting at 1.0 pips.

Deposits and Withdrawals

None of these two brokers charge for deposits on the trading accounts. However, both OspreyFX and Oanda incur withdrawal fees. OspreyFX charges 25 USD for banking fees on withdrawals exceeding 5,000 USD. Withdrawal through other payment methods comes with low to no fees mostly. Similarly, Oanda also operates with withdrawal fees for transactions through bank wire. The broker usually takes a 20 USD fee per transaction processed through the bank wire. They do not charge a fee for withdrawals to the trader’s credit or debit card.

None of these two brokers charge for deposits on the trading accounts. However, both OspreyFX and Oanda incur withdrawal fees. OspreyFX charges 25 USD for banking fees on withdrawals exceeding 5,000 USD. Withdrawal through other payment methods comes with low to no fees mostly. Similarly, Oanda also operates with withdrawal fees for transactions through bank wire. The broker usually takes a 20 USD fee per transaction processed through the bank wire. They do not charge a fee for withdrawals to the trader’s credit or debit card.

Start trading with low spreads – OspreyFX

|

|

EUR/USD |

USD/JPY |

GBP/USD |

USD/CAD |

AUD/USD |

|

OspreyFX |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Oanda |

Yes |

Yes |

Yes |

- |

Yes |

Which one has provided better software, Oanda or OspreyFX?

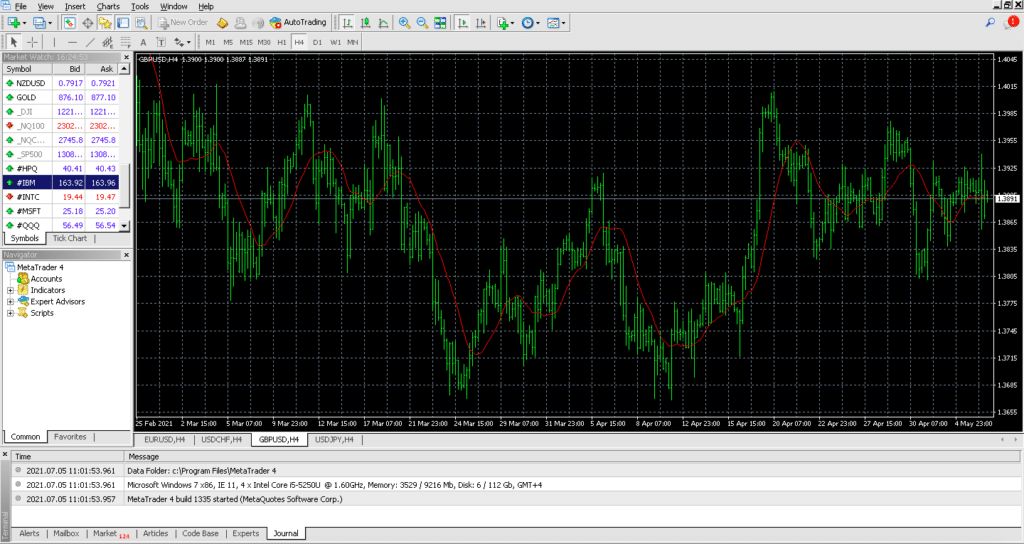

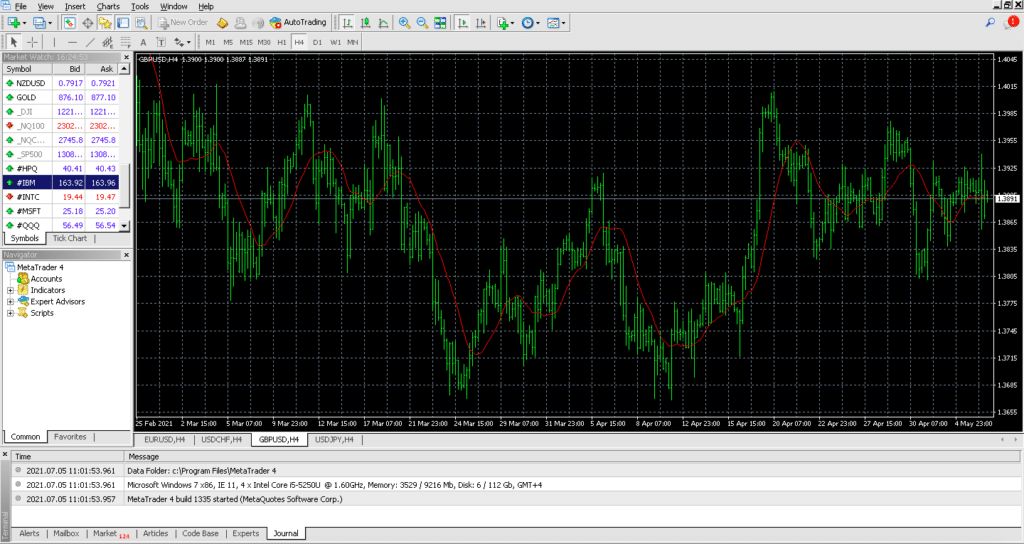

Both Oanda and OspreyFX offer their clients the most advanced and recognized trading platforms built on MetaTrader 4 software. MetaTrader 4 was initially designed to specifically fit the purposes of Forex trading, that is why it is considered to be the best tool for Forex traders.

Surprisingly, these two brokers are way more similar in their trading platforms and the terminals available for their traders. Both brokers support different compatibility modes and versions of the MetaTrader 4 software. Oanda and OspreyFX provide various terminals with inbuilt features of the MT4 software that are supported by numerous devices. The brokers offer MetaTrader 4 for Desktop (both Windows and Mac), for Browsers, which is often called a WebTrader and can be accessed directly from any browser of the user, and MetaTrader 4 for Mobile devices available for both IOS and Android devices. Oanda or OspreyFX mt4 download links can be found directly on their websites.

The main advantages of the variety in compatibility modes of the MetaTrader 4 are the user-centric focus, simplicity, and customizable interface. For instance, MetaTrader 4 requires downloading and installing on the PC of the user, therefore, some traders might prefer to trade on the go. Therefore, the best suitable option for them would be to use WebTrader, which offers the exact same features, however, without the need to download and install the platform. They can rather access the terminal through web browsers. Similarly, for those who would like to have constant access to their trading information, client data, market news, and technical analysis, the mobile version of the trading platform is the best choice.

Get your MT4 account with OspreyFX

Which broker provides better safety for traders, OspreyFX or Oanda?

First of all, the experience of the broker and the time that it has spent on the market is very crucial. Since the brokers that can survive through years within the Forex market can be considered decent and trustworthy ones.

OspreyFX is operating on the Forex market for a few years already and has a significant number of users registered on its trading platform, as well. However, the answer to the question is OspreyFX regulated by any official regulatory authority, is no, which might be a significant drawback for experienced traders. The broker states that it actually plans to receive the official license, however, as it is expensive and limits the freedom of the traders greatly in some ways, OspreyFX has avoided getting regulated before.

Oanda on the other hand has experience of over 25 years in the Forex market. Furthermore, the broker has licenses and regulations within five different regulatory bodies and therefore is deemed to be one of the most reliable Forex brokers globally. The list of the licenses and regulations of Oanda includes the license from the National Futures Association, or NFA (the license number NFA # 0325821), the regulation from the Investment Industry Regulatory Organization of Canada, or IIROC, the Financial Conduct Authority regulation in the UK, or FCA (FCA Registration No: 542574), the license in Singapore by the Monetary Authority of Singapore, or MAS (CMS Licence No: CMS100122-4), and the license in Australia by the Australian Securities and Investment Commission, or ASIC (registration number ABN 26 152 088 349, AFSL No. 412981).

Oanda on the other hand has experience of over 25 years in the Forex market. Furthermore, the broker has licenses and regulations within five different regulatory bodies and therefore is deemed to be one of the most reliable Forex brokers globally. The list of the licenses and regulations of Oanda includes the license from the National Futures Association, or NFA (the license number NFA # 0325821), the regulation from the Investment Industry Regulatory Organization of Canada, or IIROC, the Financial Conduct Authority regulation in the UK, or FCA (FCA Registration No: 542574), the license in Singapore by the Monetary Authority of Singapore, or MAS (CMS Licence No: CMS100122-4), and the license in Australia by the Australian Securities and Investment Commission, or ASIC (registration number ABN 26 152 088 349, AFSL No. 412981).

There are few basic criteria according to which the safety of the brokerage services can be assessed. The most important of all is the legitimacy of the broker along with the regulations and legal frameworks. How to distinguish between legit and scam brokers is the topic that each trader should be very familiar with.

Which one has better bonus offers, Oanda or OspreyFX?

Within this criterium, OspreyFX has an advantage over Oanda due to the fact that Oanda does not provide any reward campaigns for their traders.

Most likely the reason for that is that the current regulations of the broker do not allow the firm to employ the bonus schemes. For instance, the residents of the European Union are not eligible for bonus offerings as the regulatory bodies strongly prohibit any kind of bonuses from the brokerage firms’ side. Usually, most of the top unregulated Forex brokers will have such an advantage over the regulated companies, as they are free to choose any promotional campaign they like.

OspreyFX bonus program is offered to both existing and new registering clients on the broker’s platform. OspreyFx deposit bonus comes with respective terms and conditions applicable to its withdrawal. The clients can claim the 10% bonus on their deposits for which the cumulative amount of the bonuses can go up to 5,000 USD. The traders can actually withdraw any profit generated through trading with the deposit bonus amount given that they satisfy the trading volume conditions. The main rule for withdrawal is that the trader should have traded 1 lot for each 5 USD deposit bonus.

|

|

Pros |

Cons |

|

Oanda |

Regulated by Authorities |

No Cryptos or Stocks |

|

25 Years of Experience |

No Bonus Programs |

|

Low Minimum Deposit |

Restrictions on Leverage |

|

OspreyFX |

Bonus Programs |

Not Regulated |

|

Flexible Leverage |

Higher Deposit Requirements |

|

Diverse Portfolio of Assets |

Geographic Restrictions |

Oanda vs OspreyFX – Which one is a better broker overall?

The decision of which broker to choose always depends on the trader’s style of trading, chosen strategy, desired financial instruments, and the goals in trading. In this case, when comparing Oanda and OspreyFX, different traders will find each of them more suitable. For instance, due to the fact that OspreyFX is not regulated, some traders might seek to gain more trading freedom and more flexible leverage much more attractive than the trading conditions presented by the regulated Forex broker Oanda. Additionally, the bonus programs are huge encouraging factors for the traders, which is actively provided by OspreyFX.

On the other hand, traders seeking more stability and reliability in their trading strategies and would like to deal with experienced and trustworthy brokers would essentially go for Oanda broker. Furthermore, trading with an Oanda broker might appear to be a bit cheaper than with OspreyFX. Especially, for those who are just starting Forex trading or have a low-budget trading requirement, the Oanda minimum deposit requirement of 1 USD seems to be better compared to the 25 USD initial deposit ask from the OspreyFX broker.

FAQ on OspreyFX vs Oanda

Is OspreyFX a good broker?

Due to the fact that OspreyFX is not regulated, some might not consider it a very trustworthy company. Generally, not having a license is not a good sign and we advise you to always go for platforms that are fully licensed and regulated by reputable financial regulatory bodies, as you are going to trust them with your financial assets.

How much does Oanda charge per trade?

When it comes to trading with Oanda, customers have to pay fixed commissions per trade. The total cost of a trade is the core spread plus the commission fee. The core spreads start from 0.1 pips, while the commission fee is $40 per $1000000 traded.

Is Oanda legal in the USA?

Yes, Oanda is legal in the United States, and Forex clients from the country can receive reports on their trade execution. Due to the regulations from CFTC (also known as the Commodity Futures Trading Commission) retail Forex traders located in the USA, are restricted with leverage of 1:50 on major currencies, and 1:20 for others.

English

English  Oanda provides three different live trading account types for its clients: Standard, Core, and Swap-free. The Standard and Swap-free account types give an opportunity to the traders to operate their trades without commission charges. However, the Core account type comes with a commission fee of 40 USD per million. Similarly, the OspreyFX commission also depends on the account type. At OspreyFX there are four account types available for trading: Standard, PRO, VAR, and Mini. The commission per lot is 7 USD for the Standard account, 8 USD for the PRO account, and 1 USD for the Mini account. VAR account operates without commission charges.

Oanda provides three different live trading account types for its clients: Standard, Core, and Swap-free. The Standard and Swap-free account types give an opportunity to the traders to operate their trades without commission charges. However, the Core account type comes with a commission fee of 40 USD per million. Similarly, the OspreyFX commission also depends on the account type. At OspreyFX there are four account types available for trading: Standard, PRO, VAR, and Mini. The commission per lot is 7 USD for the Standard account, 8 USD for the PRO account, and 1 USD for the Mini account. VAR account operates without commission charges. None of these two brokers charge for deposits on the trading accounts. However, both OspreyFX and Oanda incur withdrawal fees. OspreyFX charges 25 USD for banking fees on withdrawals exceeding 5,000 USD. Withdrawal through other payment methods comes with low to no fees mostly. Similarly, Oanda also operates with withdrawal fees for transactions through bank wire. The broker usually takes a 20 USD fee per transaction processed through the bank wire. They do not charge a fee for withdrawals to the trader’s credit or debit card.

None of these two brokers charge for deposits on the trading accounts. However, both OspreyFX and Oanda incur withdrawal fees. OspreyFX charges 25 USD for banking fees on withdrawals exceeding 5,000 USD. Withdrawal through other payment methods comes with low to no fees mostly. Similarly, Oanda also operates with withdrawal fees for transactions through bank wire. The broker usually takes a 20 USD fee per transaction processed through the bank wire. They do not charge a fee for withdrawals to the trader’s credit or debit card.

Oanda on the other hand has experience of over 25 years in the Forex market. Furthermore, the broker has licenses and regulations within five different regulatory bodies and therefore is deemed to be one of the most reliable Forex brokers globally. The list of the licenses and regulations of Oanda includes the license from the National Futures Association, or NFA (the license number NFA # 0325821), the regulation from the Investment Industry Regulatory Organization of Canada, or IIROC, the Financial Conduct Authority regulation in the

Oanda on the other hand has experience of over 25 years in the Forex market. Furthermore, the broker has licenses and regulations within five different regulatory bodies and therefore is deemed to be one of the most reliable Forex brokers globally. The list of the licenses and regulations of Oanda includes the license from the National Futures Association, or NFA (the license number NFA # 0325821), the regulation from the Investment Industry Regulatory Organization of Canada, or IIROC, the Financial Conduct Authority regulation in the