Swissquote Review

Among the well-known Forex brokers in the European Union is the Swissquote. The broker is licensed and regulated by the Financial Conduct Authority (FCA) of the U.K. It offers CFD, index, commodities, and Forex trading services to residents of the EU. Besides CySEC, FCA is one of the big respected regulatory bodies in the Forex world. The brand of the firm has become ever more conspicuous having partnered with Manchester Football Club as the club’s Global Partner. In this Swissquote review, we look at the main features which make the firm unique.

Products featured and fees charged

At Swissquote, you will find three different types of accounts. However, the firm offers its clients a demo account whereby a trader can practice trading before venturing into live trading using real money. Unlike some brokers, at Swissquote you are required to indicate the level of your experience and also the platform that you intend to use. The downside to the demo account at Swissquote is that you have to indicate the amount of money that you intend to invest. It’s worth noting that there are several credible brokers that offer demo accounts with no strings attached.

Type of accounts

After reading many Swissquote reviews, you will realize that the firm is among the most expensive. For the Standard account which is the most basic one here, the minimum initial deposit is $1,000. The maximum funds allowed in the account is $25,000. The second in the tier is the Premium account which requires a minimum deposit of $25,000 while allowed maximum size of the account is $100,000. There is the Prime account which attracts a minimum initial deposit of $100,000. The different types of accounts allow scalping, trading of all instruments such as Gold, CFDs, Silver. Stop auto levels for all accounts is set at 100% for all account while digits after the dot in EUR/USD are 5.

In our Swissquote review, we find that the transaction fees charged at the firm are above average hence making the firm one of the most expensive. Transferring funds, as well as withdrawing, is not cheap too. On top of that, if your account remains inactive for a year, you will be charged a fee. For those clients who manage to maintain minimum volume requirement, the firm can lower the trading costs.

The trading platform

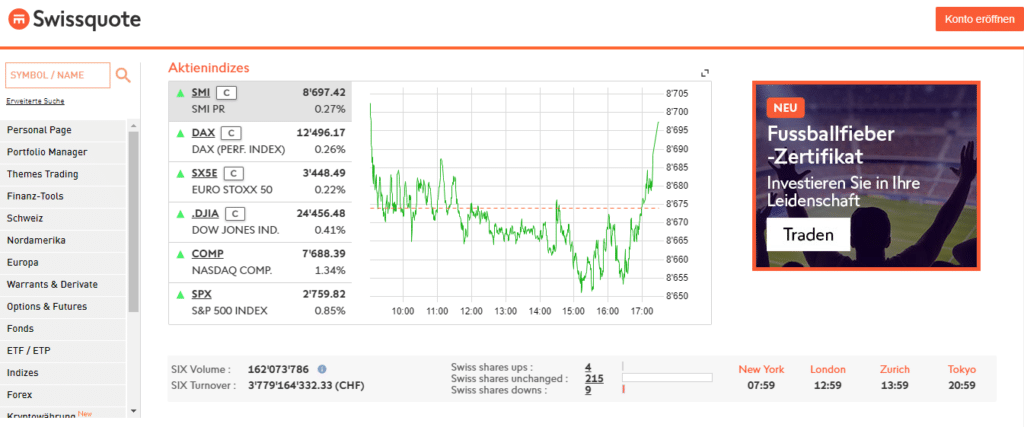

Swissquote scam claims based on the trading platforms at Swissquote should not hold as the firm offers MT4 as well as MT5 trading platforms. These two trading platforms are popular with FX traders because they offer considerable functionality. These two platforms are compatible with iPhone, Windows, and Android devices. On top of that, the broker has provided WebTrader trading platform. Traders also get to enjoy eTrading service which helps traders achieve their goals with simplicity and efficiency.

In our Swissquote review, we also take a look at the special features such as Daily Expert Reports, Autochartist, Expert Advisers, and Mobile Trading. These features are designed to make trading easy, efficient and effective for traders. The trading platform of Swissquote is also made effective and friendly by the experienced and competent support team which operates from 8:00 am to 6:00 pm U.K time.

Comments (0 comment(s))