Finding a decent and high-quality broker is tough, especially when the Forex market is expanding at a rapid pace, giving birth to more brokers by the day. Dozens of brokers are being included in the lists of the top Forex brokers each day, and choosing the best among the best is the toughest challenge of all. That is why we have decided to compare the best brokers in the industry, to demonstrate their strongest point and how they compare to each ether, with this review focusing on the titans of the industry – XM and eToro.

In this XM vs eToro comparison, we will explore two of some of the most prominent Forex brokers operating on the international market currently. Both have millions of active users registered on their trading platforms and offer premium brokerage services in various regions. XM and eToro are regulated by the same official authorities and have over 10 years of experience in providing their services on the Forex market.

While similar to an amateur eye, these two brokers have major differences in terms of their respective trading conditions. Furthermore, depending on the client’s trading style and the desired financial instruments portfolio, one of them might appear to be more appealing than the other. The comparison will focus on distinguishing these two brokers from each other and demonstrate when you should choose XM and when you should go for eToro.

XM vs eToro at a glance

When comparing two of the most prominent brokers in the industry, in-depth research is essential, and we ensure to go deep into every aspect to deliver you a clear and comprehensive comparison of these two brokers, for you to identify the one best suited for you. Before we delve deep into every minute detail, however, we have prepared a general table below, to illustrate some of the key differences between XM and eToro, for you to gain a better understanding going further into this comparison.

|

Title |

Rating |

Minimum Deposit |

Maximum Leverage |

Regulations List |

Trading Platforms |

Bonuses |

|

XM |

4.5 |

5 USD |

1:400 |

IFSC |

MT4, MT5, WebTrader |

30 USD no deposit, 50% deposit bonus, |

|

eToro |

4 |

50 USD |

1:30 |

CySEC, FCA, ASIC, FSAS |

Custom, CopyTrader |

N/A |

Which broker offers better spreads and fees, XM or eToro?

Before we delve into the cost-related trading conditions of XM and eToro, it is better to portray their general trading environments. Both brokers offer a highly diversified trading instruments portfolio to their customers. Apart from currency pairs, both eToro and XM provide opportunities for the clients to trade shares, cryptocurrencies, indices, commodities, and naturally, currency pairs. However, whereas eToro additionally offers various types of Exchange Traded Fund (ETF) assets, XM includes precious metals, energies, and stock CFDs within its financial instruments portfolio. Hence, the conditions for individual assets offered by these two brokers vary from market to market. Below, we will further explore the main differences between XM trading vs eToro trading environments.

Before we delve into the cost-related trading conditions of XM and eToro, it is better to portray their general trading environments. Both brokers offer a highly diversified trading instruments portfolio to their customers. Apart from currency pairs, both eToro and XM provide opportunities for the clients to trade shares, cryptocurrencies, indices, commodities, and naturally, currency pairs. However, whereas eToro additionally offers various types of Exchange Traded Fund (ETF) assets, XM includes precious metals, energies, and stock CFDs within its financial instruments portfolio. Hence, the conditions for individual assets offered by these two brokers vary from market to market. Below, we will further explore the main differences between XM trading vs eToro trading environments.

Commissions, administrative, and payment fees

First of all, none of the brokers charge a registration fee for the new clients. The difference between the allocation of the fees lies in the fact that XM Forex broker charges fees depending on the different trading account types, whereas eToro will charge as per trading asset chosen by the trader. In general, brokers provide commission-free trading for stocks CFDs in the case of XM and ETFs in the case of eToro.

For XM, all three account types operate without commission charge. There is only one account that obliges traders to pay the commission fee – the XM Zero trading account. The broker charges 7 USD per transaction of 100,000 USD. The amount payable is determined as the positions are opened and closed and determined according to the trading volume. For commissions with eToro, the broker transaction price for crypto products starts at 0.005 units. Furthermore, the broker has conversion fees in the amount of 50 pips.

Minimum deposits, spreads, and overnight fees

Minimum deposits for the brokers vary depending on the account types. For XM, standard and Micro accounts come with the minimum deposit requirement of 5 USD. On XM Ultra-Low Account the requirement increases up to 50 USD. The XM Shares account is the most expensive account in terms of deposit requirement, which is 10,000 USD.

Minimum deposits for the brokers vary depending on the account types. For XM, standard and Micro accounts come with the minimum deposit requirement of 5 USD. On XM Ultra-Low Account the requirement increases up to 50 USD. The XM Shares account is the most expensive account in terms of deposit requirement, which is 10,000 USD.

eToro, on the other hand, differentiates the minimum deposit requirements according to the country of residence of the client and the experience they have. For instance, the initial deposit requirement is 200 USD. Afterward, US clients are asked to deposit at least 50 USD, whereas residents of some other country might be required to deposit 1,000 USD. Furthermore, all bank wire deposits must be at least 5,000 USD.

XM broker vs eToro spreads comparison should emphasize the difference of the spreads in terms of various trading products. For example, on Forex assets, XM offers spreads from 0.6 pips, whereas the spreads for currency pairs with eToro start at 1 pip, which is a little bit higher than the market average. As for the rollover fees, both brokers employ a 3-day rollover charge on Wednesdays.

Deposits and Withdrawals

When it comes to deposits and withdrawal conditions, XM has an advantage over eToro. Usually, the eToro broker charges a 5 USD fee to fall all withdrawal requests in USD, while conversion fees might also apply to the requests made in other currencies. On the other hand, XM has no withdrawal fees, unless the trader processes bank withdrawal over 200 USD. In such a case, the application fee is 15 USD. Furthermore, none of the brokers charge an additional price on the deposits. Both of them allow deposits with 0 fees. Additionally, no matter eToro or XM, they both charge for inactive accounts, starting from 15 USD after a year of inactivity followed by the monthly maintenance fees of the inactive accounts.

Start trading with $5 with XM

|

Title |

EUR/USD |

USD/JPY |

GBP/USD |

USD/CAD |

AUD/USD |

|

XM |

Yes |

Yes |

Yes |

Yes |

Yes |

|

eToro |

Yes |

Yes |

Yes |

Yes |

Yes |

Which broker provides better software, XM or eToro?

In this regard, these two Forex brokers vary greatly. eToro is regarded as one of the leading social trading brokers, whereas XM is dominant within the Forex market. Therefore, their trading platforms were built to satisfy the requirements of their clients and the vision of the brokers. eToro supports a multi-asset trading platform that is compatible with most of the devices out there, including IOS and Android systems. Furthermore, the broker implements a copytrader within its trading platform which serves as an automated trading tool, as well. The clients of the copytrader can observe and copy the trades of the professional investors. The list of the available investors is displayed transparently along with the risk score and success ratio of the corresponding profiles.

In this regard, these two Forex brokers vary greatly. eToro is regarded as one of the leading social trading brokers, whereas XM is dominant within the Forex market. Therefore, their trading platforms were built to satisfy the requirements of their clients and the vision of the brokers. eToro supports a multi-asset trading platform that is compatible with most of the devices out there, including IOS and Android systems. Furthermore, the broker implements a copytrader within its trading platform which serves as an automated trading tool, as well. The clients of the copytrader can observe and copy the trades of the professional investors. The list of the available investors is displayed transparently along with the risk score and success ratio of the corresponding profiles.

Etoro vs XM comparison of trading platforms should outline that XM clients have different requirements in contrast to eToro’s customers. Therefore, XM employs the most popular options within the market which are MetaTrader 4 and MetaTrader 5. This two software have been the users’ favorites since the very beginning due to highly reliable operations, seamless executions, and the special dedication to financial markets. XM provides options to use the MetaTrader either on the web (WebTraders), mobile devices including IOS and Android, and install a downloadable version.

Trade using MetaTrader 4 on XM

Which broker provides better safety for traders, eToro or XM?

Both XM and eToro hold licenses from the official regulatory authorities and are classified as reliable and trustworthy brokers. The safety of the traders that the broker provides comes first from the regulations. If the brokers do not operate within any regulatory framework, then it may be a sign to be cautious with them.

Both XM and eToro hold licenses from the official regulatory authorities and are classified as reliable and trustworthy brokers. The safety of the traders that the broker provides comes first from the regulations. If the brokers do not operate within any regulatory framework, then it may be a sign to be cautious with them.

XM Global Limited holds a license from the regulatory body of Belize – International Financial Services Commission (IFSC). The license can be looked up using the registration number 000261/158. Furthermore, the broker incorporates money laundering protection protocols, which also serve as a safeguard against identity theft and related crimes. Additionally, XM broker is multiple award-winner brokers, named several times as the most reliable and most transparent Forex broker.

eToro is regulated within multiple jurisdictions and operates in numerous regions worldwide. The broker holds licenses from the Cyprus Securities and Exchange Commission (CySEC) with the license 109/10, the Financial Conduct Authority (FCA) with the license no FRN 583263, the Australian Securities and Investments Commission (ASIC) with the registration no 491139, and the Financial Services Authority Seychelles (FSAS) with the license number SD076. In addition, the funds of eToro’s customers have kept in tier 1 banks with all the corresponding personal data of the clients secured under SSL encryption.

|

Title |

ETF |

CFD |

Commodities |

Stocks |

Energies |

Metals |

Currencies |

Cryptos |

Indices |

|

XM |

- |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

- |

Yes |

|

eToro |

Yes |

Yes |

Yes |

Yes |

- |

- |

Yes |

Yes |

Yes |

Which one has better bonus offers, XM or eToro?

XM and eToro both have their own views on promotional campaigns – whereas XM offers multiple bonus programs, eToro provides a rewarding loyalty club for its members.

XM and eToro both have their own views on promotional campaigns – whereas XM offers multiple bonus programs, eToro provides a rewarding loyalty club for its members.

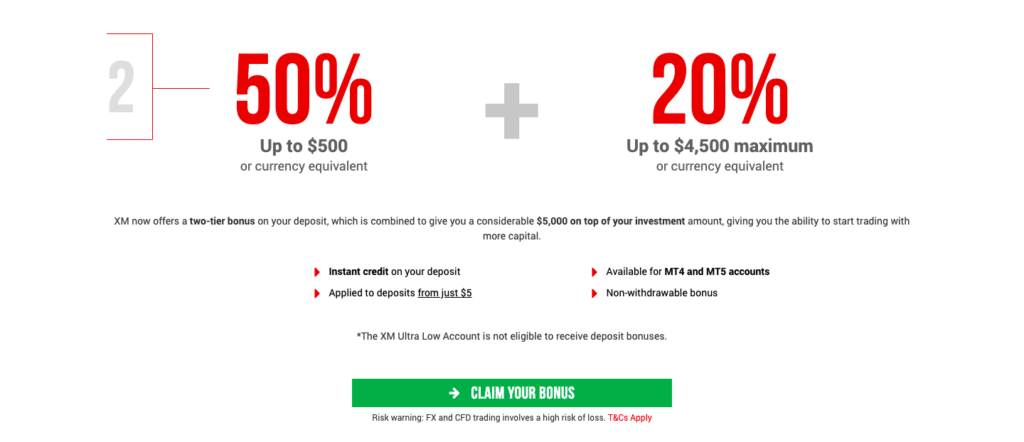

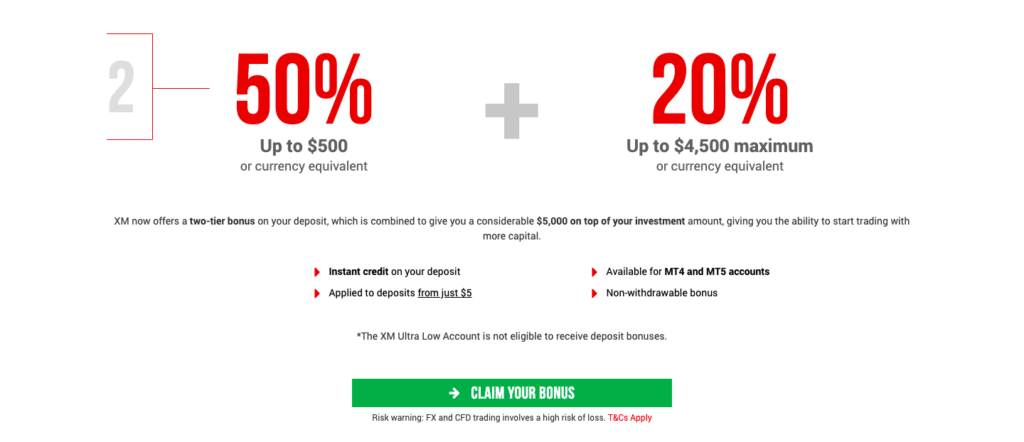

eToro vs XM bonus comparison has an obvious winner – XM due to the fact that eToro does not provide bonuses for its clients, so if you are looking for an eToro bonus promotion – it simply doesn’t exist. XM on the other hand, has multiple types of bonuses, including XM no deposit bonus, XM deposit bonus, referral bonus, and a loyalty program. The new registering users with XM can claim XM 30 USD no deposit bonus and a 50% deposit bonus up to 500 USD. Furthermore, the referral program allows traders to earn up to 35 USD for each registered referral.

eToro runs a special loyalty club promotion. In total there are five membership levels within the eToro tier list- eToro Silver tier, eToro Gold tier, eToro Platinum tier, Platinum+ tier, and eToro Diamond tier. For silver tier members, eToro is granting exclusive access to in-depth market analysis, high-quality and data-based Copy Portfolios, and the personal Customer Success Agent. Gold tier membership grants it all with additional live webcasts and exclusive expert market analysis updated on a weekly basis. Platinum members get additional exemption from withdrawal fees and free access to a top-tier digital publication. Platinum + can enjoy one-on-one meetings with their personal Account Manager via Zoom and special access to exclusive sports and cultural events. Finally, Diamond tier holders receive all of the above with additional access to premium digital publications, no exchange charges, and are invited to prestigious Diamond events of the broker.

Generally, Bonuses are inseparable parts of Forex trading, with deposit bonuses and no deposit bonuses being among some of the primary tools for brokers to attract traders. However, promotional campaigns are not that frequent even among the top Forex brokers worldwide. One of the reasons behind this is that not all regulatory bodies permit the broker to implement bonus programs. For example, the companies regulated and operating within the EU are not allowed to offer bonus campaigns to their traders. Secondly, bonus programs are expensive and often hard to employ for the broker.

|

|

Pros |

Cons |

|

XM |

Multiple Bonus Programs |

No Cryptos or ETFs |

|

Flexible Leverage |

No Social Trading |

|

Low Minimum Deposit |

Geographic Restrictions |

|

eToro |

2000 Financial Instruments |

No Bonus Programs |

|

4 Industry Regulations |

High Deposit Requirements |

|

Commission-free Assets |

Low Leverage Levels |

XM vs eToro, which one is a better broker overall?

If you are looking for a low-budget start, then most probably XM would seem much more convenient as the deposit requirements start as low as 5 USD compared to 50-200 USD deposit requirement from eToro, which could go even higher depending on the region of your residence. However, if you would like to trade ETF or cryptos, XM cannot satisfy your demands, therefore it would be reasonable to choose eToro. Furthermore, if you are expecting more encouragement from the broker then XM has got your back with numerous promotional and rewarding campaigns.

In terms of portfolio diversity, both brokers offer sufficient variety in the trading assets, however, eToro has twice as many instruments to offer to exceed 2000 in the overall amount. Nevertheless, the trading conditions are somewhat more favorable with XM, since the leverage is flexible with a maximum of 1:400, whereas eToro offers only 1:30. Additionally, the spreads on Forex products start from 0.6 pips with XM, where it averages 1 pip with eToro. If you are a Social Trader, then no matter what, eToro suits you the best.

Register your trading account with XM

FAQs on eToro vs XM broker comparison

Which is better, XM or eToro?

Depends on your goals as a trader, and where do you want to start. If you are just starting out and are low on initial funds, then XM is a good choice for you, as you can start trading with as low as 5 USD, and get lucrative bonus offers by XM. If you are looking to trade ETF and cryptos – eToro may be a better option for you to go with.

Is eToro good for beginners?

eToro has a higher initial deposit requirement when compared to XM, and may vary depending on where you live. Additionally, the lack of bonus promotions may make your launch in the Forex market a bit more challenging. So while eToro is perfectly fine for a beginner trader to work with, starting your career with XM will guarantee a smoother and easier start.

Is XM a good broker?

Yes, it most definitely is. XM is one of the most well-established and experienced Forex brokers in the industry, with a worldwide presence, millions of registered traders, lucrative bonus promotions, and a variety of trading instruments to offer to any trader.

English

English  Before we delve into the cost-related trading conditions of XM and eToro, it is better to portray their general trading environments. Both brokers offer a highly diversified trading instruments portfolio to their customers. Apart from currency pairs, both eToro and XM provide opportunities for the clients to trade shares, cryptocurrencies, indices, commodities, and naturally, currency pairs. However, whereas eToro additionally offers various types of Exchange Traded Fund (ETF) assets, XM includes precious metals, energies, and stock CFDs within its financial instruments portfolio. Hence, the conditions for individual assets offered by these two brokers vary from market to market. Below, we will further explore the main differences between XM trading vs eToro trading environments.

Before we delve into the cost-related trading conditions of XM and eToro, it is better to portray their general trading environments. Both brokers offer a highly diversified trading instruments portfolio to their customers. Apart from currency pairs, both eToro and XM provide opportunities for the clients to trade shares, cryptocurrencies, indices, commodities, and naturally, currency pairs. However, whereas eToro additionally offers various types of Exchange Traded Fund (ETF) assets, XM includes precious metals, energies, and stock CFDs within its financial instruments portfolio. Hence, the conditions for individual assets offered by these two brokers vary from market to market. Below, we will further explore the main differences between XM trading vs eToro trading environments. Minimum deposits for the brokers vary depending on the account types. For XM, standard and Micro accounts come with the minimum deposit requirement of 5 USD. On XM Ultra-Low Account the requirement increases up to 50 USD. The XM Shares account is the most expensive account in terms of deposit requirement, which is 10,000 USD.

Minimum deposits for the brokers vary depending on the account types. For XM, standard and Micro accounts come with the minimum deposit requirement of 5 USD. On XM Ultra-Low Account the requirement increases up to 50 USD. The XM Shares account is the most expensive account in terms of deposit requirement, which is 10,000 USD. In this regard, these two Forex brokers vary greatly. eToro is regarded as one of the leading social trading brokers, whereas XM is dominant within the Forex market. Therefore, their trading platforms were built to satisfy the requirements of their clients and the vision of the brokers. eToro supports a multi-asset trading platform that is compatible with most of the devices out there, including IOS and Android systems. Furthermore, the broker implements a copytrader within its trading platform which serves as an automated trading tool, as well. The clients of the copytrader can observe and copy the trades of the professional investors. The list of the available investors is displayed transparently along with the risk score and success ratio of the corresponding profiles.

In this regard, these two Forex brokers vary greatly. eToro is regarded as one of the leading social trading brokers, whereas XM is dominant within the Forex market. Therefore, their trading platforms were built to satisfy the requirements of their clients and the vision of the brokers. eToro supports a multi-asset trading platform that is compatible with most of the devices out there, including IOS and Android systems. Furthermore, the broker implements a copytrader within its trading platform which serves as an automated trading tool, as well. The clients of the copytrader can observe and copy the trades of the professional investors. The list of the available investors is displayed transparently along with the risk score and success ratio of the corresponding profiles.

Both XM and eToro hold licenses from the official regulatory authorities and are classified as reliable and trustworthy brokers. The safety of the traders that the broker provides comes first from the regulations. If the brokers do not operate within any regulatory framework, then it may be a sign to be cautious with them.

Both XM and eToro hold licenses from the official regulatory authorities and are classified as reliable and trustworthy brokers. The safety of the traders that the broker provides comes first from the regulations. If the brokers do not operate within any regulatory framework, then it may be a sign to be cautious with them. XM and eToro both have their own views on promotional campaigns – whereas XM offers multiple bonus programs, eToro provides a rewarding loyalty club for its members.

XM and eToro both have their own views on promotional campaigns – whereas XM offers multiple bonus programs, eToro provides a rewarding loyalty club for its members.