Complete Guide to Long Term Trading Strategy

Table of contents

In Forex trading there are all types of traders. Some market participants, known as scalpers prefer to open and close positions with small time frames, ranging from 1 minute to 15 minutes. At the same time, day traders might have slightly larger time frames for trade, but they do close all of their positions by the end of their trading day.

On the opposite side of the spectrum, we have long term traders. They typically hold positions open for several months and aim for large gains for every trade. It is worth noting that this trading style does have several characteristics.

Firstly, the long term traders usually do not execute large numbers of trades in a short period of time. Consequently, they do not have to worry much about the size of the spreads offered by the brokerage company. This is because they are typically aiming for hundreds of pips worth of gains, which more than offset any expenses they pay with spreads.

In addition to that for many traders, long term trading is much less stressful than scalping or day trading. The reason behind this is the fact that the actual volume of trades is much lower and also traders do not have to worry about every small movement on the market. They instead focus on the big picture and long term trends.

It is also worth pointing out that in the case of long terms trading fundamental indicators such as the real interest rate differentials and purchasing power parity indicator plays a much more prominent role in determining the exchange rate movements, compared to the short term trading.

Here it is important to mention that one of the most important things long term traders need to keep an eye on is the swap rates of the broker. The fact of the matter is that when the market participants buy a lower yielding currency and sell the higher yielding currency, they have to pay so-called swap payments to the brokerage company on a daily basis as long as they keep the position open.

Now, for 1 or 2 days the swap payments might be quite small and insignificant for many traders. However, long term traders typically keep their positions open for months. Therefore, over time, those fees can add up to a significant amount and lead to some serious losses for the market participants. Consequently, long term traders should either have to get swap-free accounts or limit their trading to those positions, where they will not be charged with rollover fees in the process.

The Long Trading Strategy Explained

There are many trading strategies available on the market, and it is very easy to find something that you will use successfully if you know exactly where you need to look for it. No matter which strategy you are using though, you will always need to use much of your time doing research and learning as much as you can about the world of trading. Many experts on the market are claiming that this strategy can be very rewarding for investors, especially if they are ready to do their homework well.

The thing, however, is that, much like any other strategy that is available on the Forex market, this one does not work for everyone. It is very important to understand what are your needs and wants, how much time do you have for trading, and how far do you actually want to go in the world of investments.

There are many other trading strategies available on the market, like scalping, swinging, or day trading. I great way to see differences in these strategies is to look at them as some type of a spectrum – on the one side, you have scalping, which makes investors make several positions a day for a very little time, then, it is day trading, which lasts only during the day, from early mornings to before the market closes. Then, there is swing trading, which can last from several days to several weeks, and then you have long term trading, which can last for several months, or even a year.

There are many other trading strategies available on the market, like scalping, swinging, or day trading. I great way to see differences in these strategies is to look at them as some type of a spectrum – on the one side, you have scalping, which makes investors make several positions a day for a very little time, then, it is day trading, which lasts only during the day, from early mornings to before the market closes. Then, there is swing trading, which can last from several days to several weeks, and then you have long term trading, which can last for several months, or even a year.

One thing that happens on the market today is that most of the investors are looking for a quicker way of income, and don’t really want to wait for longer periods of time to see the outcome of their trade. While there is nothing wrong with this, it is very important for investors to be patient, because being successful does take some time, and investors have to understand that nothing on this market happens in a matter of seconds, you can’t simply become a millionaire, you have to work and make sure that you can wait for the outcome.

It does not mean that other strategies are not useful. No, they are very useful, but only when the right person is using them. If you are someone who can not sit in front of the screen of their computer the whole day long and looking at the charts, deciding what to do next, then the short-term trading strategies will simply not work for you. On the other hand, if you have what it takes to take your time, focus on the actual goals, and have patience, you will enjoy using long-term trading strategies a lot.

How Does Long Term Trading Work?

There are many trading strategies available on the market, and it is very easy to find something that you will use successfully if you know exactly where you need to look for it. No matter which strategy you are using though, you will always need to use much of your time doing research and learning as much as you can about the world of trading. Many experts on the market are claiming that this strategy can be very rewarding for investors, especially if they are ready to do their homework well.

The thing, however, is that, much like any other strategy that is available on the Forex market, this one does not work for everyone. It is very important to understand what are your needs and wants, how much time do you have for trading, and how far do you actually want to go in the world of investments.

There are many other trading strategies available, not the market, like scalping, swinging, or day trading. I great way to see differences in these strategies is to look at them as some type of a spectrum – on the one side, you have scalping, which makes investors make several positions a day for a very little time, then, it is day trading, which lasts only during the day, from early mornings to before the market closes. Then, there is swing trading, which can last from several days to several weeks, and then you have long term trading, which can last for several months, or even a year.

One thing that happens on the market today is that most of the investors are looking for a quicker way of income, and don’t really want to wait for longer periods of time to see the outcome of their trade. While there is nothing wrong with this, it is very important for investors to be patient, because being successful does take some time, and investors have to understand that nothing on this market happens in a matter of seconds, you can’t simply become a millionaire, you have to work and make sure that you can wait for the outcome.

For many investors, the thrill that comes with short term trading strategies is something that they enjoy the most, if you are one of those investors, the long trading strategy will not be useful for you at all. This strategy needs a lot of dedication from investors, in return, you will have the ability to enjoy a very big amount of profits, however, this does come with a cost. There are a lot of risks that are associated with trading, and it is very important that investors stay up-to-date on the ongoing events on the market so that they have the ability to stay as safe as possible.

While using this trading strategy, you will open a position that will not be closed for a very long time. Because of this, you have to make sure that the position that you are opening is the one that has the ability to give you a huge profit. Unlike this strategy, scalpers will mostly open positions that will give them very little profit, however, they open and close positions the whole day long, which gives them the ability to have a decent amount of profit at the end of the day.

Unlike those, if you are using long-term trading, you will have to wait for several months, and maybe even more than that, to get some type of profit.

Who Can Use This Strategy?

As rewarding as long term trading can be, this is something that is not for everyone. This is the main thing that you need to keep in mind in the world of Forex. Something that works for one type of investor does not mean that it will work the same way for you, this is why we believe that investors should do research before doing anything on this market. Try to understand what a certain strategy is really about before you use it.

Lomg term trading is a very popular and useful tool for those who are ready to make moves, sit back, relax, and wait for an outcome. Also, the people who use this strategy should work a lot on their analytical skills, you must be able to see things behind events, to find out the real cause of the events. This is a very important part of a long term trading strategy, investors will have to use many different types of tools for decision making, trusting only one indicator will not work in this case.

They should also be ready to take a close look at the ongoing events on the market and compare them to the similar events that have taken place in the past. This is a very important thing to do, you must be able to see how the market is changing and how it is influenced. Certain events influence the market in the same way, and if you see events happening again, try to find connections between them and use this situation for your own advantage.

Steps to Success with Long Term Trading Strategy

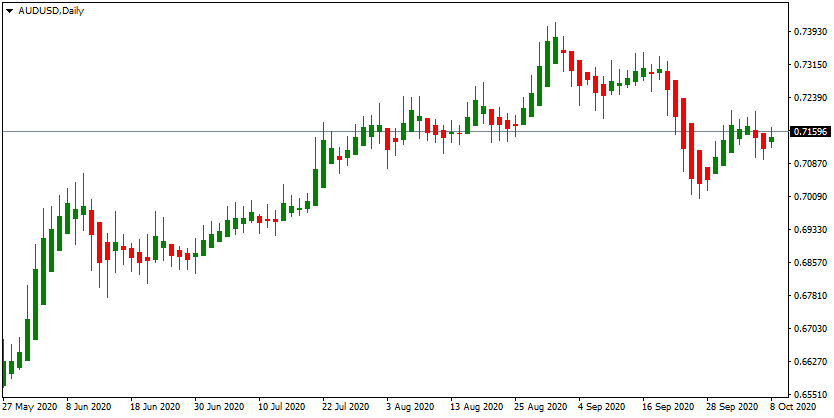

In the chart shown above, you can see the changing prices of a very popular trading pair in the world of Forex, AUD/USD. From the chart, it can be seen that the prices were pretty unstable in the last few months, however, for some time, it had a very positive trend. Then, it went down again, but now it seems to be on the rise once again. Of course, you simply are not able to make decisions based on this chart only, but shows that the prices are not stable and they are changing constantly. But, what can you do to make successful predictions?

To make sure that you are using everything that this strategy can offer, it is of utmost importance that you use every type of indicator that there is on the market. One great way to tell how the market is changing and to come up with long-term decisions is to check out charts of the past several months and see how the currency pair that you are planning to invest has been changing recently. That said, you should never trust only one indicator because things are not always what they look like they are. Just because the price of something went down does not mean that you should strictly follow this trend.

Something that is more important than the movement on the chart is the event that caused the movement. When it comes to the investment world, the events that are influencing the changes are something that is the most important part of decision making. If you understand what caused the change, you will be able to use this information in your position. So, rather than just looking at the chart, see the changes that have been happening on the market instead.

So, if the currency pair AUD/USD is down, see what is happening in Australia and the USA that is causing the change. But, never trust only one source of information – it is not smart to make decisions based on the information that you read on Social Media. Rather, always try to focus on credible sources and use several ones of them, analyze, see how the market is responding, and only then make decisions. There are many tools on the market that you can use, and there is no point in ignoring these tools because, in the end, they do have the power to influence changes.

How to Find a Trustworthy FX Broker for Long Term Trading?

No matter what it is that you are doing in this market, it is of utmost importance that you are taking as time as you need to make sure that you are investing with a credible and trustworthy company. There is nothing as important on this market as your safety and security of you and your funds. For this, there are some things that you will need to remember.

First of all, you will have to always look out for regulations and authorizations and only trust companies that are licensed by the biggest and most trustworthy regulatory agencies around the world. Regulations are something that gives you the ability to tell if the broker is safe and trustworthy or not.

However, it is not the only thing that will have to look out for. You will also need to trade with companies that have low fees and commissions, and although you will not have to worry about spreads while trading with this strategy, it is always a good idea to trade with a broker that has low fees, so that you are left with more money for trading.

While trading, the experience that you have will heavily be influenced by a broker that you are using and it is very important that you choose a credible, safe, and secure company that can make sure that you and your funds are staying as safe as possible. There are many brokers on the market, and not all of them are as good as the others. Also, not all of them are created for long term traders, so, while choosing a broker, take your time and focus on details.

Steps to Utilizing Long Term Strategy

We have already talked a little about this trading strategy and you already know who can use this trading strategy, but, how exactly do you use it? Well, there are several steps that you will need to take to make sure that you use this strategy at its best and you take advantage of every benefit that it can offer to investors. One thing that you will need to do is to make sure to always check daily and weekly charts, they are very important for investors to understand how the market is changing and what are the most important trends.

Coming up with a trading plan is also a very good idea. This way, you will have steps are written down, which will help you a lot to know exactly what you need to do, and when you need to do it. Having a trading plan will make your experience much easier, and will give you the ability to trade without thinking about what you have to do next. With the help of the trading plan, many investors have said that they feel a lot more relaxed, which is very important in this market. The trading plan should include every little detail about the market, and you should invest a lot of time preparing it and putting all of your thoughts together.

Many people do not take enough time to focus on fundamentals, while, in reality, basics are something that can make a huge difference. The fundamentals are the things that can make your job a lot easier, it includes interest rates, employment numbers, and even policies in some situations. The thing is, many people forget to focus on things like these, while, in reality, they have a huge effect on the market and the changes that happen there. So, never underestimate the importance of fundamentals, especially in the case of using a long term trading strategy.

For maximum safety, it is also very important to use a stop loss. Once you are done preparing and it is time to open your position, do not forget to set stop loss, this is a very important part. No matter how confident you are in your position, always use stop loss, so that you can sleep peacefully during the night.

Many people also forget the importance of technical analysis. They can be a very important part of a long term trading strategy for a number of reasons. When using a long trading strategy, it is very important to look at the big picture, which is in many cases a very hard thing to do, because of this, it is very important to use technical analysis. They can offer you very important insight into the trading market and it can influence your experience significantly.

Makes Sure to Use Very Low Leverage

When it comes to leverage, no matter which strategy you are using, you should make sure that you are staying as safe as it is possible. Leverage can be something considered to be pretty rewarding by many investors, but, the numbers show that most of the people using it end up losing more money than they intended.

Because of this, we recommend avoiding using high leverage, especially if you are new to the market. The thing about leverage is that as rewarding as it can be, it also has many dangers around it, meaning that it can cause investors to lose huge amounts of money. So, if you don’t know what it is exactly that you are doing, it is of utmost importance that you are staying as safe as possible.

Advantage of Using a Long Term Trading Strategy

Long term trading strategy is many times referred to as an investment in the future, and not for the wrong reason. Although the benefits of this strategy can not be seen directly, it can be very rewarding in the long run, which is creating a very intreating and rewarding situation for many investors.

While talking about the advantages of this trading strategy, there are a lot of things that can be discussed, one of the greatest things about long term investing is that it almost entirely removes the emotional aspect of trading. The thing is, a market that jumps 10 percent over 10 days will not be something keeping you sited on the edge of your seat to sell. The fact that you will be opening positions for a longer period of time will give you the ability to sit back and wait for the outcome.

While talking about the advantages of this trading strategy, there are a lot of things that can be discussed, one of the greatest things about long term investing is that it almost entirely removes the emotional aspect of trading. The thing is, a market that jumps 10 percent over 10 days will not be something keeping you sited on the edge of your seat to sell. The fact that you will be opening positions for a longer period of time will give you the ability to sit back and wait for the outcome.

The greatest thing about this strategy is the statistics that it has. As the numbers show, those using this strategy are far more likely to get rewards than those who are using other trading strategies. This is a very important thing, If you manage to follow your plan and make decisions according to the changes in the market, you can have a huge chance of making a huge profit.

Many investors using this strategy have actually said that this strategy is very easy to use. It is one of those strategies that can be used by anyone, as long as they are ready to do their homework. Sure, you are not always going to be right, but you have a huge chance of being right and getting a huge profit. As we have already said, you will need to be very focused, however, to make sure that you are doing everything right.

Another very important part of this strategy is that you will have much more time for your plan. Your position can last for several weeks to more than several months, which means that you will have a lot of time to prepare and work on your plan.

Also, one thing that is enjoyed about this trading strategy the most by investors is the fact that it comes with much less stress. The thing is, while scalpers will have to sit in front of their computers for a very long time, those who are using this strategy will have the opportunity to sit back and relax. Also, they will have the ability to enjoy their nights a lot more.

And, of course, you will have to do less work. So, let’s say that you are using a strategy like scalping: all you have to do is that you will be sitting in front of your computer all day, opening and closing positions. With this, you will not have any time for anything else, and you will be very emotional about trading. With a long term trading strategy, you simply do not have these problems, which is something that makes this strategy very popular around the world.

Disadvantages of Long Term Trading Strategy

No matter what you are doing in this market, there are advantages and disadvantages to everything. The thing is, no matter what you do in this market, everything has two sides. So, while making decisions, you will have to think about what it is that you like most about something. Some things simply work well for people, even if they have a lot of disadvantages.

One of the biggest disadvantages of this trading strategy is that you will have to worry about the overnight swaps a lot. While using day trading and scalping strategies, there is not such a thing to worry about, but this strategy opens up a lot of challenges to you. In the world of investment, the swap is something that can be very costly for investors. In the world of trading, swap, or rollover fee is something that is charged when you keep a position open overnight.

It is an interest rate differential between the two currencies of the pair you are trading, calculated according to whether the position is long or short. So, while trading with a long term strategy, you have a huge chance of paying a lot of money in this, which is a very big disadvantage. Because of this, many people actually avoid using it altogether, and that is why so many people on the market are using other strategies, such as scalping and day trading, where you will not have to worry at all about swaps.

Another thing that comes to mind is that it has fewer opportunities than short term trading. When you are using short term strategies, every small change makes difference, but when it comes to trading with long term strategies, not everything will be important for you. So, there are some things that simply won’t make any differences in the end, while in scalping, for example, even smaller changes can help investors making a profit.

Another very big problem with this trading strategy is that something unpredictable can very easily happen on the market, and it can affect the way your position ends up. The prices could collapse out of nowhere, resulting in a very dangerous situation. In order to avoid such situations, it is very important to follow news articles very closely.

Although it can be something that can be used by any type of investor, it requires them to have in-depth knowledge of the market. So, if you wish to be successful in the world of trading while using this strategy, it is very important to know everything that happens on the market in great detail.

You will not be able to make any decisions because of one certain reason, there is a lot that goes into the decision-making process, so, make sure to do your homework. Since this is something that everyone can enjoy, many people avoid using this strategy simply because they do not think they are able of making good research. Also, patience is very important for this strategy to be successful, so, if you do not have that, you should not use it at all. You will have to do a lot of waiting while using this strategy, and if you can’t do that, you should better avoid it altogether.

Charts & Long Term Trading

Charts are something that can make your job a lot easier. Forex trading is one of those markets that is changing every moment, and to be able to make the right decisions, many investors like to look at the market and how was it changing for the past few months before they make any decisions.

By doing so, they are making sure that they understand not only how the market is changing, but, also, what is the thing that affects the changes in the market. It is not that easy to confidently open positions, especially while trading with a long term trading strategy. While using this strategy, you will have one position open for several weeks or even months, which means that any type of change in the market might influence your trading experience a lot.

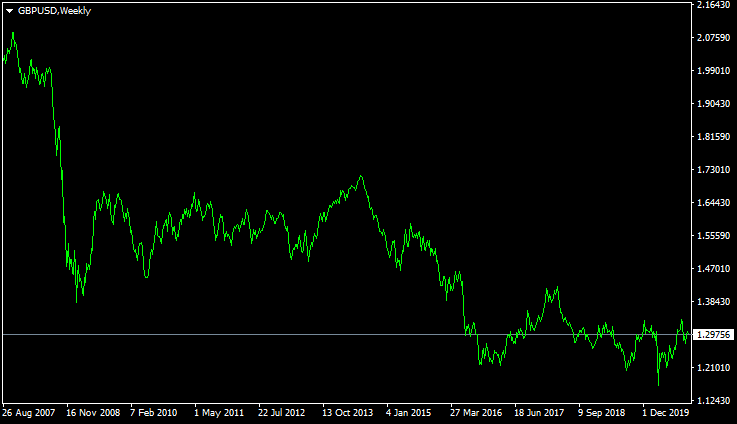

The chart that is shown above shows the changes in the prices of the very popular currency pair, GBP/USD. This currency pair is traded by many investors and there are a lot of things that affect the prices of the currency pair. The chart that is shown above indicates how the price has changed from 2007 to 2019.

You can see that the prices have changed a lot. For example, in 2008, during the financial crisis around the world, the price of this currency pair has dropped a lot and it has had a very hard time stabilizing and it continued going down after an increase in 2013. USD is considered to be a safe haven in the world of Forex, which means that it has the tendency of staying very much stable, even when the market is changing very much around the world.

Long term traders are known to be opening positions for relatively longer times than other investors that are using other strategies. Because of this, for long term investors, it is very important to understand how the prices are changing in the long run. For that, charts can be very useful. If you are having a hard time understanding charts, start with the ones that are a lot easier to read, like, Heiken Ashi Chart, for example, which gives investors an idea about how the market is changing in general. This can be a very useful source of information for investors.

While using a long term trading strategy, it is of utmost importance that you understand the things that are influencing the changes. For this, traders will have to use different types of indicators and analytical opportunities. Also, it is a very good idea to read the news articles on the market frequently, to make sure that you know what are the things that influence the changes in the market the most.

Charts are something that can make your job as a trader a lot easier, so, we recommend using them while trading Forex using a long term trading strategy.

The Summary – Using Long Term Trading Strategy

- Long term trading strategy is very popular in the world of trading. In many cases, it is regarded to be an investment in the future, which makes it a very important part of trading for many people

- In order for this strategy to be successful, investors will have to focus a lot on their patience. If you are using this strategy, you will have to make sure that you are able to stay as patient as possible. Out of the time that you will be spending on trading, most of it will be spent on waiting, so, make sure that you have what it takes before you start using this strategy

- The greatest thing about this strategy is the statistics that it has. As the numbers show, those using this strategy are far more likely to get rewards than those who are using other trading strategies. This is a very important thing, If you manage to follow your plan and make decisions according to the changes in the market, you can have a huge chance of making a huge profit

- As rewarding as long term trading can be, this is something that is not for everyone. This is the main thing that you need to keep in mind in the world of Forex. Something that works for one type of investor does not mean that it will work the same way for you, this is why we believe that investors should do research before doing anything on this market

Comments (0 comment(s))