Essential Guide to Scalping Strategy for Forex Traders

Table of contents

Scalping is one of the most famous strategies in the Forex market. It involves opening and closing positions within a 1 to 15 minutes time frame. Traders using this strategy usually have small profit goals, usually aiming to earn from 5 to 15 pips.

This trading style does have several specific characteristics. Firstly, because of such short time frames for each trade, those types of traders usually open and close positions manually, without using any take profit or stop-loss orders.

It is also important to point out that the successful scalping strategy does require solid risk management from the trader. Many experienced Forex traders advise us to set the risk to reward ratio at 1:2 or even 1:3. This can certainly improve odds in favor of a trader.

In addition to that, scalpers generally do not use trading journals. The fact of the matter is that those types of traders are executing dozens of trades per day, consequently, recording all of those trades can be a very tiring process.

One of the obvious advantages of this trading style is that traders do not have to worry about the possible rollover charges. This is because scalpers do close all of their positions before the end of the trading day, therefore, there are no swap payments to take care of.

Finally, it is important to point out that scalping is not for everyone. Executing a large volume of trades in a single day can be very stressful for many individuals. In addition to that, it is worth keeping in mind that fundamental analysis is not that useful when trading with such short time frames. Consequently, those traders who find scalping very stressful or like to trade Forex with fundamental indicators might consider using other trading strategies in trading.

Understanding Scalping Strategy

In the world of Forex trading, scalping is a term that is used to describe the process of skimming of small profits on a regular basis. This happens by going in and out of positions many times in one day. Traders are in the market for a very short time, mostly up to 15 minutes, and the ones who use this strategy are mostly those who want to enjoy payout in a very short time.

In the world of Forex trading, scalping is a term that is used to describe the process of skimming of small profits on a regular basis. This happens by going in and out of positions many times in one day. Traders are in the market for a very short time, mostly up to 15 minutes, and the ones who use this strategy are mostly those who want to enjoy payout in a very short time.

Those who trade Forex and use this strategy want to make a certain amount of profit by simply buying and selling currencies and holding their positions for a very short time and close the positions with minimum profit. Scalping is one of the most strategies on the market. Even if you are a complete beginner, you must have heard about this strategy at some point in your time in the market.

In most cases, scalping is based on real-time technical analysis, and those who use it in the world of Forex, focus on making a huge number of trades during the day, each of them having a very small profit. They do so without having to hold positions for a long time. So, while people who use other strategies hold their positions for several hours or even days or weeks, those who use this strategy will only hold their positions for just a few minutes. The rewards are also very small, they generate very few pips per position, but since they open and close so many positions a day, at the end of the day, they have a good chance of earning a decent profit.

To make it a lot easier for newcomers on the market to understand, scalping in the world of Forex is a very simple procedure of taking advantage of even the smallest changes in the price of a certain trading instrument. Because of this, each position only lasts just for a few minutes.

Many opportunities

One of the main reasons behind the popularity of the scalping strategy is the fact that it is creating a lot of trading opportunities within the same day. There are many other strategies on the market, like, long term trading, for example, and unlike those strategies, while using scalping, you will be opening and closing several positions a day. While using this strategy, you should not expect to gain more than 10 pips or lose more than 7 pips per trade, which also includes spreads. This is one of the major reasons why so many people love it. But, 10 pips is not a big number. To make sure that traders can get large profits from this strategy, they should perform it many times during the day.

This is one of the main reasons why those who use this strategy does not follow the very famous 2% risk management rule, but, instead of this, they trade in much higher volumes during their trading sessions. In the world of trading, there are two types of scalping, and they are manual and automated.

Manual & automated scalping

There are two types of scalping strategies that investors use right now depending on their needs and wants in the world of trading. While using a manual scalping system, those who use this strategy will have to do everything on their own and sit in from of their computers constantly. They should do so to open and close positions, follow the trends, see how their strategy is working, etc.

Then, there is an automated scalping system. While using this one, the trader can create a program to follow a strategy that is set up beforehand. The program will do everything that you are supposed to do, and you can go on with your day while leaving it on. Since there are these two options, this strategy can be used by any type of traders.

There are many investors in the world of Forex who simply do not trust anything and want to do everything on their own. If you are one of those people, it is very much recommended using a manual scalping system, but if you want to sit back, relax, and go on with your day while also getting profits from the Forex trading market, you can use previously set up automated scalping system which can be a lot of help.

How to get the most of scalping strategy?

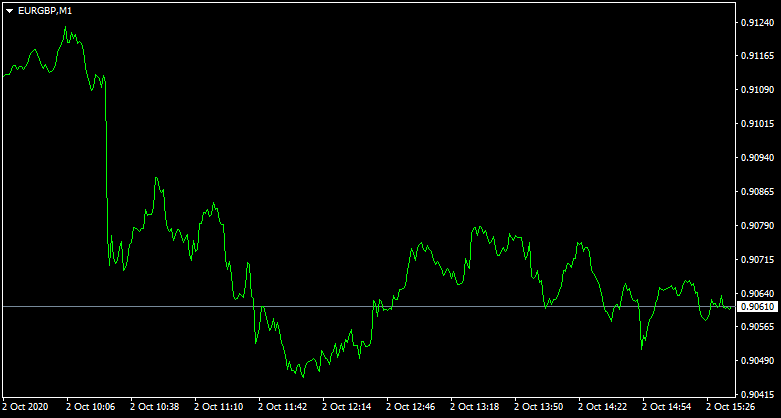

The chart shown above is one way for scalpers to forecast possible changes in the market. It is a 1-minute chart, which means that you are offered very detailed information about the ongoing changes in the market. By using charts like it, you have a bigger chance of understanding how the market is changing and it can be very helpful for future trading.

If you are planning to use this strategy, you should make sure that you are doing everything in your power to make sure that it works perfectly for you. One of the most important things while using this strategy is to make sure that you are trusting the right Forex broker. There are many companies on the market, and for this strategy to work well, you should use the brokers that have low spreads, and offer safe and secure trading.

Also, while there are not so many risks when it comes to using this strategy, there still can be some changes in the market that you should look out for. If you see that this strategy is not working well for you at the moment, do not push it further, just take your time and make sure that everything goes smoothly.

Risk Management with Scalping Techniques

No matter what strategy you are using while trading, something that you should always work on is risk management. So, before you enter into a trade, you should make sure to consider risk management, some experts would recommend to never risk more than 2 percent of your balance on a single trade idea, and stop trading if losses amount to more than 5 percent in one trading day.

Losing money is very bad, and no one wants to experience it. However, the thing is, when it comes to scalping, you will not be able to avoid it altogether. Besides, it does not mean that you should ignore the idea of being careful. We believe that before you enter the market, you should already have an action plan on how to manage risks that you might have. For many investors, it is very important to know when to stop trading. Also, the 2% rule can help out traders a lot. This means, no matter what you are doing in the world of trading, you should make sure that you are not losing more than 2% of your account balance. For example, if you have $100,000 on your trading account, you should not risk more than $2,000 in any position.

When it comes to the whole account balance, you should make sure to follow the 5% rule. With the help of this idea, investors should not have more than 5% of their total account balance at risk across all of the trades that they have. One thing that scalpers should always try to do is to be able to make the right trades. This is vital because the Forex trading market can be volatile and instead of showing small price fluctuations, it can sometimes become more volatile and change direction entirely.

Unlike other trading strategies, with scalping, you will not have to worry about stop-loss, because you are the one who is in charge of the trade. The thing about scalping is that the risks must be very closely monitored, or it could end up costing investors a lot of money. When it comes to stops, there are two ways that you can use them. Firstly, you can set your risk/reward ratio to 1:2, or 1:3, and place them near the latest lows and highs based on the chart and time frame.

Generally, no matter what strategy you are using, it is of utmost importance to be able to come up with a plan that can safeguard you and your funds. The Forex trading market is constantly changing and it is very important for investors to be able to come up with new ways to stay safe and secure.

Benefits of Scalping Trading Strategy

When it comes to Forex trading, just like anything else, scalping has its own advantages and disadvantages. Many people find it very helpful and use this strategy very actively while trading. But why is that? What it is that people love about scalping trading strategy so much? Well, there is a lot in this regard to talking about.

First and foremost, because you are trading for such a short period of time, it is considered to be less risky to trade with this strategy. We are not saying that there are no risks involved, of course, no matter what you do in the market of Forex trading, there will always be some risks. But when compared to other strategies, this one involves far fewer risks.

The main reason for it is that you are opening and closing orders at a very fast pace, which means that if there is something on the market that you should avoid, you have more chance of finding it. As the general data shows, when it comes to traders using scalping strategy, the losses are much lower.

Also, the great thing about it is that since investors are opening and closing orders all day long, there are more opportunities than with any other strategy. It gives the markets the ability to be diverse, and trade in several markets at once. The best thing, however, that everyone enjoys about it is that it has the ability to be very profitable even if you are someone who only trades a very small amount each day.

The main thing is that no matter what happens, investors have the ability to better control what they are doing on the market because they are closing and opening orders several times a day. Also, the profits add up from time to time, and they have the ability to reach a big value.

However, always remember that in order to gain a lot of profit with this strategy, you will have to trade a number of times throughout the day. The more you trade, the greater chance you have of earning a lot of profit. There are some other strategies like scalping, one of them is called the day trading strategy, which means that investors are opening one position day, and, just like scalping, day traders do not have to worry about swaps.

A quick way to make a profit

While using this strategy, you should not wait to get huge amounts of profit. However, the thing that makes it so popular is that it lasts just a few minutes. After you start trading with this strategy, you might need just several minutes. After you are done with your first order, you can start using the second one.

This strategy is known to be a great way to make a profit in a short time. You could end up earning a lot in just a few trades, however, you should always be ready to face some risks as well. While trading using this strategy, you will have to open and close orders quite a few times. This, on its own, gives you a lot of power. You can learn the market very well and open the orders when you are certain about the outcome, as a result, you have the opportunity to earn a huge amount of profits in just a few trades.

Less exposure to the market will end up limited your risks. The probability of running into a serious event that can influence the market is a lot lower since you are opening positions for a very little time several times a day. Also, smaller moves are a lot easier to obtain, which gives you a lot of opportunities in the market.

Something that investors using this strategy love very much is the automated trading system. We have already talked about it at the beginning of this guide, this system is mostly used by those who want to take part in this market but don’t really have enough time to dedicate the whole day to it. With the help of this system, you can go on doing whatever you have to do and live the system on its own for trading.

Also, the system does not have to be fully automated. You can simply give the system the ability to do the routine stuff, such as stop-loss and take-profit orders while assuming the analytical side of the task yourself. This way, you will not have to spend a lot of time doing something that will not make a huge difference in the end and use all of your time to better analyze the situation and get to know with the market and the changes that happen there a lot better on your own.

However, you should remember that this will not be true if you end up using very high leverage. Leverage can be very dangerous in the world of Forex, and it is very important to use it very carefully. While trading with this strategy, very high leverage can result in huge losses.

Using Charts While Trading

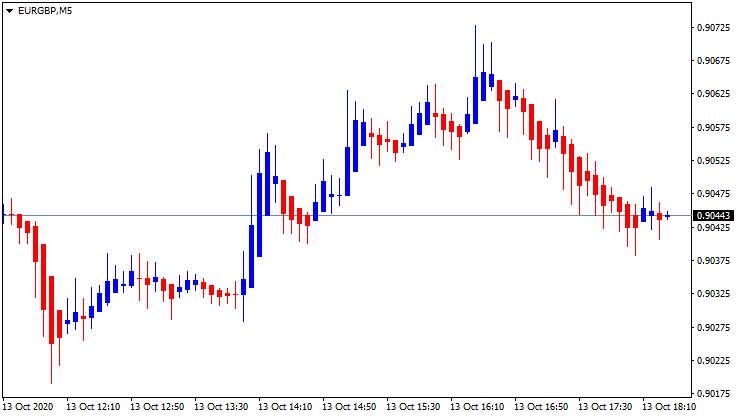

The chart shown above indicates the changing prices of the EUR/GBP currency pair and includes October 13 movements, from 12:00 to 18:10. Using this type of chart is very useful for investors because it offers them a chance to easily understand the changes in the market. As the chart above shows, the currency pair was down, in the beginning, near the support level, after which, it has increased. Although the currency did not go up significantly right away, after several hours, at 14:00, it started going up.

There are several factors that influence the changes in the price of a certain currency, and it is of utmost importance that investors understand that the changes do not happen for one reason only. In reality, there is a lot that goes into it. In many cases, changes happen suddenly, out of nowhere, which affects many investors on the market. But, staying in touch with the changes that are happening around you might be very helpful. This is especially true when it comes to trading currencies, the Forex market is very much unstable, and it requires investors to be focused on the political or social events that are happening around the world.

When it comes to Forex trading, it is of utmost importance that investors use all of the tools that are available for them. Simply trusting one indicator is not enough, however, charts like the one that is shown above will give you a much better understanding of the market than anything else.

The chart that is shown above is called the Heiken Ashi Chart, which is a great way for investors to easily tell how the market is changing. These types of charts are a very useful tool for investors who are using strategies like scalping and day trading because they can easily tell how the market is changing and what could happen in the future. Also, since scalpers are opening and closing several positions a day, they need to be very quick with decision-making, but this does not mean that they should not think about it.

Heiken Ashi chart is known to offer investors a quick insight on the market and gives them an idea about the changes that are happening on the market, and we believe that using charts like this can be very helpful. Also, you should always be ready to use additional trading tools to make sure that you are making the right decisions.

Avoid Swaps with the Help of Scalping

However, one of the biggest benefits of a scalping strategy is that investors do not have to worry about swaps. While long-term traders have to worry a lot about swaps, those who are using this strategy are safe from them. Swaps in Forex stand for a simultaneous purchase and sale of identical amounts of one currency for another with two different value dates and can make a huge change. Many people use this strategy because they do not have to worry about it at all.

Disadvantages of Scalping Strategy

While there are many advantages to this strategy, there also are some disadvantages that you should know about as well. Generally, no matter what you are doing in the world of trading, everything has two sides. Something that works for one trader does not mean that it will work the same way for others as well. We believe that you should know everything about this strategy before you start using it for trading.

It is a very well-known fact that scalping represents one of the most used and most exciting trading methods around the world. If it is used correctly, it can end up being very profitable for investors, however, if investors are not able to use it properly it can end up being very dangerous as well. It is also very demanding from the side of the investors and can be very time and energy-consuming.

If you are trading with this strategy, you should be ready for frequent trades. This means that you will have to enter the market several times and remember that this enters costs investors some amount of money. In many situations, something that happens to investors is that they are paying the money that they get from trading for entries in the market, which means that in the end, they are not left with a lot of payouts.

However, we believe that this can be avoided if you use a good broker, who does not charge huge amounts of fees. It is very important to choose a broker that offers low spreads, because the less money you pay on an entry in the market, the more you are left with for profits.

One thing that has been said by many people who use this strategy is also the fact that those who use this trading style tend to start using it as gambling. The thing is, when investors are getting excited about a winning streak, they will be more likely to abandon the strategy that they had and come up with their own rules in the hopes of making huge profits in less time, which can be very dangerous.

Something that you could do to avoid being in the same situation is to make sure that you understand what you are doing. Remember that trading is not gambling, and it can be very dangerous if you end up ignoring this fact.

How to avoid these risks?

The best way to avoid these risks is to make sure that you understand what you want exactly. This strategy, just like anything else in the world of trading, is something that will not work for any investor. The thing about this market is that you should be able to understand your wants and needs, and only after that, you will be able to find something that works perfectly for you.

Also, no matter what you need, you should always look out for risks. Although there are fairly low risks with this strategy, there still are some. If you see that the market is simply not working for you, give it time and take some rest, come back to the world of trading when you are in a better set of mind and can think more clearly.

Also, the thing that you should remember about Forex trading is that simply using one thing does not guarantee your success. There are many things that go into this market, and you need to understand everything about them. A very good thing would be to make sure that you understand how the market works, while also focusing on different types of indicators, that can make your trading experience a much easier thing to do.

Also, always try to stay up-to-date with the ongoing events on the market for maximum safety. The Forex market is changing every moment, and if there are some serious changes, you must be sure that you know all about them. This way, you will know what you should do next, what tendencies are worth following, and what you should avoid.

Who can use this strategy?

There are many trading strategies available on the market, and all of them are created for different types of investors. Something that works for you does not mean that it will work for others. There are many other strategies on the market, like swing trading strategy, day trading strategy, long-term trading strategy, and many others. Because of this, you will be able to very easily find something that fits your needs.

One thing about this strategy is that it can be used by any type of traders. The thing is, whether this strategy will work for you or not largely depends on the amount of time that you are willing to spend on Forex trading. This strategy requires investors to be constantly analyzing everything that happens on the market, and for many, it is as tiring as a full-time job.

To be able to successfully use this strategy, you will need to make sure that you are able to make decisions fast. Because of this, it is very important that you have some experience in this market before using this strategy. You should not let your emotions get to you, and if you are someone who can not distance decision from emotions, it would be better to find a different strategy, because, with this one, there will be a lot of decisions that will need to be made.

Also, you should be able to face losses. There will be times when you simply will not be able to earn profits, but this does not mean that you should panic about it. This simply is the part of trading and you need to understand that there will be some days that might not be that lucky for you. While choosing the Forex broker to use this strategy with, make sure that you are using the one that offers competitive spreads and costs, high-speed execution, high order execution quality. Also, make sure that the broker is regulated and authorized by a reputable regulatory body, and the funds that you are using are secured with a reliable bank.

Using Scalping Strategy – Summary

- Scalping is one of the most popular strategies in the world of trading. In includes opening and closing orders several times a day, for a very little time

- There are two different ways you can use scalping: automated and manual. While using a manual system, you will have to do everything on the market on your own, and it means that you will have better control over everything that you do. On the other hand, while using automated trading systems, you will have the ability to relax, sit back, and let the strategy do its thing. You can use either a fully automated trading system, or keep some things for yourself

- Most of the traders using this strategy want to make a certain amount of profit by simply buying and selling currencies while holding their positions for very short periods of time

- As with anything else that you do in the world of Forex, there are many benefits and disadvantages that come with using this strategy. To make sure that it works good for you, you should only use it if you know what you are looking for in the world of trading

Comments (0 comment(s))