Basic Guide to the Swing Trading Strategy for Forex Traders

Table of contents

When it comes to the Forex market it is worth noting that there are several trading styles. For example, scalping focuses on opening and closing positions within a very short timeframe. On the other hand, we have long term traders who might hold positions open for several months.

On the other hand, the swing trading strategy represents a middle ground between those two extremes. Traders using this strategy usually hold trades open from several days to several weeks.

This has several implications. Firstly, it is worth pointing out that unlike scalpers and day traders, swing traders might have to pay swap payments to the brokerage companies. Consequently, it can be helpful for market participants to check the interest rate differentials, as well as broker commissions, before opening any positions with a given currency pair.

In addition to that with swing trades, fundamental indicators, such as economic growth, interest rate, and inflation differentials can play a more significant role in trading, compared to in the case of scalping and day trading. Consequently, swing trading can be a useful strategy for those market participants, who like to base their trading decisions on fundamental indicators, rather than on technical analysis.

At the same time it is worth noting that with swing trading strategy, the market participants are executing considerably less amount of trades than with scalping or day trading. Consequently, for those traders who find day trading too stressful, might consider moving to swing trading. In addition to that, it is much easier to keep a trading journal with this strategy, since the overall number of trades is small and consequently, more manageable.

Finally, It is important to point out that, because of the lower volume of trades, the spread in the swing strategy is not as important as in the case of scalping or day trading. Consequently, swing traders can also take into account other factors besides spreads when choosing a brokerage company to trade with. Now let us discuss each of those specific characteristics of swing trading strategy in more detail.

Swing Trading Strategy Explained

Swing Trading strategy is something that falls between the polar opposites such as scalping trading strategy and long term trading strategies. Swing trading strategy can be used for investments in many markets, such as Forex, Futures, Stocks, Options, and many others. To say it in the simplest way possible, swing trading strategy envisages holding a position anywhere between overnight to several weeks. There are many benefits and disadvantages that come with this trading strategy, and just like any other strategy on the market, investors should always keep in mind the risks that come with using any Forex trading strategy.

Swing Trading strategy is something that falls between the polar opposites such as scalping trading strategy and long term trading strategies. Swing trading strategy can be used for investments in many markets, such as Forex, Futures, Stocks, Options, and many others. To say it in the simplest way possible, swing trading strategy envisages holding a position anywhere between overnight to several weeks. There are many benefits and disadvantages that come with this trading strategy, and just like any other strategy on the market, investors should always keep in mind the risks that come with using any Forex trading strategy.

Although this strategy is being used by many investors around the world, it does come with some risks. One thing that should always be remembered by the traders using this strategy is that because they are following a larger price range and shifts, they need to have a well-thought-out position so they can decrease the risks. To overcome this and many other challenges as well, investors should follow technical analysis to tell what could happen on the market.

Finding momentum while using this strategy is very important because it can benefit investors greatly. Because of this, every investor should strictly follow the fundamentals and principles of price actions, and the trends that are happening on the market. Also, another very interesting fact about this strategy is that this trading method is usually used by individuals rather than by big institutions.

While using this strategy, positions usually last a couple of days, but it can also go for several weeks or even months in order to profit from the price move that was anticipated. The major weakness of this strategy is that it exposes investors to overnight and weekend risks. If something serious happens that can affect the price of an asset drastically, the investors might end up losing huge amounts of funds.

This strategy is fit for many different types of investors, which is one of the major reasons for its popularity. It can be very successfully used by those who are looking for short positions, and for those who want to hold positions for a long time as well. The main aim of those using this strategy is to be able to capture a chunk of a potential price movement. No matter what you are trading, the main aim of those using this strategy is to identify where an asset price is likely to move next, and if done successfully, can be very profitable.

How to Trade Using a Swing Trading Strategy

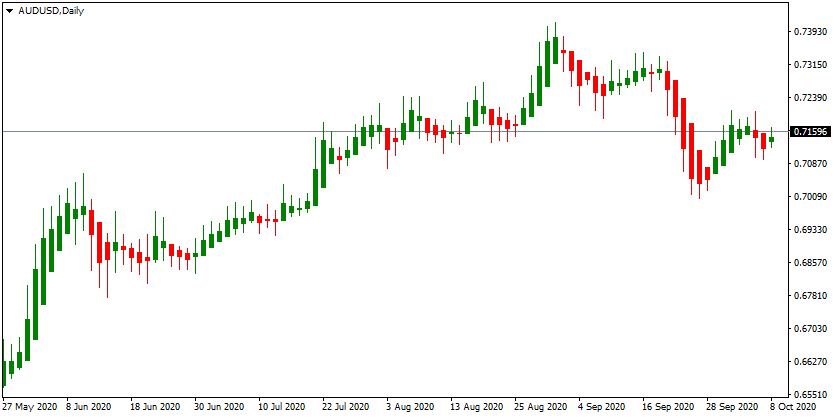

To make it a lot easier for you to understand the ways you can use this strategy, we will discuss the AUD/USD chart shown above. The chart is from May 27, 2020, to October 8, 2020. This chart shows the major dynamics of how the prices of the currency pair have been changing over the last few months.

It can be seen that at first, the price of it was increasing significantly, however, quickly after, it became unstable. There are many events that have an influence on the changing prices, but as it can be seen, in some cases, drastic and sadden changes happen as well. For instance, in the middle of September, the prices went down significantly, and it did not see an increase for several days.

While investing in the world of Forex, it is very hard to make any assumptions by using only one indicator. While it is very smart to look at the charts and analyze general changes, it is also of utmost importance to understand the reasons behind the changes. Since you will be holding positions for a certain amount of times, you should be certain about the positions that you open. You can make decisions by using analytical data about the market – look for the information regarding the things that affect price movements, check its influence on the charts, and try to use several indicators at the same time.

Forex is one of those markets that is constantly changing. The prices are going up and down every moment, and it is very important for those who want to invest in this market to understand the importance of information and knowledge. One very important tip for getting information is to never trust only one source. Look for several providers and compare their data, see how they add up and make decisions only after you are sure that you have trustworthy and accurate information about the ongoing events on the market.

The thing about this strategy is that it does come with some type of risks. But, on the bright side, it is something that falls in the middle of what talking about other trading strategies. Unlike other strategies, where you will have to either dedicate all of your time to trade or simply trust the market, here, you have control over the outcomes that you might have, while also having a lot of free time for yourself. Below, we will discuss the main differences between the Swing trading strategy and others that are available on the market.

Differences Between Swing Trading and Other Strategies

There are many trading strategies around the world that investors can use right now. All of them are very different from one another, and they are created for investors of different wants and needs. This means that no matter what you are looking for in the world of trading, you can find it very easily if you are committed enough.

So, to make it easier to understand the differences between the trading strategies, let’s discuss them in a chronological manner. The one that will need most of your attention and the one that will make you need to be most concentrated on the things that you do is the scalping strategy. While using this strategy, you will need to be very concentrated, since the positions that you will be opening up will last only a few minutes and you will have to open up several of them during the day.

Then, there is a day trading strategy. With this one, you will be opening up one position and closing it during the day, it will be open for several hours, but it will need a huge dedication from your side as you will have to use all of your time to sit in front of your computer. With both, scalping and day trading strategies, you will be able to avoid overnight risks, which is a great advantage.

Then, there is the swing strategy, which, you will have opened for between several days to weeks. With this strategy, you are open to overnight and weekend risks. After these, there are long-term strategies. As you can see, swing strategy stands between two opposites – those that will need all of your dedication, and long-term ones, which will only need you to simply open a position and wait for the outcome.

Now, how do you choose which one to use? The most obvious way to make a decision is to think about what you need from trading. If you can not dedicate all of your time to this market, then you should use long term strategies, however, if you are ready to sit in front of you computer the whole day and make the decision not emotionally but logically, then scalping and day trading might be a good decision for you.

If we look at these trading strategies as some type of a spectrum, the swing trading strategy seems to be something that lies in the middle. Because of this, we believe that it can be used by any type of investor. However, you should always remember that no matter which of the strategies you are using, it is of utmost importance that you manage to always stay informed about the market. Before you make any decisions, make sure that you have thought about them and that you are 100% sure about your decision.

Use Tools to Make Trading Easier

Every experienced Forex trader on the market will tell you that using tools is making Forex trading a much easier and rewarding thing. The thing about trading is that it is very hard to tell what you have to do and how you should change your positions. Swing strategy is a very good choice for those who want to open positions for several days or several weeks, sit back, relax, and wait for the outcome.

However, to remain calm, there will be a lot of things that swingers will have to do while trading. First of all, you need to be sure about your positions and this can be done by ensuring that you do your homework well. There are many investors on the market who are using different types of trading instruments to make decisions, and it is always a good idea to follow different types of indicators and make decisions only when you are 100% sure about something.

Forex is one of the most diverse and successful markets around the world. The average daily turnover of the Forex trading market in 2019 was as much as $5.1 trillion, which is a huge number, meaning that FX trading can offer investors something that not all markets can.

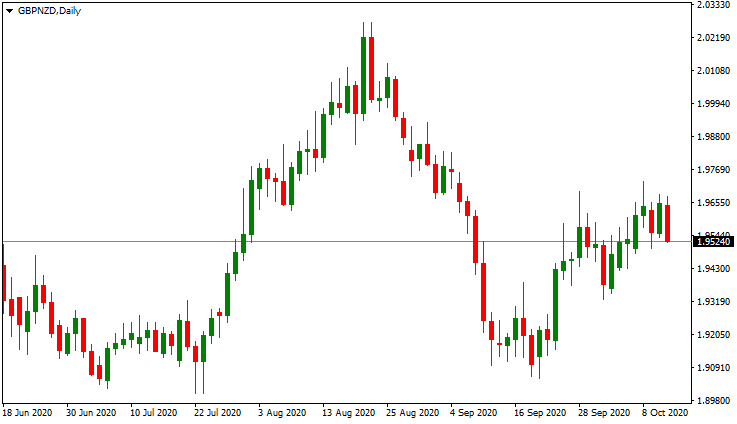

The chart that is shown above indicates the changing prices of currency pair GBP/NZD, it is a regular candlestick chart, which, unlike other charts, like, Heiken Ashi, for example, offers investors a detailed insight on the changes that happen on the market. Even the slightest changes that have happened on the market is shown in this chart and can be very useful for investors.

As it can be seen on the chart shown above, the prices of GBP/NZD has been changing a lot until it has gone up to the resistance level in the middle of August, these resistant and support levels can be used by investors to make sure that they are making right decisions. After you see a bounce, it means that it is time for you to open position.

In addition, you should always use every single opportunity that the market offers you in terms of research and information. There are many trustworthy news outlets on the market, that also offer investors analytical data about the market, which can be very successfully used by swingers. The more you know about the trading market, the easier it gets for you to make moves. So, make sure to always stay up to date with the changes that are happening in the trading market.

Who Can Use a Swing Trading Strategy?

This trading strategy is a perfect choice for those investors who are ready to wait for some time after opening a position. The thing about this strategy is that you should be able to tell when it is time to close the position, or when it is better to wait a little longer. There are many risks that come with it, so you should be ready to face the challenges that come with it.

This strategy will work perfectly for those investors who are ready to think critically and make decisions according to real facts. The market is constantly changing, and you should be able to control your emotions to get the most out of trading. If there is something that is not going as you thought on the market, it does not mean that you should panic and avoid making any moves. A much better thing would be to control your emotions and if you can do so, this strategy might be a great option for you.

There are a lot of people who act very fast and do not wait for how the situation will go on, which means that they close their positions the moment they see something not going the way they wanted it to. So, if you are one of those people, this strategy might not be the one for you. If you are someone who can control their emotions, hold back, and wait for the results, this strategy will work very well for you.

Also, do not forget the importance of knowledge and information. Those using this strategy will find the fundamental analysis very helpful, you will also most likely need many sources of information. The thing is, it is very hard for investors to trust one source of information, and it is very helpful to use several sources to make sure that the information that you are getting is very accurate and you are not doing anything wrong.

Benefits of Swing Trading Strategy

For those who are new to the world, fo trading will find this trading strategy very helpful because it has a number of benefits for them. One of the biggest advantages of using a swing trading strategy is time. As we have already said, those who are trading using day trading strategy or scalping will have to dedicate most of their time to the trading world as they will have to constantly analyze the market, close the positions, open new ones, look, or information constantly, etc. They are basically much like a regular 9 to 5 job which is something that not all investors want to do. So, if you are one of those people, you will love this strategy. They also require a great deal of discipline, which is something that not all investors have.

When it comes to swing strategy, it is something that day traders love a lot, because it simply offers them a very friendly time frame, which gives them enough time to think about their decision and analyze the things that they do in the world of trading. They will also spend much less time analyzing and trading, as they will have to open fewer trades, and the trades will last over longer periods of time, which is very important for many investors on the market. With the help of this strategy, you will have more time to think, place your positions, and spend only a few minutes a day making trades. You will even have some free days, simply waiting for the outcome of your position.

One thing that really draws people to this trading strategy is the fact that it gives them the ability to benefit from long-term trends. Those who use other strategies, like scalping and day trading, for example, have to rely on short-term changes on the market and earn income from changes that happen in a short time. However, Swing traders have the ability to benefit from long-term changes in the market. Also, each trade that investors using the Swing trading strategy make, have more time to generate profit. This mostly happens because investors who use this strategy mostly follow longe trends that affect price changes on the market.

Spend Less Money on Spreads

We have talked about many of the benefits that this strategy has, but something that is the most important is that it is more cost-efficient than other strategies. While trading, one of the main costs that you will have to pay is the spreads, which are the differences between the buy and sell prices of a certain asset. While spreads can be considered to be pretty small, they do get charged every time you trade on the market.

While using strategies such as scalping and day trading, you will have to open and close many positions, which can lead you to pay a lot of money on spreads. This basically means that the cost of trading for you will be much higher. While swing strategy comes with the risks of overnight swaps and the things that might happen over the weekends, you are not paying such huge money on spreads. This can be a huge advantage for many people since it is a lot easier for them to understand what they are spending their money on.

For those who are using swing strategy, spreads matter less because they will be opening up positions for a considerably longer time than those who use scalping and day trading strategies. Also, while those trading with scalping strategy are more likely to open a number of positions during the day, swingers will only open one for several days, or even weeks.

Another very great thing about this strategy is that it gives investors the ability to exploit significant price movements that would be otherwise very difficult to obtain during a day. There are also many instruments that can be used, and since the trading happens for relatively long-term, investors will be able to open positions, sit back, go on with their everyday lives, and wait for the outcome.

Disadvantages of Swing Trading Strategy

While working on this guide to swing trading strategy, we wanted to touch upon every single important aspect of it. The thing about Forex trading is that something that works for you and meets your needs, will not work for others just as well. There are many different types of traders on the market, and all of them have their own views and wants when it comes to trading.

No matter which strategy you choose, there will be some advantages and disadvantages, but as long as the strategy fits your needs and you can utilize it well for trading, you can be very successful in the world of investment. There are many benefits that this strategy has, and we have already talked about those, but all of these advantages come with a price. Whether it is worth taking those risks depends on what you want to be doing while trading.

The term originally is referred to holding a certain type of position for just a few days, however, recently, because of the increasing popularity of this strategy, the term has changed a little bit. As of now, it basically means holding a position from overnight, for at least two days, to several weeks.

If you end up holding your position for just one day, it means that you are using day trading strategy, and if you hold your positions for more than a few weeks, it means that you are using a long term trading strategy. There are many things that investors have to think about before they start using this trading strategy, and below, we will discuss these things in greater detail to make sure that you understand everything about this very popular, yet risky trading strategy.

Markets Can Change Dramatically out of Nowhere

The thing about trading is that the market can change very dramatically out of nowhere in just a matter of a few minutes. This can be something that can very much affect the experience that swingers can have. Overnight, while you are peacefully sleeping, the market can make some dramatic moves. In case such moves are against your position, you will wake up to huge losses. Traders who think ahead and are smart about their trades use stops, but sometimes even they can not be helpful.

Because of this, there are many investors in the market who decide to avoid using this strategy. They simply do not want to fall victim to overnight changes that they have not to control over. This is something that can influence the outcome of your trades a lot, and if you are not smart about it, you could end up losing a lot of money.

Because of this, investors who use this strategy should be using different types of tools to make sure they stay safe. Using stops is very smart, you can set them to automatically close your positions when something does not go the way you wanted it to, which can be very helpful in most of the situations.

The thing is, you have to be very well experienced in technical analysis to make sure that this strategy works for you. While this might not be something that is considered to be a disadvantage by many people, it certainly means that you will need a little amount of extra work. You need to understand how, why, and when the market is changing to be able to forecast the possible changes in the future. But this is not easy, it takes time and practice, but it proved to be very rewarding.

Also, it takes investors to have the ability to control their nerves and outlooks to make sure that they are staying safe. This means that you should not panic if you see something not going the way you wanted to. Just take a look at the market trends, and think critically – do not trust your emotions.

However, although there are some risks involved in swing trading strategy, this does not mean that it should not be used by anyone. The thing about trading is that no matter what you do, there will be some cons and pros, there is nothing that works for the whole majority of traders. If you think that this strategy is a good fit for you, try it out, focus, and make sure that you follow the tips that we have talked about in this very detailed guide to using swing trading strategy.

How to Choose a Perfect Broker for Swing Strategy?

When it comes to trading, it is of utmost importance that you choose a broker that can offer you safety and security. For investors using swing trading strategy, it is not as important to focus on the number of spreads that they will have to pay, it is more important for those who are using scalping and day trading strategies, which means that those using this strategy can fully focus on the safety and security part of the broker.

Always try to trade with brokers that are authorized by official regulatory bodies around the world, it is very important for your safety. Also, never go for brokers that do not seem trustworthy, and only use reputable companies on the market. Also, it is very important that the broker you are using offers tools for stops. When using a swing trading strategy, for maximum safety, it is very important to use stops, to make sure that you do not lose more than you can afford.

Summary – Using Swing Trading Strategy

- There are many trading strategies available around the world, each of them created for different types of Forex traders. If we look at the trading strategies as some type of a spectrum, swing trading falls somewhere in between of other extremes like scalping and long-term trading

- If you want to make moves on the market and go on with your day relaxed, this option is great for you. All you need to do while using this strategy is to make up your mind about the moves you want to make, open positions, and start trading. After that, you just wait for an outcome, swing traders usually hold positions for several days or weeks

- Unlike other trading strategies, such as scalping for example, where you have to open and close several positions during the day, swingers open one position and wait for an outcome. This gives swingers a huge advantage because they do not have to pay a lot of money in spreads. For scalpers, a huge amount of their money is being spent on spreads, because they have to open and close several positions a day. That is not the case for swingers, and they can enjoy trading without having to pay huge amounts of their turnover in spreads

- However, there are some risks that come with this strategy as well. One thing that every investor should keep in mind is that there are some serious overnight risks that are associated with long-term trading strategies such as swing trading strategy. To make sure you are staying safe, it is very important to use stop tools, so in case there is some type of drastic change overnight, you will not lose more money than you can afford

- In the end, remember that every single strategy has its own downsides, and it is not about how it works for others, but how it works for you. So, focus on your needs and wants, do your research, and you will be good to go

Comments (0 comment(s))