UTrada Forex Review

Read our full UTrada review to get exact details about their safety, accounts, spreads, platforms, assets, support, and many more. Our unbiased UTrada opinion allows our readers to decide whether UTrada is a reliable broker.

UTrada Forex Broker History

UTrada was launched in 2018 in Malaysia and has been working since then to acquire more coverage and licenses. The broker launched its office in Singapore in 2019, launched corporate collaborations in 2022, and opened its office in Australia in 2024. The broker has acquired two licenses and offers competitive conditions with access to advanced trading platforms.

UTrada broker safety

When it comes to safety, UTrada was launched in 2018, which makes it experienced in its industry. The broker holds two licenses:

- UTrada Global Limited – Financial Services Commission, Mauritius (FSA Mauritius)

- UTrada Limited – Labuan Financial Services Authority (Labuan FSA)

The broker employs segregated accounts to ensure client funds are protected and can not be touched by the broker, which is a crucial safety policy. While UTrada is a member of the investor compensation scheme as required by regulators, the broker does not provide negative balance protection (NBP). The NBP is a crucial policy that ensures traders can never lose more than their initial investment, in other words, they can not go into minuses if the high leverage is abused. The lack of this policy is a serious drawback for beginner CFD traders and they should be extremely cautious with UTrada.

UTrada Broker Review of Accounts

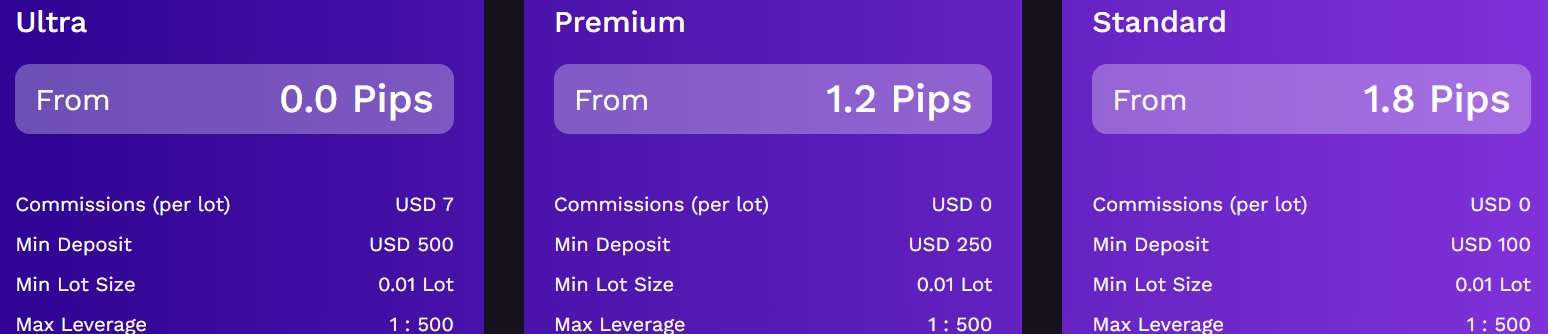

When it comes to trading accounts, UTrada provides several choices, standard, premium, and ultra. The accounts differ by spreads, commissions, and minimum deposit requirements. The UTrada standard account offers the following conditions:

- Minimum deposit – 100 USD

- Spreads from – 1.8 pips

- Commissions – 0 USD

- Maximum leverage – 1:500

- Minimum lot size – 0.01 lots

As we can see, the standard account has expensive spreads and a bit higher minimum deposit but charges no commissions for CFD trading.

The Premium account by UTrada has the following conditions:

- Minimum deposit – 250 USD

- Spreads from – 1.2 pips

- Commissions – 0 USD

- Maximum leverage – 1:500

- Minimum lot size – 0.01 lots

The premium account is better than the standard if the trader has a budget to meet its minimum deposit requirement.

The Ultra account is the only account that offers 0 pips spread trading and requires the following:

- Minimum deposit – 500 USD

- Spreads from – 0 pips

- Commissions – 7 USD per lot round trip

- Maximum leverage – 1:500

- Minimum lot size – 0.01 lots

As we can see, only the Ultra account offers 0 pips spreads and charges commissions, but has a high minimum deposit of 500 dollars, which is not competitive.

UTrada instruments

The broker offers access to only CFDs but there are many different asset classes provided such as Forex pairs, commodities, indices, shares, and cryptos. Since cryptos and shares are CFDs, traders can instantly buy and sell any instrument which gives them many advantages. However, due to high spreads, only Ultra accounts allow scalping, which requires a 500 USD minimum deposit. The leverage of 1:500 enables traders to control serious trading power and open positions 500 times their balance.

UTrada Reviews of Trading Platforms

UTrada offers two advanced trading platforms, MT4, and MT5. These platforms are widely popular among traders, making it a seamless process to start trading at UTrada. Both custom indicators and Expert Advisors are allowed by the broker, allowing traders to employ full capabilities of these software. For mobile trading there is a UT app, which is accessible on both Android and iOS devices, enabling CFD trading on the go.

UTrada Forex Review of Extra Features

The broker offers many extra features as well, including trading academy, tools, deposit bonus, and so on. In the academy, traders can find trader blogs, learning centers, analytical tools, events, UT clubs, and even webinars. The learning center provides educational resources for beginners, which is very useful for novices who want to learn about CFD trading. The webinars are a great way to get knowledge from experts. The analytical tools help traders increase their trading precision. The blog provides posts about daily analysis of various currency pairs and assets. The deposit bonus offers a 15% bonus on each deposited amount, which is very attractive. The maximum amount to be received as a bonus is capped at 10,000 USD, which is competitive.

There are some social features as well like copy trading, PAMM trading, and trading signals available.

UTrada Reviews of Customer Support

Customer support experience at UTrada is provided via live chat but traders can only leave messages and the broker answers via email, which is inconvenient. The chat is not live all the time, which is a drawback for the broker. As a result, there are no phone support and email options available, a major red flag for a regulated broker. Both the website and support are available in more than 5 languages, which makes UTrada a multilingual trading platform.

UTrada Deposit and Withdrawal

The broker promises diverse payment options for deposits and withdrawals, including wire transfers and bank cards. Deposits are instant and withdrawals take several days to get processed. There are no commissions charged from the broker’s side, which is flexible.

UTrada Review Conclusion – Can you trust UTrada?

UTrada is a moderately competitive broker offering multiple trading account types, advanced trading platform access, and a wide range of CFD assets. The broker is regulated by the FSA of Mauritius and Labuan FSA adding some degree of trustworthiness. However, the lack of negative balance protection and limited customer support options are serious downsides, especially for novice traders. While experienced traders can benefit from UTrada’s ultra account and 0 pips spread, we advise our readers to be cautious due to the broker’s high deposit thresholds and basic support framework.

FAQs on UTrada

Is UTrada a scam?

The UTrada scam is unlikely as the broker is overseen in two jurisdictions including Labuan FSA and Mauritius FSA.

What is the UTrada minimum deposit?

The minimum deposit at UTrada starts at 100 USD for the UTrada Standard account, which is a commissionless account with 1.4 pips spreads.

Is UTrada a cheap broker?

No, the broker has higher spreads than industry standards and its minimum deposit is also not competitive.

Comments (0 comment(s))