ZFX Forex Review

Read our full ZFX review to get exact details about their safety, accounts, spreads, platforms, assets, support, and much more. Our unbiased ZFX opinion allows our readers to decide whether ZFX is a reliable broker.

ZFX Forex Broker History

Zeal Market or ZFX was founded in 2017 and has acquired two licenses since then, which is always a good sign. The broker operates under robust regulatory oversight in both Seychelles and the United Kingdom. The broker aims to offer secure and transparent trading services and attractive trading conditions.

ZFX broker safety

Regulations are critical in Forex trading; the more licenses the broker has, the safer it is for traders. ZFX is governed by top-tier regulatory bodies:

- Zeal Capital Market (Seychelles) Limited – by the Financial Services Authority of Seychelles

- Zeal Capital Market (UK) Limited – by the Financial Conduct Authority

With these licenses, the ZFX scam is out the window, and the only thing remaining is to evaluate its trading conditions and policies. There is no negative balance protection available, which is a serious downside, especially when the maximum leverage is up to 1:2000 under the Seychelles FSA. It is lower under the FCA jurisdiction, but the lack to prevent trading balance going beyond 0 USD is still a needed feature.

The broker, as a regulated brokerage entity, is a member of the investor compensation fund, and keeps traders’ money in segregated bank accounts with top-tier institutions. This is very important as segregated banks prevent brokers from touching trader funds.

ZFX Broker Review of Accounts

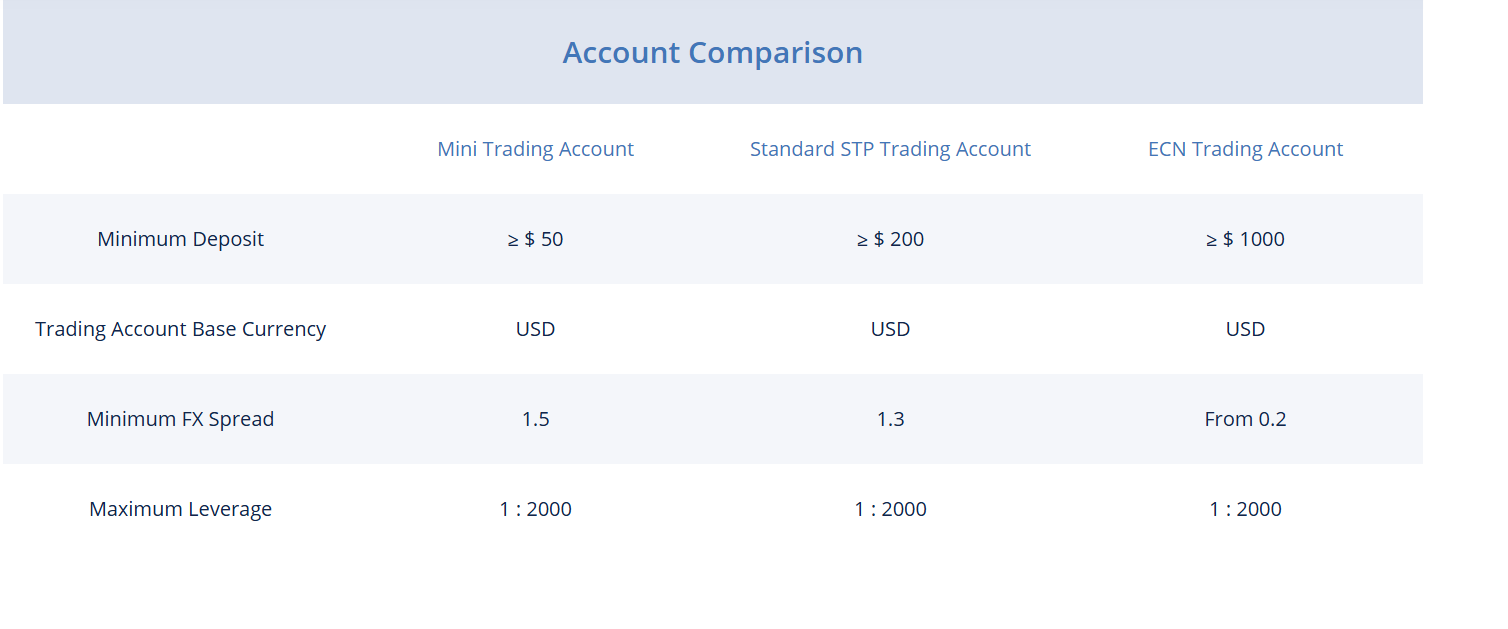

ZFX provides three distinct account types to accommodate different trading styles. There are Mini, STP, and ECN trading account types. The mini account is a micro or cent account that offers spreads from 1.5 pips, which is very expensive. It charges no commission on trading volume, and the minimum deposit starts at 50 dollars. The leverage is 1:2000 for all account types for traders who fall under Seychelles regulations. However, UK jurisdiction offers much lower leverage.

The STP account requires a higher minimum deposit of 200 USD and has slightly better spreads from 1.3 pips, but still expensive.

For traders who need the lowest spreads, the broker offers an ECN trading account where spreads start at 0.2 pips. However, this account charges commissions, and the minimum deposit is 1000 USD.

ZFX instruments

Traders can access a broad range of markets, including major FX pairs, minor pairs, exotic pairs, indices, metals, energies, shares, and even digital currencies via CFDs. CFDs enable traders to both buy and sell shares and cryptocurrencies. The leverage is more than enough to control large trading positions, and depending on their jurisdiction, traders should be careful not to take excessive risks.

ZFX Reviews of Trading Platforms

ZFX offers MetaTrader 4 (MT4) exclusively, which is a versatile platform that allows both custom indicators and Expert Advisors (EAs). Traders are allowed to employ EAs, and they can also use custom indicators. There are web trader and mobile MT4 versions available as well to enable traders from any device from anywhere, which is flexible.

ZFX Forex Review of Extra Features

Additional trading aids such as an economic calendar, copy trading, a signal center, and up-to-date market news are available, which are very useful to help traders make informed decisions and stay ahead of market movements. There is a help center and an FAQs section where traders can get answers to all their questions about payments, accounts, and many more.

ZFX educational resources

The broker offers a plethora of educational resources in its academy. The academy is designed for absolute beginners and provides many important materials, including core financial trading concepts. The A-Z academy resources include articles where traders can learn about important trading concepts in a well-organized manner. There is also a trader’s glossary where traders can learn about important trading terms, which is very important.

ZFX Reviews of Customer Support

ZFX broker offers customer support via live chat, email, and phone channels. The hotline support is available 24/5. The support is available in several languages, more than 5, and so is true for the webpage of the broker. The live chat is the fastest support option and is built inside the website. There is also an online form, which is an email option as well.

ZFX Deposit and Withdrawal

Transactions are handled through bank wires and credit cards. Deposits are commission-free, and withdrawals have a minimum threshold of 15 USD. Processing times typically range between 3-5 business days, subject to verification procedures. The minimum deposit and minimum transfer amount for deposits is 50 USD.

ZFX Review Conclusion – Can you trust ZFX?

In our comprehensive review of the Zeal Market, we found that ZFX seems to be a reliable and legitimate brokerage company that has been around for some time. However, considerable disadvantages include very high spreads on non-ECN trading accounts and a lack of negative balance protection. However, there is an ECN account available, although the minimum deposit is 1,000 USD, which is higher than the industry average for ECN accounts.

Overall, traders should carefully consider their needs and strategies before selecting this broker, as it has high spreads.

FAQs on ZFX

Is ZFX a scam?

ZFX scam is highly unlikely as the broker is regulated and follows strict regulatory standards set by the FSA and FCA.

What is the ZFX minimum deposit?

The minimum deposit starts at 50 USD for the ZFX Mini account (cent account), which is competitive.

Is ZFX a cheap broker?

ZFX offers competitive leverage and diverse account options, but its spreads are very expensive, making the broker expensive.

Comments (0 comment(s))