Financial regulation in Nordics

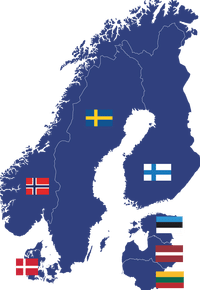

Nordic countries have some of the best financial regulations in the world, which is why the credit rating agencies award these economies a triple-A rating. Besides the effective financial regulations, the Nordics are also known for having excellent quality of life. The main countries in the Nordics include Norway, Sweden, Finland, Denmark and Iceland.

The main financial regulators in these countries, according to www.norskecasinoer.co are:

- Financial Supervisory Authority of Norway (Finanstilsynet) in Norway

- Financial Supervisory Authority in Sweden (Finansinspektionen) (FI) in Sweden

- Finnish Financial Supervisory Authority (FIN-FSA) in Finland

- Danish Financial Supervisory Authority (Finanstilsynet) in Denmark

- Financial Supervisory Authority of Iceland (Fjármálaeftirlitið) (FME)

To get a picture of the financial regulations in the Nordics, one has to look at EU membership.

Relationship between Nordics and the EU

Nordic countries in the EU are Sweden, Finland and Denmark, while Norway and Iceland have not joined the EU. Being members of the EU, 3 of the 5 Nordic countries are influenced by EU financial regulation, which means that laws passed by the EU parliament are adopted as law.

Nordic countries in the EU are Sweden, Finland and Denmark, while Norway and Iceland have not joined the EU. Being members of the EU, 3 of the 5 Nordic countries are influenced by EU financial regulation, which means that laws passed by the EU parliament are adopted as law.

As for the remaining Nordic countries outside the EU, Norway and Iceland, they are still part of the European Economic Area (EEA) which means that EU laws can apply to them too. The only caveat is that prior to the actual implementation of EU law by non-EU countries, the legislation has to be approved by the local parliamentary body.

There is a bit of leeway here, whereby a country’s parliament can reject a piece of EU legislation even though it is still within the EU. However, once a country passes and adopts an EU law, financial or otherwise, they are not free to amend or revoke the law until approval is received from the EU parliament. Given that Nordic countries rely heavily on trade with other EU nations, EU laws are often adopted into law, and some legislators have complained about the EU’s influence on non-EU countries in Europe.

How the EU membership influences financial regulation

Financial regulations set by the EU have a huge impact on the regulations imposed by the Nordics. Often, these EU regulations go against the Nordic model, and this can have a negative reaction. For example, the European Commission tries to ensure that risks by economies are kept low and that business strategies become a priority. On the other hand, the Nordic model follows a traditional Christian belief that emphasizes on social good for all.

This can put at odds the requirements by the EU regarding business strategies and those of the Nordics that prioritize social good. Such a difference can be observed in the difference between the EU’s priority on keeping business costs low while the Nordics encourage employees’ rights. These opposing views are the reason the Nordic Financial Unions (NFU) was formed, to try and lobby the European Commission to maintain the Nordic model. According to the NFU, they prefer good regulation rather than just regulation.

Some of the differences between financial regulation by the EU and the Nordics include:

- collective bargaining,

- employee representation,

- whistle blowing systems,

- laws on sales and advice,

- a level playing field, etc.

Comments (0 comment(s))