TradeSmart Scam Reviewed and explained

TradeSmart Broker review — Safety, assets, support, and many more!

TradeSmart is a Forex broker that offers its trading services globally. The broker was established in 2021, which makes it relatively young. TradeSmart offers multiple account types, an advanced MT5 platform, and a high leverage of 1:2000.

Let’s review and assess the broker’s key features, including safety, account types, spreads, fees, platforms, support, learning materials, and more.

The Safety and Security of TradeSmart

Safety is critical in FX trading. Unfortunately, TradeSmart is not regulated. TradeSmart is the trading name of TradeSmart Capital Limited, a brokerage company registered and incorporated in Saint Lucia, an offshore jurisdiction. The broker is only registered there and not regulated by any authority. Being unregulated is a major red flag for the broker’s safety and reliability.

When it comes to segregated accounts, it’s impossible to confirm that the broker offers segregated accounts to keep trader funds separate from its operational funds.

The broker does not provide negative balance protection for its retail trading accounts. It is only provided for VIP accounts, which is a considerable drawback.

TradeSmart Fees and Spreads

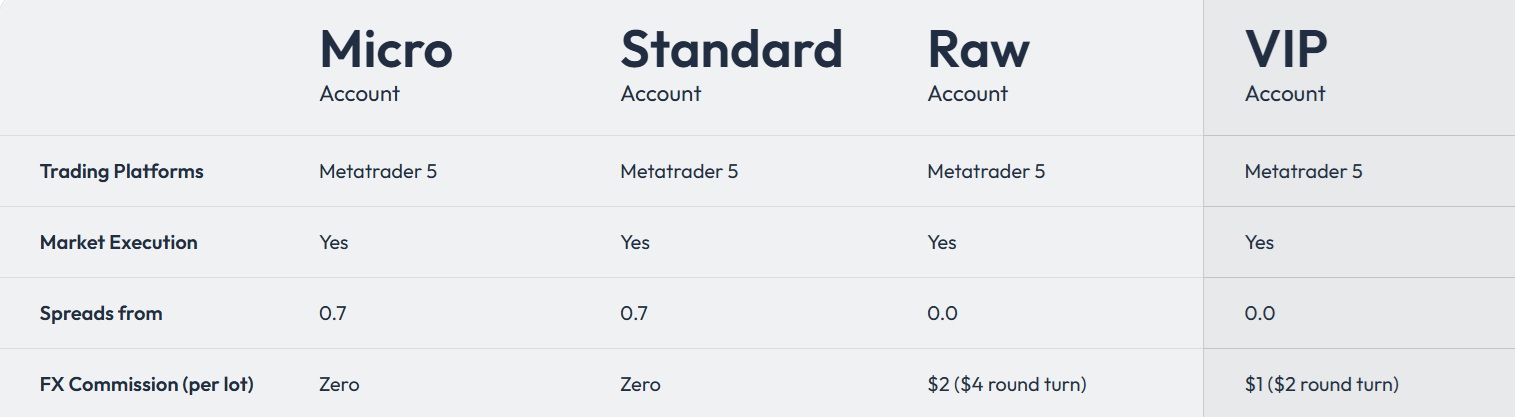

TradeSmart offers very affordable trading conditions, with 0.7 pips and no commissions on Micro and Standard accounts. The spreads are 0 pips on Raw and VIP accounts and commissions are $2 ($4 round turn) and $1 ($2 round turn) respectively.

Withdrawals and deposits are fee-free as the broker provides only one payment method.

TradeSmart Accounts, Deposits, and Withdrawals

TradeSmart broker offers a wide range of different trading account types, including Micro, Standard, Raw, and VIP.

TradeSmart Micro Account

The Micro account has the lowest minimum deposit of all accounts. The minimum funding amount is 50 USD, which is not very competitive as many reputable brokers offer even lower deposits. The spreads are very competitive starting at 0.7 pips and commissions are zero, making the TradeSmart Micro account very cost-effective. The maximum leverage is high at 1:2000 but the broker does not provide negative balance protection on this account, meaning traders can become liable for losses beyond their initial investment. This is a serious drawback especially when such high leverage is provided. This account does not offer a 7-day swap-free or Islamic option.

TradeSmart Standard Account

The standard account has similar conditions as the Micro but a higher minimum deposit is required. The minimum funding here is 300 dollars, which is very high. The spreads are the same as Micros starting at 0.7 pips and commissions are also 0. However, the leverage is much lower at 1:500, way more conservative than Micro’s 1:2000.

TradeSmart Raw Account

The raw account is a low-spread account where traders can get 0.0 pips on major pairs and the commissions are 2 USD per lot per side which is 4 dollars round trip. The leverage is also capped at 1:500, and the minimum deposit is also high starting from 300 dollars. Traders are not protected with negative balance protection. This account is more suited for scalpers due to low spreads but the minimum deposit is its downside.

TradeSmart VIP Account

The VIP trading account is also a low-spread account with spreads starting from 0.0 pips on major pairs like EUR/USD. The commissions are lower than the raw account at 1 USD per side per lot (2 USD round trip). However, the account has a 10,000 USD minimum deposit requirement, which is much higher than other account types. The maximum leverage is also lower at 1:400 for the VIP account and traders are protected with negative balance protection.

Deposits and Withdrawals

The broker has limited payment options as it only supports Confirmo payments. The minimum deposit amounts are 50 dollars or euros and processing times are instant. However, when it comes to withdrawals, the processing times are lengthy at 1-2 business days. No fees are charged for withdrawals either, and the minimum withdrawal amount is 15 USD/EUR.

TradeSmart Trading Platforms, Assets, and Features

TradeSmart broker only offers one trading platform as a main trading software, MetaTrader 5. The platform supports custom indicators and EAs and mobile trading is available via the MT5 mobile app, accessible on iOS and Android devices.

Assets

TradeSmart assets are diverse and include popular markets like Forex currencies, commodities, indices, cryptos, and stocks. The broker also allows CFD trading and leverage is more than enough to control large trading positions. Spreads are competitive but minimum deposits required are relatively high.

Extra Features

TradeSmart promos include a 120% cash bonus, a SmartBoost bonus, and Elite competition. Traders can get 120% of their deposits in bonus but no more than 10,000 USD and the minimum receivable bonus is 200 dollars. There are volume requirements for both bonuses. The smart boost bonus is a welcome bonus for new clients of the broker and the Elite competition is a trading contest.

TradeSmart Customer Support Review

TradeSmart broker support consists of email, live chat, and phone support channels. The live chat is available directly on the website enabling fast connection with support personnel. Unfortunately, the broker only offers English language for both website and support options, which is a minor drawback.

TradeSmart Education

When it comes to education, the broker falls short in resource diversity. There is only a trading blog that provides basic education but can not be used as a sole source for online financial trading education, which is a drawback for beginners. There are also no market research tools provided which is a drawback as well.

Should you consider TradeSmart?

Overall, TradeSmart is an unregulated Forex broker based offshore with high leverage, appealing bonuses, and multiple trading account types. The lack of regulations and negative bane protection on retail accounts coupled with limited educational and market analysis resources are its huge drawbacks.

FAQ on TradeSmart

Is TradeSmart a scam broker?

TradeSmart is unregulated and based offshore, which makes it very probable that the broker might be a scam.

Is TradeSmart a cheap broker?

Yes, spreads start from 0.7 pips and some accounts have no commission, but minimum deposit requirements are higher than competition.

What is the TradeSmart minimum deposit?

The minimum deposit at TradeSmart starts at 50 USD/EUR, which is higher than the industry standards.

Comments (0 comment(s))