Forex charts explained – How to predict future movements using charts?

Table of contents

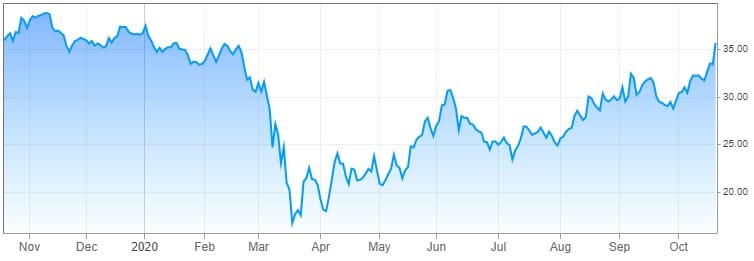

Many traders are using Forex charts for technical analysis in order to predict upcoming price movements. Charts provide traders with visualized price movements of the currency pairs. This way, you can understand how the market is affected by different types of political or economical events.

There are different types of charts available for Forex traders. In general, to read Forex charts. However, there are some chart types that are more detailed than others. In Forex, you can come across lines, candles, mountains, and many other types of charts. They also have different time frames.

Depending on your preferences, you can see the price movements during the past day or even a year. Most of the Forex brokers will provide you with a trading platform, which you can use to access Forex charts.

In our guide to Forex exchange charts, we will cover different aspects of Forex charts. So, if you want to learn how to read charts, follow our guide and understand how you can use them for the best outcome.

Forex chart explained – Basics

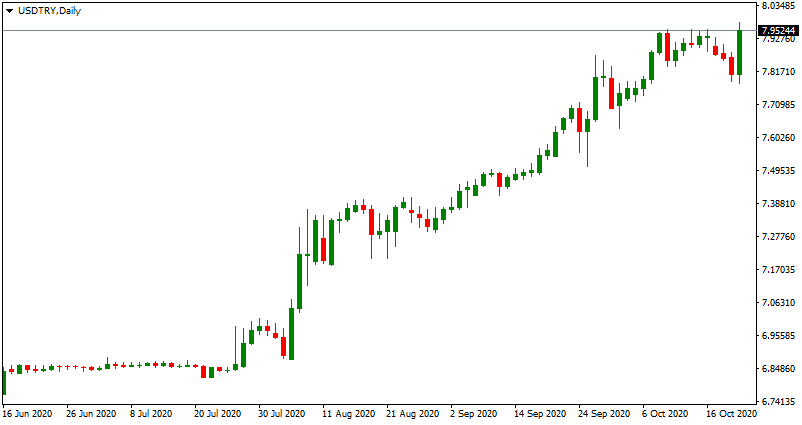

Forex market charts show price movements in a very simple way. On the chart, you can see that there is an x-axis, which is the horizontal line of the chart, and the y-axis, the vertical line. The x-axis of the Forex trading chart shows the time frame of the chart, while the vertical line indicates the price of the currency pair.

Forex market charts show price movements in a very simple way. On the chart, you can see that there is an x-axis, which is the horizontal line of the chart, and the y-axis, the vertical line. The x-axis of the Forex trading chart shows the time frame of the chart, while the vertical line indicates the price of the currency pair.

In the majority of cases, you will find different types of charts in the trading platform offered by the broker you are using. Thanks to the trading platforms, you will be able to access the charts with both, live and demo accounts.

On the other hand, you can also use third-party applications and software that will give you access to special types of charts. There are numerous charting solutions offered to traders who want to dive deep into technical analysis, for which, using charts is an essential factor.

As you might already have heard, in Forex trading, the prices of the currency pairs are constantly changing. You will see that sometimes the prices are going up, while other times they are going down.

Things to learn from Forex market charts

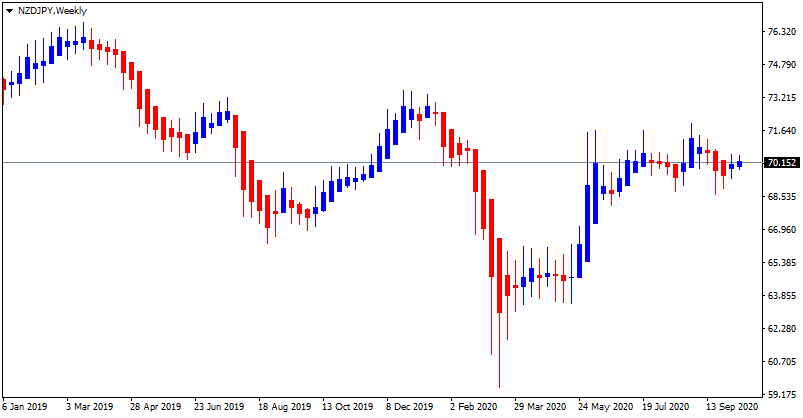

Thanks to Forex charts, you can very easily identify uptrends and downtrends. This way, you will know the history of the currency pair. This might be very important information. If you know that something very important happened at some point during history, you will be able to understand how it affected the price movements.

After this, you can use this information in your future trades: if something similar happens, you will have an easier time understanding which direction the prices are more likely to take.

So, if you believe that the price of a certain currency pair is more likely to increase, you’d usually want to buy the currency pair, on the other hand, if you think that it is about to decrease, you’d prefer to sell it.

The most popular Forex chart types

As we have already said, there are dozens of different Forex chart types available in the market. Depending on the Forex broker and trading platform you are using, you will have access to different types of them. Among the most popular variations of Forex trading charts are:

- Candlestick Charts

- Heiken Ashi Charts

- Line Charts

- Mountain Charts

- Bar Charts

While with design these charts might be a little different, the general idea is the same – to show traders the major trends of the market. Every chart, however, shows the price movements in a different manner. While some focus on details, others only show the most important, general information.

Customize your charts with XM MT4

Forex charts reading – Candlestick charts

For many traders, the first thing that comes to mind when you are talking about Forex trading is the candles. These candles have become so famous because of the candlestick chart. This chart combines very detailed information in just one place. It should not come as a surprise that this is one of the most popular charts in Forex.

Candlestick charts give you information about not only the changes that are happening in the market, but also give you detailed information about the whole price movements. In total, this type of chart will give you information about four different prices in a longer time frame. You can set the time frame most suitable for you according to your preferences.

When you look at the candlestick chart, you will see different types of candles, the space between the short vertical lines in the candlestick chart is called the real body of the candle. Depending on the broker and trading platform you are using, the color distribution will be different.

Generally, if the real body is green or white, it means that the opening price was lower than the closing price. On the other hand, if the real body is either black or red, it means that the opening price was higher than the closing price.

Sometimes, these bodies also have a narrow line on top of them. This line is called upper shadow and it shows the highest price point during the trading day. There also is a different line that is below the real body. This line is called lower shadow, and it indicates the lowest price point of the given trading day.

Forex charts analysis – Heiken Ashi charts

Sometimes called a better candlestick, Heiken Ashi is among the most popular trading Forex charts globally. In a sense, this chart is very similar to the regular Japanese Candlestick Charts, in fact, many traders are having a very hard time differentiating these two.

But, there are some distinctive differences between Heiken Ashi and Candlestick charts. The biggest difference that every trader should know about is the fact that, unlike candlestick charts, Heiken Ashi offers traders information in a much simpler way.

Sometimes, you don’t really need or have to go through all the details about a certain currency pair and all you need is just basic, major information about the price movements. This chart will give you only the most important, general information about the currency trading market. You will be able to see the major trends in the market.

You can tell the average high and average of the day, and the general trend that the market has. This chart was also developed and created in Japan and it shows price movements in specific colors.

Why do people love Heiken Ashi?

As we have already said, Heiken Ashi is one of the most used Forex charts globally. One of the main reasons for this is the simple design and user-friendliness of this chart. In Japanese, Heiken Ashi means ‘average bar’, and this name perfectly describes this chart.

One of the major reasons why so many people use this chart is that it makes analyzing processes much easier. This is especially true for beginners, who are having a hard time understanding the information that they get from Candlestick Chart.

As we have already noted, the open and close levels in the Heiken Ashi chart are calculated in averages. This means that when you see the closing price at this chart, it is calculated in the following way: open + close + low + close divided by 4.

As for the opening price in the Heiken Ashi is calculated accordingly: One of the previous bars + close of the previous bar divided by 2. Simply put, it shows the midpoint of the previous bar.

Line Forex trading charts analysis

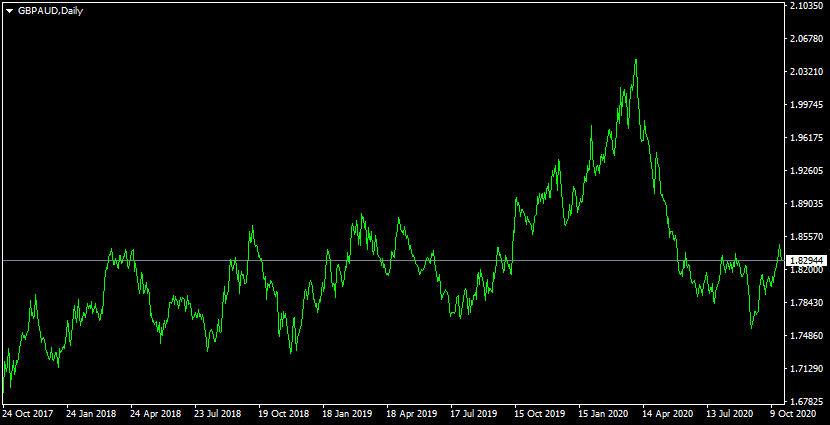

When it comes to Forex charts meaning, to put it the simplest way possible, it is something that shows you price movements in a specific timeframe. Just by looking at a line chart, you will be able to very easily tell how the prices are moving in the market.

What a line chart does is that it marks various price points of a currency pair and, after this, it connects the neighboring points to each other. The result of this connection is represented as lines.

Although this chart is very easy to understand for the major chart trends, it does not give traders detailed information about the market movements. This might be a huge disadvantage for many. However, keep in mind that this is specifically created for those who want to see the major trends in the market, without any additional information.

Unlike other charts, for example, the candlestick and Heiken Ashi, this chart does not show the close or open price of the trading day. Because of this, not everyone uses this chart, but for general ideas and information about the going events in the market, line charts can be very helpful for many traders.

If you are someone who wants to get complex information about the market, it would be better if you used charts such as Candlestick or Heiken Ashi.

Reading a Forex chart – Mountain charts

If you have ever seen the mountain and line chart together, you will be able to see that there are many things that these two have in common. The thing is, they work in a very simple and similar way – they show only the trends of the market. However, there still is a difference, but mostly about the design.

Unlike line charts, Mountain charts have the space below them filled with a color. Sometimes they are also called area charts because of the way they look. It has dips and peaks, and because it looks like a side of a mountain, it is called a mountain chart.

If you are someone who wants does not want to go in-depth about the price movements and only wants to grasp the major changes over time, this chart will be very helpful for you.

Forex chart types – Bar charts

Unlike like and mountain charts, and much like Heiken Ashi and Japanese Candlestick charts, Bar charts will give you complex and detailed information about the Forex trading market. In a given timeframe, the bar chart is capable of showing you information about four different prices of the currency pair. The bar chart has two ends, top, and bottom.

The top end of the bar shows you the highest price point, while the bottom end shows you the lowest price point of the currency pair during the trading day.

You can also see a short vertical line on the left side of the chart, which shows the opening price, and the same line on the right side of the bar will show you the closing price of the currency pair during the trading day.

There are many traders who are using this chart because of the fact that it gives traders very detailed information. However, candlestick and Heiken Ashi charts, which we have already discussed, are much easier to understand for traders.

The major reason for it is that they show market movements in different colors, making it easier for traders to understand the major trends of the market, while also getting detailed information about price changes.

Other live Forex trading charts

Throughout this guide, we have discussed some of the most popular Forex trading charts, however, there is much more that you might come across while trading Forex. Some Forex brokers even offer advanced Forex charts that were created especially for their clients.

In most cases, these charts feature different types of indicators and drawing tools, making trading much easier for beginners. Using indicators might be a very good choice for beginners and experienced traders alike.

Identifying Forex charts patterns

Understanding Forex chart patterns can be a very important part of Forex trading. Patterns in Forex trading are the price actions that have a higher than average chance of follow-through in a certain direction. Many are using patterns to decide which positions to open, and which to close. There are three major types of chart patterns, and they can be very helpful for traders.

Understanding Forex chart patterns can be a very important part of Forex trading. Patterns in Forex trading are the price actions that have a higher than average chance of follow-through in a certain direction. Many are using patterns to decide which positions to open, and which to close. There are three major types of chart patterns, and they can be very helpful for traders.

One that you might have already heard is the continuation chart pattern. This one mostly appears when the price is trending. If you see that there is a continuation of the chart pattern in trend, it means that the price of the currency pair is correcting. because of this, it is more likely for a new move in the same direction to happen.

While this tells you that the price is going to continue to increase, the reversal chart patterns inform you about a possible downtrend. This happens at the end of the trend. The reversal chart patterns show that the current trend is very likely to trend, thus, resulting in decreasing price movements.

The third one is the neutral chart pattern, and it is a little confusing. While you can tell with this pattern that the price is being pushed to a new move, it is very hard to tell which direction it is going to take.

Sometimes differentiating patterns can get very confusing. Because of this, traders can use Forex chart tools, which can give you detailed information about current trends and patterns that you can use for trading Forex.

Forex charts and technical analysis

Many traders are reading trading charts every moment. While trading Forex, or any other asset for that matter, many traders are using technical analysis, which is an amazing method to better tell the future changes in the Forex trading market.

As we have already said throughout this guide, Forex traders are usually using charts to identify the history of the price movements in the trading market. With this, they are hoping to make the right decisions about their positions. Trading charts represent one of the biggest parts of technical analysis. Many traders are using technical analysis with fundamental analysis for the best outcome.

Improve trading performance – XM MT4 Charts

How to get Forex trading charts?

Depending on the Forex broker that you are using, you will have access to the trading platform. Inside the trading platform, you will be able to use free Forex charts. Most of the Forex brokers will give you access to the majority of trading charts.

However, if you feel like the charts that are offered to you are not enough, you can always use third-party charting solutions. One of them that is very popular among traders is the TradingView.

This charting solution also works as a type of social platform for traders who want to get to know other traders and see how they are trading Forex and how they are using charts. Online, you can find many other third-party programs, that can make the process of creating and using charts much easier.

Final thoughts on Forex market charts

Forex charts perfectly visualize the price movements in the market. Thanks to Forex charts, you can see the history of currency pair prices and see how different types of events are influencing price movements.

There are different types of Forex charts available globally, and all of them are very different from one another. For example, while line charts give traders general information about the market, candlestick charts are known for giving traders very detailed information about Forex.

Comments (0 comment(s))