An analytical EuroPrime review with detailed consideration

Currently, the Forex industry is oversaturated with a large number of Forex brokers that are offering their services to traders of all kinds. EuroPrime Forex broker is one of such, operating in the European markets. It is also one of the worst Forex brokers, with a number of the worst qualities a broker could have driving their rating down. The worst of these qualities all involve the broker promoting them to be something that they are not, specifically exaggerating the qualities in such ways as to cause confusion among the potential traders and to cause them to start an account with the broker, before the traders can realize that the service they will be getting is not the service that they wanted. Combine this with the fact that the broker struggles to provide even an adequate version of the service that they are promising to their users, and as a result, you get yourself a broker that is getting closer to becoming known as a EuroPrime scam, rather than a legitimate company trying to offer their services in a competitive market.

General EuroPrime review

The first feature that is to be discussed in this general overview of the broker will be the page that they operate from. The design of the page leaves a lot to be desired, combining an ugly colour with a number of terrible geometric shapes that result in a very unsatisfying picture. Moreover, the website makes it a point to make the process of finding information about its services harder than it should be. The information is scattered across several pages instead of being kept in bunches where it would be easy to read through altogether. The only piece of information that is offered in bulk is the fact that users are able to have different levels of accounts. Each level, being more expensive, promises better services to the users. This way the users will think that it is better to deposit more money with the company. Whether the information scattering is done intentionally, to keep the users form understanding how the services might be sub-par, or unintentionally through sheer bad design, it means that the EuroPrime opinions that should be forming from the very beginning of visiting the page should already negative.

It is also important to find out and address the kind of platforms that the broker employes. The EuroPrime SIRIX web trader is the one made available to the users, and it comes in the shape of a desktop application and of a mobile application. As a desktop application, the SIRIX web trader provides the users with some of the very basics of what they will need in order to trade successfully, such as basic tools for analytics, tracking and the ability to place certain types of orders. There are no advanced functionality options for the piece of software, which means no advanced analytics or complex orders. The application is also not customizable, so users will not be able to apply changes that they feel could be useful to their trading. The mobile application is limited in the same sense, as it does not provide a high level of functionality that many users would find more useful in their work. Sometimes the mobile application freezes and crashes, which might have a terrible outcome if the broker is in the middle of placing a trade or if some other situation arises that will not be easy to remedy.

It is also important to find out and address the kind of platforms that the broker employes. The EuroPrime SIRIX web trader is the one made available to the users, and it comes in the shape of a desktop application and of a mobile application. As a desktop application, the SIRIX web trader provides the users with some of the very basics of what they will need in order to trade successfully, such as basic tools for analytics, tracking and the ability to place certain types of orders. There are no advanced functionality options for the piece of software, which means no advanced analytics or complex orders. The application is also not customizable, so users will not be able to apply changes that they feel could be useful to their trading. The mobile application is limited in the same sense, as it does not provide a high level of functionality that many users would find more useful in their work. Sometimes the mobile application freezes and crashes, which might have a terrible outcome if the broker is in the middle of placing a trade or if some other situation arises that will not be easy to remedy.

Customer support

One item that would have been useful, if the issues with the platform are as prevalent as they seem, is if the broker had an adequate customer support centre. The broker does boast that they have several ways to get in touch with their customer support centres. Namely, they list their mail address, their email address, the phone number and finally, the online chat as options to get in touch. A variety is nice to have, but only if the variety of options adds something to the experience. In the case of the EuroPrime FX brokerage, the customer service representatives are not fast to answer. Through online chat, it may take up to twenty minutes. A phone call might result in about an hour of waiting time. There is no point in discussing the wait time for the eMail and mail services, as those take far too long and they are never actually useful unless you are mailing the broker some kind important documentation. The customer service professionals are nice though, even though it seems like there are not that many of them and some of them seem to be a little tired when speaking to them on the phone.

EuroPrime withdrawals, deposits, leverage

One of the most important topics to discuss is depositing and withdrawal with the EuroPrime Forex broker. According to their website, it may take up to a few working days for the user to be able to receive the funds they withdraw from their accounts. The processing time is high because of the high clientele load, is what they explain. Beyond this, the broker also mentions that depending on the situation, certain charges to the account may apply. What seems interesting is the fact that certain charges may also apply to the deposit procedure. It seems like either to withdraw or deposit money to the broker you might have to pay extra. While this does not apply to all transactions you complete, it is entirely arbitrary and up to the broker to decide when it will happen. This means that the user may end up losing some money during the process. While some may think this means that a EuroPrime fraud scheme is running, the entirety of the procedure is legal, even if a little too expensive and taxing on the pocket of the trader.

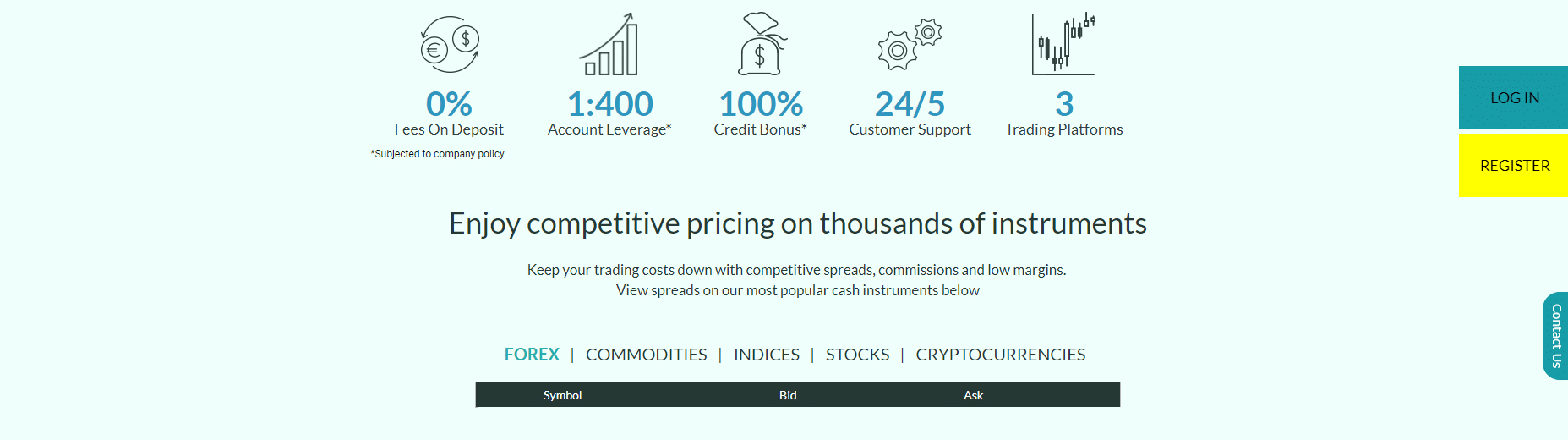

The broker also offers its users a seemingly extremely generous leverage option. This leverage option would allow users to receive around 1:400 leverage, or at least so says their front page. The thing is, this declaration comes with small text in the terms and conditions part of the page. here the broker explains that they do actually comply with the requirement that the users that are not considered to be pro users be only allowed a maximum of 1:30 leverage, while the 1:400 is only available to pro traders. While this is good news in terms of the broker not being a scam, it is bad news in the sense of it being an example of the broker inflating their services. This means that the broker is overmarketing as a way of gaining more users and it just an example of how unreliable the broker actually is. At least we know that there is no such thing as a EuroPrime scam, for now.

EuroPrime bonus offer

One interesting piece of information is that the broker also offers a number of bonuses to their potential users. These bonuses range from a 50% deposit bonus to a certain insurance type of bonus. While these are nice to see, they are also another marketing ploy to get a trader to trade with the broker. It is nice to have a bonus to start trading with, always, but the issue with the broker providing a sub-par service remains, which means that even if a user was to receive a bonus, they would end up losing the money because of the service being inadequate. This is why, while the bonuses might seem attractive, it is advisable that users remain vigilant of the rest of the broker’s qualities and abstain from being roped in by the bonuses.

Licensing

The question in this situation is “can EuroPrime be trusted?”. This question has an answer that consists of a complex number of items that need to be discussed. The fist of these are the reviews that are provided online by the past users of the brokerage. A number of these reviews state that the broke can be trusted to provide the exact service that they are saying they will be providing, as long as the beginner trader ends up reading the fine print provided by the company. A vast majority of the reviews, on the other hand, list a number of issues which all stem from the fact that the company ended up marketing the services it provides in a false manner. So, in theory, the broker can be trusted to provide a service that they promised, but only as long as the service is fully understood. The user will not be getting what is advertised.

On top of the reviews, there is also the license that the broker has received, enabling it to operate in the industry in Europe. The broker was given the license by the FSC of Belize, a regulatory body that provides many Forex brokers around Europe with its license. This grants the broker at least some credit, meaning that the users that wonder “is EuroPrime legit?” can rest easy in knowing that it is at least not a scam. Whether the traders will be receiving a service that they will be able to enjoy is a fully different question.

In Conclusion

While this might be only one of the many brokers in the industry, it is our sincere EuroPrime opinion that the broker stands out, but not in a positive manner. The broker is prone to overmarketing the services it is able to provide, bordering on lying to their users on some of the topics. Furthermore, the broker is only able to provide terrible service, as compared to all of the other brokers in the industry within Europe. It is one of the choices that should only be made if no other option remains, and even then it would be wiser of the trader to wait for a while until a more legitimate broker is found to be traded with.

Comments (159 comment(s))