Headway review – should you open an account with this broker just to claim the bonus?

Headway is an international Forex and CFD (Contracts for Difference) broker located in South Africa. The company is licensed locally by the FSCA (Financial Sector Conduct Authority) of South Africa.

Headway registers clients from all over the world except for the few sanctioned countries and the United States of America residents. The broker offers various asset classes for trading such as stocks such as CFDs, indices, commodities, crypto, and FX pairs. The company offers the most popular trading platforms such as MetaTrader 4, and MetaTrader 5.

Because the regulations are not strict, the broker is able to offer various promotions and high leverage. Let’s delve into understanding the broker’s trading conditions and if it’s worth opening a live trading account just to claim the bonus. In our review we will discuss all the important aspects of Forex brokers, such as trading fees, safety and security, account types, account opening, education, customer service, and more.

The Safety and Security of Headway

Safety and security of your funds should be at the top of your priority list when searching for an FX broker. But how to find a safe broker? To answer this question, let’s first figure out what do we mean by safe. There are essentially three categories of financial brokers:

- There are brokers that are fraud

- There are brokers that are not fraud, but use sketchy practices to attract new traders such as offering high leverage, promotions, and trading competitions. This approach is effective in attracting traders with gambling like attitude

- There are brokers that are strictly regulated and never try to urge traders overtrade

Headway is not a fraud broker, but on the downside, its regulator is not top-tier. This enables the broker to offer high leverage, the 111 USD bonus promotion, and gift shop.

Headway is operated by JAROCEL PTY LTD. And the company is authorized and regulated by FSCA (Financial Sector Conduct Authority), license number 52108.

In addition, Headway provides its clients with Negative Balance Protection (NBP), which guarantees that traders will not lose more money than what’s on their trading balance. Trading CFDs involves the usage of leverage. In this broker’s case, available leverage is unlimited, meaning that traders can open huge positions using borrowed money from their broker. And if trade goes against the plan and makes huge jumps during increased volatility, trades can result in huge losses, and make the trading balance go negative. The NBP simply means that if this actually happens, the broker will cover for the losses and revert the account balance back to zero. To make sure that this doesn’t happen, or doesn’t happen often, there’s Stop Out levels in place. Margin call occurs at 30% and the traders are stopped out from their active positions automatically once free margin levels reach 0%.

The dangers of trading with high leverage

Having access to high leverage might seem enticing from the start because it allows traders to control larger positions with relatively small amounts of capital, but in reality, high leverage increases the risks significantly. The number one reason why most traders lose money is that they pick high leveraged positions and once the trade goes against their predictions, account balance gets the hit. Leverage is often referred to as a double-edged sword, as leverage increases the potential losses and gains simultaneously. It’s extremely difficult for traders to have unlimited leverage, deposit a 100 USD and use proper risk management rules. What typically happens is that a trader deposits the money, loses it all, and then deposits again just to take oversized trade and lose everything once more. Trading without proper risk management in place is very similar to gambling.

Promotions offered at Headway

Headway offers a 111 USD welcome bonus to its new clients. The bonus cannot be withdrawn, but traders are allowed to withdraw the profits generated from trading using the bonus. But there’s a twist. Even the profits cannot be withdrawn right away. Traders need to meet certain trading goals and reach predetermined turnover to be able to get the money. After reading this information, you might be reconsidering opening the account with Headway just for claiming the money. Let’s learn more about the terms and conditions of the promotion. There are a couple of steps traders need to take:

- Traders need to open the live account and grab the bonus. The bonus is activated without the need of account verification or any deposits from the trader’s end.

- The bonus is active for 7 days, and traders need to trade during this period.

- Once the bonus period is concluded, the bonus account will be closed. The profits will be visible in the personal area. And the profits can be withdrawn after meeting the conditions.

- Traders cannot trade using the bonus money to meet the withdrawal requirements. It is required to make deposits on the live accounts.

To break it down: if you’ve earned 60 USD in profits in the seven days, you’ll need to deposit money and trade 20 lots to withdraw the entire amount. You can also withdraw a part of the profits, for instance, to withdraw just 6 USD, you will be required to trade 2 lots.

The clear dangers of this promotion includes: the danger of overtrading, and danger of using high leverage. Overtrading refers to a practice when traders place unnecessary orders when there’s no trading opportunities at present. Overtrading and increased position sizes almost always result in losses, and they promote gambling-like approaches to trading.

Trading fees at Headway

Finding a Forex/CFD broker that offers low trading fees is critical for success. The impact of fees on your balance may seem insignificant at first glance, but if you actually calculate how much money is spent in fees, you will be shocked, especially if you are an active trader.

There is no inactivity fee on Headway, and in general, trading fees are low. Spreads in Cent and Standard accounts are as low as 0.3 pips. And the commissions on Pro accounts are up to 1.5$ each side per lot. In addition, the broker doesn’t charge traders for deposits and withdrawals. Overall, trading fees are low.

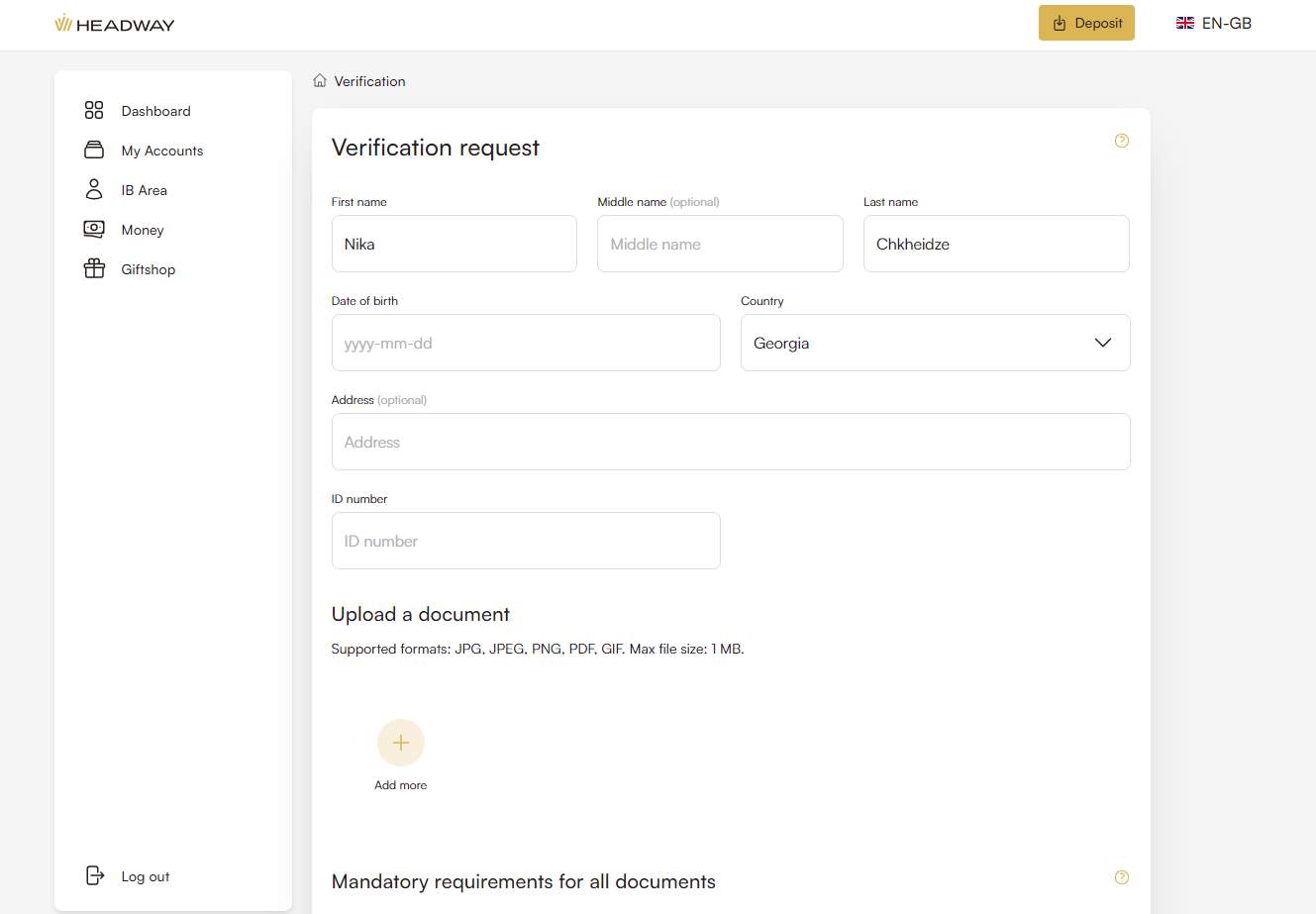

Account opening

The account opening process at Headway is a smooth and user-friendly experience. In order to open a live trading account with this broker, traders first need to register by clicking on the “Personal Area” from the Headway’s main page. Traders will be transferred to the sign in page, where they can press “Register” and start the process.

Once the registration process is finalized, it’s time to verify your trading account. It is true that you can simply deposit money and start trading, but if you do not have a verified account, you won’t be able to withdraw money from the broker.

The verification process is simple, simply fill in the application form and provide the broker with two documents:

- Proof of your ID: you can use your driving license, international passport, or ID card for proof of your ID. You can scan the documents, or take a digital photo using your smartphone. Just make sure that the photo quality is good, the document has no light reflections or shadows and the information is clearly visible.

- Proof of your residence: you can use a utility bill, or a bank statement as proof of your residence. Similarly, the information in the uploaded documents needs to be clearly shown.

After the verification is completed, you can download the trading platform of preference, and start trading.

Account types

When starting the trading journey, selecting an account type that can serve you best is critical for success. Brokers offer different account types to meet the requirements of different trader types. For instance, traders that place orders frequently and are highly active, are looking for account types with low spreads and high trade execution speed, and traders that are less active, are looking for accounts with low commissions.

To meet the needs of all trader types, Headway offers 3 account types:

- Cent account – works best for traders that do not have big capital to invest in trading and for individuals that wish to live test their trading strategies without risking too much capital.

- Standard account – is created for traders that are less active such as position traders and swing traders. This account type offers zero commissions and trading fees are included in spreads. This fee structure benefits low frequency traders the most.

- Pro account – best suits active traders, such as scalpers, news traders, intraday traders, high frequency traders, algorithmic traders. Spreads on this account start from 0 pips, instead trading fees are charged in the form of commissions.

Let’s take a closer look at each trading account and compare their features side by side.

| Account name | Cent account | Standard account | Pro account |

|---|---|---|---|

| Best suited for | Beginners, traders that wish to live-test their strategies | Beginners, swing traders, position traders | Active traders, scalpers, high frequency traders, intraday traders |

| Minimum deposit | 1 USD | 10 USD | 100 USD |

| Account currency* | USD | USD, EUR, IDR, JPY, THB | USD, EUR, IDR, JPY, THB |

| Spread | Floating from 0.3** | Floating from 0.3** | Floating from 0.0** |

| Instruments

(Stocks, indices, and FX indices available for MT5 trading) |

More than 300:

Forex, cryptocurrencies, metals, energies, stocks, indices, FX indices |

More than 300:

Forex, cryptocurrencies, metals, energies, stocks, indices, FX indices |

More than 350:

Forex, cryptocurrencies, metals, energies, stocks, indices, FX indices |

| Maximum lot size | 1000 | 500 | Unlimited |

| Maximum number of positions | 300 | 1000 | Unlimited |

| Commission | No | No | Up to 1.5$ each side per lot |

| Minimum lot size | 0.01 | 0.01 | 0.1 |

| Leverage(Unlimited leverage is available after trading standard 5 lots) | from 1:1 to 1:Unlimited | from 1:1 to 1:Unlimited | from 1:1 to 1:Unlimited |

| Order execution speed | from 0.16 sec | from 0.16 sec | from 0.16 sec |

| Swap-free*** account version | Yes | Yes | Yes |

| Limit & Stop Levels | 0 | 0 | 0 |

| Margin call | 30% | 30% | 30% |

| Stop out | 0% | 0% | 0% |

* Account currency is a currency traders open their accounts in. This simply means that, for example, if you use EUR in your daily life and open an account in EUR, you’ll be able to save currency conversion fees during deposits and withdrawals.

** “Spreads from” term simply means that there are market spreads and spread markups. Spreads naturally occur in the financial markets due to the difference between bid and ask prices. Some brokers include trading fees in spreads as markups, while others have no spread markups and charge traders with commissions per traded lot instead. In this case, the broker offers both options in different account types.

***Swap-free accounts are also known as Islamic accounts because these accounts were created in compliance with Islamic finance.

Available trading platforms at Headway

Trading platforms play a crucial role in financial trading. There are numerous ways they help traders make the trading process easier. Platforms are primarily used for trade execution, and there are various different order types on each platform. They also help in market analysis, risk management and accessibility. It’s super convenient to have access to your trading account through multiple devices such as desktop apps, mobile apps, and web based platforms.

Headway offers the most popular MetaTrader platforms that support mobile and web trading as well as desktop software. The MetaTrader platforms are super reliable and super popular.

Traders can choose between MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms were developed by a Russian software company named MetaQuotes. And while both platforms have a lot in common, there are substantial differences that make them completely different when it comes to trading. Let’s take a look at the comparison table below:

| Platform | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Supported market classes | Forex, indices, commodities, crypto CFDs | Forex, indices, commodities, crypto CFDs, bonds, shares, options, futures |

| Execution models | Execution on request, execution by market, instant execution | Execution on request, execution by market, instant execution, exchange execution |

| Order types available | Buy/sell stop orders, buy/sell limit orders | Buy/sell stop orders, buy/sell limit orders, buy/sell stop limit orders |

| Supported timeframes | 9 | 21 |

| Graphical Objects | 31 | 44 |

| Technical Indicators | 30 | 38 |

| Economic Calendar | No | No |

| Community Chat | No | Yes |

| Risk Management strategies | Hedging | Hedging and Netting |

| Strategy Tester | Single-thread strategy tester,used for testing simple trading strategies | Multi-thread strategy tester,

used for testing simple and complex strategies |

| Programming language | MQL4 | MQL5 |

MT5 is known as a multi-asset platform because it supports more asset classes. Typically traders that wish to trade not only FX but also stocks, choose this platform. And traders that aim to solely trade currencies, pick MT4. MT4 is less complex and offers an user-friendly interface.

One super important feature that MT5 has and MT4 lacks is DoM (Depth of Market). Traders can open the DoM window on MT5 and observe the bid and the ask prices. This feature helps price action analysts make market sentiment predictions. Bid and Ask prices are also used in deciding where to put Stop Loss (SL) and Take Profit (TP) orders.

Mobile trading platforms at Headway

The broker provides mobile versions of the MetaTrader 4, and MetaTrader 5 trading platforms to its customers. The platforms are available for both iOS and Android users. The mobile apps offer many benefits to traders who want to remain connected with the financial markets and manage their trading activity on the go. The platforms enable traders to execute multiple trading orders, analyze trading charts in real time, and manage their trading portfolios. The mobile accounts are connected with desktop software. Which makes trading highly convenient.

The mobile apps offered by the broker also serve as a highly useful tool in emergency situations. For instance, imagine that there’s a power outage, you’ve lost connection on your computer, or the computer simply starts updating windows in the middle of the trading session. You can use the mobile apps in such cases. You can close active trades you forgot to put stop loss orders on, or place the stop loss orders on the mobile. On the other hand, it’s important to note that mobile apps come with their own limitations. The most obvious one is the size of the screen. Often, it’s best to conduct market research on a larger monitor.

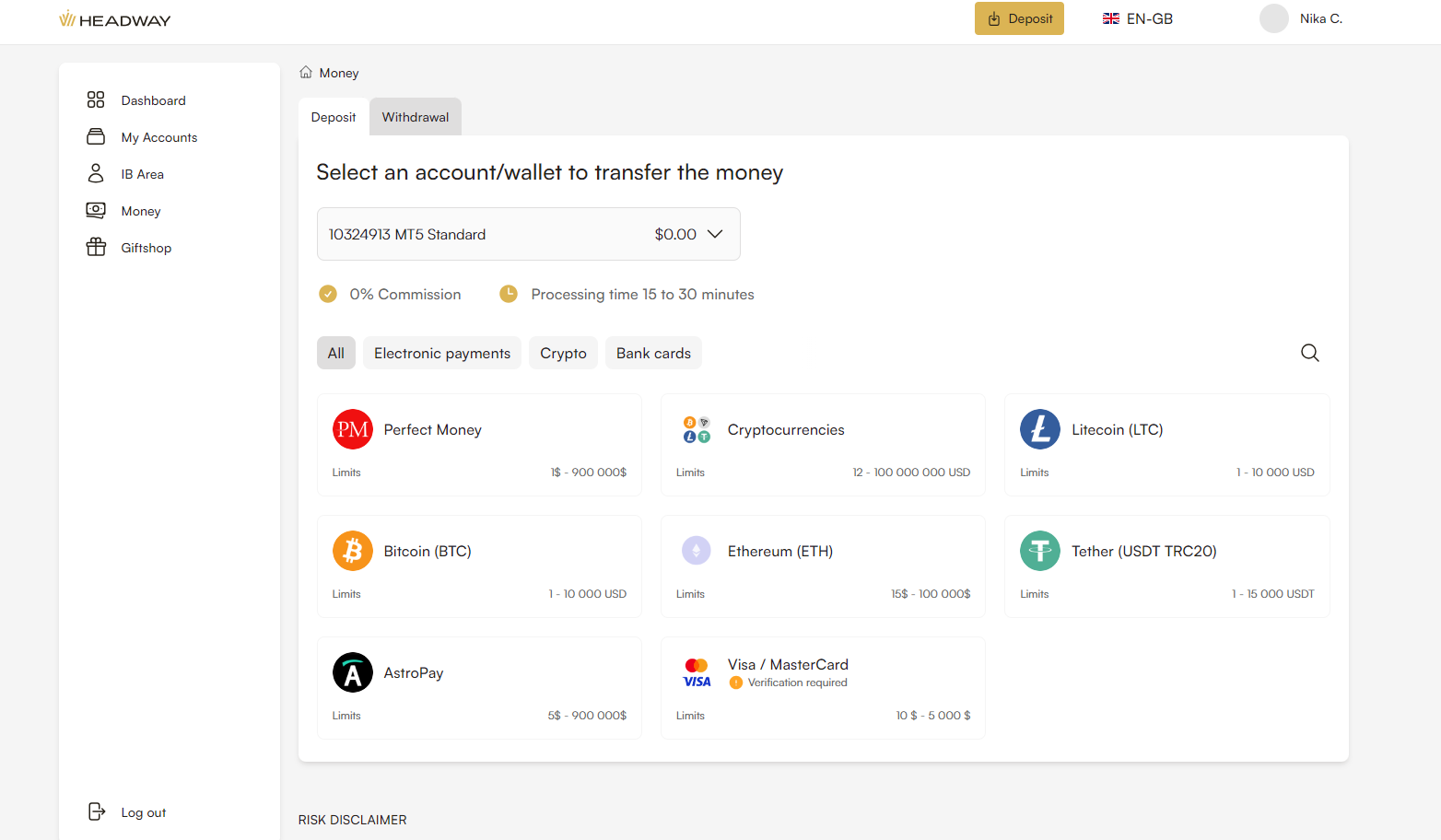

Deposits and Withdrawals

The broker enables traders to use various deposit options to fund their live trading accounts. There are zero commissions from the broker’s end and the processing time is typically ranging between 15-30 minutes. While most methods have no minimum deposit requirements, in case you are planning on using Credit/debit cards you can only deposit within 10-5000 USD limits per transaction.

When it comes to withdrawals, as already stated previously, traders need to have verified trading accounts in order to be able to withdraw their funds.

Markets and Products at Headway

When selecting your next trading broker, finding the one that offers the asset classes you wish to trade is essential. Traders should never settle for less when it comes to the products aspect because there are so many brokers out there offering access to huge amounts of trading instruments. Having access to a wide range of instruments gives traders flexibility in their trading activities.

There are 353 instruments available for trading at Headway. However, it should be mentioned that the number is considerably less for MT4 users. The number of accessible instruments for Cent, and Standard account holders is approximately 300. Only Pro account users can experience the full range of instruments offered by the broker.

Forex trading at Headway

There are 70 currency pairs available for trading at Headway. The broker offers access to major, minor, and exotic pairs with unlimited leverage and spreads starting from 0.3 pips (For Cent and Standard accounts). Traders can access popular trading instruments, such as:

- Euro vs US Dollar (EUR/USD)

- Great Britain Pound vs US Dollar (GBP/USD)

- New Zealand Dollar vs US Dollar (NZD/USD)

- US Dollar vs Canadian Dollar (USD/CAD)

- US Dollar vs Japanese Yen (USD/JPY)

- US Dollar vs Singapore Dollar (USD/SGD), etc.

Metals and energies trading at Headway

There are 8 Metals as CFDs available for trading at Headway. Spreads start from as little as 1.4 pips on Gold vs US Dollar when trading using the Pro account (no spread markups). Precious metals as CFDs can be traded using leverage and traders can make money in even bearish markets by shorting the CFDs, this option is not available for investors purchasing physical gold. There are only Gold and Silver coupled with various major currencies available for trading with this broker.

Clients of Headway have the opportunity to invest in popular energy CFDs such as Crude Oil Brent, Natural Gas, and Crude Oil, against the US Dollar. Let’s take a look at the comparison table for Pro account users.

| Instruments | Minimal spread | Commission | Margin | Swap long | Swap short |

|---|---|---|---|---|---|

| Crude Oil Brent vs US Dollar (XBR/USD) | 3.3 pips | $1.5 | 0.5% | -25.3 | -12.8 |

| Natural Gas vs US Dollar (XNG/USD) | 8.8 pips | $1.5 | 5% | -87.2 | 0 |

| Crude Oil vs US Dollar (XTI/USD) | 1.1 pips | $1.5 | 0.5% | 3.25 | -25.4 |

Crypto trading at Headway

Trading cryptocurrencies and speculating on their massive price changes is becoming increasingly popular around the world. At Headway, traders are offered cryptos as CFDs and not crypto tokens.

There are 32 crypto assets as CFDs available for trading. Let’s take a look at some of the available options and their conditions on the comparison table below.

| Name of the crypto pair | Minimal spread | Commission | Margin | Swap long/short |

|---|---|---|---|---|

| Bitcoin vs US Dollar (BTC/USD) | 3.5 pips | $1.5 | 0.25% | 0 |

| Etherium vs US Dollar (ETH/USD) | 0 pips | $0.5 | 0.25% | 0 |

| Litecoin vs US Dollar (LTC/USD) | 0 pips | $0.25 | 0.5% | 0 |

| Bitcoin Cash vs US Dollar (BCHUSD) | 0 | $0.5 | 0.5% | 0 |

| Solana Token vs US Dollar (SOL/USD) | 13.8 pips | $1 | 5% | 0 |

As already mentioned, there are no physical crypto tokens at Headway, only CFDs. It should be noted that physical tokens are for investing in crypto long term, and CFDs are for market speculation. Physical assets cannot be traded using leverage.

Some of the key advantages of trading crypto CFDs over physical cryptos include:

- When traders use crypto CFDs, they can go short and make money even in falling markets, while this is not available for physical token investors.

- CFD traders have access to leverage.

- Crypto CFDs are more liquid than physical tokens.

Indices trading at Headway

There are 34 indices available for trading at Headway. Indices or stock indexes are the type of investment instruments that enable traders to invest in multiple stocks at the same time using one index. For example, Hong Kong 50 Index, typically refers to the Hang Seng Index (HSI), tracks the performance of top 50 company stocks listed in the Hong Kong stock market. By investing in indices, traders are not betting on one individual company, instead they bet on entire sectors or industries.

Investors can invest in indices or trade them short term. In addition, indexes have one more use, they help in market analysis. Prices of certain indexes represent collective prices of certain baskets of individual stocks, which gives analysts clues about how good or bad certain economies are doing.

Stocks trading at Headway

There are 205 individual stocks as CFDs for trading at Headway. Keep in mind that these assets are only available on MetaTrader 5 (MT5). Stock CFDs are perfect for market speculations, but investors typically use physical/real stocks for long term investing. What we’ve said about the benefits of trading CFDs earlier, is also true for stock CFDs, including the ability to short-sell, use leverage, and enjoy high liquidity. The broker offers access to popular stocks, such as:

| Name of the Company | Minimal spread | Commission | Margin | Swap long/short |

|---|---|---|---|---|

| Apple Inc. (AAPL) | 2 pips | $1.5 | 5% | 0 |

| American International Group (AIG) | 5 pips | $0.5 | 5% | 0 |

| Amazon.com, Inc. (AMZN) | 1 pips | $1.5 | 5% | 0 |

| Alibaba Group Holding Limited (BABA) | 4 pips | $1.5 | 5% | 0 |

| Meta Platforms, Inc. (META) | 2 pips | $1.5 | 5% | 0 |

Customer service

Customer support is an essential component of every Forex broker as it directly affects the overall trading experience. Customer support agents help in technical assistance and guidance. In addition, professional customer service plays a critical role in problem resolution at an early stage.

Headway offers multilingual support via live chat, email, and over the phone. The broker is also very active on social media sites such as: Facebook, Instagram, Telegram, and Youtube. Supported languages include: English, Indonesian, Japanese, Malaysian, and Thai.

Education

Quality education in Forex and CFD (Contracts for Difference) trading can have a significant impact on trading results. Traders need to understand market dynamics, learn how to manage emotions and risks, develop tools and techniques for technical analysis, understand fundamentals that influence price creation, and learn how to use trading platforms. In this process, brokers are trading to aid their clients and turn beginners into professionals that stay in the game long term. However, unfortunately, educational materials offered by Headway are limited. Traders can access the education section by clicking on the “Learn” tab from the brokers window. The Learn tab will transfer visitors to an educational page. The education page mostly includes articles and blogs regarding financial trading and investing. On the downside, there are no webinars, seminars, or one on one training courses. Overall, the educational section is not great with this broker.

Closing thoughts

To sum everything up, Headway is an international broker that operates globally and offers CFDs on Stocks, indices, crypto, commodities, and currencies. The trading fees are reasonable, and the available trading platforms are industry standard (MetaTrader 4, MetaTrader 5). While the broker is regulated, the regulator is not strict that enables Headway to offer unlimited leverage and promotions. Education offered by the broker is not great, and the customer support is average. It is certain that Headway is not the greatest broker we have reviewed. You can read more of our reviews and you’ll easily discover Headway’s competitors with better trading conditions and access to more tradable instruments. Opening an account with this broker just for the offered bonus makes very little sense to most traders as the bonus offered cannot be withdrawn, and the profits generated from the promotion can only be withdrawn if the trader places a certain number of trades within the 7 day range.

FAQs on Headway

Is it worth taking bonus offers from Headway?

Headway offers traders a 111 USD welcome bonus. However, there’s a twist. Traders cannot withdraw this bonus. They can only withdraw profits generated from this bonus amount. But, there’s another twist, traders can only withdraw the profits after reaching trading objectives and trading a certain number of lots. In addition, there’s a 7 day time restriction, which means that traders need to use the 7 days to meet the terms and conditions, otherwise the progress will be lost. It is difficult to recommend our readers to get the 111 USD bonus offer, which is not really a gift you can withdraw to your bank account.

Is Headway a safe broker?

Headway is authorized and regulated by FSCA (Financial Sector Conduct Authority), license number 52108. The FSCA is a South African regulator and it is not a top-tier one. It should be mentioned that there is no other regulatory body that oversees the broker. For these reasons, we do not consider Headway to be a safe broker.

How much is leverage with Headway?

Headway offers unlimited leverage to its clients. This is another clear sign that Headway is loosely regulated. Typically, brokers that are overseen by top-tier institutions, offer conservative leverage. Trading using high leverage is highly dangerous and often leads to destruction of trading balance.

Comments (0 comment(s))