Legacy FX Review – Disadvantages to Expect With This Broker

Since 2017, LegacyFX has been a broker with numerous flaws in various elements of the business. Customers can trade FX and CFDs on a variety of assets, including gold, oil, cryptocurrencies, indices, and stocks. LegacyFX has a number of certifications, including the CySEC, FCA, and BaFin, all of which are aimed at boosting financial transparency and protecting clients. It’s a different question how successfully they execute this.

It has some of the worst trading conditions on the market, with spreads as low as 1.6 pips.

Cryptocurrency trading has gained a lot of traction in the market. Cryptocurrencies are used by millions of people for trade, and the number of cryptos is growing by the minute.

You can also trade thousands of CFDs on global indexes with the broker. Indices are a collection of stocks that can be traded together. It measures the efficiency of a given economic sector and may be traded using CFDs.

The firm provides MT5 software as a trading platform for its consumers. MT5 stands for Multi-Tasking Platform 5, which is a cutting-edge and widely utilized trading platform. It is popular among users because of its excellent research software, mobile apps, and a vast selection of assets and charts. This platform has proven its worth over time, regardless of whether a user is a seasoned or rookie trader.

Can LegacyFX Be Trusted?

According to LegacyFX reviews, the firm has a number of qualifications, three to be exact. However, after conducting research on the site we have found that this is a lie. This brokerage firm has a Vanuatu license.. There are no three regulatory bodies that are in charge of overseeing this brokerage firm’s services and products. The firm only has one, VFSC qualification and that is it.

What Account Types are There on LegacyFX?

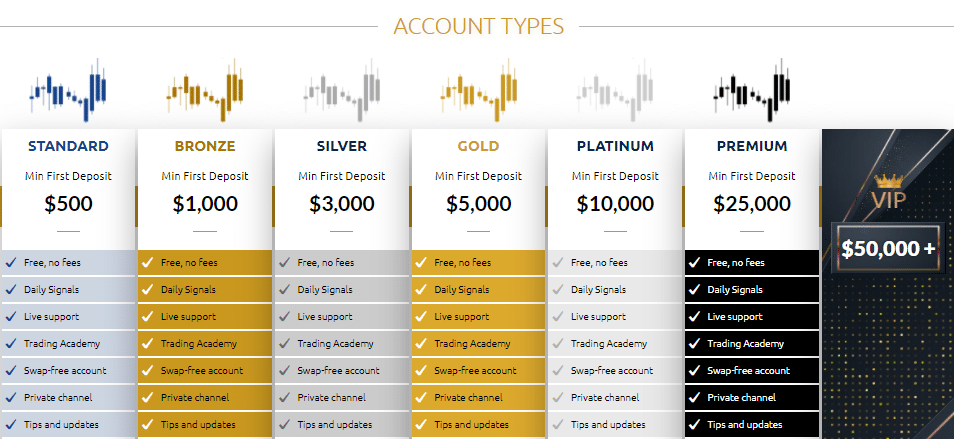

There are seven account types available on the site. The authenticity of LegacyFX brokers will be discussed in this section of our evaluation. Nowadays, brokers can be regulated by multiple regulatory bodies, which may appear shady, as brokers must now demonstrate their intentions through their actions; simply having qualifications will not suffice with today’s consumers, who are well aware of both the positive and negative aspects of the industry.

The broker offers three different account types to suit the demands of any trader that registers.

The Silver trader account is the most convenient, with a $250 minimum deposit requirement. When compared to the minimum deposit requirements, this appears to be adequate for a beginning trader.

Surprisingly, the Silver account offers a lot of features: it includes everything that the higher-tier accounts provide, with the exception of the Dealing Room direct line, advanced analysis, and 1-on-1 help.

Minimum Deposit

The minimum depositing amount is a very important aspect of any brokerage firm. The minimum requirement for traders on this site is $500. Which is very stiff. Usually, other brokers, counterpart firms require much less money for depositing purposes. This is evident in the presumptuous nature of the brokerage firm as they want money they want to get it by lying.

Leverage

The optimal time frame for a currency pair is determined by the pair’s most stable time frame.

You may do the same for your selected pair by keeping an eye on the news and events surrounding the currencies involved. It is usually a few hours after the currency market opens. You can keep an eye on the couple for a few days to figure out when the best times are. The maximum leverage available for the consumers is 1:200.

Bonus

There are no bonuses on this site and the firm seems to think that a loyalty program is a valid form of promotional offer when it’s just a marketing ploy made by the firm. The ways the company rewards its consumer’s loyalty is preposterous and only beneficial for the firm.

They imply that they provide Specialized content within the program, this is such a vague notion and also a call with the principal account manager should not be a luxury as many counterpart firms have it as a regular feature. But the most laughable promotional gifts are the three stages of Personalized Gifts on different levels of the loyalty program. This is such a stupid idea to begin with and the fact that the ultimate prize is a gift card says many things without even further inspection. The whole program is tone-deaf.

Spreads

Fixed spreads for popular currency pairings like EUR/USD start at 1.6 pips with the Silver account. The spreads on the Gold and Platinum accounts are much tighter, down to 0.6 pips. Fixed spreads on major currency pairs trading with the Silver account are roughly 3 pips.

Final Words

All in all, this is not a forex brokerage firm that we would recommend our readers to do business with.

Despite the fact that the company claims to provide bilingual customer service, this is not the case. The customer service department is staffed by irritable Russians with limited English skills. Who is hesitant for you to join up and make a deposit in order to trap you in a scam and take all of your funds.

The following is how unregulated forex brokers typically operate. InvestMarkest, despite being regulated in some way, tries to persuade individuals to make the first minimal deposit, and they’ll use any trick in the book to do so. They will make promises that seem too good to be true, such as easily tripling your initial deposit or making $500 each day.

Overall we would recommend one to stay away from this brokerage as it has many markers of a faulty brokerage firm and we have a presumption that the service and products of the company are not great.

Comments (1 comment(s))