Noor Capital UK Forex Review

Is Noor Capital UK legit? This Forex Trading Bonus review about Noor Capital UK will dig deep into the broker’s critical specs and allow our readers to define whether they can trust Noor Capital. Ensure you read everything till the end to see our unbiased Noor Capital UK opinion.

Noor Capital UK Forex Broker History

Noor Capital UK is a regulated Forex and CFDs broker based in the UK and regulated in the United Arab Emirates by the Central Bank. Noor Capital UK scam is, therefore, highly unlikely as the broker is regulated since 2005. It offers ECN types of accounts and 60-plus trading instruments in Forex, indices, commodities, and equities on the MT5 platform. Spreads are competitive, and trading commissions are average. The broker has been around since 2005, making it very experienced in the industry. It mainly targets traders from the UAE and offers Islamic account types as well as accounts with different tiers. In today’s review, we will dive deeper into the critical specs of the Noor Capital UK broker and evaluate how reliable this broker truly is.

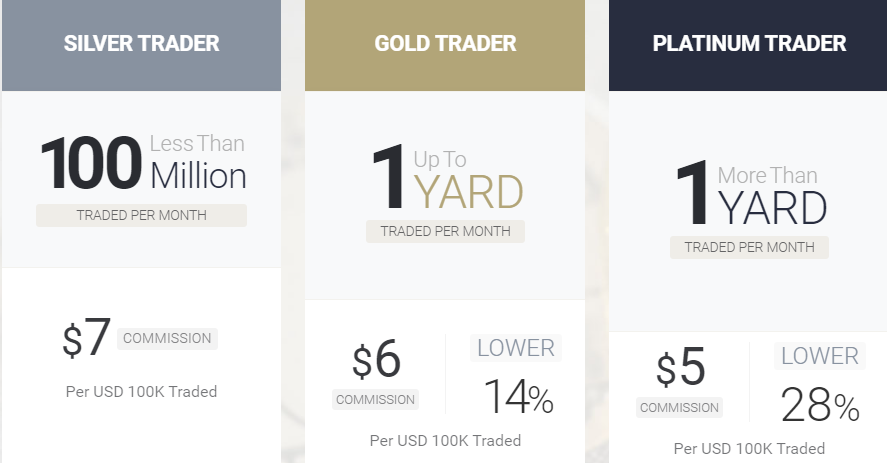

Noor Capital UK Broker Review of Accounts

Noor Capital UK accounts are divided into three tiers depending on the monthly turnover of the trader, Silver Trader, Gold Trader, and Platinum Trader. They all have similar basic specs, except for trading commissions per lot traded. The trading commission per 100k traded is 7 USD for the silver, 6 USD for the gold, and 5 USD per 100k for the platinum account. The Silver Trader tier is assigned to traders who trade less than 100 million USD per month. Gold traders have to trade up to 1 billion USD, and traders with above 1 billion USD monthly turnover are assigned the Platinum Trader status.

Here are other specs for all three trading accounts:

- Account base currency — EUR, USD, GBP

- Trading assets — 60 plus Forex pairs, indices, commodities, equities

- Maximum leverage — up to 1:100

- Spreads — From 0.2 pips (floating)

- Minimum lot size — 0.01 lots

- Execution type — ECN

- Hedging, EAs, One-click trading — Allowed

- Trading platform — MetaTrader 5 (MT5)

The broker allows mobile trading for both Android and iOS devices, allowing traders to speculate on markets on the go. There is also an Islamic account available for Sharia law followers.

The spreads seem competitive, which is natural, as Noor Capital also charges trading commissions based on trading volume. This is typical for ECN accounts, where brokers offer low spreads for small charges designed for scalpers. In essence, Noor Capital UK is more suitable for scalpers, meaning traders who love to speculate on extremely short movements for small profits.

Here are typical spreads for popular assets:

- EURUSD — from 0.2 pips

- USDJPY — from 0.5 pips

- AUDCAD — from 1.2 pips

- GBPUSD — from 0.3 pips (one of the lowest floating spreads for this pair)

- Gold — from 0.7

- Silver — from 1.9

Noor Capital UK Reviews of Trading Platforms

Noor Capital UK offers MetaTrader 5 (MT5) for all devices and offers it for free download, similarly to all other brokers. MT5 while being the successor to MT4 is still not as popular, and it is a downside for the broker not to offer MT4. In all other terms, MT5 offers similar and more advanced capabilities than MT4, so, it should be sufficient to do any trading task. Noor Capital UK allows Expert Advisors(EAs) or Automated trading robots and one-click trading, offering the full functionality of the MT5 advanced platform.

Noor Capital provides MT5 for all devices including mobile and web traders, meaning traders can control all MT5 versions with just one credential, which is advantageous. Traders should be able to trade from anywhere in the world using mobile MT5 apps.

Noor Capital UK Forex Review of Extra Features

Noor Capital UK offers an economic calendar and trading cost guides to help traders make informed decisions. The broker also offers services to institutional clients and has a decent referral program. There are no trading bonuses available at the moment, which is a downside for this broker. No other extra features stood out when we were researching the broker on their website and the web.

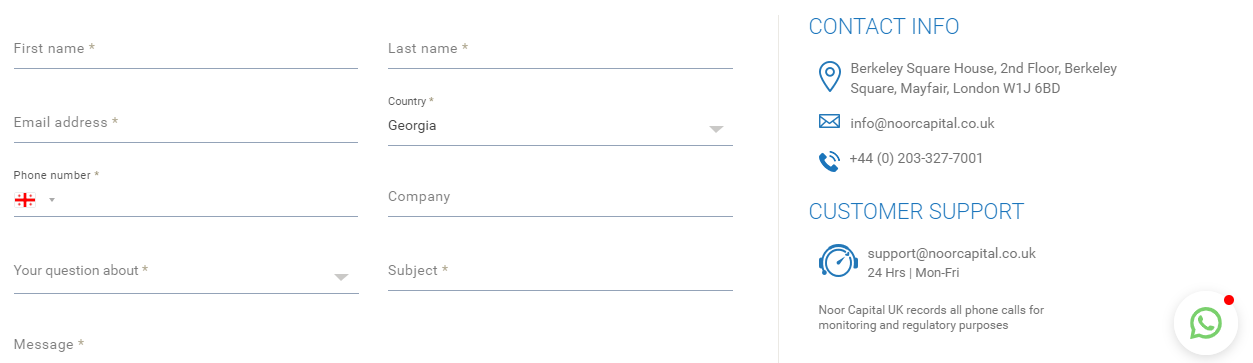

Noor Capital UK Reviews of Customer Support

Noor Capital UK Customer support includes popular channels such as live chat, email support, phone support, and online form (also email support). The live chat is provided via WhatsApp, which requires users to download and register with the app for using it. For existing WhatsApp users, it is not uncomfortable. But for users who do not have it, it is a time-consuming process and requires additional hassle. Support is available 24/5. Both the support and website can be accessed in two languages: English and Arabic.

Noor Capital UK Deposit and Withdrawal

From payment options, Noor Capital UK accepts only three options: debit cards credit cards, and wire transfers. No popular online wallets are available and there are no cryptos accepted as well. Both the deposit and withdrawals take some time to be completed. For wire transfers deposits and withdrawals can take 1 to 5 working days, and for bank cards, the time is reduced from 24 to 48 hours. The broker will process all withdrawals within 2 business days if the request was sent before 11 am UK time during any business day.

Noor Capital UK Review Conclusion

In the end, Noor Capital UK is a well-established Forex and CFDs broker, operating since 2005 and regulated by the Central Bank of the UAE. The broker offers three account tiers of the same account with different trading commissions. There is also an Islamic account, as the broker mainly targets traders from the UAE and offers both the website and support in Arabic as well as in English languages. The trading platform is MT5 and traders can access to Forex pairs, commodities, indices, and equities. There are no cryptos or any other asset classes offered as of now, nor are there any bonus promotions. However, an economic calendar is offered, and the broker also targets institutional clients. Support forms include email, live chat using WhatsApp, and phone support, together with the physical offices in certain cities. Deposits and withdrawals are accepted via bank cards and wire transfers and take between 1 and 5 business days.

Overall, Noor Capital UK seems an average broker that has all services balanced and should be reliable as it has been around for some time now. The Noor Capital UK fraud is highly unlikely as the broker is regulated and experienced in the FX industry.

Comments (0 comment(s))