OnEquity Forex Broker Review

Read our comprehensive review of OnEquity broker to define whether you can trust this broker. We are going to assess the broker’s critical features including safety, accounts, support, platforms, and more.

OnEquity broker background — A brief overview

OnEquity is a Forex and CFDs broker that offers access to Forex, commodities, indices, stocks, and crypto CFDs. The broker allows traders to trade with up to 1:1000 leverage which is allowed by Seychelles FSA. This leverage is high and can allow novice traders to blow their accounts easily, which is never a good thing. There are not many reviews online and the broker is regulated offshore, which is a red flag. The broker allows access to multiple popular indices including NASDAQ 100, and GER40. There are US, UK, and European stocks offered. From Forex pairs, there are more than 40 instruments, which is not much but still decent. The broker also offers more than 15 crypto CFDs, which increases both potential profits and losses, as CFDs are risky asset classes.

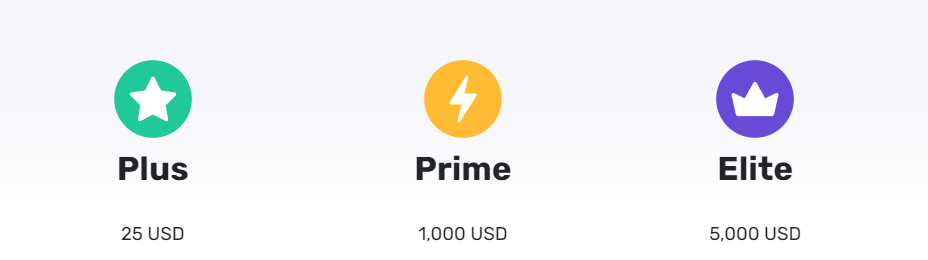

OnEquity Review of Accounts

OnEquity Forex broker offers three different account types, Plus, Prime, and Elite accounts. Each of these accounts provides slightly different trading conditions, with the Plus account starting from 25 USD and 1.5 pips spreads. To get 0 pips spread, traders have to deposit at least 5,000 USD in their accounts, which is super expensive for the average Forex trader. The broker is not competitive in the spreads department, as many reliable brokers offer much more attractive conditions with much fewer deposit requirements. Let’s overview each of the three accounts in more detail below.

OnEquity Plus account

The Plus account is an entry-level trading account with just a 25-dollar minimum deposit requirement. Let’s list the main specs of this account:

- Minimum deposit — 25 USD

- Typical spreads on EURUSD — From 1.5 pips

- Account base currency — USD, EUR, JPY

- Maximum allowed leverage — Up to 1:1000

- Commissions per lot — 0 USD

- Trading platforms — MetaTrader 4, MetaTrader 5

- The number of instruments — Over 300

- Minimum lot size — from 0.01 lots

- Negative balance protection — Yes

- Islamic account variant — Yes

The Plus account offers a low minimum deposit, but spreads are expensive and not reasonable for scalping strategies.

OnEquity Prime account

The Prime account has the following specs:

- Minimum deposit — 1,000 USD

- Typical spreads on EURUSD — From 0.4 pips

- Account base currency — USD, EUR, JPY

- Maximum allowed leverage — Up to 1:1000

- Commissions per lot — 5 USD

- Trading platforms — MetaTrader 4, MetaTrader 5

- The number of instruments — Over 300

- Minimum lot size — From 0.01 lots

- Negative balance protection — Yes

- Islamic account variant — Yes

This account offers lower 0.4 pips spreads but charges commissions, which makes it expensive to trade for scalping strategies. The minimum deposit is also high from 1000 USD.

OnEquity Elite account

And for the Elite account, OnEquity offers the following conditions:

- Minimum deposit — 5,000 USD

- Typical spreads on EURUSD — From 0.0 pips

- Account base currency — USD, EUR, JPY

- Maximum allowed leverage — Up to 1:1000

- Commissions per lot — 5 USD

- Trading platforms — MetaTrader 4, MetaTrader 5

- The number of instruments — Over 300

- Minimum lot size — From 0.01 lots

- Negative balance protection — Yes

- Islamic account variant — Yes

Overall, this account has the most attractive conditions of the three trading account types by OnEquity, but the minimum deposit of 5,000 USD is far beyond what many reliable brokers have.

OnEquity Deposit and Withdrawal

Both deposits and withdrawals have no commissions, and there are a multitude of methods accepted. The most popular methods include bank cards and wire transfers, and there are also e-wallets like Skrill and Neteller. Deposits are instantly processed, and some methods like e-wallets take up to 30 minutes.

OnEquity Reviews of Trading Platforms

OnEquity provides traders with advanced trading platforms, including MetaTrader 4 and MetaTrader 5. Both of these platforms are advanced software with a multitude of built-in indicators and chart analysis tools. Both platforms also can be launched as web traders, which allows traders to trade without installation.

Mobile trading at OnEquity

The broker offers all its trading platforms for all devices, including desktop and mobile. Both MT4 and MT5 can be downloaded and installed on both Android and iOS. Both platforms are also compatible with tablets and make trading possible on the go. While mobile apps are limited when compared to desktop counterparts, they still offer a multitude of built-in indicators and MT5 was recently updated to look modern and offers many useful features.

OnEquity Forex Review of Extra Features

The broker does not offer many extra features, which is unfortunate. There are welcome bonuses offered to help beginners supercharge their trading beginnings. Despite lacking some features, the broker offers several features including daily technical analysis, weekly outlooks, market news, economic calendar, trader glossary, and more.

OnEquity Review of Education and Tools

The firm offers some educational resources with its trader glossary, but there are no other resources such as courses or video webinars. As for the tools, the broker offers plenty of market research tools such as economic calendars and pip calculators.

OnEquity Reviews of Customer Support

The support from OnEquity includes hotline and email options, but there is no live chat, which is a huge downside for this broker. Live chat is the most efficient and fastest way to contact brokers and OnEquity, lacking this crucial support feature, is much less attractive as a broker. The website of the broker is available in 5 different languages, which is a positive sign.

OnEquity Review Conclusion

In the end, OnEquity tries to present itself as a viable option for traders interested in Forex and CFDs but fails terribly in offering corresponding support options. There is no live chat, and traders will have to deposit at least 1,000 USD to get competitive spreads. While the standard account only requires 25 dollars, it has very expensive spreads from 1.5 pips, which makes it less attractive for intraday traders. The 1000 USD trading account only offers 0.4 pips spreads together with a 5 USD commission and is still expensive to operate. The only way to get 0 pips spreads for this 5 USD commission is to deposit at least 5,000 USD, which is very expensive.

While OnEquity offers some attractive features, traders should think twice before signing up for this broker.

Comments (0 comment(s))