WeTrade FX Forex Review

Read our comprehensive and unbiased review of the Forex and CFDs broker WeTrade FX to find out whether you can trust this broker.

WeTrade FX Forex Broker History

WeTrade International LLC is a regulated Forex and CFDs broker, offering its trading services to global traders across the globe. Despite being registered with several offshore authorities, the broker is only regulated by the Financial Services Authority of Saint Vincent and the Grenadines. However, we have to note to our readers that this regulatory authority is not as strict as other global regulators, leaving room for flexibility which can lead to increased risks for traders.

All trading accounts at WeTrade FX come with inbuilt negative balance protection, meaning traders can not lose more than their initial investment, preventing them from going into minus balances. All client funds are kept in segregated bank accounts that prevent the broker employees from touching user funds.

WeTrade is also a member of the investor compensation fund, further solidifying investor safety. With this membership, eligible investors will receive compensation if the broker goes bankrupt.

WeTrade FX Broker Review of Accounts

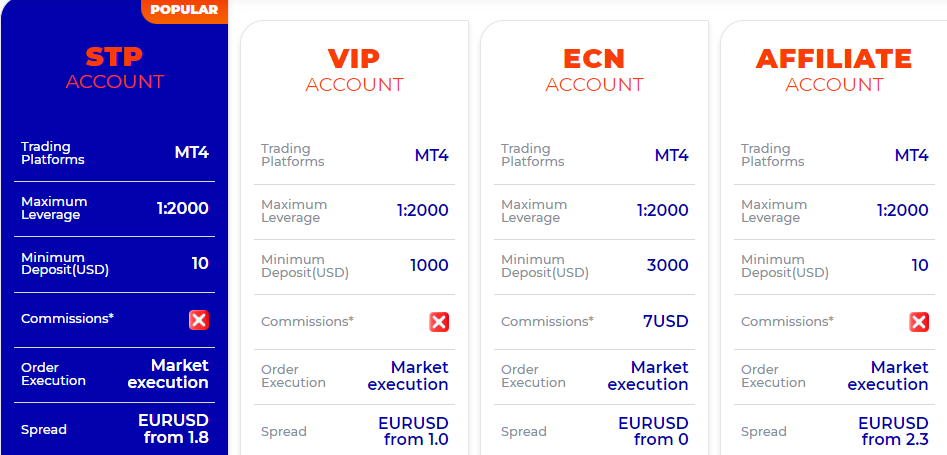

Numerous account types at WeTrade FX target traders with a diverse range of strategies and trading budgets. The four main account types are available such as Cent accounts, STP, ECN, and VIP all offering different trading conditions.

Over 90 tradable instruments are offered in Forex, commodities, indices, cryptos, and stocks. All instruments are available in the form of CFDs, enabling traders to speculate on both directions of the market.

Cent account despite its name comes with a relatively high minimum deposit requirement of at least 100 USD. It would be more appealing if this account offered a lower minimum deposit like many other brokers. This account is even less attractive because of its 1.8 pips minimum spreads on Forex major pairs. Maximum allowed leverage is set at 1:500 and the account operates with STP execution model.

An STP account is more attractive in terms of a lower minimum deposit of 10 USD, and maximum leverage capped at 1:2000. But spreads are very expensive on this account too, from 1.8 pips on major pairs. With an industry-standard being 1 pip, WeTrade FX’s spreads are truly expensive and unattractive.

The VIP account is very similar to the STP one, with a 1,000 USD minimum deposit requirement and spreads from 1.0 pips on major pairs.

Finally, there is an ECN account offering spreads from 0.0 pips on major pairs, and a high leverage of 1:2000, but the initial deposit requirement is high at 3,000 USD. ECN account also has a trading commission of 7 USD per lot round turn, making it appealing to scalpers. The only downside is its huge initial deposit requirement.

Affiliate trading accounts can also be opened at WeTrade FX, with a 10 USD minimum deposit and 1:2000 leverage, but spreads are painstakingly higher from 2.3 pips.

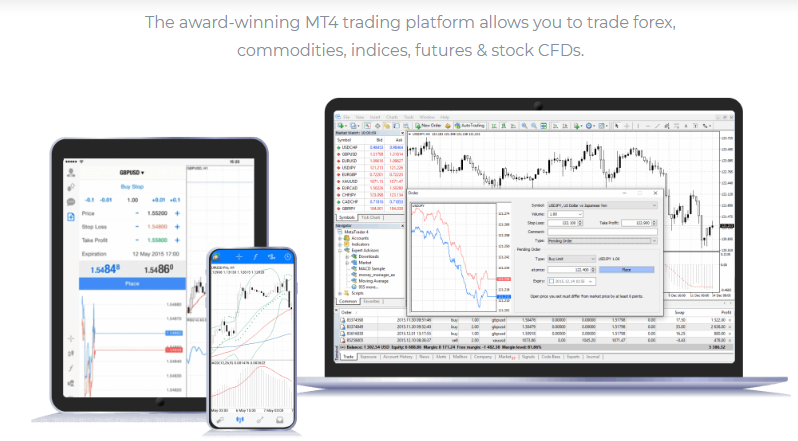

WeTrade FX Reviews of Trading Platforms

The trading platform is an advanced software MetaTrader 4 that comes for all devices at WeTrade FX. All devices including mobile, desktop, and web can be used to trade with MT4 which is very advantageous for WeTrade FX clients.

MT4 comes with indicators and fully automated trading capabilities. The broker also offers a multi-terminal MT4, enabling traders to manage multiple trading accounts simultaneously using one trading platform.

WeTrade FX Forex Review of Extra Features

WeTrade FX offers several useful features as a bonus to its traders. The most important one is educational resources. Forex terminologies and candlestick pattern guides will be a nice addition to any trader’s library.

Additionally, there are numerous tools to help traders better understand financial markets and make informed decisions. Economic calendar, trading central, analyst views, and TC MT4 indicators package. Indicators for MT4 are especially useful to enrich market research capabilities.

There are promotions available every month with various cash rewards related to sports and various other events.

WeTrade FX Reviews of Customer Support

From the FAQ section to multilingual live chat and email support, WeTrade FX offers all essential channels to connect with the broker directly and efficiently. Live chat which is available in more than five languages together with the multilingual website offers traders the ability to find all the details and solutions very quickly.

The one red flag here is the lack of phone support, which is not a good sign for any Forex broker. Phone support is important as it shows the broker is not shy to let users contact it, and lacking this important feature only raises suspicions.

The FAQ section offers quick assistance to frequently asked questions that any beginner trader or new client may have and is a good solution for simple issues.

WeTrade FX Deposit and Withdrawal

The methods for deposits are different from the options that can be used for withdrawals. This raises immediate questions and red flags. Additionally, there is a broker-recommended payment options rank system, and it seems the broker ranks depositing methods higher than withdrawal ones. Does this mean the broker is not happy if traders withdraw their profits?

Deposits can be made via USDT, bank wire, or a local bank. All deposit methods are free of charge except bank wire, which is known for being a lengthy and expensive option.

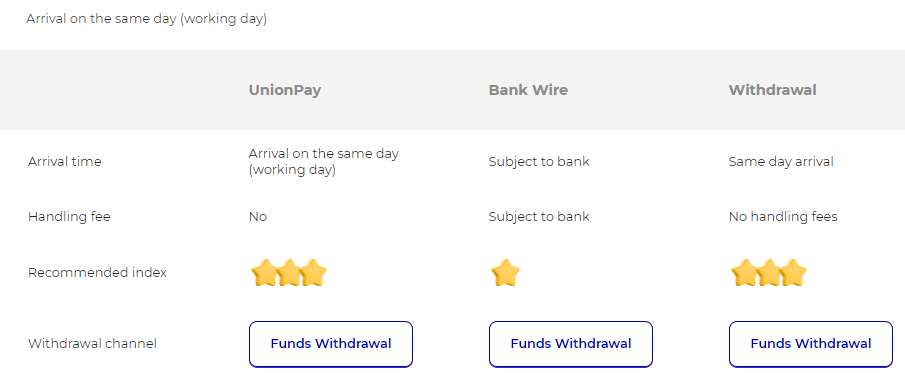

For withdrawals, the methods are UnionPay, bank wire, and local bank withdrawals. Withdrawals, as the broker claims, require from several hours to 1 business day for processing. Withdrawals are also commission-free.

WeTrade FX Review Conclusion

As we can see, WeTrade FX is an offshore-regulated Forex and CFDs broker offering MT4 as the main trading platform. Despite offering multiple trading accounts, the spreads are expensive from 1.8 pips and leverage is excessively high at 1:2000. Over 90 instruments can be traded and there is multilingual customer support in the form of a live chat and email support. There is no phone support which is a minor red flag together with limited options for withdrawals and offshore regulations.

We advise extra caution to all our readers when dealing with this broker because of all the reasons we have mentioned.

Comments (0 comment(s))