Best MT5 Expert Advisors

Table of contents

Expert Advisors or EAs are algorithmic trading robots that can fully automate trading on the advanced MetaTrader 5 platform or MT5. EAs come in different shapes and forms and not all of them are designed to execute live trades, some of them are just doing various functions for traders. However, many EAs have inbuilt order execution functionality and can fully automate trading processes. Since trading financial markets is risky, finding a reliable EA becomes critical. In this guide, we will list the top MT5 EAs and provide a step-by-step guide for installation.

Understanding Expert Advisors (EAs)

Expert Advisors are robots that can complete various functions depending on their predetermined programming. Both MT4 and MT5 support EAs, but the programming language is slightly different. The dedicated programming language for MT5 is MQL5, and it allows developers to code various technical trading strategies into automated trading EAs. To launch and make EA work, a trader has to attach it to the chart from the navigation panel and set its parameters. EA then will do its activities if the automated trading is allowed from MT5 settings. Traders might develop EAs themselves or download them from the internet, there are thousands of free and paid ones available online and the community of the MT5 forum is large.

There are several advantages of using EAs in trading. They can help traders implement trading strategies more easily or manage risks and open positions. However, before you can use an EA for a live account, there are several considerations.

Criteria for Selecting the Best MT5 Expert Advisors

The most critical point for selecting a reliable MT5 EA is its performance. The most prominent way to check the EA performance is to see its verified live trading results. One such place is Myfxbook where traders can submit their live trading results. EAs with verified results are much more reliable than ones with only test results. This is because it is relatively easy to overfit the data and make the EA seem profitable for some historical period, while it might lose in a live environment. Even though there might be verified results on Myfxbook, it is a must to test EA yourself and check if it can work profitably on your preferred instrument. EA that trades profitably on EUR/USD might lose money on Gold. To avoid such pitfalls, ensure you have read and understand the trading strategy and trading instruments the EA was designed for.

It is critical to know what strategy the EA is using, as some strategies are risky and might show positive results for short periods but guarantee loss in the long term. Martingale trading systems are the most obvious example when a trading bot might win for some time, but will lose surely in the long term.

Another reliable way to ensure the EA is profitable is to read comments and user feedback. Traders often comment about their experience with the EA they have downloaded, and there is a high chance of someone already using the EA you are about to download.

Top MT5 Expert Advisors for Different Trading Strategies

Let’s list the top MT5 EAs that have shown their performance on live markets.

Portfolio — Flagship

Portfolio flagship is a fully automated trading system developed by the professional team of Elite CurrenSea. The robot has been doing great for the last few years, which can be checked on Myfxbook verified results. The system has shown a verified 7.25% monthly gains since 2022 which is a superb result for any automated trading robot. Portfolio flagship is a paid robot and traders will have to register on the Elite CurrenSea website to use it. A 7.25% monthly revenue is much higher than investing in dividend stocks or bank deposits. The robot uses complex algorithms to analyze ongoing market dynamics and then enters the position using strong risk control to protect invested money from any market adverse movements. Portfolio flagship is not a martingale system, as it has a 10.31% drawdown, which is half the recommended maximum level of 20%. It also typically wins more than it loses, meaning it has both a high win rate and a high risk-to-reward ratio. It also uses an advanced position sizing system based on the market risks, and losing trades are usually lower in amount than winning ones. The highest return month was in December 2022 with 30.72% profits.

Quantum Trade EA MT5

Quantum Trade EA is a paid Expert Advisor on the MT5 trading platform that trades exclusively GBP/USD major FX pairs. The robot was developed by a team of actual traders with real trading experience, making the robot more legit. The robot is available on the MQL5 marketplace and currently has a 500 USD price. The rating on the marketplace is 4.97 with 109 reviews and 104 comments. The fact that so many traders reviewed and commented on the EA only indicates it might be a very profitable EA. The minimum recommended deposit to launch the robot is 500 USD, and several popular Forex brokers are supported. Developers have included the full manual for the installation of Quantum EA, and many comments claim months of profitable performance.

Some traders have also shown their trading history to support their claims of Quantum Trade EA being a profitable system. It does not use the grid, hedge, or multiple open trades. Every trading position is protected by 100 points stop loss, and the bot uses a trailing stop calculated on a 1-hour chart. Quantum Trade EA automatically defines the lot size for each trading position. However, despite these good specs and comments, there are no Myfxbook verified results shown. So, traders should take these results and positive comments with a grain of salt.

Let’s switch to free trading bots anyone can download and use.

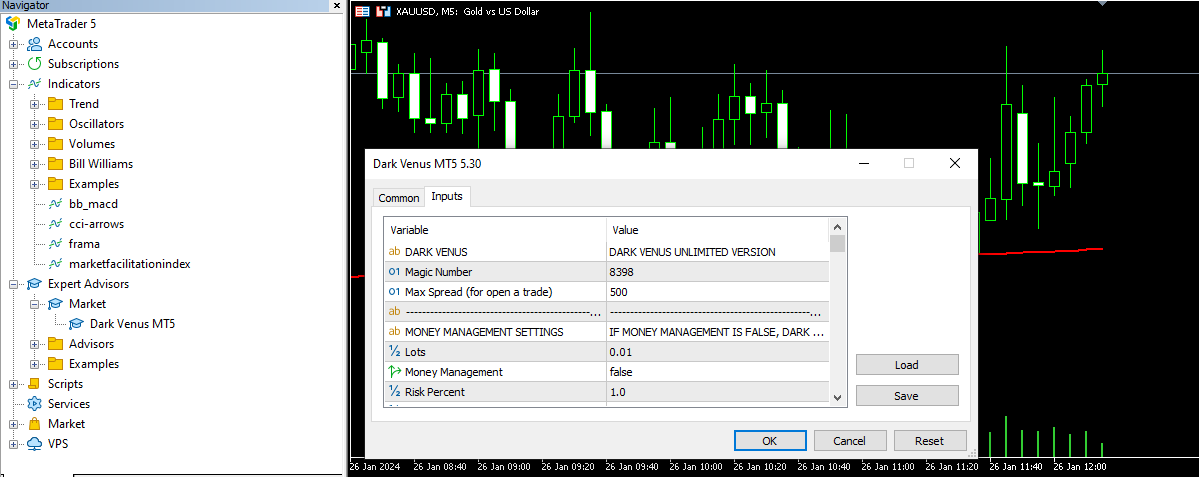

Dark Venus MT5

Dark Venus MT5 is a fully automatic Expert Advisor that uses a scalping strategy. Scalping means very short-time trades, which some traders might find appealing. The bot is based on Bollinger bands and requires frequent attention from a trader as it has a High Operating Frequency. The developer team claims the bot has a very high win rate. Dark Venus has a 4.52 rating on the MT5 marketplace, which is a good result with 734 reviews and 503 comments.

The robot is highly customizable and everyone can fully adapt to their needs. The settings are external, meaning each trader has to select and set their preferred settings, which requires significant experience in trading. Recommended timeframes are M5 and M15, although traders can use any timeframe they feel comfortable with. Recommended currency pairs include EUR/USD, GBP/USD, AUD/USD, and USD/CAD and traders can select other pairs as well. ECN broker is recommended for low spreads. The EA comes with a full user manual to understand how it works.

Universal Breakout MT5

Universal Breakout MT5 is yet another free trading robot. This expert advisor uses the classical range breakout strategy and can be used for implementing any strategy that is based on a breakout of price or a band. Traders can use Universal Breakouts to trade certain session breakouts as well. This EA is advanced and requires user input and thorough backtesting, just like Dark Venus. Universal Breakout MT5 has a score of 4.34 with 34 reviews and 159 comments. The list of customizable settings is large, and traders are recommended to test the bot on a demo comprehensively before using it on a real account. The minimum recommended deposit for FX trading is 100 USD, leverage 1:10 or above will be sufficient, and recommended assets include Forex pairs, stocks, indices, and commodities.

BotAGI MT5

BotAGI for MT5 is an automated trading robot. It uses stop loss for every trading position and according to developers is not grid or martingale. The recommended currency pair is EUR/USD. BotAGI works in groups of 2 trades meaning it opens the 1st trade with 0.01 lots to test the market conditions and if the 1st trade is successful only then will open the 2nd trading position. The ea is an extremely simplified version of BotGPT. Recommended leverage is 1:500, deposit 300-500 USD, minimum lot size 0.15 on trade B (2nd trade), and the monthly profit target 5-10%.

Developers recommend first making profits equal to the deposits made, withdrawing the initial capital, and only then applying a more aggressive lot size of 0.2 for the trade B. Recommended timeframe is 15M.

Evaluating the Performance of MT5 Expert Advisors

To evaluate the EA performance, traders have to look for several key performance indicators (KPIs). Some of the most important KPIs are win rate, risk-reward ratio, maximum drawdown, and equity curve.

The win rate describes how many trades are winners on a percentage basis. For example, if a bot took 100 trading positions and 50 of them were winners, then the win rate of the EA is 50%. Depending on the trading strategy, different win rates may be appealing. Trend following strategies have the lowest win rate of 3-40%, swing traders usually go with 51-66%, while scalping strategies can even reach to 70-80% win rate. Another key indicator in evaluating whether the win rate is sufficient is a risk-to-reward ratio, which shows the relationship between risk and potential profits. The risk-reward ratio shows how much profit are you expected to make for each dollar you risk. The higher the risk-reward ratio, the better it is for EA. If the win rate is 50%, but the risk reward is 1:2, then the strategy is profitable. Higher win rate strategies generally tend to have lower risk-reward ratios. Trend following strategies has 1:3 and more to account for the losses during bad periods. Scalping strategies can have a 1:1 ratio or even lower, because of their high win rate. The maximum drawdown is simply the size of the largest loss, and it can indicate the risk levels. Martingale robots have the highest drawdown. The most comfortable number for maximum drawdown is below 20%. Anything above this level should be considered extremely risky and should be approached cautiously. Last but not least KPI for good EA performance is the equity curve, which is just a visual representation of the trading account balance over time. It shows if the EA was winning or losing during the test period. The best curve is the line that increases consistently. If the curve is choppy, then the EA is risky.

Risks and Considerations

EAs can be super helpful, but there are still some risks. Since they are programmed, there could be bugs that can jeopardize the profits’ potential. Sometimes markets may be more volatile than usual and can make EA open positions unexpectedly and result in unnecessary losses. This is why it is important to always monitor and check the EA to ensure it works as it should. If there is abnormal behavior it is recommended to stop the EA and contact the support or if it’s a free EA message the developer on the forum. So far we have discussed bugs and market conditions risks. However, another essential aspect is to ensure you understand the underlying strategy well. This is to check if the EA is performing well and doing its job as it should.

Steps to install and set up an EA on MT5

To use MT5 EAs it is necessary to install them first for the platform to see the EA. Here is the step-by-step guide on how to install any EA on any MT5 platform.

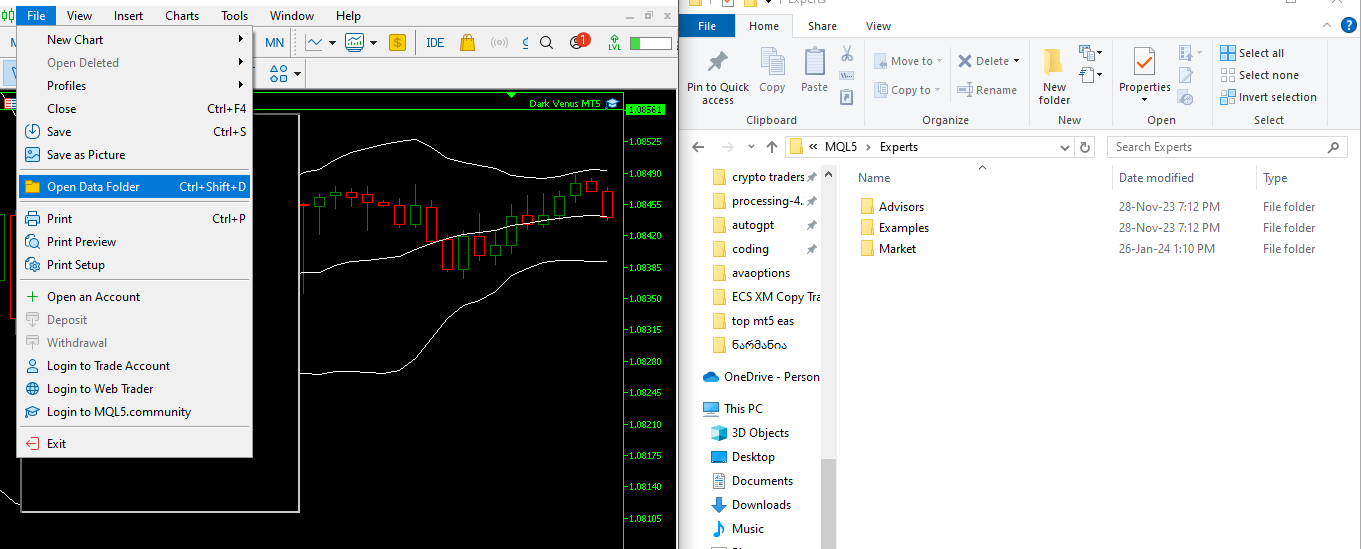

Step one: Place the EA in the MT5 folder

If you have downloaded the EA from the internet, you need to unzip it and place the EA file in the MT5 platform folder. To access the folder where the EA has to be placed, click on the: File>Open Data Folder (CTRL+SHIFT+D). Then click on the MQL5 folder and then the Experts folder. Here you can place your trading EA and the job is done.

Step two: apply the robot to the preferred chart.

After the EA files are placed into MT5 folders, you need to restart the platform. It is also possible to refresh the list of EAs from the navigation panel. To access the navigator panel, you can either click on View>Navigator or use the quick keys CTRL+N. After this, the EA will be visible in the Expert Advisors list of the navigator, and you can apply to the chart with the following methods of double-clicking on the name of the EA or attaching the EA to the chart.

The EA is always attached to the current chart. Some EAs may have inbuilt settings to trade only certain pairs, but generally, traders can use an EA for any instrument.

Comments (0 comment(s))