Equiity Forex Review

In this comprehensive review of Equiity Forex broker, traders will find out about this broker’s essential conditions including regulations, spreads, fees, commissions, accounts, and many more.

Equiity Forex Broker History

Equiity Forex and CFDs broker is a regulated broker that was established in 2022. The broker is relatively young but has already managed to develop a well-thought-out website with all the information about conditions given clearly and transparently.

The company which owns and operates the Equiity website is called MRL Investments Ltd. The company is registered and regulated by the Financial Services Commission of Mauritius as a securities broker. The broker is fully licensed to offer various CFDs. MRL Investments is also registered in Cyprus and has a license as a payments provider.

Equity offers Forex pairs, stocks, commodities, indices, cryptocurrencies, and precious metals for trading. All the assets provided by Equiity are in the form of CFDs or contracts for differences. CFDs from Equiity have a superfast execution speed and allow traders to instantly short-sell or buy any asset. This is especially important for crypto traders at Equiity as cryptos are known for their slow transaction speeds which can take up to several hours to be completed.

Negative balance protection which prevents traders from losing more than their initial investment is active for all trading accounts. This effectively prevents traders from going into minus balance and is especially useful for beginner traders.

Client funds are in segregated bank accounts, preventing Equiity’s employees from touching them.

Equiity is a member of the investment compensation fund, meaning eligible investors will get their funds back in case the broker goes insolvent.

Equiity Broker Review of Assets and Accounts

Equiity offers over 350 tradable instruments as CFDs. These instruments include over 50 major and minor pairs and a multitude of exotic pairs. A multitude of stocks are also offered together with the most popular stocks such as CFDs such as Amazon, Tesla, Apple, Nvidia, and many more. Bitcoin, Litecoin, Ethereum, BNB, and others are also available for instant trading. Precious metals come with low spreads and high leverage of up to 1:50 including gold, silver, platinum, and several others. Indices and commodities include crude oil and a multitude of E-mini indexes.

The leverage system offered by Equiity is applied to all trading accounts and is capped at 1:200, which is a very reasonable level to trade with. For Forex pairs the leverage limits are highest at 1:200, for indices, commodities, and precious metals 1:50 leverage can be selected, stocks come with traditionally lower leverage levels of 1:20, and cryptos can be traded with 1:5 leverage. 1:20 leverage for stock CFDs is higher than many other brokers, giving traders greater flexibility to trade with a lower budget.

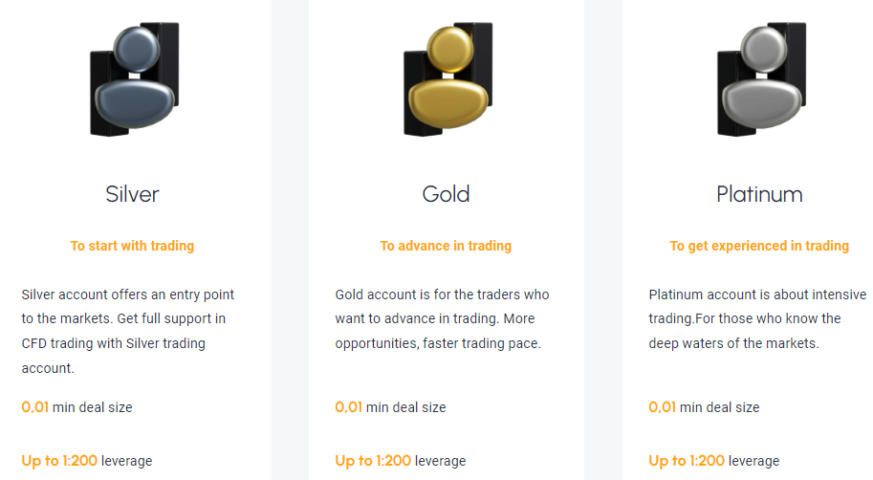

Three trading accounts of silver, gold, and platinum are available for Equiity clients, and they all come with an Islamic account option. Swap-free trading accounts are appealing to Sharia law followers, and since the broker mainly targets Islamic countries, it is understandable.

Three accounts offered by Equiity are silver, gold, and platinum, and each of them comes with increasingly attractive conditions. Leverage limits are similar for all trading accounts, together with a minimum lot size of 0.01 lots. The minimum deposit requirement is 250 EUR or USD, depending on the account base currency. There are no trading commissions charged at trading volumes, as the broker makes its earnings only from spreads.

Silver accounts are entry-based accounts offering Forex spreads from 2.6 pips, and there are the same spreads for crude oil. Minors come at 3.6 pips and gold at 7.4 pips. Available services include only dedicated customer support and hedging.

Gold account has lower spreads from 2 pips on major pairs and crude oil. And 2.6 pips for minor currency pairs. Gold can be traded with 5.6 pips spreads. As for services, there are dedicated account managers, webinars, videos, a 25% swap discount, dedicated customer support, and hedging.

Platinum account has the lowest spreads from 1.4 pips for major pairs, and crude oil. Minors come at 1.8 pips and gold can be traded for 3.8 pips. Platinum comes with a multitude of offered services including a News Alert feature, a dedicated account manager, webinars & videos, a 50% swap discount when compared to a silver account, dedicated customer support, and hedging.

Equiity Reviews of Trading Platforms

Equiity has an in-house customer web trading platform that offers modern design and all needed functionality. Equity WebTrader offers inbuilt indicators and features such as stop loss and take profit. The platform can be used as a full-fledged trading platform for market analysis and opening and managing trading positions.

The only downside is the broker is not offering any advanced alternatives like MT4, or MT5. The platform is accessible from all devices, including mobile and desktop. There is no dedicated mobile app that can be downloaded, as the WebTrader requires only a browser.

Equiity Forex Review of Extra Features

The only way of getting extra features and services is to hold at least a gold account at Equiity. With educational resources offered as webinars and video tutorials, it is much easier to learn about trading and its specifics. Platinum account holders can also use the News Alert feature that enables traders to be always informed about important upcoming fundamental events like NonFarm, unemployment data, and many more.

Equiity Reviews of Customer Support

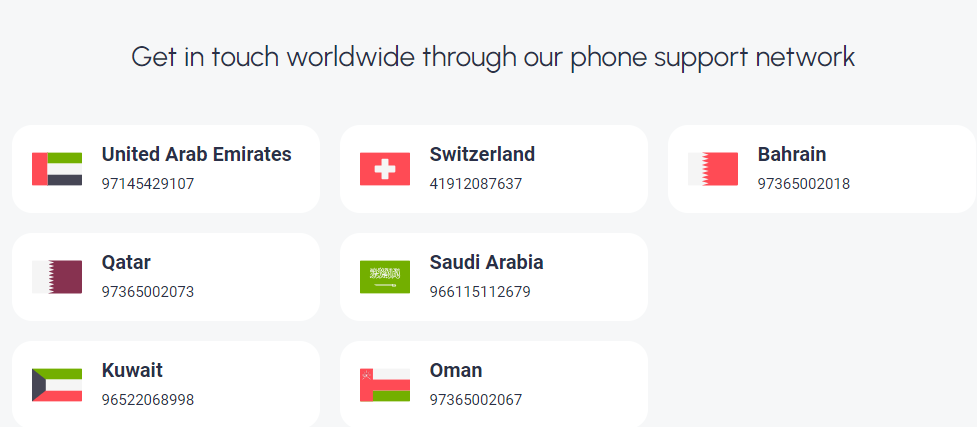

When it comes to customer support, Equity has one of the best support options available for traders. All channels are offered to connect with the broker representatives directly, including a multilingual live chat, hotline, email support, and inline form to leave a message.

The broker has a network of phone support centers across the world including countries such as the United Arab Emirates, Switzerland, Bahrain, Qatar, Saudi Arabia, Kuwait, and Oman.

Equiity Deposit and Withdrawal

Payment options accepted by Equiity include all popular methods including Visa, MasterCard, Neteller, and Skrill. These payment methods are known to be fast, especially when online payments like Neteller, and Skrill are used. There is a little commission for deposits made from 2.5% and withdrawals are charged with the same fees. With the multilingual live chat, Equiity offers top-of-the-line support quality to all of its clients.

Equiity Review Conclusion

As we can see, Equity is a regulated Forex broker with a multitude of security policies such as segregated accounts, and negative balance protection on all accounts. It was founded in 2022 making it a relatively young broker. Equity offers a diverse range of assets, all in the form of CFDs with quick execution. Equity provides multiple trading accounts, user-friendly trading platforms, and compressive support, making them a really appealing choice to newcomers in the industry.

Comments (0 comment(s))