GOFX broker review – Can you trust them?

In the present review, we will explore all the essential details about the GOFX Forex broker and reveal whether they are trustworthy.

GOFX Forex Broker History

GOFX is a regulated Forex CFDs broker offering diverse trading assets and over 1000 tradable instruments. The broker has a well-designed website available in multiple languages including English and Thai. It mainly targets a Thai-speaking audience. This is why the broker seems like a more appealing choice for local traders in the Comoros archipelago, where it holds its trading license. GOFX is not as attractive for global traders, and we are going to describe exactly why, in this review.

However, the MWALI International Services Authority (Comoros) is not the only regulator supervising the broker’s activities. GOFX also holds a license from the Financial Services Authority of Seychelles, enabling it to offer its services to a global audience. With two regulators overseeing its fairness, GOFX seems a legit broker. It is a member of the investor compensation fund. Additionally, GOFX has all client funds in segregated bank accounts. This prevents the broker employees from touching traders’ funds.

Unfortunately, there is no negative balance protection to prevent traders from losing more than their initial investment. This increases the risk for beginner traders to experience excessive losses because of the high leverage the broker offers. With a 1:500 leverage limit, it is easy to go into minus on the GOFX trading account, and we hope the broker addresses this issue shortly.

GOFX Broker Review of Accounts

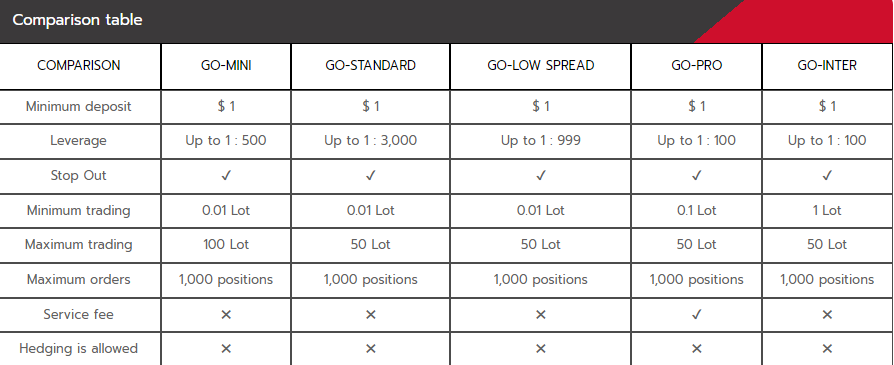

As for trading accounts, GOFX excels with diverse options with various types and kinds of accounts. There are five different accounts and there are major similarities between them. Forex traders can choose between GO-MINI, GO-STANDARD, GO-LOW SPREAD, GO-PRO, and GO-INTER accounts.

Go Mini trading account targets beginner traders with its features and functionality. The leverage for the Go Mini account is capped at 1:500 which is more than enough for beginners, it is a bit high leverage for inexperienced traders. The minimum deposit requirement is 1 USD, enabling traders with a very tiny budget to start trading on a live account. Hedging is not allowed on the Go mini account. The minimum starting lot is 0.01, and fees for services are zero.

What comes after the Go Mini account is the Go Standard account with all the similar features, but higher leverage litmus of 1:3000. Trading 3000 times the trading account balance is extremely dangerous and beginners must avoid trading with this trading account. The minimum lot size is also 0.01, services fees are zero, and hedging is not allowed. The minimum deposit is also 1 USD.

Go Low Spread account is targeted at scalpers and traders who rely on very short-term trading profits. The spreads start from 0.1 pips for this account, which is very advantageous for scalpers. Although this spread is not zero, it has to be mentioned that other zero spread brokers also offer spreads within the 0.1-0.2 pips range. The minimum lot size is 0.01, the minimum deposit starts at 1 USD, and hedging is not allowed similarly to other accounts. The maximum leverage is also capped at 1:999.

Two more trading accounts are Go Pro and Go Inter. Go Pro is for professional signal providers and has a servicing fee. It uses ECN technology for faster order execution speeds. The leverage is reduced to 1:100 only, the minimum lot size is also low at 0.1 lots, the minimum deposit starts from 1 USD, and hedging is not allowed.

Go Inter is for professional stock traders and investors. As a result, the minimum leverage is 1:100, which is much higher than other brokers offer for stock trading. Lot size starts from 1 lot. Service fees are zero and the minimum deposit requirements also start at 1 USD. It is impossible to start trading with 1 USD when leverage is 1:100 and minimum lot size is 1, so this is more of a gimmick than a practical thing.

GOFX Reviews of Trading Platforms

GOFX provides traders with an advanced trading platform, MetaTrader 4. GOFX MT4 is available for all devices including Android, iOS, and Desktops. There is also a web trading platform version of MT4 to access through an internet browser. MT4 mobile app is not as advanced and feature-rich as other platforms, and it is disadvantageous the broker is not offering MT5 or other mobile apps.

GOFX Forex Review of Extra Features

The extra features are severely limited, as the broker only offers a loyalty bonus program. This loyalty program from GOFX offers benefits to its loyal customers. The points system is applied to trading and investing. Traders can accumulate points as they open trades and progress in a tier list, offering higher and higher rewards. From smartwatches at lower levels to cars and luxury items on high-end tier levels.

There are no trading bonuses or trading technical tools offered by GOFX at this moment.

GOFX Reviews of Customer Support

Customer support is offered via live chat, which is available in three different languages and offers the fastest way of contacting customer support representatives. As for other support forms, there are none. This raises some serious red flags, as all brokers must offer phone support to contact them in case something goes wrong with the trade and the trader wants to close positions but is unable to do so. In these cases, the only way is to phone call the broker and ask them to close your opened positions, which is impossible with GOFX and therefore not recommended. Another red flag is that hiding the details such as the address of the offices and phone numbers indicates potential scams and frauds. While GOFX may not be a scam, these issues are still significant red flags every trade must take into account.

There is a help center dedicated to offering tutorials for opening an account, depositing funds, operating MT4, and so on.

GOFX Deposit and Withdrawal

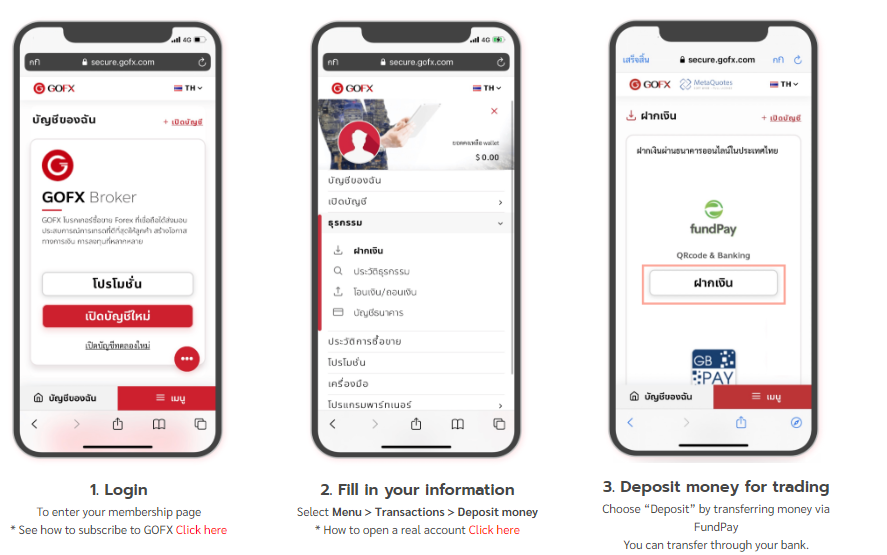

Deposits and withdrawals can be made via local payment systems and mobile payment methods. The most popular method offered by GOFX for funding is called Fund Pay, and it is available through a mobile app.

It is required that traders are fully verified before they can withdraw profits from their trading accounts.

GOFX Review Conclusion

In the end, GOFX is a regulated broker, holding a license from two regulators of FSCA and MWALI. With these licenses, the broker offers a degree of trustworthiness. However, the high leverage may expose beginners to high risks. The range of accounts caters to different trading styles, but some features may not be practical, especially the 1 USD minimum deposit requirement on the Go Int account where the minimum lot size is 1 lot. The trading platform is MT4, which is sufficient for trading and analysis, but its mobile app is not as advanced as MT5. Extra features are limited, with a loyalty program being the sole offering. Customer support, available only through live chat, raises concerns, and the absence of phone support and clear office details is a red flag.

As we can see, GOFX has pros and cons which may be more suitable for the local traders and not for global traders. We advise global traders to exercise extra caution when dealing with this broker.

Comments (0 comment(s))