XM Broker Account Types Review

XM is a popular trading destination for traders all around the world. The company allows customers to take advantage of four different account types on the platform – Micro, Standard, XM Ultra Low, and Shares accounts. By doing so, they ensure to satisfy the needs of every trader will it be a beginner or experienced one since all of them have different requirements. This is a pretty convenient method to engage more and more users since they find different kinds of offerings for each account type. Keep in mind that you need to choose the right one for you very carefully by considering all your resources. You also have a chance to switch between these account types anytime you need!

Standard Features of XM Accounts

We want to talk about the similarities of these account types in this section. Generally, the first three accounts – Micro, Standard, and XM Ultra-Low include pretty much the same qualities. They have a lot of attributes in common such as base currency options, the amount of leverage, negative balance protection, spreads on majors, commission fees, maximum open and pending orders per client, minimum trade volume, lot restriction per ticket, the ability of hedging, and so on.

These three accounts resemble significantly considering the above-mentioned aspects and there are very few distinctive features. However, you still need to pay attention to every detail before deciding to select each one! As for the shares account, we can say that this one is completely different compared to the previous types which we will cover down below. This is intended mostly for experienced XM traders who operate in this industry for many years!

Individual Features of XM accounts

As we have stated above, despite being so similar, every account type of XM broker includes its own characteristics intended for all kinds of traders. You have to take into mind all sorts of things before you opt for any of them such as currencies, leverage, your budget, fees, and so on. Then, you will understand which option will bring the most benefit for you!

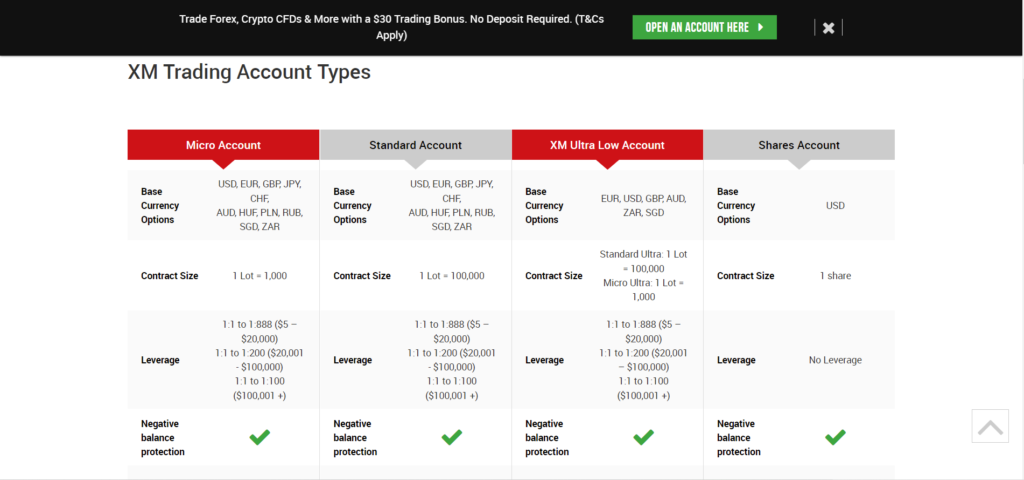

Micro Account

The XM Micro account will be the most suitable for traders who are new to this field since it offers basic qualities. The base currency options for this one include USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, and ZAR. The amount of leverage depends on the deposited funds but it can go up to 1:888 in case you deposit funds in the range of $5 – $20,000. It also contains negative balance protection and spreads on all majors starting with as low as 1 pip. The minimum trade volume is 0.1 lots for both Meta 4 and Meta 5 software and the lot restriction per ticket includes 100 lots. As for the minimum possible deposit, you have a chance to start trading with only 5$ here. So, as you can tell, it furnishes novice traders with all the necessary attributes and this Micro Forex account is a perfect starting point for everyone!

Standard Account

As for the XM standard account, it provides nearly the same features with slight differences. The XM standard account minimum deposit also includes 5$ which is obviously a pretty low number and everyone is able to start trading here. The currencies are also the same as in the previous one – USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, and ZAR. The leverage numbers is also similar as they can go up to 1:888 for 20.000$ deposits, 1:200 for $100,000 deposits, and 1:100 for $100,001 + deposits. The spreads on all majors also start with as low as 1 pip and the minimum trade volume is 0.01 lots as well. However, what makes the standard one different from the Micro account is that the lot restriction per ticket is 50 lots here. So, you have to make a decision by taking into mind only this factor when it comes to these two accounts!

XM Ultra Low Account

XM Ultra Low Account provides relatively different characteristics compared to the above-mentioned accounts. Here, the base currency options are the following – EUR, USD, GBP, AUD, ZAR, and SGD and the spread on all majors starts with as low as 0.6 pips. On the other hand, it also includes negative balance protection and the same amount of leverages for certain deposits. What’s interesting, there is no commission for these three account types and there is a total of 300 positions for maximum open orders per client for each one. The minimum deposit required is 5$ for this account as well and the lot restriction per ticket includes 50 lots for standard ultra and 100 lots for micro ultra. The minimum trade volume for this one is also 0.01 lots for both standard and ultra options, so as you can see, the attributes of the two previous accounts are united in the XM Ultra Low account!

Shares Account

As we have already noted, the Shares account provides the most unique and exceptional qualities compared to every account type above. The base currency option for this one is only USD and there is no defined leverage here. It also includes negative balance protection and the spread is calculated as per the underlying exchange. However, it provides only 50 positions for maximum open orders per client which is far less than the previous three accounts. As for the minimum trade volume, it is only 1 lot for this one, and the lot restriction per ticket depends on each share. The major distinctive characteristic is also the minimum possible deposit which is 10.000$ for the shares account, so it is intended for traders who wish to operate with huge amounts of money. We would not recommend this one for people who are just beginning their trading experience since it requires a lot of skills and knowledge in the field to successfully utilize this account. If you are a beginner then you should stick with either of the accounts mentioned above!

Other XM Account Types You Can Choose

We want to highlight that apart from the account types written above, every user is eligible to utilize a demo and Islamic accounts on this platform. These two accounts provide tremendous benefits in separate ways since demo accounts help novice traders to get familiar with the true working mechanism of trading and learn every feature connected to it. As for the Islamic account, it is intended for Muslim clients. We would like to explain both of them in detail down below.

Demo Account

The Demo account of XM broker is an excellent resource in order to test your trading potential. With its help, you have the possibility to carry out every process on the platform using virtual money, so that you will get a general idea behind every attribute. You will not risk anything in this case since you don’t provide real money here, so sit back and enjoy surfing the platform without worrying about anything. This is especially advantageous for traders who are taking their first steps in this field as they will learn what are some trading strategies, how the market moves, how to place orders, and so on. At the end of the day, you will be ready to open XM real account and start trading with real money!

As with every account type, it is very simple to create a demo account on the XM website since you only need to enter your email and password. As a result, the platform certainly has the potential to make you one of the most successful traders in the world!

Islamic Account

The second option apart from the traditional accounts is an Islamic account which is mainly intended for Muslim customers. Considering the Shariah law, the majority of Islamic traders don’t have the possibility to keep the trading platform open for more than 24 hours since this process requires you to pay a rollover fee. There are some restrictive laws regarding this matter in Islamic countries, and as a result, traders there are not able to fully experience every service.

In order to solve this issue, the majority of brokers have decided to implement special Islamic accounts for Muslim clients and XM did not miss out on this trend as well. It is an optional choice for each account type if you want to go for this one or not and keep in mind that the Islamic account includes all the characteristics that you see in every account type. It is also simple to create this account as you have to verify your identity as a Muslim user and provide enough information for a specific department to review your request and provide answers accordingly.

Pros and Cons of XM Account Types

By looking at all the characteristics of XM account types, we can say that they provide highly beneficial services but there are some downsides as well for specific types of traders. Therefore, it is important to carefully consider all of your needs before deciding to choose a certain account type on this platform. As a result, you will be able to get the most benefit and grow drastically as a trader! We want to describe all the pros and cons thoroughly below!

Pros

The first advantageous attribute of Micro, Standard, and Ultra Low accounts is that they all allow you to deposit as low as 5$. You will not find such kind of opportunity on the majority of platforms nowadays. Also, the leverage can go up to high numbers in case you want to trade with enormous amounts and the spreads are very little for every account type. Moreover, there are a lot of positions for maximum open orders per client on this platform and the minimum trade volume starts with as low as 0.01 lots here. The ability of hedging is allowed for each account type and the lot restriction per ticket is in the range of 50-100 lots. The shares account is intended for the most experienced traders in the world since you need to provide at least 10.000$ here and in return, you will take advantage of the highest quality of services.

Cons

When it comes to the downsides of the XM account types, we have to state that there are no major cons here. One considerable disadvantage might be the fact that accounts don’t include cryptocurrencies in the base currency options and the number of traditional fiat currencies might seem restricted as well for some people. Moreover, 100 lots for the lot restriction per ticket can be too high for specific types of customers.

As you can tell, these are some minor drawbacks of the platform that seem nothing compared to all the benefits you get here. So, you don’t need to worry about these slight factors by any means!

More About XM Broker

XM broker was launched back in 2009 and it has earned a name of a high-class and trustworthy platform by providing exceptional services over the last 13 years. The main objective of this broker has always been to guarantee the maximum satisfaction of customers and give them a reliable place to carry out trading procedures. Consequently, As of today, they serve more than 5.000.000 customers from 190 countries in the world and the platform operates with nearly 600 professional employees in order to ensure the highest quality.

Considering all those facts, it is no surprise that XM broker has been awarded countless times in various categories through these years. Those categories include the most popular broker, the best affiliate programs, the best FX educational broker, the Global Forex broker, the most reliable broker, and so forth. The platform has earned all these awards in a lot of countries and currently, the number of customers is only rising a day by day. Here, you will come across a variety of opportunities, and most importantly, there is a tremendous chance of growing as a trader and becoming one of the best in the world!

XM Overview

We would like to point out that XM broker is operated by XM Global Limited with a registered address at Suite 404, The Matalon, Coney Drive, Belize City, Belize. It is regulated by the Financial Services Commission with the license number 000261/309 and Trading Point of Financial Instruments Limited which operates under the laws of Cyprus. Hence, it is an entirely reliable platform where all your funds will be protected maximally.

XM Forex broker offers a wide range of products such as Forex trading, cryptocurrencies, stocks, commodities, energies, indices, metals, shares, and so forth. You will be able to carry out every task related to XM trading on this platform!

Comments (0 comment(s))